Weekly News Digest #4

# of announced deals

11

announced deals’ size

$83m

# of closed deals

11

Ubisoft Shares Plummet 34% following Radical Restructuring and Mass Layoffs

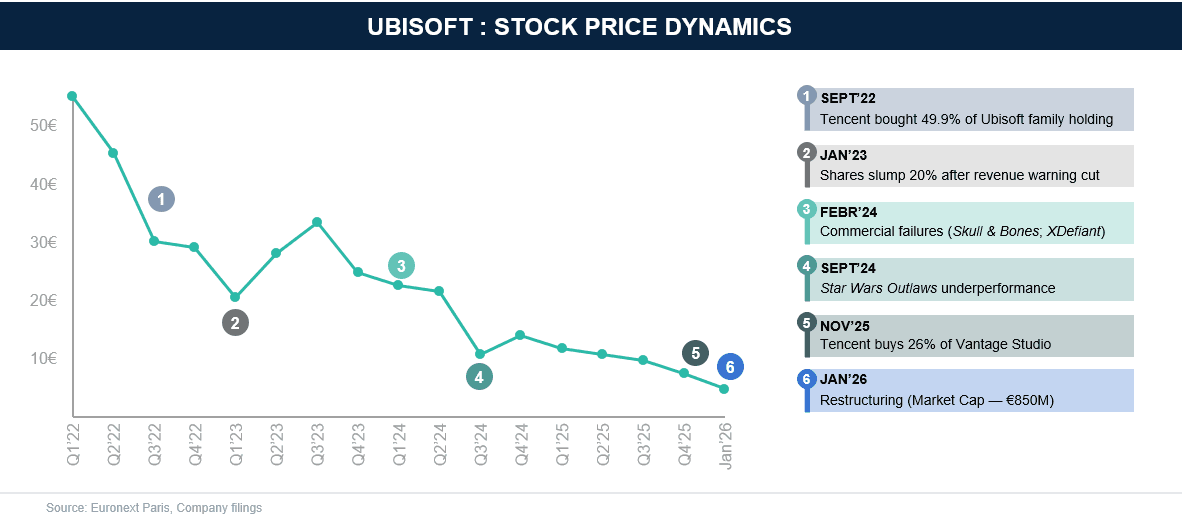

France-based games company Ubisoft Entertainment (PAR: UBI) saw its share price plunge 34% on January 22, 2026, following an announcement of sweeping restructuring measures. The single-day decline, the largest in the company’s 30-year public history, reduced market capitalization to approximately €850m ($995m), down from over €12B at its all-time high peak in mid-2018 — a staggering 93% decline in shareholder value over 7 years. The slide continued into January 26, 2026, with market value hitting a new low of approximately €600m ($712m).

In 2024, Ubisoft faced a series of commercial underperformances with titles like Skull & Bones and XDefiant. Following Star Wars Outlaws‘ underperformance in September 2024, Ubisoft shifted from its Ubisoft Connect exclusivity model to a Day-1 Steam release strategy for all future titles. Fearing a repeat of the soft commercial reception, the company delayed its flagship title, Assassin’s Creed Shadows, from Nov’24 to Feb’25, then subsequently to Mar’25, citing the need for extra time to polish the game and incorporate player feedback.

In Nov’25, the Chinese conglomerate Tencent (SEHK: 700) completed a strategic investment of €1.16B for a 26% stake in Vantage Studios, a new Ubisoft subsidiary holding Assassin’s Creed, Far Cry, and Rainbow Six franchises. The subsidiary was valued at €3.8B on a pre-money enterprise value basis. The funds were used to reduce debt, shifting Ubisoft’s core franchises into a structure partially owned by Tencent. We covered the strategic rationale in a previous review on our website.

On January 21, 2026, Yves Guillemot announced a major organizational restructuring with five key pillars:

- Financial Impact: Expected operating loss of ~€1B ($1.17B) in FY2026, including €650m one-time writedown. Cost-cutting targets €500m in savings.

- Organizational Changes: Company divided into five Creative Houses operating as autonomous business units.

- Game Portfolio Adjustments: Six titles cancelled (including Prince of Persia: The Sands of Time remake, announced 2020); seven additional titles delayed.

- Studio Closures: Halifax and Stockholm locations closed entirely; restructuring at Abu Dhabi, Helsinki, Malmö, RedLynx, and Massive Entertainment.

- Return-to-Office: A five-day in-office mandate was implemented across all teams, prompting union-called walkouts.

The announcement triggered a massive sell-off, with the stock crashing 34% in a single trading session. Ubisoft initiated the application of its cost-cutting measures on January 26, 2026, officially opening a voluntary redundancy program at its head office in Paris. This move targets the elimination of up to 200 roles, approximately 18% of HQ staff. The company withdrew FY2026/27 guidance, expecting content releases in FY2027/28 to drive a return to profitability. A chain of commercial failures, underperformance of new releases, and structural and operational restructuring led one of the top gaming giants in the EU to experience consistent decline over several years. We will continue to watch how the Creative Houses model impacts future releases.

Neon helps game publishers take control of their commerce. Our DTC platform handles everything from webshops and checkout to global payments, tax, and compliance, with full transparency and flat-rate pricing. No black boxes, no restrictions, no surprises. Built by payments, fintech, and gaming veterans, we work hands-on with publishers to optimize revenue and simplify operations. If you’re serious about DTC, we’re serious about helping you win.

| NOTABLE TRANSACTIONS |

MERGERS & ACQUISITIONS

Gamebeast, a LiveOps and data insights platform, has acquired the US-based Roblox market research platform RTrack for an undisclosed sum. RTrack, founded in 2019, provides developers with market research data and analytics on Roblox. The platform includes RTrack Deep Aware, an AI-augmented research system analyzing over seven years of Roblox data. Gamebeast’s network reaches 100 million monthly active users on Roblox.

Canada-based play-and-earn platform Mistplay has entered into a definitive agreement to acquire the Connected Rewards platform and related assets from US-based Mobivity Holdings (OTCQB: MFON) for $5.3m. The acquisition will expand Mistplay’s LoyaltyPlay business, enabling loyalty experiences via mobile gaming. The transaction is expected to close in Q1’26.

Germany-based marketing agency 1SP Agency has acquired Netherlands-based event platform MeetToMatch for an undisclosed sum. MeetToMatch provides the networking infrastructure for more than 60 global industry events annually, with a portfolio that includes GDC, Gamescom, and Pocket Gamer Connects. The acquisition follows 1SP Agency’s acquisition of UK-based Renaissance PR in Feb’24.

US-based scholastic esports platform PlayVS has acquired US-based youth esports platform Vanta Esports for an undisclosed sum. The transaction brings together two youth-focused esports platforms serving high school and college programs. PlayVS partners with state athletic associations and operates in over 30,000 schools.

VENTURE FINANCING

US-based Bitcoin payments provider ZBD has raised $40m in Series C funding led by Blockstream Capital Partners, which contributed $36m. The funds will support the expansion of ZBD’s payment infrastructure for gaming. ZBD processes over 120 million transactions annually and has doubled game integrations over the past year, enabling developers, including TapNation, Fumb Games, and PlayEmber, to deliver fiat, Bitcoin, and gift card rewards. Despite not yet being profitable, the 2019-founded startup, which maintains a portfolio of 55 games, will use Series C proceeds for aggressive global expansion across North America, Europe, LATAM, and APAC.

Z League, a skill-based tournament platform, has secured $21.4m in funding from an undisclosed investor, according to an SEC filing. The filing shows a total offering of $23m with $21.4m committed from 21 investors, with the first sale on December 24, 2025. The funds are expected to support the expansion of the company’s skill-based tournament platform and accelerate product development. The platform enables casual gamers to compete in structured tournaments with similar-skill opponents. Founded in 2020 by Lucas Pellan and Robbie Schneidman, Z League previously raised a combined $17.24m across its Seed and Series A rounds from Lucas Pellan and Robbie Schneidman, according to SEC filings.

US-based AI marketing tech company GIGR (known as Playad) has raised $5.4m in pre-Seed funding led by Mirae Asset Venture Investment. The round will accelerate the development of Playad, an AI-native creative system that utilizes autonomous agents to produce, test, and optimize advertising assets, leading to a ~90% reduction in production overhead. Proceeds will support continued development of autonomous ad production agents and commercial growth with digital marketing clients.

US-based AI gaming tech company Overworld has raised $4.5m in a pre-seed funding round led by Kindred Ventures, with participation from Amplify.LA, Garage Capital, and angel investors from Snowflake and Roblox. The funds will support the development of real-time, local-first world models for interactive software. Overworld, founded by former Stability AI researchers Louis Castricato and Shahbuland Matiana, is building diffusion-based systems for persistent, on-device world generation.

US-based Web3 Gaming Platform AKEDO has raised $5m in Seed funding led by Karatage. The capital will scale AKEDO’s multi-agent infrastructure for creators and studios. The company develops an AI-driven platform that enables the automated creation, deployment, and monetization of digital games and interactive content. The platform has over 2 million registered users and approximately 30,000 daily active users, positioning itself as a ‘vibe-coding’ system. In addition to AI-generated content and game creation, AKEDO is building a one-click token launch capability for game collections and content, aiming to open multiple monetization paths for creators.

Poland-based AI gaming tools developer Ludus AI has raised $1.3m (4.5m PLN) from Hard2beat, 24Ventures, and Hartmann Capital. Ludus AI is using this investment to make its generative AI copilot enterprise-ready for Unreal Engine developers. With a community of 5,000 users already on board, Ludus helps more teams automate the complex aspects of game design. The raise shows continued investor appetite for AI tooling in game development, particularly solutions positioned for enterprise adoption.

China-based VR game developer ZoomGames Studio has secured $140k in Seed funding from Jiangxia Science and Technology Investment Group. The Seed round brings the company’s total raised to $220k, which will support the expansion of its development team and the acceleration of new title releases. Founded in Shanghai, ZoomGames Studio develops VR and mobile games, including VR simulation and training experiences for both entertainment and enterprise applications. The studio’s current portfolio spans eight titles across action, casual, and educational categories, with a focus on immersive VR content for the domestic Chinese market.

FUNDRAISING

UK-based Belfast XR Festival has launched a $269k (£200k) Amplify:XR Labs development fund. The fund is focused on supporting early-stage XR projects across television, film, and games, and will back 10 UK-based teams. Selected finalists will receive financial, creative, and professional support.

Türkiye-based app developer VLMedia has launched Anka Ventures, a new investment fund established with the support of asset management firm Neo Portföy. The fund will focus on early-stage mobile game and mobile application companies, as well as SaaS and AI startups. VLMedia has already backed mobile games developer Byterise in Jan’24.

EARNINGS RELEASES

US-based streaming company Netflix (NASDAQ: NFLX) disclosed in its Q4’25 earnings that it has rolled out cloud-delivered TV party games to roughly one-third of members, achieving approximately 10% reach among eligible households. Following its Dec’25 announcement, Netflix remains on track to launch an exclusive FIFA football simulation game — developed by Delphi Interactive — timed for the FIFA World Cup 2026. For Q4’25, Netflix reported $12B in revenue (up 18% YoY), 325 million paid memberships (up 15.9% YoY), and guided 2026 revenue to $50.7-51.7B. The company has entered into a definitive agreement to acquire Warner Bros. Discovery (NASDAQ: WBD) for $82.7B, a deal recently amended to an all-cash transaction to simplify the structure and accelerate the stockholder vote ahead of its expected Q3’26 close. We previously analyzed the strategic rationale behind this landmark deal and its implications for the broader industry. The moves signal Netflix’s accelerated push into gaming through both licensing partnerships and M&A, following years of limited commercial impact with its organically built games division.