Weekly News Digest #39

# of announced deals

8

announced deals’ size

$55B

# of closed deals

7

EA Exits the Public Arena in Record $55B Private Buyout

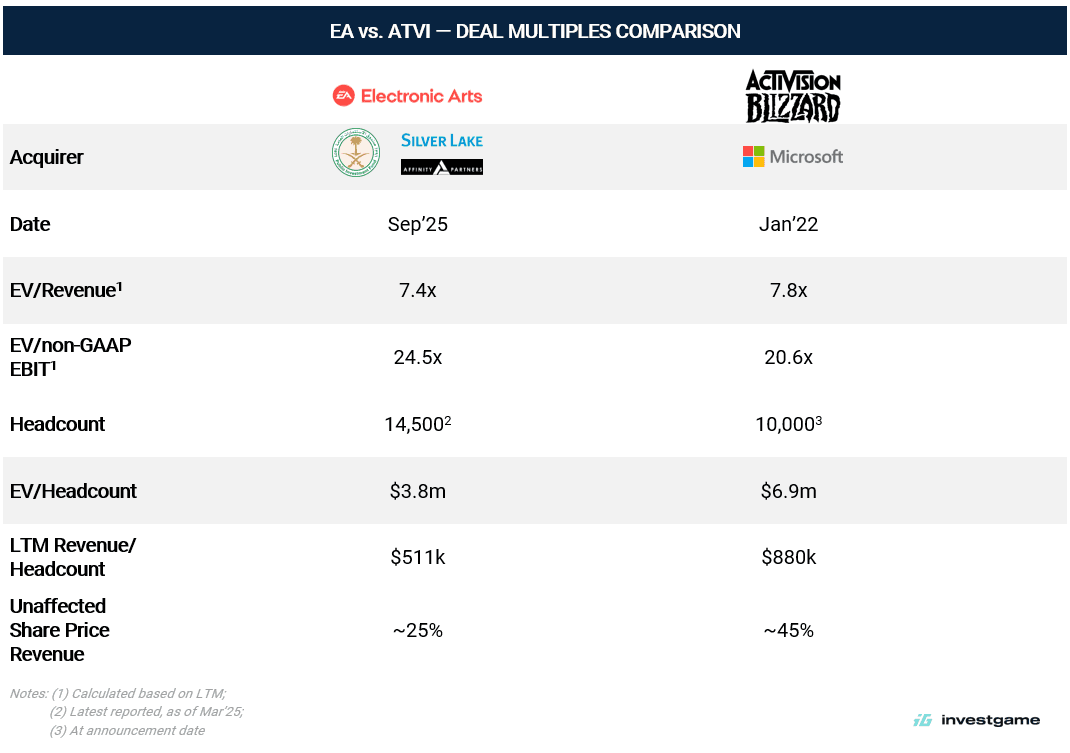

Electronic Arts (NASDAQ: EA), one of the last major Western independent publishers in gaming, has agreed to be acquired via a $55B all-cash transaction by a consortium of Saudi Arabia’s Public Investment Fund (PIF), Silver Lake, and Affinity Partners, the private equity firm founded by Jared Kushner, which PIF also backs. EA shareholders will receive $210 per share in cash, representing a 25% premium to EA’s unaffected price of $168.32 on September 25, 2025, with PIF rolling over its 9.9% stake. The deal is backed by approximately $36B of equity commitments and $20B in debt financing arranged by J.P. Morgan, and is expected to close in Q1’FY27. EA will remain headquartered in Redwood City, with Andrew Wilson continuing as CEO. This marks the largest all-cash private equity-backed take-private deal in history and the second-largest take-private gaming deal after Microsoft’s $68.7B acquisition of Activision Blizzard.

Founded in 1982, EA has been shaping the industry for decades. From The Sims to Battlefield and Apex Legends, the company built a massive portfolio — but above all, it established dominance in sports through FIFA (now EA SPORTS FC) and Madden NFL. These franchises pioneered recurring monetization long before “live services” became industry standard.

Today, EA finds itself in a different position. While it remains one of the industry’s largest publishers, its growth profile has shifted. Revenues remain flat, sustained primarily by its sports franchises, while other segments deliver uneven results. The company has invested heavily in M&A — $5B since 2020 across Codemasters, Glu Mobile, and Playdemic — but these deals have not become new growth engines for EA. Within public markets, that pattern has recast EA: no longer viewed as a high-growth innovator, but increasingly as a cash-flow utility — valued for predictable margins, yet discounted for its lack of expansion.

We thank NEON for supporting this digest.

We’re attending the Mobidictum Conference 2025 — see you this October in Istanbul! Use the code INVESTGAME-NEWSLETTER to get a 15% discount.

| NOTABLE TRANSACTIONS |

MERGERS & ACQUISITIONS

UK-based game development studio Splash Damage has divested from Tencent Holdings (SEHK: 700) and been acquired by a private equity group for an undisclosed sum. The company will continue operating under its existing leadership. Splash Damage, known for creating team-based multiplayer FPS, has participated in the development of over a dozen titles, including Gears Tactics, Gears 5, Halo MCC, and Batman: Arkham Origins. The deal follows the cancellation of Transformers: Reactivate in Jan’25. Splash Damage was a subsidiary of Leyou Technologies following its acquisition in Jul’16, with Tencent taking control over Leyou for $1.4B in Dec’20.

US-based games developer and publisher 2K Games, a subsidiary of Take-Two Interactive Software (NASDAQ: TTWO), has acquired US-based game technology company Yoom for an undisclosed sum. Yoom develops 3D digital character creation and markerless performance capture solutions.

VENTURE FINANCING

US-based AI Tech gaming company Nilo has raised $4m in a Seed funding round from Supercell and a16z Speedrun, among others. The company is developing a browser-based, AI-powered tool that enables the creation of collaborative 3D environments through text, image, and voice prompts.

US-based video game publisher Midwest Games has secured $2m in funding from Prevail Capital. The funding will be used to expand the team, strengthen data-driven insights, and broaden global capabilities. Founded in 2023, Midwest Games operates a publishing-as-a-service model for developers and has released seven titles to date. The company has raised a total of $6.6m across two funding rounds, with the most recent $3.3m round in Mar’24.

A US-based, undisclosed gaming hardware startup founded by Brynn Putnam, a former executive at Mirror, has secured an undisclosed investment from Lerer Hippeau. The company is developing devices that enable in-person social interaction through games, combining hardware with user-centric design. Mirror, Putnam’s previous venture, focused on smart fitness mirrors that streamed workout classes.

FUNDRAISING

Saudi Arabia’s Ministry of Communications and Information Technology has launched the second edition of the Saudi Game Champions program. The initiative will provide up to 20 incubated teams with approximately $53k each, alongside mentorship, technical training, and business development support. The program will begin with a three-day Game Jam in Oct’25 before selected groups enter a six-month incubation phase in Riyadh.

The Scotland-based industry association, Scottish Games Developers Association, has launched the Games Accelerator Program to support early-stage game development studios. The program will offer nine in-person workshops on product development, financing, and pitching, as well as mentorship from experienced developers and hands-on development of small game prototypes. The accelerator runs from Nov’25 to Mar’26.

Three UK-based game developers have secured undisclosed funding from the newly established Aurora 2025 Pilot Programme accelerator by Code Coven. Each studio is UK-registered and has at least 50% of its leadership comprised of underrepresented groups. The selected studios include:

- PC & Console games developer Fast Loris Studios, developing the Walkies title.

- PC & Console games developer Glowfrog Games, developing the scrapbooking title Pieced Together.

- Hologram Ghost, developing an undisclosed cyberpunk dramedy adventure.