Weekly News Digest #51

Israel-based gaming VC fund vgames has partnered with US-based fund General Catalyst to offer growth capital to mobile gaming studios through a non-dilutive growth financing model. The partnership has already deployed $350m+ into UA and marketing financing, with a target to deploy an additional $500m over the next 12 months.

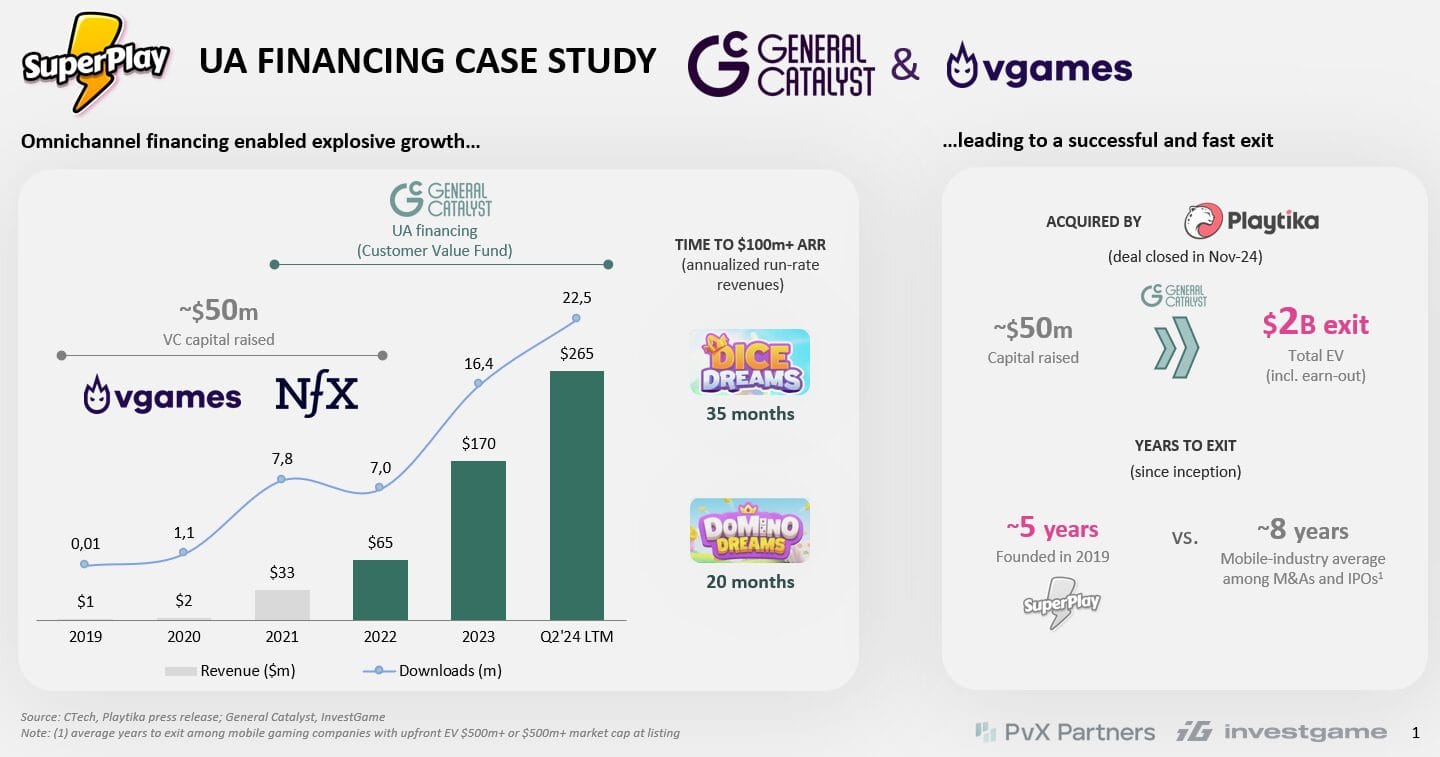

The partnership builds on prior collaboration between the two firms, including UA financing provided to SuperPlay in 2021. The partnership combines vgames’ sector-specific gaming expertise with General Catalyst’s Customer Value Fund, which has deployed over $5B across 60+ companies since its inception in 2019.

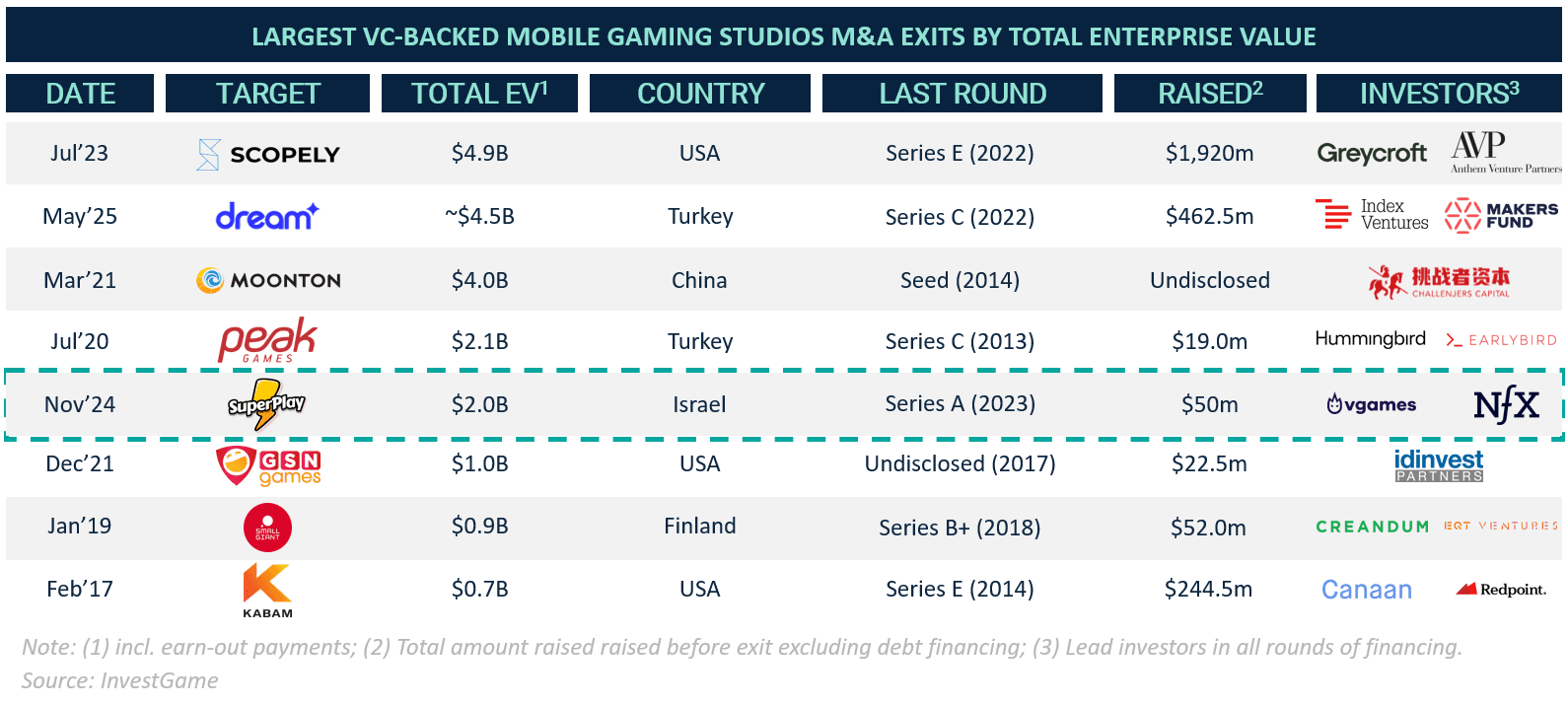

Founded in 2020 by Google Gaming veteran Eitan Reisel, vgames is led by Reisel and Daniel Mironov and has backed over 40 gaming companies, managing ~$400m AUM. The fund has participated in notable rounds, including investments in such companies as Candivore, Innplay Labs, and SuperPlay, which became one of the largest $2B ($700m upfront and $1.3B in earn-out) exits in the mobile gaming industry.

The New Reality of Funding

Growth financing is emerging as an alternative growth capital model for mobile game developers. With user acquisition and marketing-related expenses often accounting for 35-50% of gross revenue, studios have traditionally relied on either dilutive equity financing or debt with fixed repayment schedules. Under the new model, vgames and General Catalyst pre-fund UA and marketing campaigns, with repayments tied directly to revenues generated by the financed player cohorts. Repayment is performance-based rather than fixed, reducing upfront risk and aligning capital costs with actual returns.

The model has already been validated through SuperPlay (read more in the InvestGame UA Financing report). In 2021, General Catalyst provided growth financing to the studio via its Customer Value Fund, supporting growth without equity dilution. SuperPlay’s revenue has seen tremendous growth, achieving $100m+ ARR in less than 3 years.

Source: InvestGame

Mobile gaming studios face an increasingly challenging financing environment (read Aream & Co.’s latest Q3’25 Gaming report). Traditional VC funding has contracted, debt markets remain restrictive, and rising UA costs continue to squeeze margins — leaving many proven studios without viable paths to scale. Against this backdrop, performance-based UA financing offers a compelling alternative: capital that aligns with revenue generation, preserving equity while enabling growth.

The vgames–General Catalyst partnership reflects a broader maturation of the mobile gaming ecosystem. With gaming funds like vgames making strong exits and new financing models gaining traction, the infrastructure supporting mobile game developers is evolving rapidly. This collaboration leverages vgames’ sector expertise and portfolio network to identify studios where performance-based financing can unlock growth while preserving founder ownership — a signal that the industry’s capital stack is becoming more sophisticated and founder-friendly.

| NOTABLE TRANSACTIONS |

MERGERS & ACQUISITIONS

US-based streaming entertainment platform Netflix (NASDAQ: NFLX) has acquired Estonia-based cross-game avatar platform Ready Player Me for an undisclosed sum. As part of the transaction, around 20 employees, including co-founder and CTO Rainer Selvet, will join Netflix. The other founders — Haver Järveoja, Kaspar Tiri, and Timmu Tõke — will not join Netflix. Ready Player Me is expected to wind down its standalone product in Jan’26. The company previously raised a total of $72m, including a $56m Series B round in Aug’22.

France-based gaming giant Ubisoft Entertainment (PAR: UBI) has acquired March of Giants, including its intellectual property and the Montreal-based development team, from Amazon Game Studios, a subsidiary of US-based corporation Amazon (NASDAQ: AMZN). As part of the transaction, Amazon will provide Ubisoft with marketing support for the title on Twitch. March of Giants is an F2P 4v4 MOBA that completed a closed alpha earlier in 2025. Following the acquisition, the team will operate within Ubisoft as part of a newly established Creative House. The transaction comes amid layoffs at Amazon Game Studios in Oct’25.

UK-based PC & Console games developer Mythwright has acquired Thronefall IP from Germany-based games developer Grizzly Game for an undisclosed sum. Thronefall is a medieval-themed strategy defense game available on PC, Nintendo Switch, and mobile platforms, and has surpassed one million units sold. Doghowl, a studio responsible for the mobile version of the game, will continue to publish the mobile versions.

Japan-based gaming company Bandai Namco (TYO: 7832) has divested Germany-based PC & Console games developer Limbic Entertainment to an undisclosed private investor specializing in video games for an undisclosed sum. The divestment follows Bandai Namco’s portfolio refocus on areas where the group holds stronger competitive positions. Limbic Entertainment — the developer of Tropico 6 — will continue to operate under the same management team and brand, with a continued focus on management simulation titles. The studio was acquired by Bandai Namco in Oct’22. The transaction takes place amid Nintendo’s acquisition of Bandai Namco Singapore in Nov’25 and Sony’s minority stake acquisition in Jul’25.

US-based esports organization DarkZero has acquired US-based esports company NRG Esports for an undisclosed cash consideration. The transaction includes NRG’s professional teams and staff, while explicitly excluding Full Squad Gaming, NRG’s casual gaming division. Full Squad Gaming will remain under the ownership of NRG founder and CEO Andy Miller. DarkZero described the acquisition as part of a longer-term strategy aimed at consolidation within the esports sector.

VENTURE FINANCING

Japan-based AI and cloud solutions company Ubitus has raised $107m (¥17B) in the form of an investment grant under the “Large-Scale Growth Investment Grant for Medium-Sized and Small Enterprises” program from Japan’s METI. The investment will support the expansion of Ubitus’ computing infrastructure centered on AI, and the development of the NeoCloud platform. Ubitus specializes in cloud streaming for gaming, AI solutions, and GPU infrastructure, with recent efforts focused on AI data centers. The company previously secured funding in Feb’25 to support GPU data center expansion and cloud computing initiatives.

UK-based AI gaming company Iconic AI has secured $13m in a Seed funding round co-led by Kindred and Northzone, with participation from Google AI Futures Fund, Conviction Embed, Deepwater Asset Management, Sequoia Capital scouts, and other investors. The funds will be used to accelerate the development of the company’s on-device AI platform for game development. Originally established as a game developer, Iconic AI has since shifted its focus to an on-device AI platform built on small language models, enabling real-time, voice-driven interactions that dynamically shape immersive game worlds without internet connectivity. The company has released a demo of its debut title, The Oversight Bureau, which showcases this technology. Iconic AI previously raised a $4m pre-Seed round in Jul’24.

US-based PC gaming platform Wavedash has secured $4.3m in a Seed funding round led by Mike Maples, Jr. of Floodgate, with participation from Y Combinator, Rebel Fund, Brainstorm Ventures, Griffin Gaming Partners, and angel investors. Wavedash enables users to play PC games directly in a web browser. The platform is currently in public beta and is available with a single title, the arcade-style racing game Parking Garage Rally Circuit DX. Wavedash has participated in Apr’25 Y Combinator Spring batch.

New Zealand-based XR company StretchSense has raised $2.3m in a funding round led by PXN Ventures, with support from Scottish Enterprise. The new capital will be used to support StretchSense’s global expansion. StretchSense specializes in motion-capture glove technology designed to connect human movement with digital environments, with applications across animation, gaming, training, and simulation. The company has raised $20m to date, with its most recent round being a $7.6m raise in Nov’22.

UK-based multiplatform games developer Ace High Sports has attracted $800k (£600k) in funding. Of the total, $0.4k was raised through equity financing from the South West Investment Fund, with the remainder provided as a grant from the UK Games Content Fund. The funds will support the company’s growth strategy, including expansion into a new genre of sports-led card games and the development of its proprietary games portfolio. The company’s debut title, Touchdown Poker — a hybrid of Texas Hold’em Poker and an American football setting — is scheduled for release in 2026.

China-based tech giant Tencent Holdings (SEHK: 700) has invested an undisclosed sum in France-based PC & Console games developer Drama Studios as part of a Series A round. The investment will support team expansion and accelerate the development of Unrecord. Unrecord is a realistic body-cam FPS. Drama Studios previously secured a $2.5m Seed round from The Games Fund in Sep’24.

Israel-based mobile games developer Zoe Studios has secured an undisclosed sum in an angel funding round from John Wright, Phil Mansell, Dilpesh Parmer, Simon Hade, Maxime Demeure, Juha Paananen, Carolin Krenzer, and other investors. The funds will support the development of a new casual chess game for mobile platforms. Zoe Studios was founded by Danielle Chen, former head of product management at Playtika, and is currently preparing for a VC funding round.

PUBLIC OFFERINGS

According to the SEC, US-based gaming company Snail Games has secured $3.3m out of a $7.7m offered amount in the form of debt. Snail Games is a multiplatform games developer behind ROBOTS AT MIDNIGHT, Ark Franchise, and BELLWRIGHT.

FUNDRAISING

South Korea-based gaming holding Krafton (KRX: 259960), in cooperation with internet company Naver and Mirae Asset Financial Group, has launched a $670m Unicorn Growth Fund. Mirae Asset Venture India will manage the India-focused vehicle, which is scheduled to launch in Jan’26 with initial capital exceeding $334.6m. Krafton plans to commit $137.2m at the initial closing. Naver is expected to make a capital commitment of a similar scale to Krafton’s investment. With this fund, Krafton aims to broaden its India strategy beyond the gaming sector.

France-based gaming-focused fund PixCapital, in partnership with UK-based advisory firm Agora Gaming Partners, has launched a new investment vehicle, ICHIBA. The vehicle will focus on game developers and publishers in late-stage development, targeting projects with titles scheduled for release within the next 15 months. ICHIBA will primarily support funding needs related to polish, QA, and marketing.