Weekly News Digest #37

# of announced deals

11

announced deals’ size

$353m

# of closed deals

10

Playtika Acquires Innplay Labs for up to $300m

Israel-based mobile games developer Playtika (NASDAQ: PLTK) is set to acquire Israel-based mobile games developer Innplay Labs for a total amount of up to $300m, including an upfront consideration of $80m.

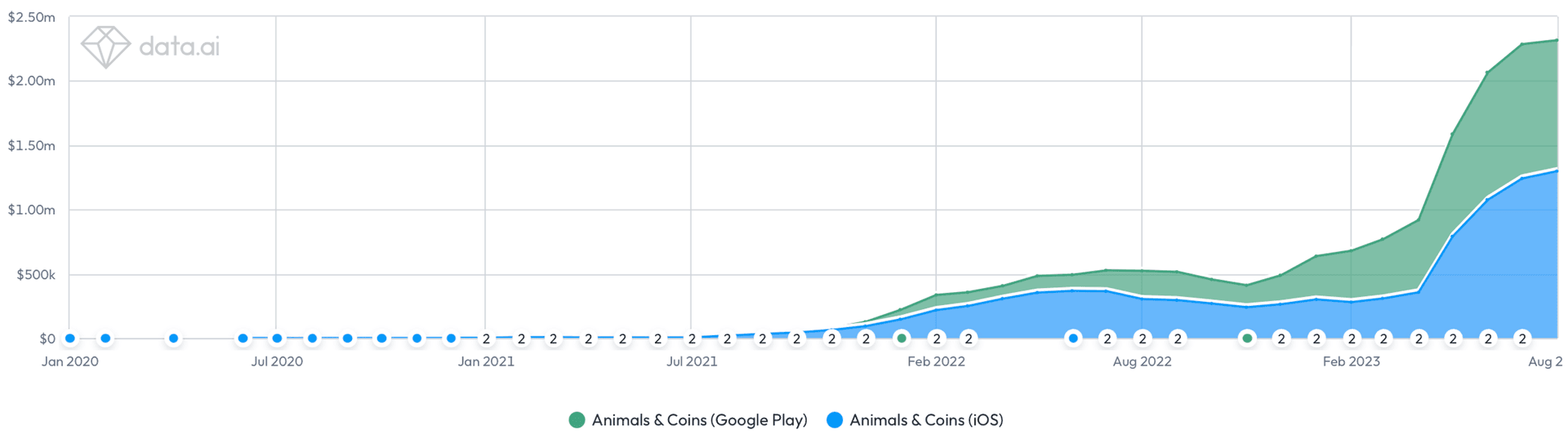

Innplay Labs, founded in 2019, is primarily known for its mobile casual game Animals & Coins. Since its global launch on both platforms in 2021, the game has generated more than 9.5 million downloads and $16.8m in IAP Net Revenue, according to data.ai. In Aug’23, the game showed $2.3m in Revenue and 1 million downloads.

Source: data.ai

Animals & Coins is one of the few titles, which managed to continuously grow in scale under the dominance of Moon Active’s Coin Master. According to data.ai, there are only 5 titles making more than $1m IAP Net Revenue per month in the genre of Luck Battle — that’s how data.ai defines this type of game. We will also refer to their classification for convenience.

Luck Battle is usually a more casual interpretation of classic casino mechanics like slots and dice rolls. Being one of the major players in the social casino genre, Playtika also made its moves to expand to the Luck Battle market. Its Pirate Kings game is the top-7 game in the market and generates around $800k per month.

So by acquiring Innplay, Playtika gains the expertise and knowledge of one of its competitors, who managed to differentiate and reach its audience despite all the challenges of the tough market. Now, the company plans to “rebrand Animals & Coins alongside Innplay”. We don’t know what this rebrand will be about, but we might consider that Playtika plans to further compete with the monopoly of Coin Master and… Monopoly Go.

The recent success of Scopely’s Monopoly Go is likely something that was happening alongside the ongoing M&A negotiations between Innplay and Playtika. Though it is unlikely to have affected the deal, it is fair to assume that the future rebranding will be influenced by the success of Scopely.

Source: Playtika

Overall, the deal is a continuation of Playtika’s shift from casino-themed games to casual-themed ones. In its Q2’22 financial report, Playtika stated that its Revenue mix had shifted towards casual-themed games. This trend continues from then on, with casual-themed games generating more and more Revenue every quarter. Today more than 56% of the company’s Revenue comes from casual games, such as Bingo Blitz, Solitaire Grand Harvest, June’s Journey, and several other titles, compared to 48.3% in Q2’21.

This may be happening because, according to Deconstructor of Fun, the number of social casino players is relatively modest and it might be around 100 thousand users, who should be attracted and retained, which might become quite a challenge due to Apple’s app tracking transparency policy.

Source: Playtika

In its latest financial report Playtika states that the company has generated a Revenue of $642.8m over Q2’23 (-2.5% YoY), with credit adjusted EBITDA being $215m for the same period (+6.7% YoY).

All in all, Playtika’s revenue remains pretty stable, as does Credit Adjusted EBITDA, with minor deviations ranging from 2% to 7%. In the current market, stability is already an achievement. However, to keep it that way, the company has to pay a great price. In one of our previous digests, we already highlighted some of the challenges Playtika is going through. In Oct’22 Playtika shut down its subsidiary gaming studio Seriously, laying off 600 employees, after laying off 250 people before that.

In Mar’23, we also saw Playtika stop launching or developing new games until the recovery of the market. Nevertheless, the company seems to be having a special strategy in this part. If the market struggles to launch and grow new titles, then it might be worth pursuing already successful stories. Thus, in Aug’23, Playtika entered into an agreement to acquire the Youda Games’ IPs, such as Governor of Poker 3, from Azerion (EURONEXT: AZRN) for up to $163.9m (€150m).

Looks like Playtika knows its strengths and limitations well. Playtika understands the risks of releasing new games, but it also has a huge background in scaling and operating titles, that already survived the oversaturated market in the post-IDFA era. In this scenario, M&A seems to be a great way to fuel the growth of the company. Let’s hope that newly acquired assets won’t face the fate of Playtika’s early-mentioned former subsidiaries.

We want to thank MGVC for supporting this digest.

| NOTABLE TRANSACTIONS |

MERGERS & ACQUISITIONS

Germany-based Web3 startup Spielworks has acquired Germany-based NFT marketplace Atomic Hub for an undisclosed sum. Spielworks aims to maintain the NFT landscape on WAX while integrating its Wombat wallet and \$WOMBAT token with Atomic Hub. This move will enrich NFT-related offerings, including browsing, trading, and collecting non-fungible assets, and expand Atomic Hub’s presence on other networks like EOS and Immutable X. Spielworks plans to set a new standard in asset trading and Web3 gaming in collaboration with Atomic Hub.

VENTURE FINANCING

US-based game developer Pahdo Labs has raised $15m in a Series A funding round, led by Andreessen Horowitz, with continued support from Pear VC, BoxGroup, Long Journey Ventures, Neo, and Global Founders Capital. Pahdo Labs aims to create a virtual world where players can build their own anime-style worlds using AI and procedural generation. The company is currently developing its first title, an AI-powered anime PC RPG with user-generated content codenamed Halcyon Zero, a pre-alpha test of which is set in Sep’23.

Turkey-based Web3 incubator and launchpad Seedify has raised $10m in a funding round from LDA Capital. With over 65 blockchain projects incubated, Seedify has embarked on creating a user-generated content gaming platform called Seedworld, aiming to evolve gaming. This partnership with LDA Capital provides access to capital solutions and value-added services, fostering further growth and innovation in the blockchain ecosystem.

Newly-founded Web3 gaming studio GamePhilos has raised $8m in a Seed funding round from Xterio, Animoca Ventures, SevenX Ventures, and Chain Hill Capital. The money will be used for further development of the company’s NFT-based dinosaur game Age of Dino. The title features real-time battles between dinosaur factions, in-game trading, and NFT ownership. The funding will support the game’s development for mobile and PC, showcasing the integration of Web3 technology and blockchain-based assets.

US-based AI-powered gaming technology company Series AI has raised $7.9m in a Seed funding round from a16z Games, BITKRAFT, F4 Fund, and the Siqi Chen Access Fund. Series AI is developing AI-powered game authoring tools to accelerate game creation. The company aims to revive innovation in the gaming industry by enabling rapid prototyping and development of new games and game worlds, reducing the time between idea and execution.

Singapore-based entertainment company Mythic Protocol has raised $6.5m in a Seed funding round, led by Shima Capital and Alpha JWC with participation from several other investors. The funds will be used to develop Riftstorm, a cross-play action-shooter rougelite, as well as Mythic’s blockchain-based Decentralised Universal Meta and a collaborative asset set Legacy.

US-based newly-founded games developer Rascal Games has raised $4.2m in a Seed funding round, led by Patron, with participation from Andreessen Horowitz and other investors. The funds will be used to develop a shared world group-based PvE adventure game Project Wayward, inspired by titles like Sea of Thieves, Valheim, and Minecraft. Rascal Games aims to leverage its founders’ expertise in building products loved by gamers.

Croatia-based blockchain-based F2P trading card game developer Evertwine has raised $1.2m in a Seed funding round to support its ongoing development and growth. Evertwine aims to deliver a gaming experience, leveraging NFTs and blockchain technology while responding to user feedback and expectations.

UK-based VR games developer Fallen Planet Studios has raised $0.62m (£0.5m) in a Seed funding round from fund:AI, managed by River Capital. Fallen Planet Studios is primarily known for its VR horror title Affected: The Manor, released in 2018. The investment will be used to bolster the development of new titles incorporating AI, enhancing the company’s proprietary toolsets and player experience.

US-based fantasy sports games developer SuperDraft has raised an undisclosed strategic investment from US-based sports media company The Sporting News (TSN). The funding will enhance SuperDraft’s operations, as well as allow TSN to create a new revenue stream.