Coffee Stain Goes Public as Embracer Completes Its Spin-Off Cycle

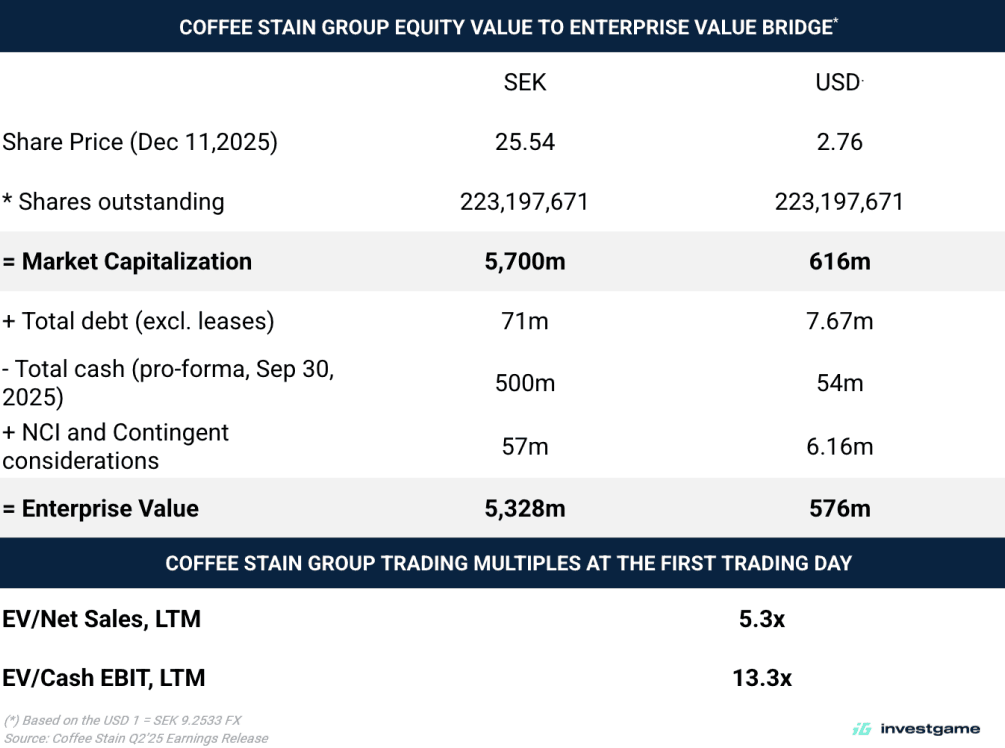

Sweden-based games developer Coffee Stain Group has listed on Nasdaq First North Premier Growth Market with a $616m (SEK 5.7B) market cap under the ticker COFFEE B. The company issued a total of 223,197,671 shares (9,000,000 class A, 214,197,671 class B).

At the moment of listing, Coffee Stain’s top 5 shareholders were Lars Wingefors with 20.10% of capital and 41.37% of votes, Savvy Games Group with 7.46%, DNB Asset Management with 7.09%, Matthew Karch, co-founder of Saber Interactive, with 5.57%, and Alecta Tjanstepension with 3.02%.

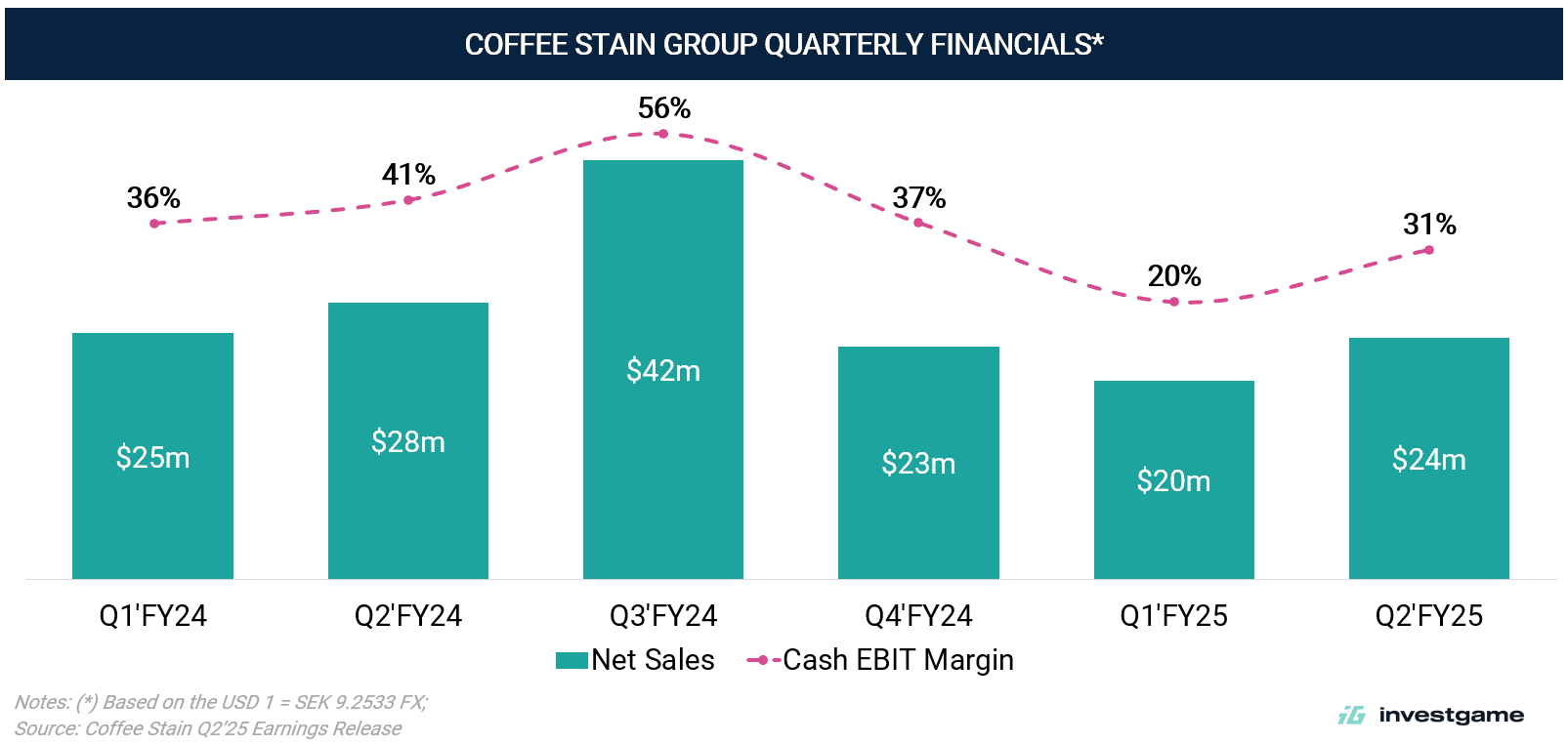

The company reported net sales of $104m (SEK 1.1B) and adjusted EBIT of $52m (SEK 544m) for FY 2024/25, representing a 50% margin and reflecting an organic revenue decline of 7% YoY in H1’25.

The new entity consists of approximately 250 employees across 13 studios: Coffee Stain Studios, Coffee Stain North, Coffee Stain Göteborg, Coffee Stain Malmö, Box Dragon, Lavapotion, Easy Trigger, Invisible Walls, Ghost Ship Games, Tuxedo Labs, ACE (A Creative Endeavor), Kavalri Games, and Frame Break.

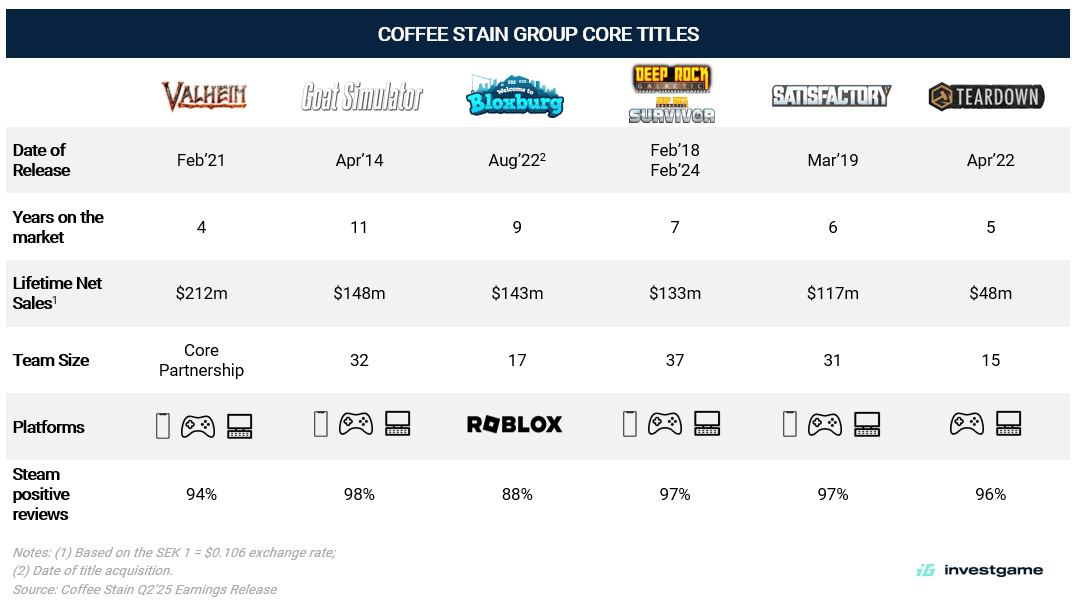

Coffee Stain was divested as part of Embracer Group’s restructuring program, which aimed to streamline the group and allow each division to focus on its respective strategy. The direct listing of Coffee Stain follows the Asmodee listing in Apr’25. Coffee Stain Group will focus on developing and expanding PC & Console indie and AA projects, prioritizing their six core IPs while selectively investing in new titles. The company’s 90% of revenue has been driven by 6 major franchises: Goat Simulator, Satisfactory, Deep Rock Galactic, Valheim, Teardown, and Welcome to Bloxburg.

Strategic Rationale

The Coffee Stain listing marks the final phase of Embracer Group’s restructuring, completing the separation into three independent entities. The separation enables Coffee Stain to operate with an independent capital structure and pursue strategic opportunities aligned with its indie/AA focus, while offering investors direct exposure to PC/Console indie publishing and development business. This is a shareholder value-creation approach validated by Embracer’s successful completion of the Asmodee spin-off earlier in 2025.