Weekly News Digest #6

# of announced deals

7

announced deals’ size

$290.9m

# of closed deals

7

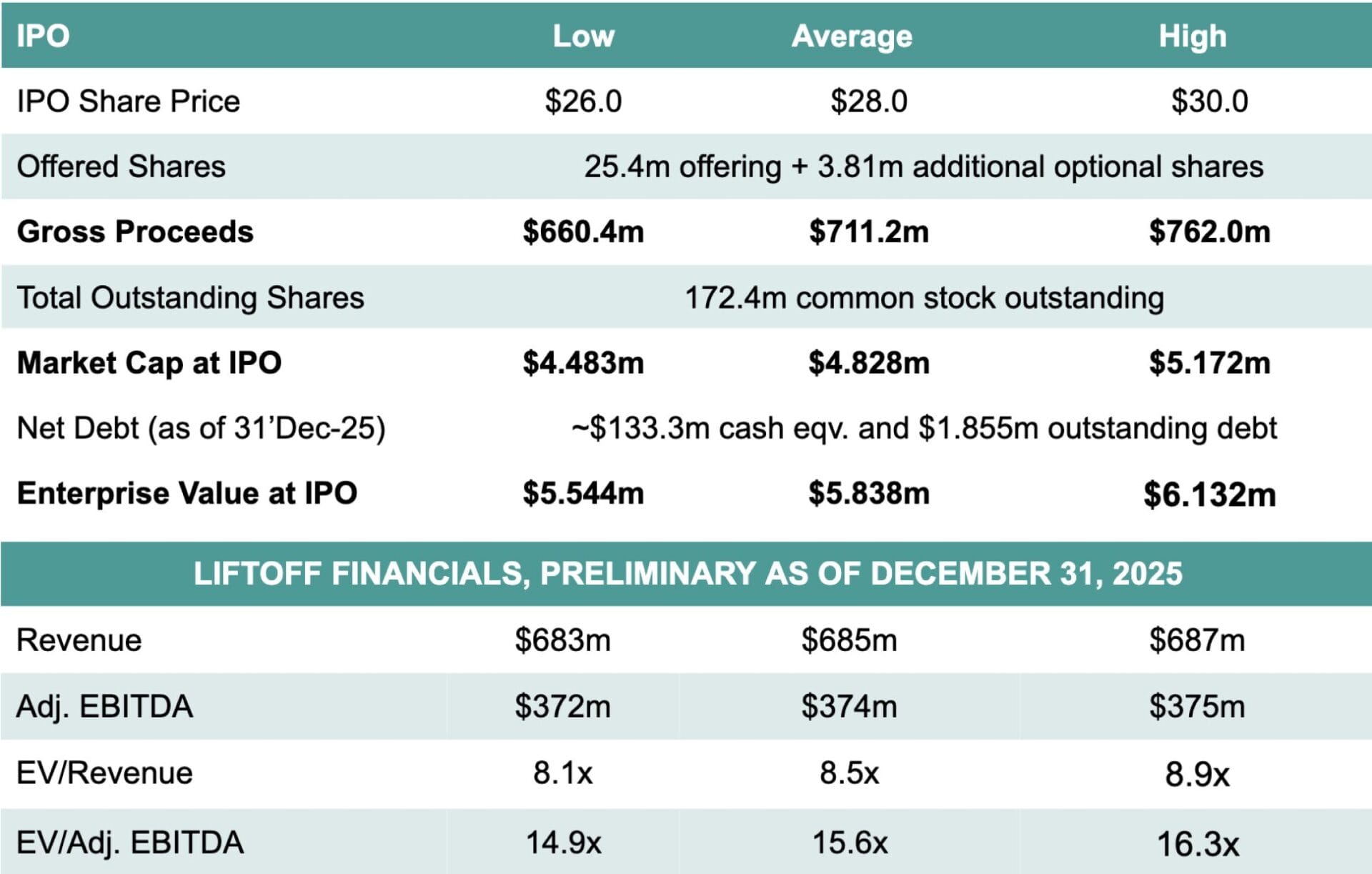

Liftoff Mobile: Postponed NASDAQ IPO

US-based Liftoff Mobile has postponed plans for an IPO on the Nasdaq due to the software sector’s selloff, including declines in shares of peers AppLovin Corp. (NASDAQ: APP) and Unity Software Inc. (NYSE: U). Initially targeting $26–$30 per share, the company planned to use up to $762m in proceeds for its mobile app marketing platform. The firm confirmed in a statement that, “Given current market conditions, we have made a business decision to take additional time before listing,” adding that it plans to pursue public markets “when timing and conditions best support our long-term vision.”

Since late January, more than $800B has been wiped off the market cap of the S&P 500 software and services index, contributing to investor risk aversion in technology IPOs.

IPO Terms Overview

In earlier digests, we mentioned that Blackstone (NYSE: BX) has been positioning Liftoff for a potential public listing following the Vungle acquisition and the subsequent merger of the two businesses. While the company has now postponed its Nasdaq IPO due to weak market conditions, the S-1 filing confirms Blackstone is expected to retain majority control, with Goldman Sachs, Jefferies, and Morgan Stanley leading the offering when the process resumes.

Neon helps game publishers take control of their commerce. Our DTC platform handles everything from webshops and checkout to global payments, tax, and compliance, with full transparency and flat-rate pricing. No black boxes, no restrictions, no surprises. Built by payments, fintech, and gaming veterans, we work hands-on with publishers to optimize revenue and simplify operations. If you’re serious about DTC, we’re serious about helping you win.

| NOTABLE TRANSACTIONS |

MERGERS & ACQUISITIONS

US-based leading mobile games platform Skillz (NYSE: SKLZ) has completed the acquisition of certain Beamable assets, a modern game backend and LiveOps platform. This deal allows Skillz to integrate Beamable’s backend services, microservices architecture, and LiveOps tooling into its platform. This backend infrastructure will be an integral part of the Skillz SDK roadmap, specifics expected to be introduced before the Game Developers Conference (GDC) in Mar’26.

India-based digital entertainment company JetSynthesys has completed the acquisition of EverMerge from Big Fish Games, a former subsidiary of a global entertainment and gaming content creation company Aristocrat Leisure Limited (ASX: ALL). Since its launch, EverMerge has generated $350m in lifetime revenue. JetSynthesys has finalized several deals since 2015, acquiring six targets in India and one in the US. Meanwhile, Aristocrat has divested its key non-social casino assets, including Big Fish Games and Plarium, transforming into a “pure-play” social casino and real money gaming powerhouse, allowing the group to reallocate capital to its core, high-margin gambling segments.

PUBLIC OFFERINGS

US-based video game commerce company Xsolla has completed a partial exercise of the overallotment option for its affiliated SPAC, Xsolla SPAC 1. The underwriters purchased an additional 419,385 units at $10 per unit, generating $4.2m in gross proceeds. Following the transaction, the total number of units offered to the public increased to 20,419,385, bringing aggregate gross proceeds from the IPO to $204m. As previously reported, Xsolla SPAC 1 targets a total raise of up to $250m, with each unit comprising one share of common stock and one-third of a warrant.

VENTURE FINANCING

US-based game developer and publisher Ares Interactive has raised $70m in a Series A led by General Catalyst, with participation from founder and executive chairman Niccolo de Masi (ex-CEO of Glu Mobile), to build a new generation of a cross-platform F2P game company. The company’s leadership team includes executives with prior experience at major mobile publishers, including Glu Mobile, Kabam, and Gameloft, who bring operational experience in F2P development and live ops at scale. De Masi not only participates in the round as an investor but also serves as Executive Chairman.

France-based VR studio Atlas V completed $6m (€5m) funding led by Taiwan-based HTC (TW: 2498) and other investors. The main use of funds will be to expand its F2P and offline immersive experience businesses. Founded in 2017, Atlas V is known for narrative VR projects such as Gloomy Eyes and Spheres, and has recently partnered with IP holders including Aardman Animations and Bandai Namco. The studio currently employs ~55 people, has nine projects in development, and plans to leverage its publishing arm, Astrea Immersive, to strengthen control over production and distribution.

US-based rewards platform developer Tesoro XP raised $5.4m in Seed funding co-led by Treasury and TK MediaTech Ventures. The platform enables retail brands to fund in-game currency for F2P gamers, targeting 220 million players. Co-founders Sami Khan and Beau Button previously built ATLAS: EARTH, a platform that surpassed $50m in lifetime sales by mid-2024.

UAE-based gaming content maker iBLOXX has raised $5.4m (AED 20m) to finance the final stage of development and launch of its third-person shooter StrayShot. Registered in the DMCC free zone, iBLOXX is a part of DMCC Gaming Centre and participates in the Dubai Program for Gaming 2033 (DPG33).

EARNINGS REPORTS

| Report Date | Company Name | Earnings Release Presentation | Share Price Dynamics (Report Date vs. 09-Feb) |

|---|---|---|---|

| 2026-02-03 | Electronic Arts | Electronic Arts FY2025 Q3 | (1.9%) |

| 2026-02-03 | Nintendo | Nintendo FY2026 Q3 | (16.3%) |

| 2026-02-03 | Take-Two Interactive Software | Take-Two Interactive Software FY2026 Q3 | (11.5%) |

| 2026-02-04 | Stillfront | Stillfront Group FY2025 Q4 | (8.0%) |

| 2026-02-05 | Modern Times Group | Modern Times Group FY2025 Q4 | (6.3%) |

| 2026-02-05 | Bandai Namco Group | Bandai Namco Group FY2026 Q3 | 5.7% |

| 2026-02-05 | Square Enix | Square Enix FY2026 Q3 | 6.6% |

| 2026-02-05 | DeNA Co | DeNA Co FY2025 Q3 | 2.5% |

| 2026-02-05 | Roblox | Roblox FY2025 Q4 | 5.8% |

| 2026-02-05 | Sony Corporation | Sony Corporation FY2025 Q3 | 3.7% |