Weekly News Digest #43

# of announced deals

6

announced deals’ size

$90.4m

# of closed deals

5

Microsoft Closes $68.7B Acquisition of Activision Blizzard

On the 13th October, after all the struggle with anti-monopoly regulation, Microsoft (NASDAQ: MSFT) finally managed to close the acquisition of Activision Blizzard (NASDAQ: ATVI). After almost 20 months since the announcement, the $68.7B deal is still unprecedented for the gaming market and will likely remain the biggest deal in the industry for a long time.

The Deal Background: A Recap of the Fight

The deal value came from a $95.00 price per share, paid entirely in cash. Based on ATVI’s closing share price on January 14, 2022, right before the announcement of the deal, the transaction represented a 45% premium.

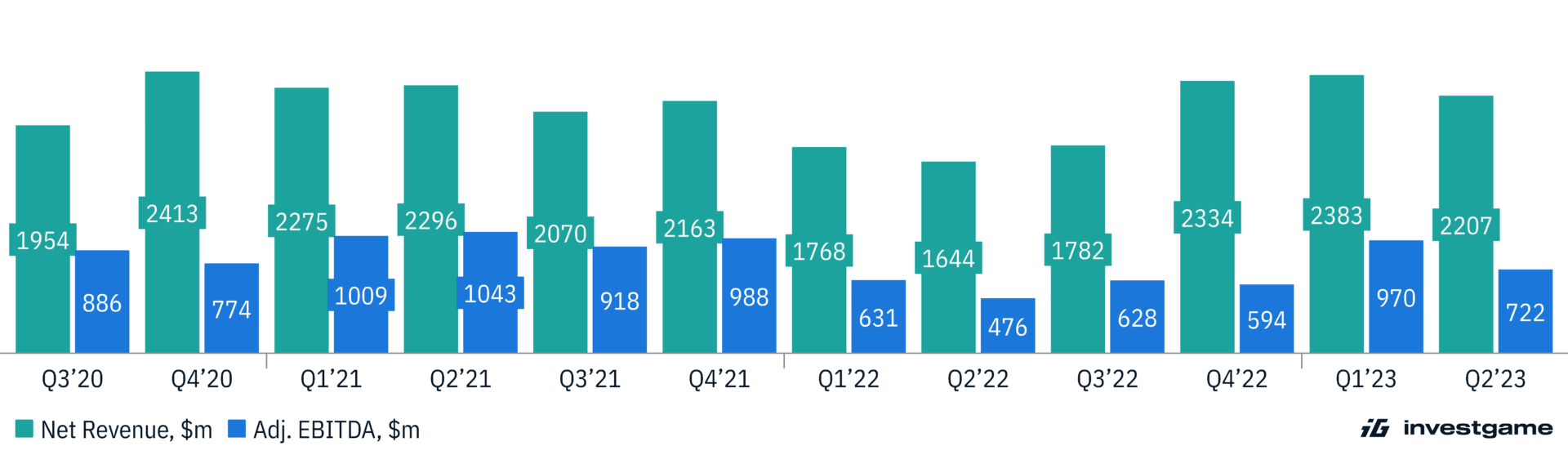

At the moment of the announcement, the value represented 7.9x EV/Net Revenue and 20.2x EV/Adj. EBITDA, coming from forecasted financial performance for 2021. Let’s look at the financial performance of ATVI for the last twelve months: we will see that 7.9x EV/Net Revenue comes almost on the same level due to a booming number of releases of new games in Q4’22 (Call of Duty: Modern Warfare II; World of Warcraft: Dragonflight; Overwatch 2), release of Diablo IV in Q2’23, and stable growth of King’s revenue, while 23.5x EV/adj. EBITDA increases mainly because of the increase in most expenses: Product Development, Marketing, and G&A.

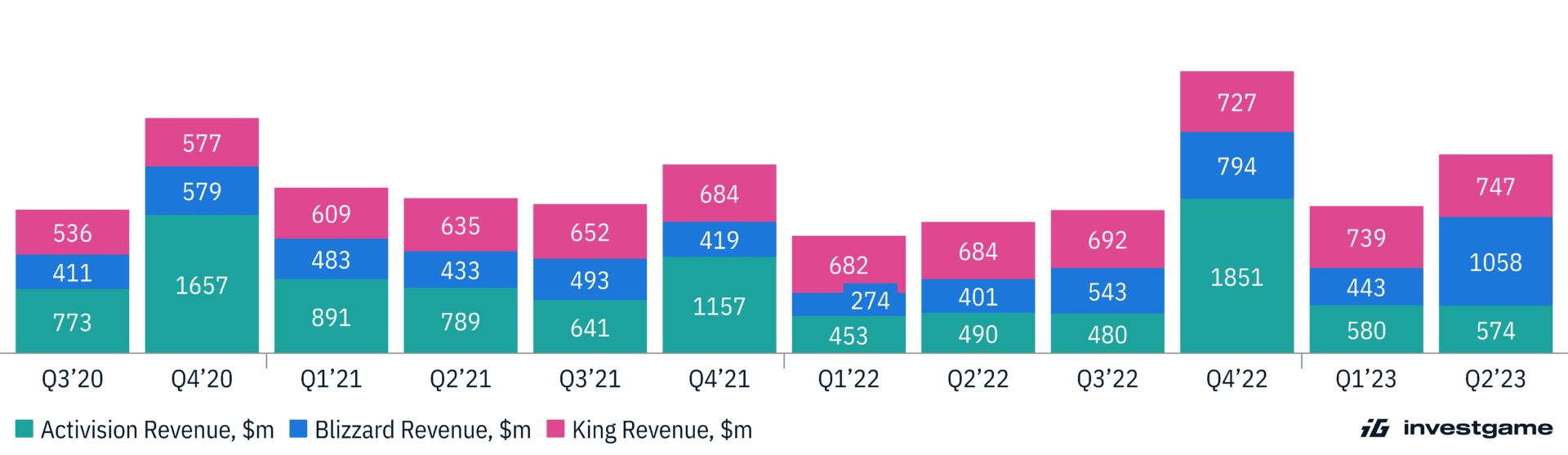

All in all, during the given period from Q3’20 to Q2’23, the average Revenue and Adj. EBITDA was relatively stable, with several ups and downs in the Revenue of Activision and Blizzard. For instance, Activision releases a new Call of Duty series title every fourth quarter of the year, provoking a spike in the Revenue. Regarding Blizzard, there was an increase in the Revenue linked to the release of Diablo IV in Q2’23. King keeps gaining momentum, steadily increasing its Revenue every quarter. The deal and the companies have been reviewed from every point possible, so let’s just have a short overview of each company.

Activision: 20 years, 20 shooters

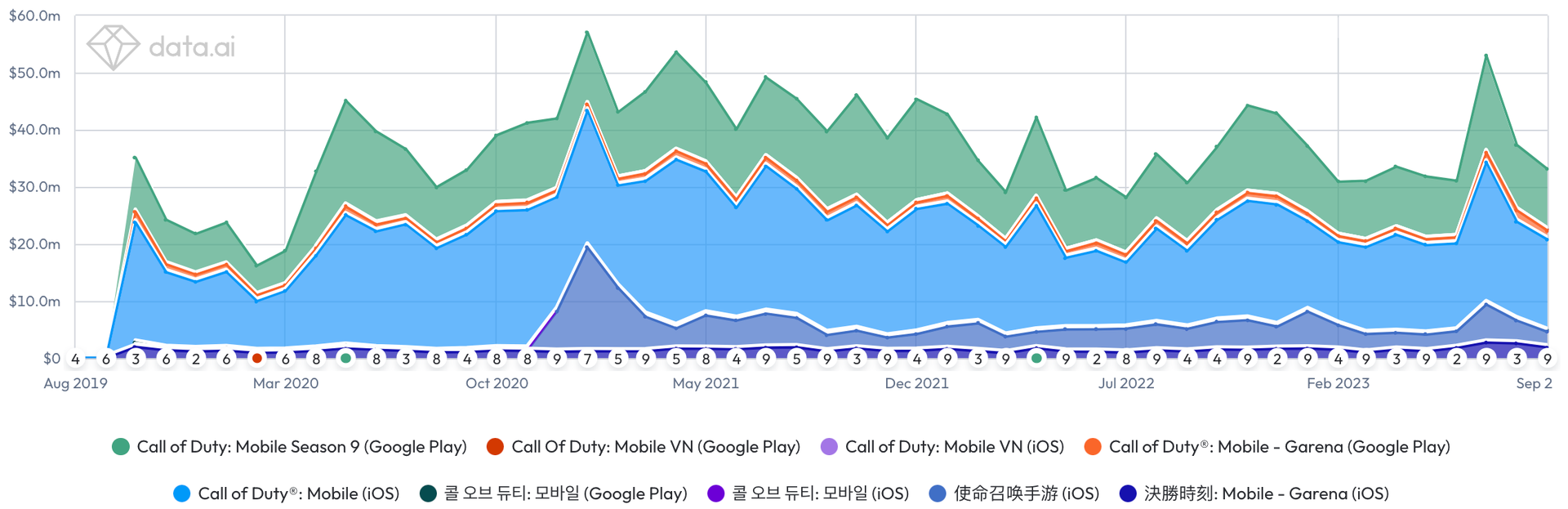

Though all three company pillars own one of the best-known IPs in the industry, Activision is a fascinating case. For twenty years already, Call of Duty has remained an annual experience awaited by millions of players worldwide, considering the average Activision MAU of approximately 98 million for the last year. Besides the single-player games coming every year before Christmas, the franchise has one of the most popular F2P PvP shooter titles for PC & Consoles — Call of Duty: Warzone. The other strong Revenue source is a mobile installment CoD: Mobile created by Tencent’s subsidiary TiMi Studio.

In many ways, the potential monopolization of the Call of Duty series became the reason for all the struggle around the acquisition. That is why we’ve witnessed Activision signing a 10-year agreement to keep Call of Duty on PlayStation. Even more surprising is the plan to release Call of Duty on Nintendo Switch — the console sold better than the past and the current generations of Xbox and PlayStation.

All this makes Activision an extraordinarily influential and dominant company on the market, but the premium model and the historical pace of development bring great responsibility. The recent installments of the franchise, Call of Duty: Vanguard and Call of Duty: Modern Warfare II, could have been better received by the audience. The company still has a strong reputation and a solid audience, but Activision must innovate its good old formula to keep the franchise fresh and prospering.

Blizzard: Success and Failures of the Recent Releases

Blizzard keeps getting relatively stable Revenue due to the maintenance of its leading franchises, World of Warcraft, Diablo, and Overwatch. Every two years, Blizzard has a spike in Revenue with the release of the new WoW addons, with the last one being Dragonflight, released in Q4’22. Moreover, since its release in 2019, WoW Classic has also become an additional source of Revenue.

In Nov’22, the company announced the suspension of its services in mainland China due to the expiration of the contract with China-based games developer and publisher NetEase (NASDAQ: NTES), which was publishing Blizzard games in China. After the suspension, Blizzard reportedly lost 3 million active users, meaning a massive loss of profit for the company, which can be seen in the Q1’23 Revenue, which was 56% less than in the previous quarters.

Overwatch 2 can be considered as another lost profit. Released in Oct’22, the game disappointed franchise fans, adding almost nothing new to the original Overwatch. The scandal around PvE missions also spoiled the series’ reputation, leaving fewer and fewer players ready to spend their money on the game.

Except for the WoW and Overwatch series, the company has other strong franchises like Diablo. Despite the initial disappointment of the core Diablo series fans, Diablo Immortal, released in Jun’22, turned out to be quite a success, bringing the company up to $80m a month two months after the official release. Yet Blizzard failed to keep up with such Revenue, which started dropping dramatically right after its Aug’22 peak due to the lack of new content.

Source: data.ai

Another Revenue spike was provoked by the release of Diablo IV in Jun’23. The Revenue in Q2’23 was 133% more than in the previous quarter.

Blizzard also keeps developing and publishing new games that could potentially support a long-term revenue stream, such as the mobile action strategy title Warcraft Ruble, which is planned to be fully released in Q4’23. Besides, there are rumors about a brand-new survival title, Odyssey, but there is no official information about the game and its current development stage.

In recent years, Blizzard has slipped from its position as the second-largest revenue and operating profit earner after Activision to King. The latter has maintained stable revenue growth with an average MAU of ~30 million players. Given the outcomes of their new games and the decreasing audience for core games, Blizzard will probably continue to experiment to find a new hit title like WoW or Overwatch, aiming to stabilize its financial performance.

King: Stable Leadership in Match-3

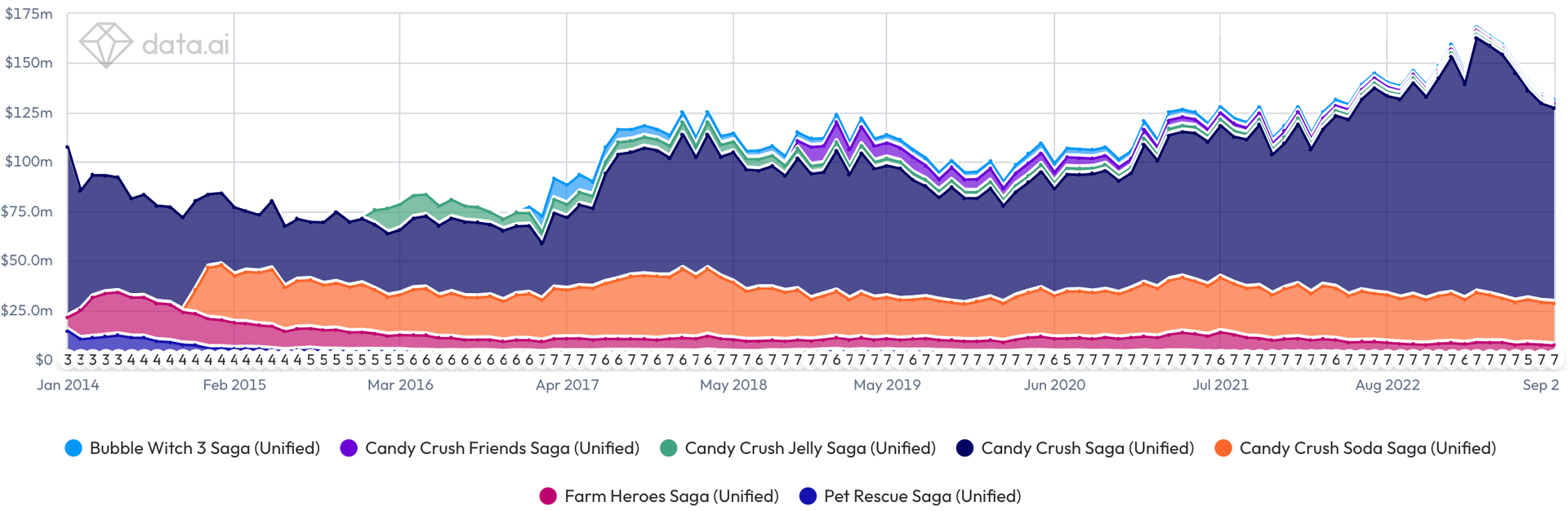

King keeps gaining momentum. According to data.ai, the studio’s flagship title, Candy Crush Saga, performs better in Revenue every year. One of the leading and genre-defining Match-3 titles continues to improve its performance from User Acquisition even in today’s tough post-IDFA market.

In contrast to Blizzard, King, which is probably the most successful Match-3 mobile games developer in the market, has maintained a consistent MAU base of 240 million players over the past three years. Simultaneously, the company has demonstrated stable revenue growth ($2.5B in 2021 vs. $2.7B in 2022). According to data from data.ai, King’s flagship title, Candy Crush Saga, continues to improve yearly performance. Despite the challenges posed by the post-IDFA market, King has managed to sustain a stable operating profit, amounting to $1.1B in 2022 and 2023. These results help to support King’s position as the second most significant contributor to the current financial results of Activision Blizzard company.

Source: data.ai

However, we don’t see any new titles making at least comparable money, which might be an alarming sign for the future. Still, while the company keeps Candy Crush Saga prospering, King remains the most stable source of Revenue for Activision Blizzard.

Strategic Rationale

We discussed the deal’s strategic rationale in one of our previous digests. So, to avoid repeating ourselves and giving a different perspective on this historical acquisition, we talked to gaming and tech M&A lawyer Richard Faichney, Senior Counsel at Taylor Wessing.

As an M&A lawyer working in games and as a gamer, this has been a fascinating saga to follow over the last two years. The deal’s announcement back in January 2022 certainly stunned the industry. At $68.7B, this is one of the largest M&A deals ever – especially in the tech and entertainment industries – and is the largest M&A deal in the history of gaming. It dwarfs Microsoft’s other recent gaming deals and the second-biggest gaming deal ever (T2’s (NASDAQ: TTWO) acquisition of Zynga). Most of these have also happened in the last three years alone.

The breakneck pace of M&A consolidation in recent years is well-known, and a small group of prominent tech conglomerates increasingly dominates the market. This draws attention from regulators when there is a growing trend of some taking a more aggressive stance on Big Tech. There is a sense they’ve been too permissive with tech M&A in the past. The argument is they’ve allowed players already strong in one market to acquire strong positions in newly emerging markets and to reduce competition.

Whether that idea is correct is a complex economic question. So much so that only some of the world’s significant regulators agree. It’s clear, however, that some hold this concern, and it impacts their approach. The Microsoft x Activision Blizzard deal is a perfect example.

Key points from my perspective:

There were differing approaches between the major anti-trust regulators. The EU Commission and most other global bodies approved; the FTC in the US and the CMA in the UK opposed.

Those challenges were unusual since this was a so-called “vertical” merger (i.e., between players at different parts of the value chain, with Microsoft making hardware and ATVI making software). Challenges to such mergers are rarer since the theory of economic harm is often harder to show than a merger between two direct competitors (known as a “horizontal” merger).

The CMA’s challenge initially focused on the concern that Microsoft would make Activision games (especially Call of Duty) exclusive to Xbox. Ultimately, this challenge was dropped as the data suggested it would be so financially adverse as to be a strong disincentive. Microsoft also signed 10-year deals with Nintendo, Sony, and many others to keep Activision games on those platforms for the foreseeable future.

The second big concern for the CMA was cloud gaming. This is currently a tiny part of the gaming industry but has been growing fast. There are differing views on how impactful this emerging sector will be for the games industry. However, cloud streaming has profoundly impacted music and TV/film, and there is some expectation that it could also profoundly affect games. The critical point is we have yet to determine how this area will evolve. However, this is an area where Microsoft and others have already invested heavily, and Microsoft is arguably already strong in cloud services. The combination of exclusivity for the Activision portfolio, some argue, could give them a commanding position and reduce effective competition in cloud gaming before that segment has adequately gotten off the ground.

The problem with this theory of harm is that accurately predicting which markets and emerging tech will be the next big thing is tricky. This also explains why other major regulators like the EU Commission have had different objections than the CMA and FTC.

While blocking the deal outright at first, the CMA ultimately allowed the deal to go ahead after Microsoft made significant concessions to address the cloud gaming concern. Microsoft granted Ubisoft (EPA: UBI) an exclusive 15-year license to cloud streaming rights for Activision’s past and future catalog. This license is exclusive worldwide, except within the EEA, where others may also license the cloud streaming rights.

While many have framed this as an embarrassing climbdown for the CMA and dismissed cloud gaming as irrelevant, I tend towards another view. The process has been messy and massively delayed. However, the result appears net-positive. The deal has been extensively reviewed, and the aspects that have not raised concerns have been allowed to proceed. The element that has raised concerns for some regulators – cloud gaming – has been addressed with a significant, creative, and relatively unprecedented solution.

From its public statements, the CMA views this as a win. In its view, it was the only regulator in the world that could extract real concessions to address its concerns in an emerging, unproven, but potentially significant part of the games industry. It also lays blame for the delay primarily on Microsoft, who the CMA says should have engaged more openly and been more creative in proposing solutions sooner to address the CMA’s concerns.

From a business and dealmaker perspective, the critical lesson here is that regulators must be engaged effectively if deals are to be navigated smoothly and with minimal delay. Microsoft has ultimately been successful here as a result of adopting that approach. For any dealmaker in gaming and tech right now, having excellent advisers, a proper regulatory engagement strategy, and an open mind to creative solutions are essential to getting the deal done.

The Microsoft x Activision Blizzard saga shows that no company is too big to fail in getting an M&A clearance and that regulators are willing to flex their muscles, even for the harder-to-win challenges and against the most prominent players in the game. As consolidation looks set to continue in a gaming industry dominated by Big Tech conglomerates, I’m not expecting regulatory scrutiny to ease soon.

Richard Faichney is an M&A lawyer specializing in technology and gaming deals at Taylor Wessing LLP.

Taylor Wessing is one of the world’s leading legal advisors to the technology and video game industries. They are an international law firm with dedicated technology and gaming teams based in 29 offices in 17 countries worldwide.

We want to thank MGVC, Taylor Wessing, and Xsolla for supporting this digest.

| NOTABLE TRANSACTIONS |

MERGERS & ACQUISITIONS

Hong Kong-based Animoca Brands has acquired a majority stake in a US-based Web3 streaming platform Azarus, for an undisclosed sum. Azarus is primarily known for its interactive Overlay Games, a tool that allows them to run interactive trivia games with the viewers, who get tokens for playing. The tokens can then be spent at Azarus Store. This acquisition aligns well with Animoca Brands’ strategy harnessing Web3 technology. The company had already invested money in Azarus in Feb’22.

China-based gaming giant Tencent (SEHK: 700), via its subsidiary Aceville, has acquired a minority stake in a South Korea-based games developer Shift Up for ~$59m (₩79.9B). This deal follows Tencent’s earlier 20% stake acquisition in 2022, bringing its total ownership in Shift Up to 24%. The studio is primarily known for its anime-themed mobile RPGs Goddess of Victory: Nikke and Destiny Child. Apart from that, Shift Up is currently developing its first AAA console title Stellar Blade.

VENTURE FINANCING

US-based game developer and publisher Neon Machine has raised $20m in a Series A funding round led by Polychain Capital, with participation from Griffin Gaming Partners, Brevan Howard Digital, Franklin Templeton, IOSG Ventures, and Tess Ventures. The sum will go to the development of the studio’s upcoming Web3 AAA extraction shooter game Shrapnel. The funds will support the release of an early access version in Dec’23, with a full F2P launch planned for 2024. The game features a post-apocalyptic Tokyo setting and has attracted significant industry attention for its production values and gameplay concepts.

US-based mobile game development studio Harmony Games has raised $3m in a Seed funding round funding, led by Griffin Gaming Partners. Co-founded by industry veterans Volkan Ediz, James Koh, and Joseph Kubiak, Harmony Games is currently developing its debut puzzle title Tiles Delight. The funding will be used to further develop the game, utilizing AI/ML technology for streamlined operations, level design, live operations, monetization, game art, and marketing.

US-based Web3 game developer Hytopia has raised $3m in a Seed funding round, led by Delphi Ventures, with participation from several other investors. The company, formerly known as NFT World, is currently developing a free-to-play Minecraft metaverse game and a toolkit for it. Hytopia also offers a monetization system that allows creators to earn money for cosmetic items they create.

Cayman Islands-based Web3 games developer Moonveil Entertainment has raised $2.4m in a Seed funding round led by Gumi Cryptos Capital and Arcane Group, with participation from Longhash Ventures, IOSG Ventures and Infinity Venture Crypto. The studio previously raised $3m in Sep’22. The funds will be used for further development of the studio’s Web3 casual multiplayer mobile games AstrArk and Project B (code name). Moonveil plans to utilize Web3 features for player rewards, emphasizing engagement over speculative interests. The games are planned to be released in Q4’23.