Weekly News Digest #32

# of announced deals

9

announced deals’ size

$48.5m

# of closed deals

9

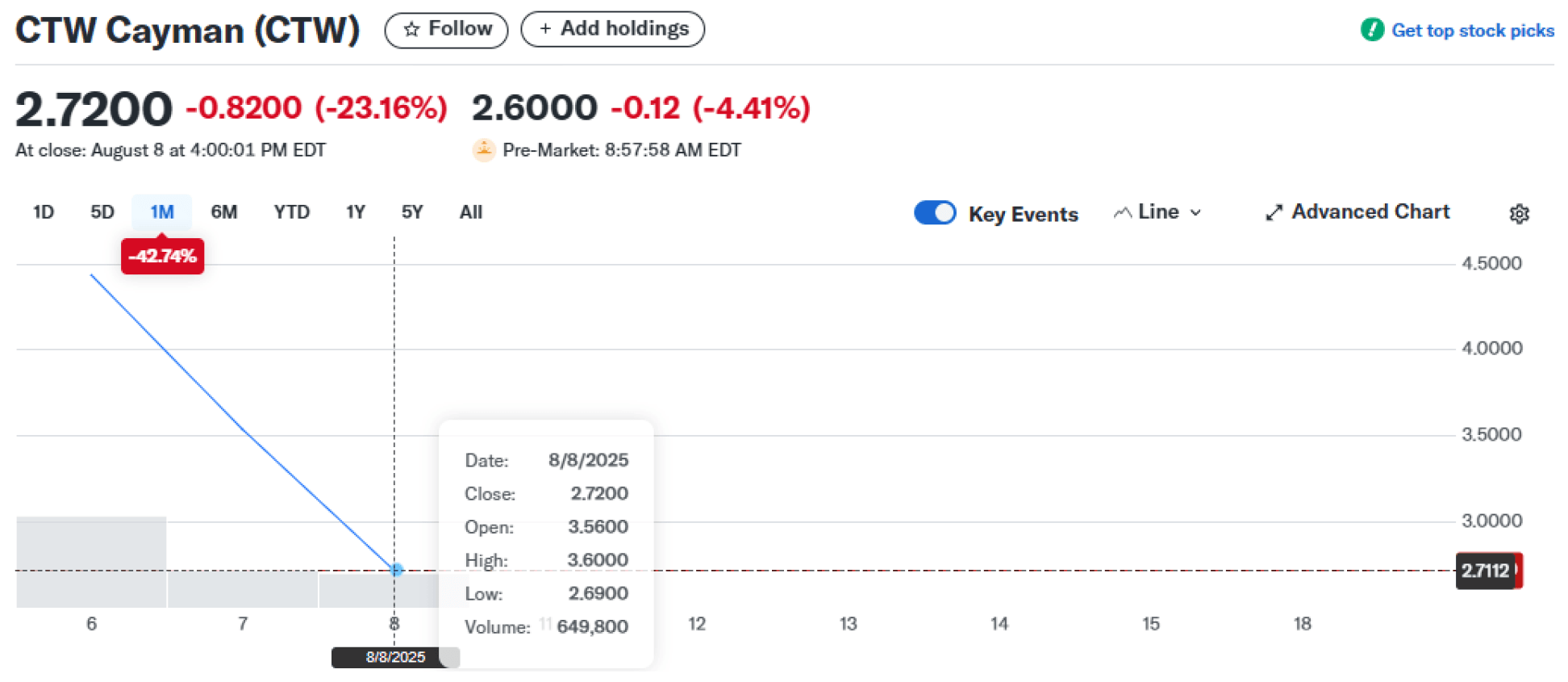

CTW Cayman Raises $12M in IPO, Eyes Global Expansion

Japan-based HTML5 browser gaming company CTW Cayman raised $12m in gross proceeds through its initial public offering on the NASDAQ under the ticker CTW on August 6, 2025. The offering consisted of 2.4 million Class A ordinary shares at $5.00 each, implying a post-offering market cap of $240m based on 48 million shares outstanding. Roughly $10m of the IPO proceeds will be allocated toward international expansion, with the rest to be used for general corporate needs.

This is the first Asian gaming IPO since ShiftUp’s Jul’24 listing and the first Japanese gaming listing since WonderPlanet’s public offering in Jun’21, adding another example to the gaming companies’ listings we covered in one of our previous features by $GDEV.

Company Background & The HTML5 Platform Play

Founded in 2013, CTW operates G123.jp, a browser-based HTML5 gaming platform offering anime-based F2P titles such as Goblin Slayer, Queen’s Blade, and So I’m a Spider, So What? Ruler of the Labyrinth. The platform currently offers 29 active titles, and 19 more are in development. A total of 65 titles have been published on the platform since its establishment. CTW’s role spans anime IP licensing, distribution, marketing, platform hosting, and revenue sharing, while third-party studios handle development.

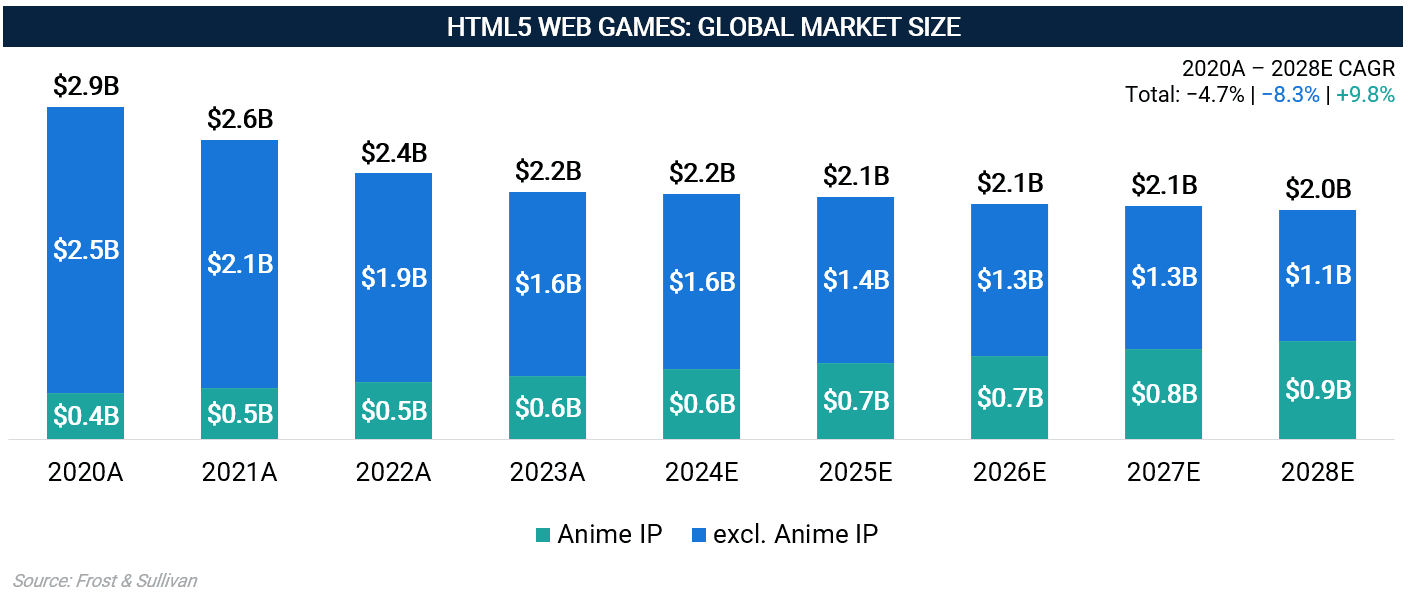

Browser gaming remains niche in Western markets, and HTML5 monetization outside Japan has been historically difficult. The anime fandom has surged globally — with anime now among the most-watched genres on platforms like Netflix (NASDAQ: NFLX). The continued rise of IP-first experiences gives CTW a compelling hook, especially as younger audiences embrace cross-platform, lightweight gaming models. While the broader HTML5 gaming market has seen a gradual decline in recent years, anime-themed titles have been quietly taking over. According to Frost & Sullivan research, anime IP-based games have steadily expanded their share, growing from just 10.3% of the global HTML5 market in 2019 to 25.5% in 2023 — more than doubling in five years.

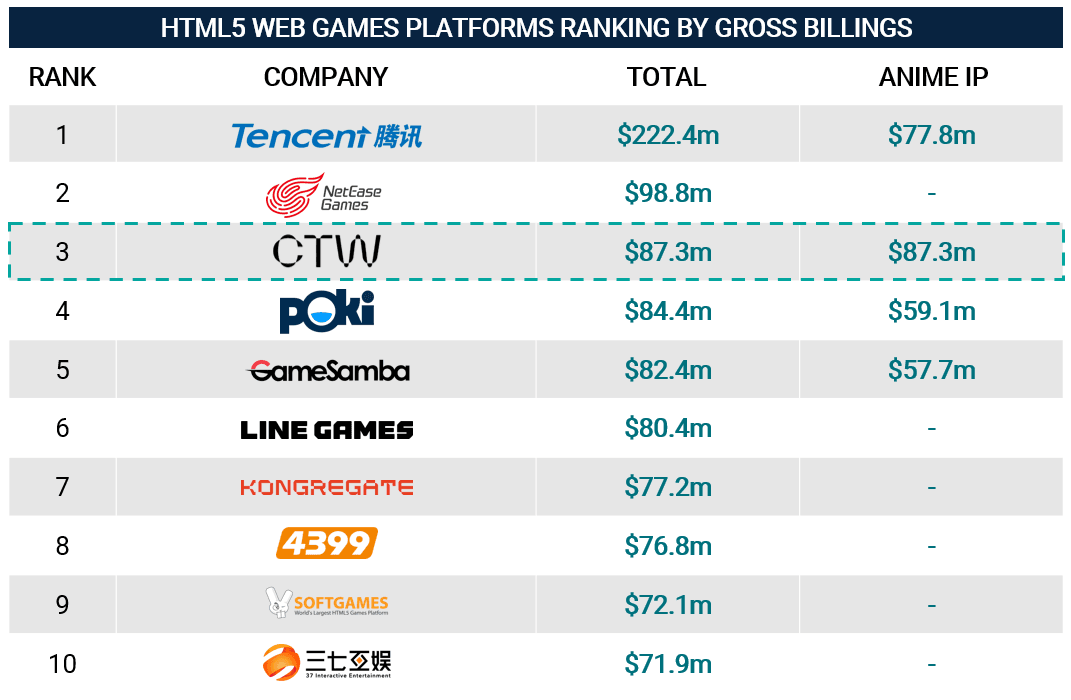

In Japan, “instant play” browser games retain strong appeal thanks to direct distribution and fast IP rollouts. CTW claims the top spot globally among anime IP-based HTML5 platforms, and ranks #3 among all HTML5 game developers worldwide by gross billings.

Financial Performance & Growth Trajectory

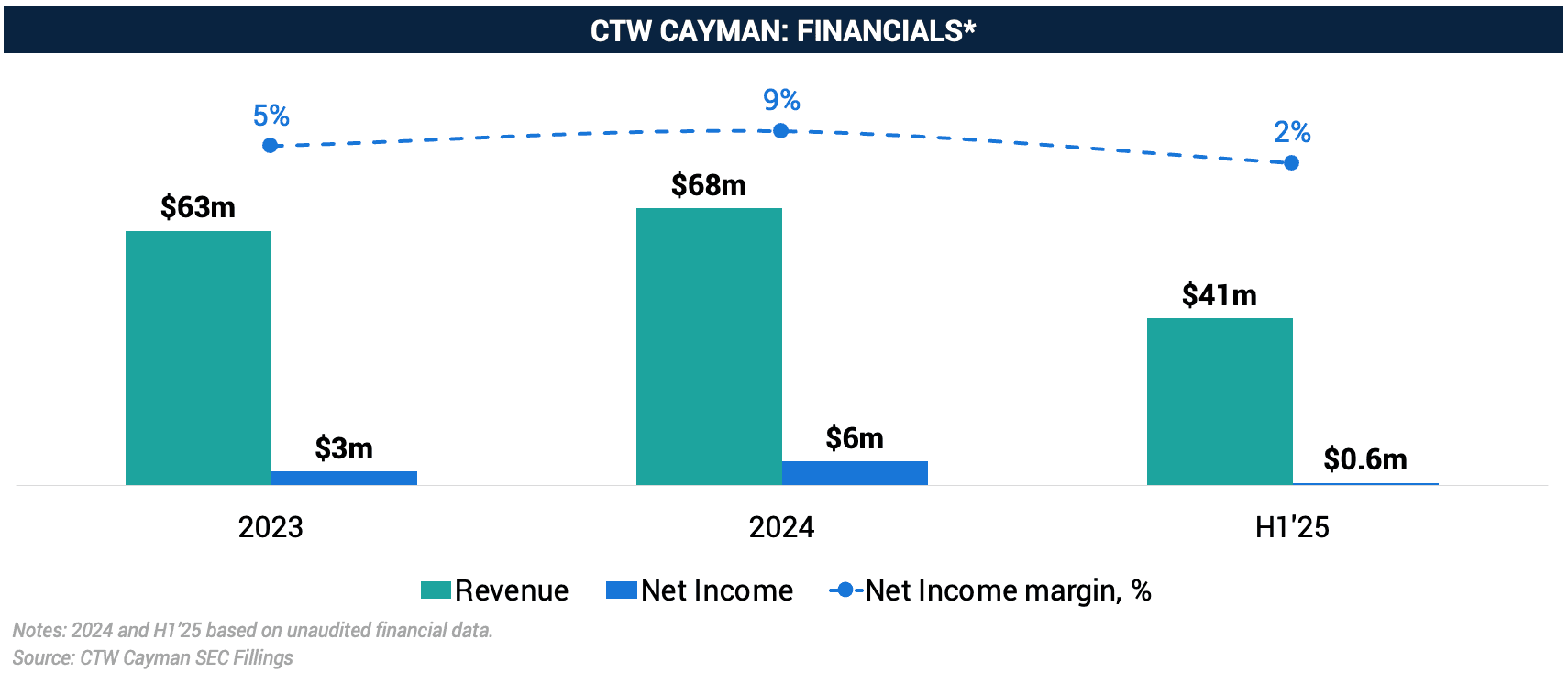

CTW Cayman entered the public market with modest but consistent growth indicators. The company reported $68.4m in revenue for FY’24, up 8.7% YoY, and a net income of $6.0m, nearly doubling from $3.4m in FY’23, suggesting improved monetization efficiency across its platform.

For the six months ending Jan’25 (H1’25), revenue reached $41.2m, implying an annualized run-rate of ~$82.4m. At the IPO valuation of $240m, this suggests a ~2.9x EV/Revenue multiple.

CTW’s user base continues to scale steadily: MAUs rose to 3.3 million users (vs. 2.1 million in 2023), while ARPMAU sits at ~$2.5. Its top-performing users remain highly monetizable, with paying MAUs contributing ~$107 each on average, reinforcing the value of its anime-first, browser-based niche.

While these indicators are encouraging, revenue concentration remains a key risk. In H1’25, flagship titles Vivid Army and Queen’s Blade: Limit Break still accounted for over 40% of revenue, down from 60% in FY’24 and 89% in FY’23. Yet this diversification has limits: a newer release,So I’m a Spider, So What? Ruler of the Labyrinth, launched in Oct’24, already contributed 15.9% of H1’25 revenue, reinforcing the platform’s continued reliance on a handful of high-performing IPs.

This highlights both the upside and vulnerability of CTW’s model, strong monetization from hit anime titles, but limited revenue depth.

Finally, while FY’24 margins remained stable, H1’25 saw a decline, driven by heavier spending on international expansion and content pipeline growth. Whether CTW can replicate its domestic performance abroad, without declining margins, will probably be one of the crucial points.

Anime HTML5 Games: A Global Opportunity?

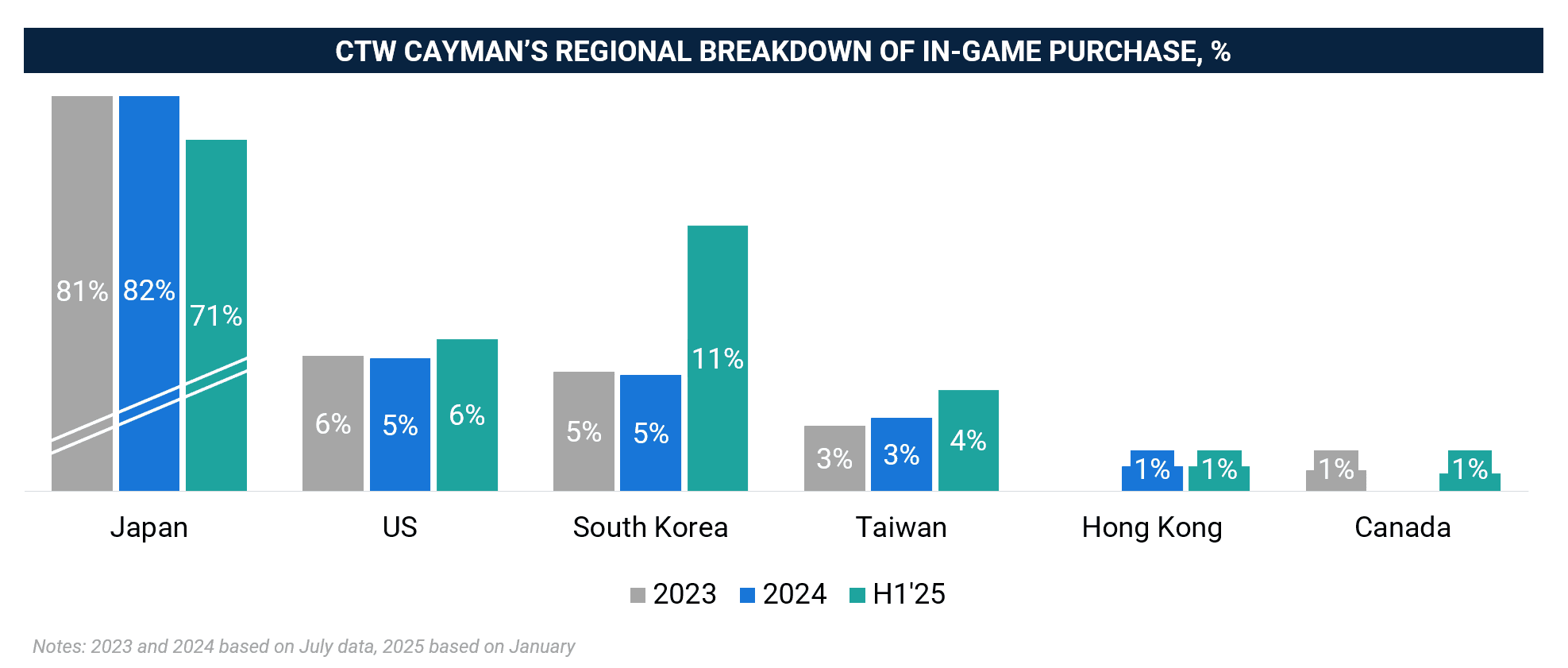

Japan remains CTW’s largest market, generating 71% of revenue in H1’25, but its share has been steadily declining as overseas sales — particularly in South Korea and Taiwan — show a steady growth.

The company’s user base is heavily localized, and its content strategy is tightly tied to Japanese anime culture. But CTW sees global upside: with 19 games in development and 9 in pre-registration, it plans to double its portfolio while expanding reach across the US, Europe, and Southeast Asia.

Strategic Rationale: Surfing the Anime Wave

CTW’s IPO comes amid growing investor interest in anime-based games and IP strategies. Recent examples include Bandai Namco’s (TYO: 7832) partnership with Sony (TYO: 6758; NYSE: SONY), following previous deals with Kadokawa, to expand anime globally. For CTW, going public is both a capital move and a visibility play: it seeks to establish credibility in global markets, attract new IP partnerships, and accelerate its rollout across Western geographies.

With a focused content niche, strong domestic product-market fit, and over a decade of operating experience, CTW stands out as a capital-efficient, IP-driven player in the gaming space. Its lean model, built on browser-based distribution and strategic content partnerships, offers a differentiated approach to scaling anime-themed games globally.

But execution will be key. Can CTW maintain its monetization efficiency while expanding to less familiar markets? Can it localize Japanese IPs without losing their core appeal?

Since its debut, CTW’s share price has fallen ~45%, a clear sign that investors are waiting for evidence that the company can translate domestic success into international growth.

PvX Partners: The Leading Growth Platform for Scaling Mobile Games

PvX Partners empowers gaming and consumer app developers with capital and intelligence to scale their user acquisition effectively.

The PvX Lambda platform drives this by delivering advanced cohort analytics, real-time ROAS benchmarking, and financial projections, enabling teams to optimize performance and make informed decisions.

These insights power PvX Capital, which provides non-dilutive funding to grow UA spend without impacting your cash balance. Teams can confidently scale campaigns, maintain their cash position, and increase long-term ROI — all without giving up equity.

With seamless data integration and ongoing funding eligibility checks, PvX offers the infrastructure for sustainable, profitable growth.

👉 Visit PvX Partners to Learn More

| NOTABLE TRANSACTIONS |

MERGERS & ACQUISITIONS

China-based games developer and publisher XD Inc. (SEHK: 2400) has acquired a 5.3% stake in Singapore-based game development studio Miao for $14m, valuing the game studio at $246m. The investment will support accelerating game development initiatives and establishing an artificial intelligence lab focused on automating coding, level design, storytelling, and art asset creation. Miao, founded by a former CEO of Giant Network, is also developing an open-world multiplayer game. This transaction follows Miao’s Mar’23 ~$14m angel funding round.

Cyprus-based multiplatform gaming company GDEV (NASDAQ: GDEV) has acquired Cyprus-based full-stack mobile games developer Light Hour Games for an undisclosed sum. As part of the transaction, Light Hour Games will retain creative autonomy, receive operational funding from GDEV, and participate in long-term upside through a revenue-sharing model. The acquisition aims to enhance GDEV’s mobile casual portfolio by incorporating Light Hour Games’ AI-first development workflows, which facilitate rapid iteration without compromising product quality. Light Hour Games is a 15-person team currently developing a tile-match casual mobile title.

US-based mobile learning platform Duolingo (NASDAQ: DUOL) has acquired a team behind UK-based music gaming startup NextBeat for an undisclosed sum. The acquisition involves integrating a team of 23 experts specializing in game design, user retention, monetization, sound design, and music licensing. This acquisition aims to enhance the company’s Music course by bringing in dedicated expertise in music-gamified learning. NextBeat is recognized for the mobile rhythm games Beatstar and Country Star, which together have achieved over 100 million downloads and approximately $200m in revenue.

UK-based games and hardware analysis platform Digital Foundry has reacquired approximately 50% of its outstanding shares from US-based media company IGN for an undisclosed sum. The buyback was led by founder Richard Leadbetter and Eurogamer founder Rupert Loman-West, restoring majority ownership to the company’s six-member team. The company intends to leverage complete operational independence to launch a new site and expand its coverage of retro and PC gaming analysis. Digital Foundry produces technical reviews of new game releases, hardware performance breakdowns, and the weekly Digital Foundry Direct podcast. IGN purchased Gamer Network, which owned Digital Foundry, in May’24.

VENTURE FINANCING

India-based mobile game developer SuperGaming has secured $15m in a Series B funding round, bringing the company’s valuation to $100m. The round included participation from a16z Speedrun, SkyCatcher, AET Fund, BACE Capital, Bandai Namco 021 Fund, Neowiz (KRX: 095660), P2 Ventures, and other investors. The proceeds will support the global expansion of the studio’s flagship title, Indus Battle Royale, with a strategic focus on the LATAM region. The funds will also be used to scale game development, expand the team, build original IPs, and deepen partnerships with publishers. In addition to Indus Battle Royale, the company is developing two proprietary technology platforms: Indus Engine and SuperPlatform. This round follows an earlier undisclosed corporate investment from Bandai Namco in Feb’25.

India-based AI game tech company GameRamp has raised $5.4m in a pre-Seed funding round led by BITKRAFT, with participation from South Park Commons, Mixi, DeVC, and various angel investors. The funding will support team expansion across the US and India, as well as the launch of the company’s initial product offering. GameRamp is developing two AI-powered tools for mobile game developers: Sentinel, which uses reinforcement learning to optimize in-game economy and monetization in real time, and Grow, an embedded financing solution designed to improve capital access for developers.

Israel-based mobile games developer Liberty Pixel has raised $1.1m in a funding round from undisclosed investors. The proceeds will support development and live-ops team expansion, enhancement of marketing efforts, and AI-driven production workflows to scale its casual and hybrid-casual games portfolio. The company’s upcoming titles include skill-based arcade Roll Masters and merge puzzle Merge Match: Bubble Puzzle. According to the press release, the company reached $1m ARR. This round brings Liberty Pixel’s total funding to $2.3m.

Germany-based game developer Honig Studios has secured $1m in a funding round from the German Federal Ministry for Economic Affairs & Energy and Arbitrum Gaming Ventures. The investment will fuel the development of the title, The Lost Glitches. The Lost Glitches is a narrative-driven, strategic trading card game available on Steam.

| Report Date | Company Name | Earnings Release Presentation | Share Price Dynamics (Report Date vs. 10-Aug) |

|---|---|---|---|

| 2025-08-04 | Playstudios | Playstudios Q2’FY25 | (5%) |

| 2025-08-05 | Bandai Namco | Bandai Namco Q1’FY26 | 8% |

| 2025-08-06 | Light & Wonder | Light & Wonder Q2’FY25 | (13%) |

| 2025-08-07 | G5 Entertainment | G5 Entertainment Q2’FY25 | 1% |

| 2025-08-07 | Playtika | Playtika Q2’FY25 | (4%) |

| 2025-08-08 | Take-Two Interactive | Take-Two Q1’FY26 | (8%) |