Weekly News Digest #34

# of announced deals

8

announced deals’ size

$57.7m

# of closed deals

6

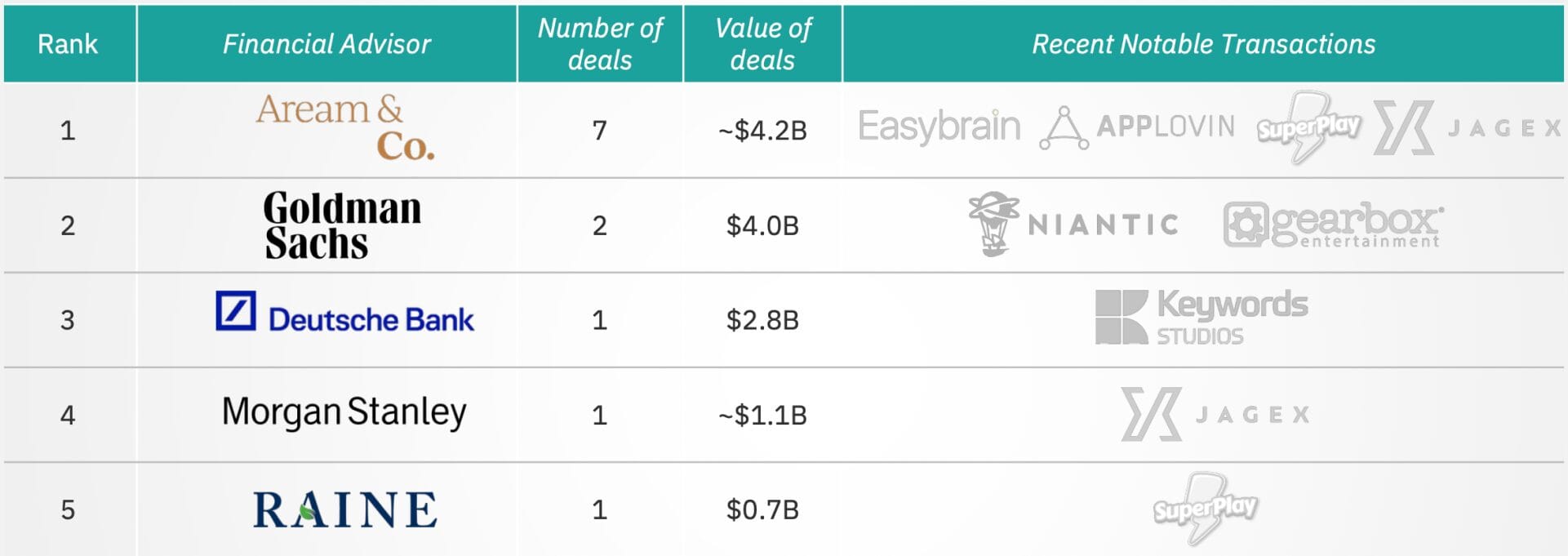

Gaming M&A Sell-side Advisory Ranking 2024–2025 YTD

InvestGame is pleased to present the Sell-Side M&A Advisory Ranking.

Since we first introduced this ranking in 2021, the role of financial advisors in gaming has grown significantly. Over the past 18 months, gaming M&A has rebounded from moderate post-pandemic levels. In the first half of 2025 alone, total disclosed deal value in control acquisitions has already exceeded $6.5B across 50+ transactions.

This activity is unfolding in a rapidly evolving environment marked by shifting geopolitics, trade tensions, and the increasing importance of “portfolio management–type” deals in corporate strategy. In this increasingly complex landscape, strategic guidance has become more essential than ever: advisors navigate companies through the nuances of deal-making while structuring transactions to maximize value and ensure seamless execution.

Designed for founders and investors, our analysis serves as a practical guide to the evolving M&A landscape. We rank over 20 financial advisory firms using a methodology that balances total disclosed transaction value with deal count across 80+ major acquisitions. Selection criteria were:

- Seller profile: Involved in game development or publishing.

- Deal size: Minimum of $65m in estimated upfront consideration (earn-outs excluded).

- Scope: Transactions involving the sale of a controlling stake with a disclosed sell-side financial advisor.

Explore the league table below for insights on the top advisory firms with the strongest track records in gaming M&A.

PvX Partners: The Leading Growth Platform for Scaling Mobile Games

PvX Partners empowers gaming and consumer app developers with capital and intelligence to scale their user acquisition effectively.

The PvX Lambda platform drives this by delivering advanced cohort analytics, real-time ROAS benchmarking, and financial projections, enabling teams to optimize performance and make informed decisions.

These insights power PvX Capital, which provides non-dilutive funding to grow UA spend without impacting your cash balance. Teams can confidently scale campaigns, maintain their cash position, and increase long-term ROI — all without giving up equity.

With seamless data integration and ongoing funding eligibility checks, PvX offers the infrastructure for sustainable, profitable growth.

👉 Visit PvX Partners to Learn More

| NOTABLE TRANSACTIONS |

MERGERS & ACQUISITIONS

Saudi Arabia-based investment firm Impact46 has acquired mobile games developer Kammelna for more than $53m (SAR 200m). The acquisition aims to expand culturally grounded digital IP and scale Kammelna’s operations. The studio is best known for its mobile card game Baloot, which has reached 6 million downloads and 1 million MAU. This transaction marks the largest deal to date for Impact46.

US-based esports company Affinity Esports Group has acquired US-based esports training company CT Esports Academy for an undisclosed sum. The transaction is expected to expand community-focused esports activities, including after-school programs, game nights, social gaming clubs, educational classes, club teams, and private coaching in the Connecticut region.

Canada-based digital channel network Vertiqal Studios (TSX: VRTS) has announced the acquisition of Canada-based esports organization Luminosity Gaming and US-based YouTube partner network Omnia Media from Enthusiast Gaming (NASDAQ: EGLX) for a $660k cash consideration. The transaction is expected to close in early Sep’25. The acquisition aims to scale Vertiqal Studios’ operations across the digital advertising ecosystem with expansion on YouTube and Twitch. Luminosity Gaming is a North American esports organization with competitive teams in Counter-Strike and Super Smash Bros, while Omnia Media operates a YouTube network previously acquired by Enthusiast Gaming in Sep’20.

India-based esports firm Nodwin Gaming, a subsidiary of mobile game publisher Nazara Technologies (NSE: NAZARA), has acquired a stake in US-based fighting game tournament organizer Evolution Championship Series (EVO) from Sony Interactive Entertainment (NYSE: SONY) for an undisclosed sum. Nodwin will join RTS as co-owner of the company. Sony will remain involved with EVO as a global sponsor through 2028. EVO provides major fighting title esports events, including Street Fighter 6, Tekken 8, and Mortal Kombat 1, with tournaments held in Las Vegas, Los Angeles, Tokyo, and Nice. The transaction follows Nodwin’s $5.5m acquisition of Starladder in Jan’25.

VENTURE FINANCING

Saudi Arabia-based gaming accelerator Exel by Merak has invested $300k each in 17 gaming startups, totaling $5.1m, through its first Demo Day. The cohort was selected from over 300 applicants. The investments provide equity funding, mentorship, relocation and legal support, and market readiness services, along with access to global partners. Exel is backed by Merak Capital’s $80m Gaming Fund, raised in Nov’24, and is supported by the National Development Fund and the Social Development Bank.

US-based intelligence platform Palladio AI has secured an undisclosed investment in a venture round led by Griffin Gaming Partners. The funding will support hiring across ML, AI, data, and engineering teams. Palladio AI develops an intelligence platform for product-led teams, initially focusing on mobile games. The platform, currently in beta, enables problem identification, prioritization, and faster decision-making. The company was founded by veterans from Uber, Chime, and Google.

US-based esports organization RTS has received investment from Saudi Arabia’s Qiddiya as part of the country’s Vision 2030 program, which aims to diversify the Saudi economy. Additionally, Qiddiya will also extend its global partnership with Evo through 2027.

FUNDRAISING

India-based venture capital fund Lumikai has closed its $50m Lumikai Fund II. Announced in Jun’23, the fund has already been deployed into several companies, including a $13.5m Series B investment in Eloelo. Since launching its first fund in 2019, Lumikai has invested in 18 companies that have collectively raised $126.3m.

South Korea-based game publisher Com2uS Holdings (KRX: 063080) has launched a $7.3m global publishing contest in partnership with Turkey-based gaming industry platform Mobidictum, targeting developers in Turkey and the MENA region. The program will provide up to $730k per selected project, with additional rewards linked to testing milestones and download performance. The submissions open until the middle of Sep’25. Com2uS Holdings will offer global publishing opportunities for up to 10 selected teams across mobile, PC & Console.

COMPANY REPORTS

| Report Date | Company Name | Earnings Release Presentation | Share Price Dynamics (Report Date vs. 24-Aug) |

|---|---|---|---|

| 2025-08-19 | Starbreeze Entertainment | Starbreeze Q2’FY25 | (2%) |