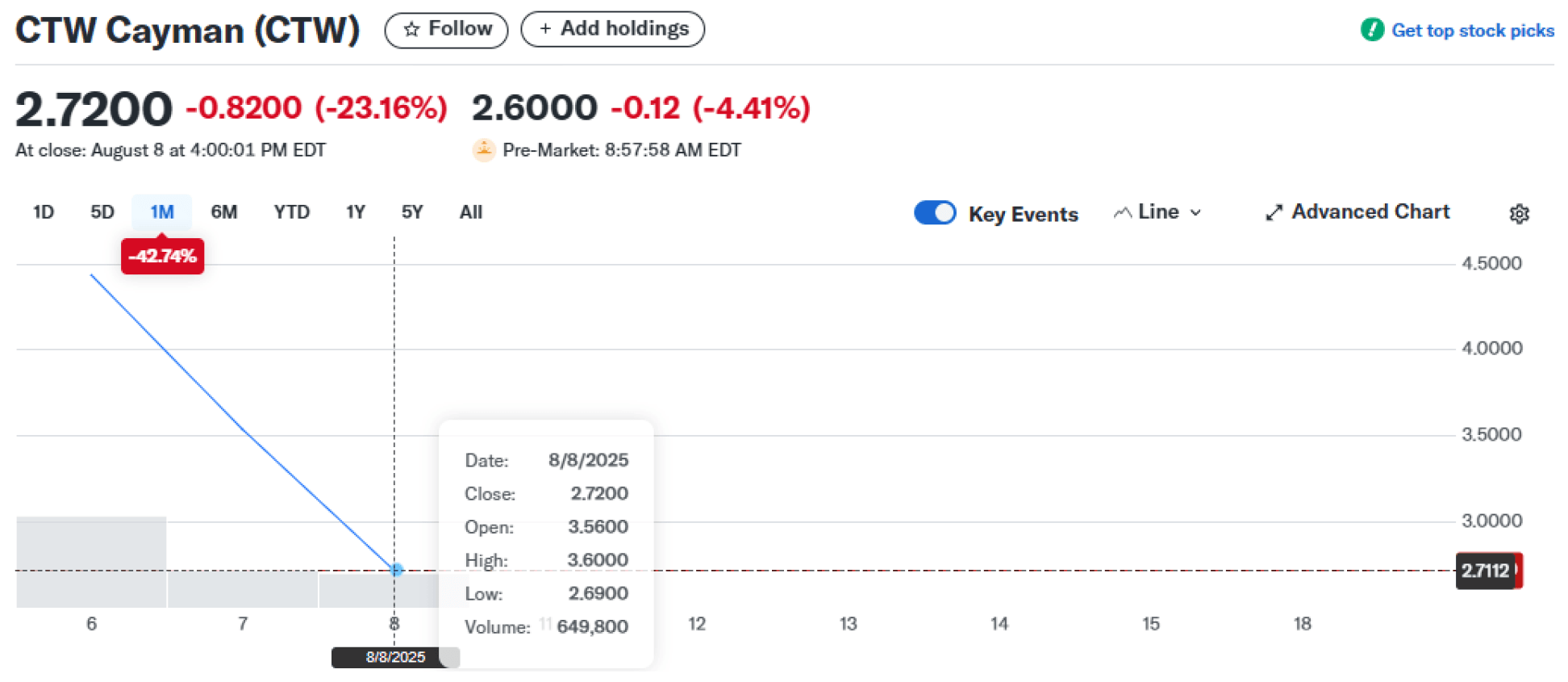

Japan-based HTML5 browser gaming company CTW Cayman raised $12m in gross proceeds through its initial public offering on the NASDAQ under the ticker CTW on August 6, 2025. The offering consisted of 2.4 million Class A ordinary shares at $5.00 each, implying a post-offering market cap of $240m based on 48 million shares outstanding. Roughly $10m of the IPO proceeds will be allocated toward international expansion, with the rest to be used for general corporate needs.

This is the first Asian gaming IPO since ShiftUp’s Jul’24 listing and the first Japanese gaming listing since WonderPlanet’s public offering in Jun’21, adding another example to the gaming companies’ listings we covered in one of our previous features by $GDEV.

Company Background & The HTML5 Platform Play

Founded in 2013, CTW operates G123.jp, a browser-based HTML5 gaming platform offering anime-based F2P titles such as Goblin Slayer, Queen’s Blade, and So I’m a Spider, So What? Ruler of the Labyrinth. The platform currently offers 29 active titles, and 19 more are in development. A total of 65 titles have been published on the platform since its establishment. CTW’s role spans anime IP licensing, distribution, marketing, platform hosting, and revenue sharing, while third-party studios handle development.

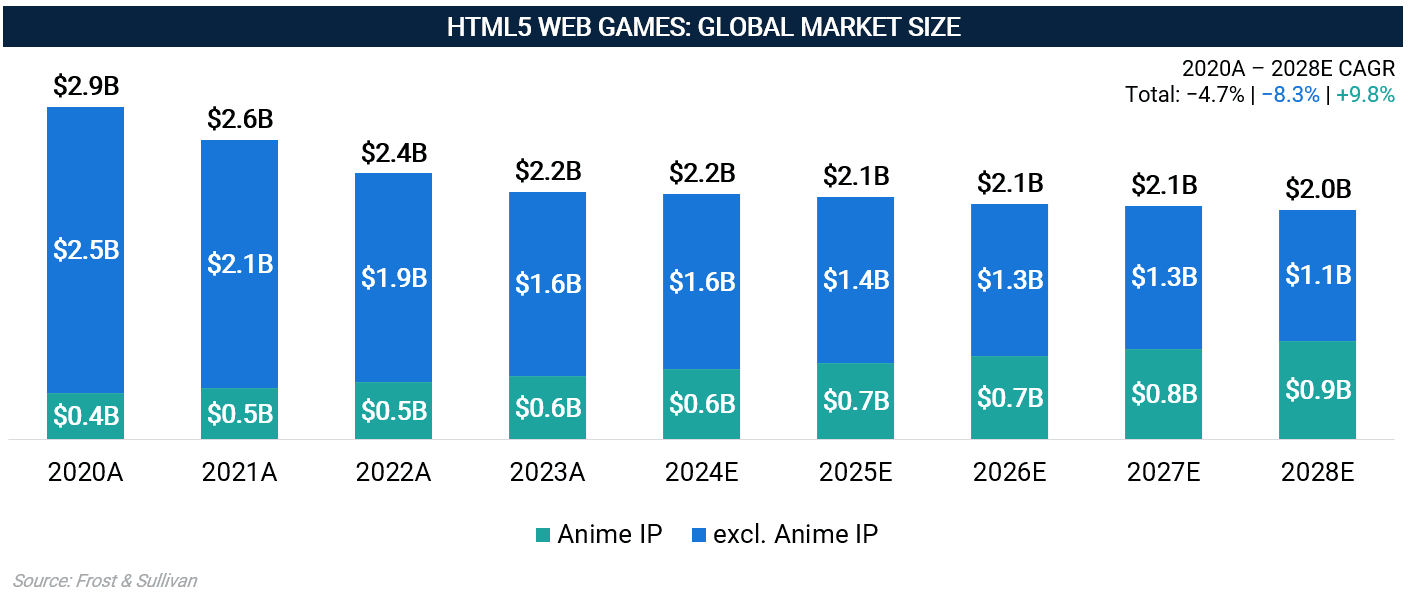

Browser gaming remains niche in Western markets, and HTML5 monetization outside Japan has been historically difficult. The anime fandom has surged globally — with anime now among the most-watched genres on platforms like Netflix (NASDAQ: NFLX). The continued rise of IP-first experiences gives CTW a compelling hook, especially as younger audiences embrace cross-platform, lightweight gaming models. While the broader HTML5 gaming market has seen a gradual decline in recent years, anime-themed titles have been quietly taking over. According to Frost & Sullivan research, anime IP-based games have steadily expanded their share, growing from just 10.3% of the global HTML5 market in 2019 to 25.5% in 2023 — more than doubling in five years.

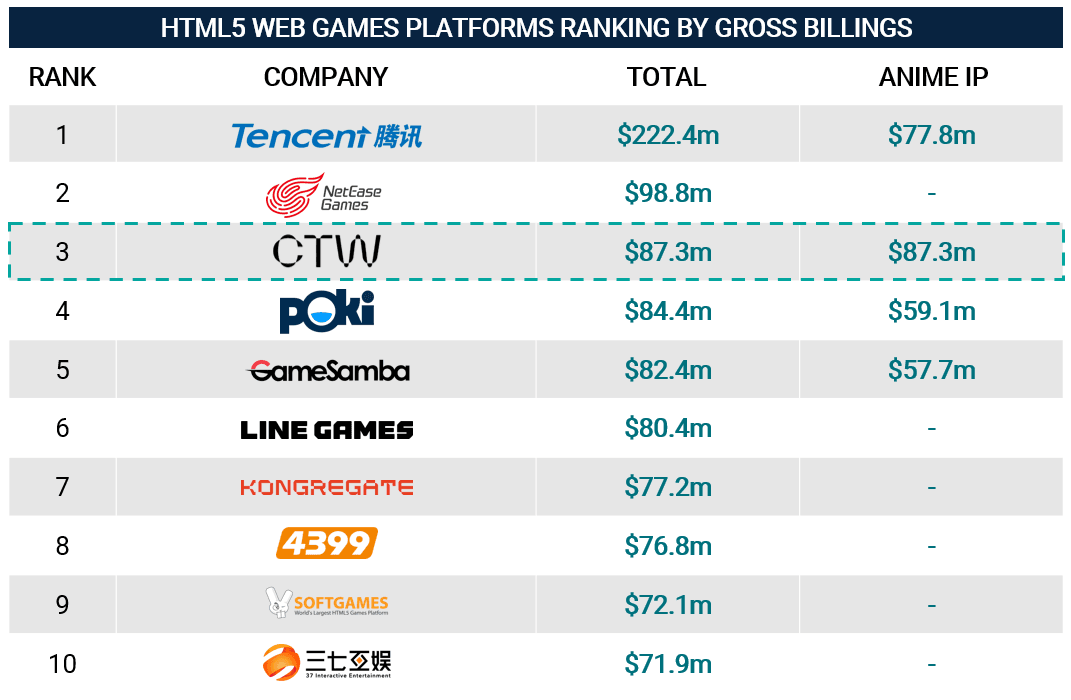

In Japan, “instant play” browser games retain strong appeal thanks to direct distribution and fast IP rollouts. CTW claims the top spot globally among anime IP-based HTML5 platforms, and ranks #3 among all HTML5 game developers worldwide by gross billings.

Financial Performance & Growth Trajectory

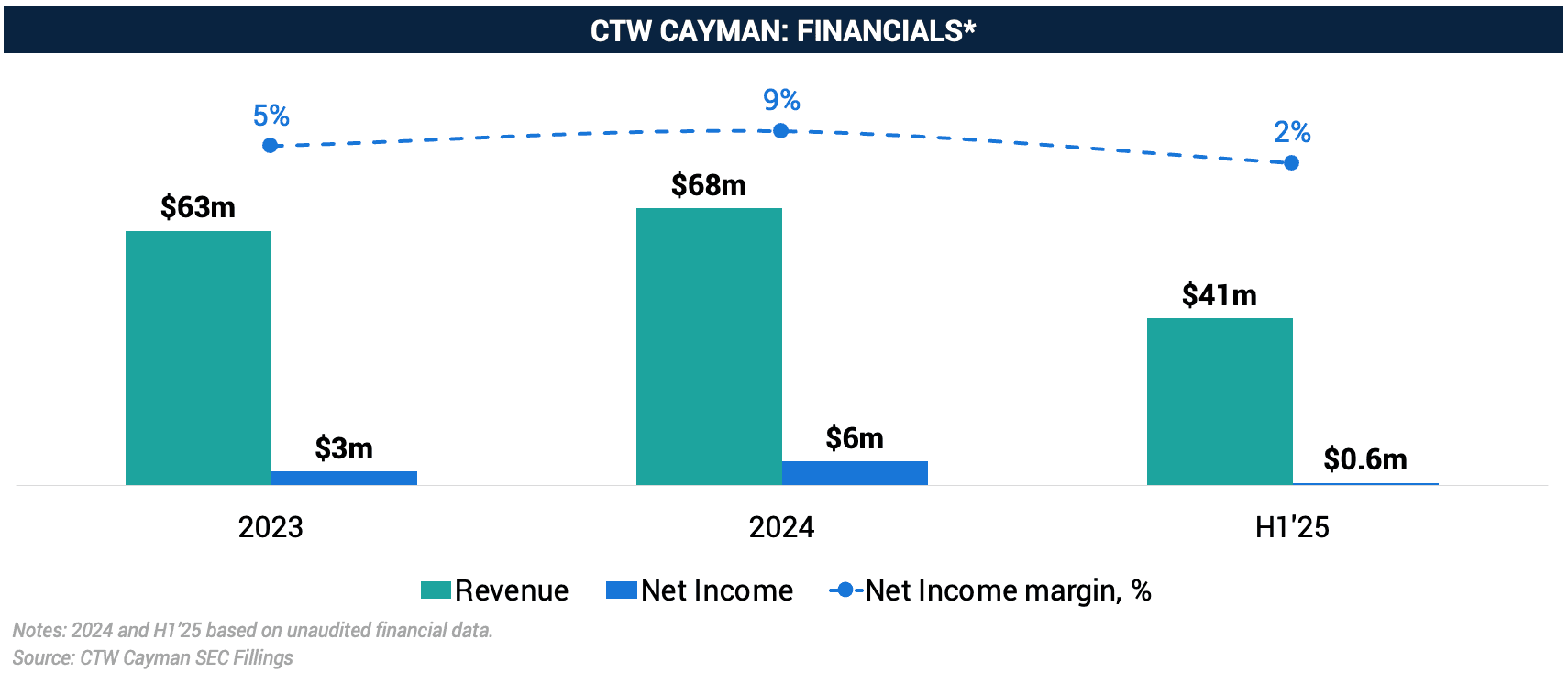

CTW Cayman entered the public market with modest but consistent growth indicators. The company reported $68.4m in revenue for FY’24, up 8.7% YoY, and a net income of $6.0m, nearly doubling from $3.4m in FY’23, suggesting improved monetization efficiency across its platform.

For the six months ending Jan’25 (H1’25), revenue reached $41.2m, implying an annualized run-rate of ~$82.4m. At the IPO valuation of $240m, this suggests a ~2.9x EV/Revenue multiple.

CTW’s user base continues to scale steadily: MAUs rose to 3.3 million users (vs. 2.1 million in 2023), while ARPMAU sits at ~$2.5. Its top-performing users remain highly monetizable, with paying MAUs contributing ~$107 each on average, reinforcing the value of its anime-first, browser-based niche.

While these indicators are encouraging, revenue concentration remains a key risk. In H1’25, flagship titles Vivid Army and Queen’s Blade: Limit Break still accounted for over 40% of revenue, down from 60% in FY’24 and 89% in FY’23. Yet this diversification has limits: a newer release,So I’m a Spider, So What? Ruler of the Labyrinth, launched in Oct’24, already contributed 15.9% of H1’25 revenue, reinforcing the platform’s continued reliance on a handful of high-performing IPs.

This highlights both the upside and vulnerability of CTW’s model, strong monetization from hit anime titles, but limited revenue depth.

Finally, while FY’24 margins remained stable, H1’25 saw a decline, driven by heavier spending on international expansion and content pipeline growth. Whether CTW can replicate its domestic performance abroad, without declining margins, will probably be one of the crucial points.

Anime HTML5 Games: A Global Opportunity?

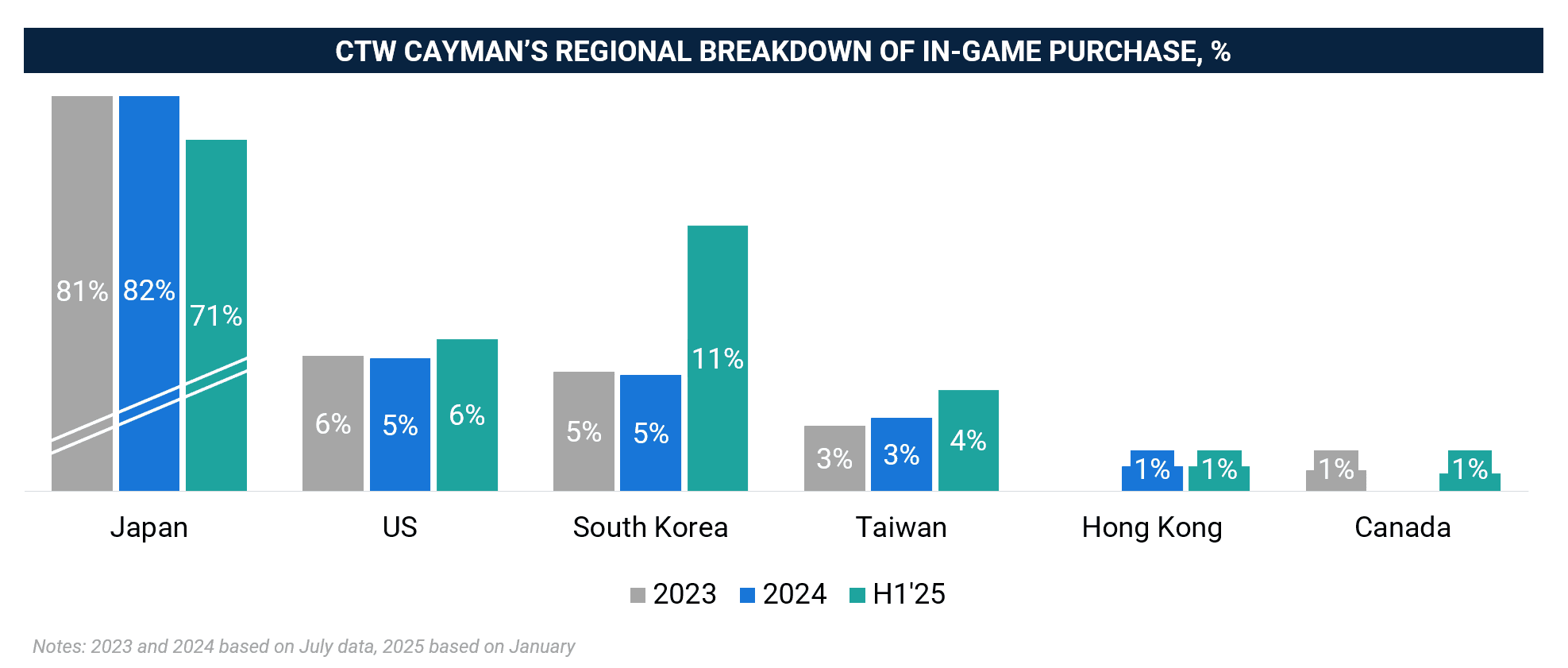

Japan remains CTW’s largest market, generating 71% of revenue in H1’25, but its share has been steadily declining as overseas sales — particularly in South Korea and Taiwan — show a steady growth.

The company’s user base is heavily localized, and its content strategy is tightly tied to Japanese anime culture. But CTW sees global upside: with 19 games in development and 9 in pre-registration, it plans to double its portfolio while expanding reach across the US, Europe, and Southeast Asia.

Strategic Rationale: Surfing the Anime Wave

CTW’s IPO comes amid growing investor interest in anime-based games and IP strategies. Recent examples include Bandai Namco’s (TYO: 7832) partnership with Sony (TYO: 6758; NYSE: SONY), following previous deals with Kadokawa, to expand anime globally. For CTW, going public is both a capital move and a visibility play: it seeks to establish credibility in global markets, attract new IP partnerships, and accelerate its rollout across Western geographies.

With a focused content niche, strong domestic product-market fit, and over a decade of operating experience, CTW stands out as a capital-efficient, IP-driven player in the gaming space. Its lean model, built on browser-based distribution and strategic content partnerships, offers a differentiated approach to scaling anime-themed games globally.

But execution will be key. Can CTW maintain its monetization efficiency while expanding to less familiar markets? Can it localize Japanese IPs without losing their core appeal?

Since its debut, CTW’s share price has fallen ~45%, a clear sign that investors are waiting for evidence that the company can translate domestic success into international growth.