Feature #15

- Capital Realignment: $20.7B in transactions across 208 gamified consumer-app investments and exits since 2020—as mobile gaming IAPs stagnate, non-gaming consumer apps surged +24% YoY to $41B, proving gamification now drives mainstream consumer growth.

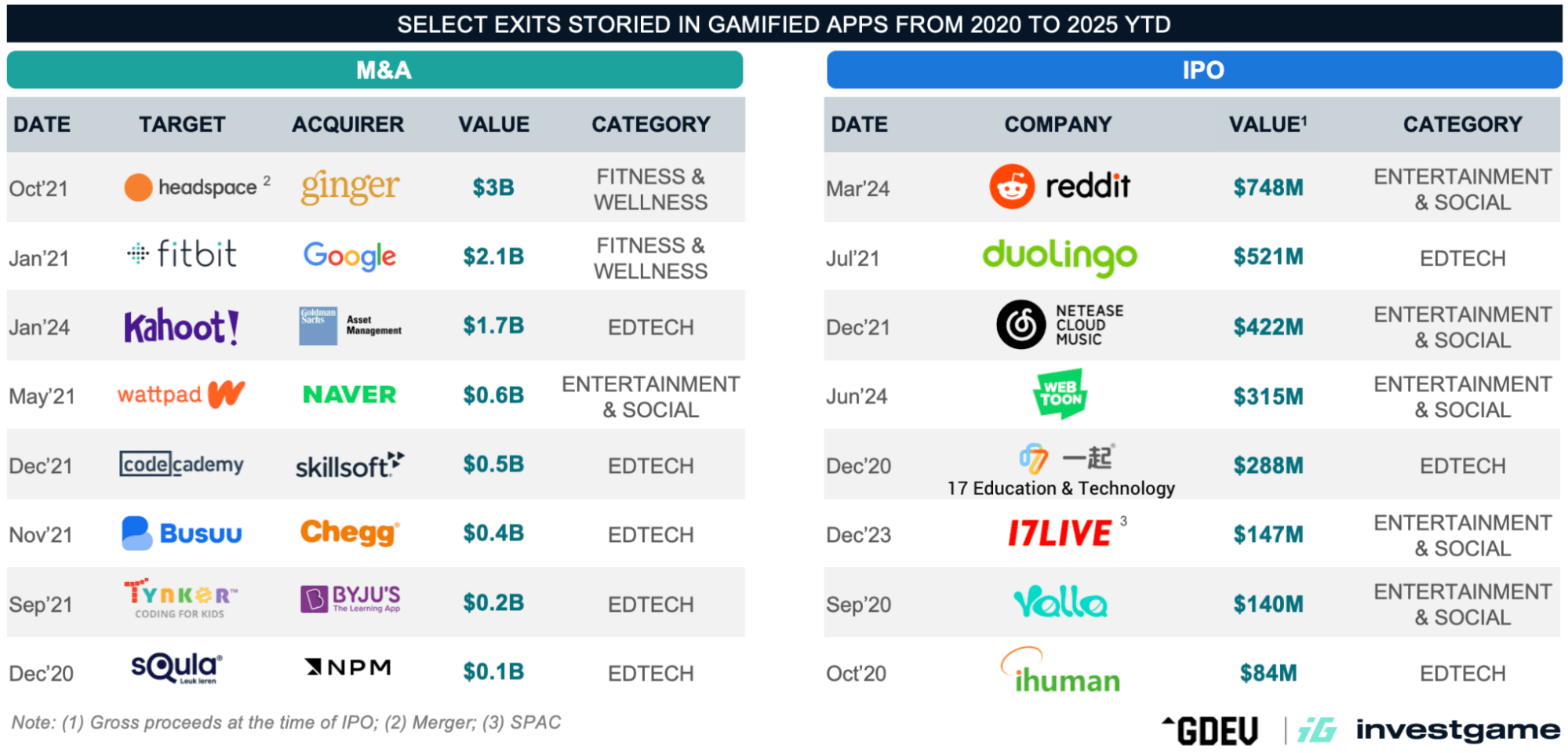

- Vertical Dynamics: EdTech ($4.4B raised), Fitness & Wellness ($2.4B), and Entertainment & Social ($2.5B exits) show distinct paths—from Duolingo’s +160% IPO to Headspace–Ginger’s $3B merger and Reddit’s public debut.

- Strategic Validation: Google–Fitbit $2.1B deal, Naver–Wattpad $600M transaction, and Goldman’s $1.7B Kahoot! take-private confirm gamified retention loops have become essential infrastructure for consumer engagement.

Feature sponsored by $GDEV

Gamification has become the tech industry’s favorite buzzword. Everyone cites Duolingo’s streaks and Noom’s retention loops—every consumer-oriented B2C app now pitches progression mechanics. Yet no comprehensive analysis tracks the fundamentals: how much capital is deployed, which companies have seen exits, and whether success scales beyond celebrated outliers.

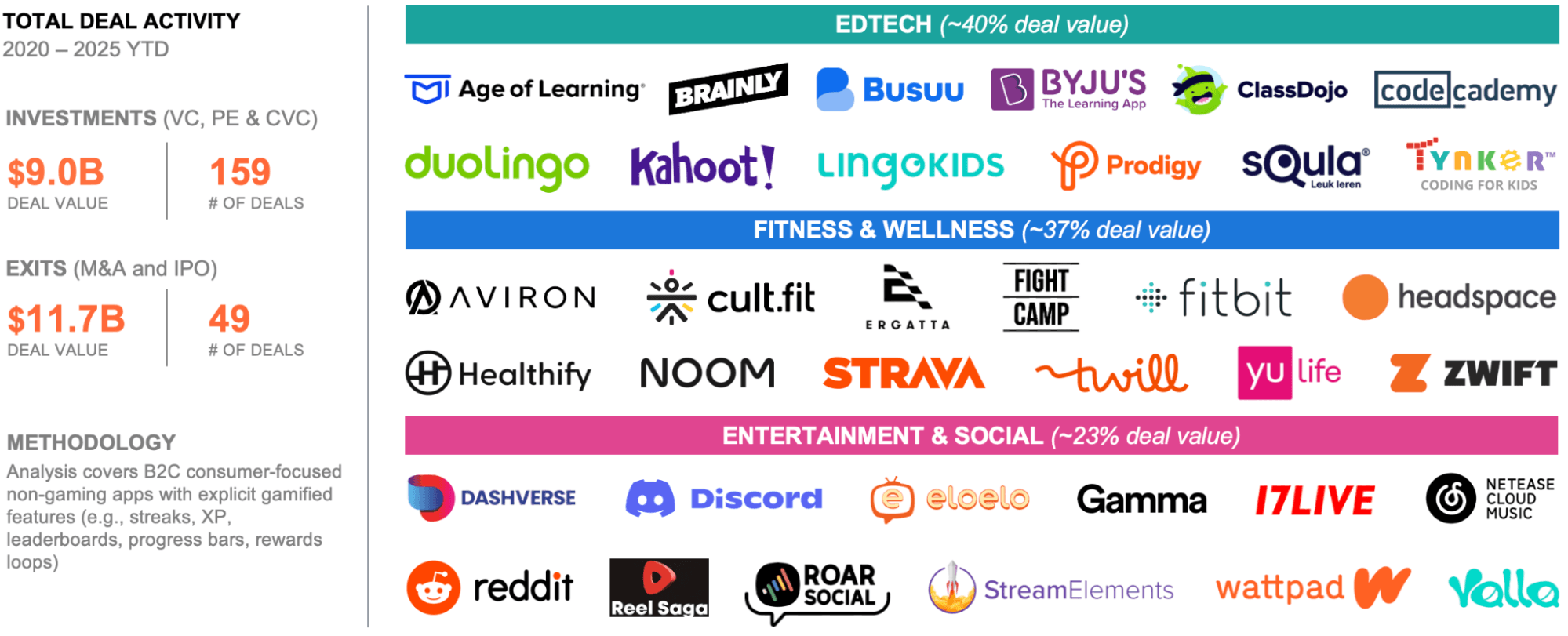

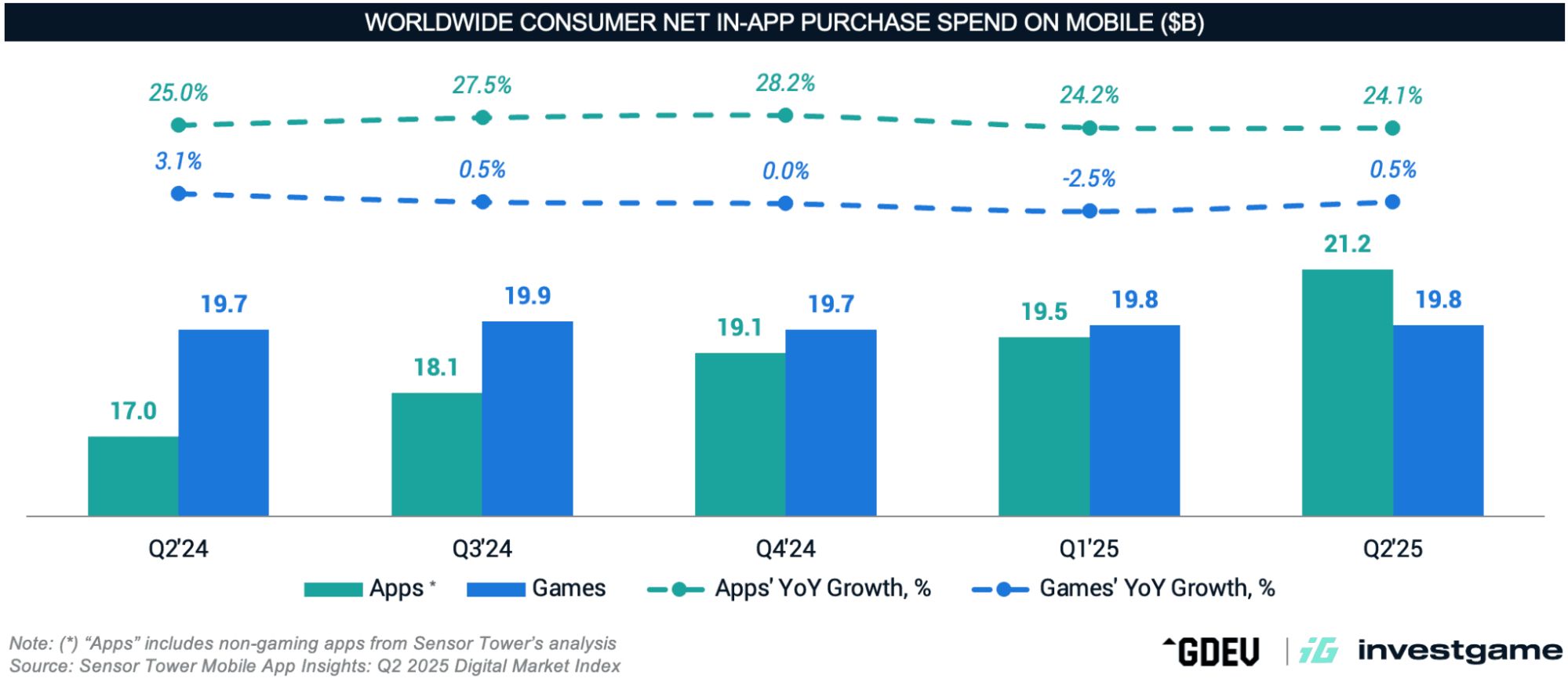

The InvestGame team decided to map the sector systematically. Our analysis reveals that since 2020, gamified consumer apps built on gaming progression mechanics have generated over $20.7B across 208 transactions, split among EdTech (~40%), Fitness & Wellness (~37%), and Entertainment & Social (23%). The shift is structural: while mobile gaming in-app purchase revenue stagnated over the past year, non-gaming consumer apps surged 24% YoY, surpassing games for the first time in H1’25 ($41B vs $40B, according to Sensor Tower). Retention systems designed for video games now drive measurable performance when applied to consumer apps with real-world outcomes. Gamification is no longer just a UX layer—it’s a growth engine that powers retention and monetization.

For a detailed analysis, check out the accompanying report:

Methodology: Analysis covers B2C consumer-focused non-gaming apps with explicit gamified features (e.g., streaks, XP, leaderboards, progress bars, rewards loops) in EdTech, Fitness & Wellness, and Entertainment & Social that received VC/CVC investments or completed M&A/IPO transactions between 2020 and 2025 YTD.

Disclaimer: This is our first-ever analysis of the gamified B2C apps sector. We welcome corrections, additional data points, and ideas from readers as we continue tracking this space

Check the Full Top-50 Gamified Deals Pack

The boundary between gaming and utility is dissolving. Progression mechanics that kept players engaged, for example, in Clash of Clans, one of the biggest mobile games on the market—streaks, adaptive difficulty, social leaderboards, and reward loops—now drive retention in Duolingo’s learning apps, Noom’s weight tracking, and ShareChat’s creator rewards. Gaming VC funds have also taken note of this: Play Ventures, Makers Fund, BITKRAFT, and a16z have shifted significant capital toward gamified consumer apps, recognizing that the same unit economics and retention curves apply when entertainment mechanics serve real-world outcomes.

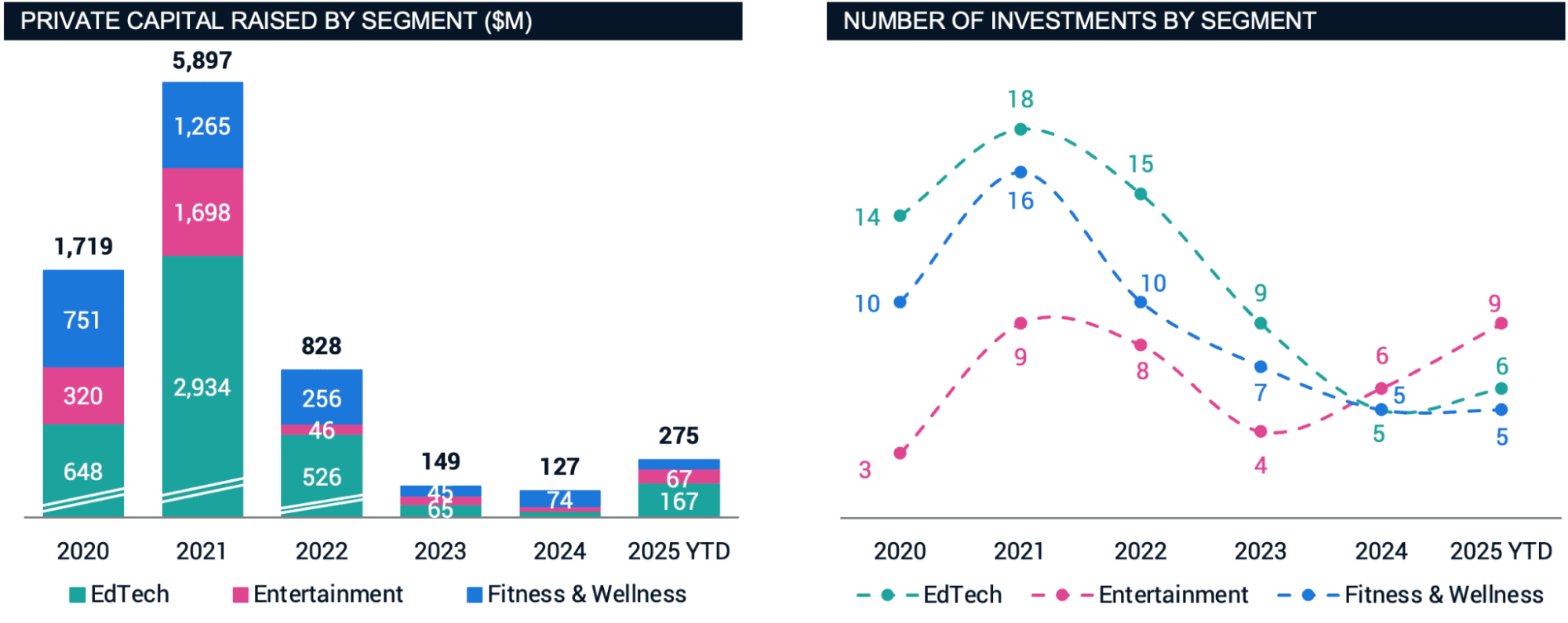

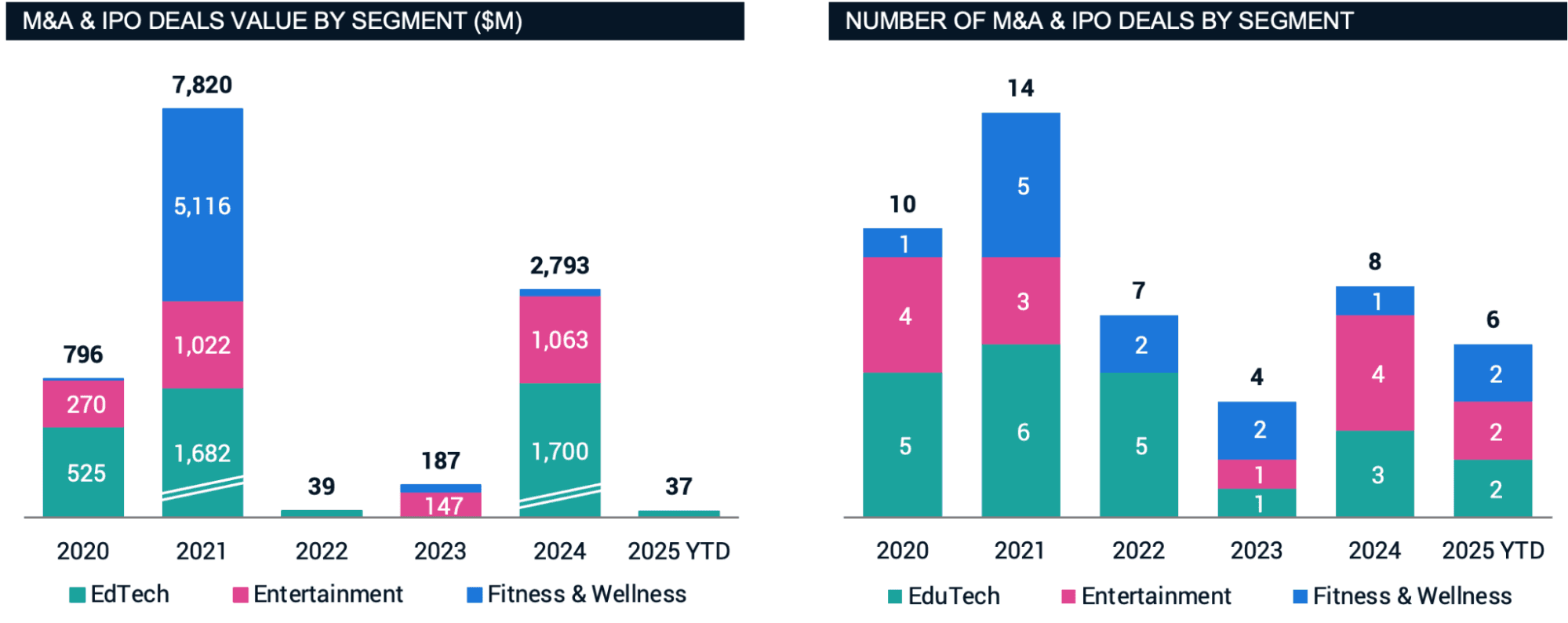

Overall, our analysis encompasses $9B capital raised in private investments across 159 deals with $11.7B proceeds generated in exits (M&A/IPO) across 49 transactions.

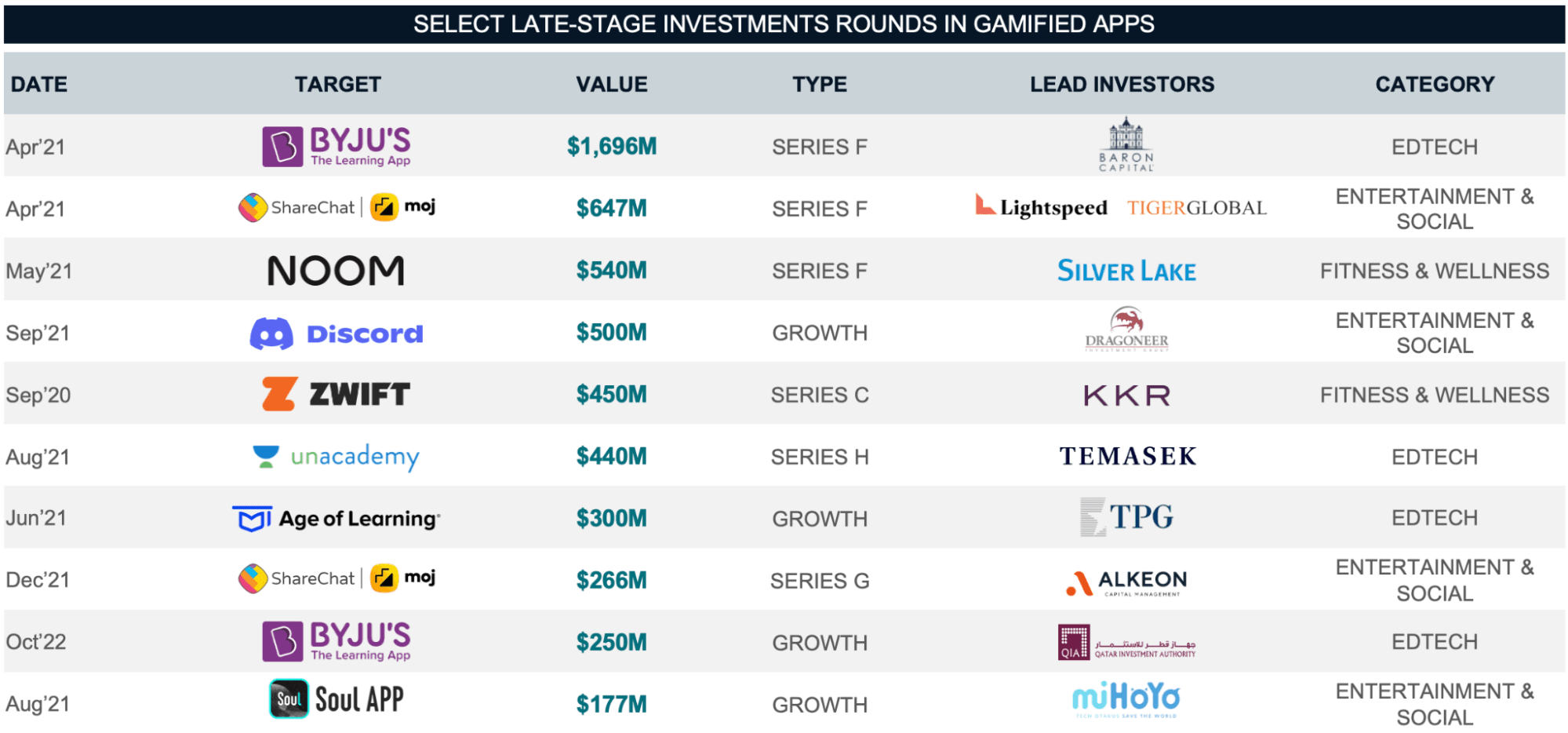

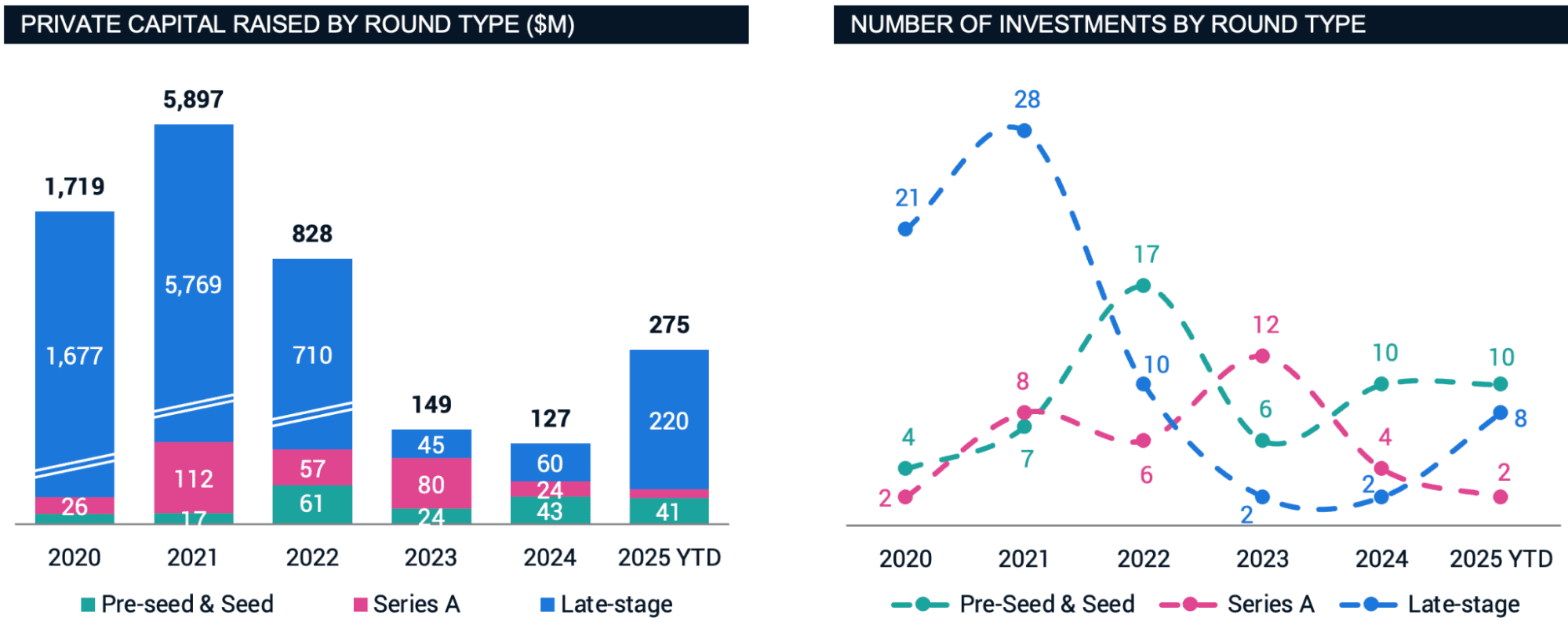

From Pandemic Spike to Sustainable Baseline

Like many consumer software companies, capital deployed in gamified apps reached its high-water mark during 2020-2021, when low interest rates and post-COVID digital adoption created ideal conditions for investment in consumer apps. Activity peaked in 2021 at $5.9B—nearly two-thirds of the five-year investment deployed—led by mega-rounds like BYJU’S $1.7B Series F, ShareChat & Moj’s $647m Series F, Noom’s $540M Series F, and Discord’s $500M investment.

The correction came in 2022-2023, but unlike video game developers and publishers, which faced flat or declining investment, gamified consumer apps maintained momentum. By 2024, the sector had stabilized with consistent deal flow, and as of 2025 YTD, it had already exceeded full-year 2024 levels. The recalibration didn’t collapse; it was maturation from FOMO (“fear of missing out”) capital to disciplined deployment focused on long-term fundamental performance rather than short-term hype. The funding curve mirrors the adoption curve: pandemic-driven experimentation has given way to a durable subscription-habit economy.

However, aggregate numbers obscure vertical dynamics. Each vertical—EdTech, Fitness & Wellness, Entertainment & Social—developed distinct characteristics, investor profiles, and monetization models. To understand where capital is concentrated and which mechanics attracted strategic exits, we examine each segment separately.

EdTech: Proving Gamification at Scale

EdTech (the largest category by total number of deals, at 43%) emerged as one of the earliest adopters of gamification at scale, proving that learning mechanics could drive both engagement and monetization. The sector’s flagship success story is Duolingo, which went public in Jul’21 at $102 per share and has since delivered almost 160% returns to IPO investors—a rare outcome that validated gamified learning as a sustainable business model and sparked a wave of subsequent fundraising across the category.

Overall, EdTech has attracted $4.4B in private investments since 2020 to date, with notable late-stage deployment including BYJU’S $1.7B Series F (Baron Funds, 2021), Unacademy’s Series H (Temasek, Aug’21), and Age of Learning’s $300M growth round (TPG, Jun’21). Capital remains highly concentrated, with the top-3 fundraising companies accounting for ~56% ($2.4B) of total deployment. While the Duolingo-driven fundraising frenzy peaked in 2021-2022, the sector has maintained momentum. Lingokids’ $120M Series D in Sep’25—led by Bullhound Capital and General Catalyst—demonstrates that institutional capital continues to back proven gamified learning models.

But the sector didn’t just attract investor interest—it delivered exits. Beyond Duolingo’s public market success, we’ve seen Kahoot! sale to Goldman Sachs Asset Management for $1.7B (Jan’24), Codecademy sale to Skillsoft for $525M (Dec’21), Busuu to Chegg for $400M (Nov’21).

The segment continues to evolve beyond pure consumer-direct models, with leading platforms like Kahoot! and Lingokids now complementing D2C revenue with hybrid B2B2C approaches, monetizing through both individual subscriptions and institutional partnerships with school districts and enterprises. This dual-channel strategy positions gamified EdTech to capture the $204B+ global market opportunity while experimenting with new engagement mechanics that blur the line between classroom software and consumer entertainment.

Fitness & Wellness: Where Progress Becomes Ritual

Fitness & Wellness transformed gamification into daily rituals—the kind of sticky behavioral patterns that traditional consumer apps struggle to achieve organically—by turning measurable progress into content, platforms like Fitbit, Zwift, Headspace, and Strava embedded themselves into users’ routines: morning meditation streaks, post-ride power outputs, nightly sleep scores. Retention isn’t driven by algorithm-fed entertainment but by personal improvement loops that make switching costs tangible.

The capital deployment signals institutional conviction. Leading private equity firms closed substantial rounds early in the cycle: Noom’s $540M Series F (Silver Lake, May’21), Zwift’s $450M Series C (KKR, Sep’20), and Strava’s $110M Series F (TCV and Sequoia Capital, Nov’20). These weren’t speculative pandemic bets—they backed defensible moats built on hardware integration, physiological tracking, and habit formation. When users monitor cardiovascular fitness or mindfulness consistency, switching becomes costly: progress data doesn’t port, streaks reset, and communities fragment. Overall, the vertical attracted $2.4B across 53 deals, with investments less concentrated than EdTech—the top three companies raised $1.1B, accounting for 47% of deployment—suggesting a broader opportunity across sub-verticals.

The segment delivered exits to match. Fitness & Wellness recorded $5.2B in M&A across 11 transactions with two largest transactions across our entire sample: Google’s $2.1B Fitbit acquisition (Jan’21) established the hardware-plus-subscription playbook, while Headspace’s $3B merger with Ginger (Oct’21) validated mental wellness as a defensible category.

Early-stage momentum continues accelerating. Ergatta raised a $30M Series A round for rowing training, Sweatcoin closed a $13M seed round to incentivize users’ outdoor exercises, and Ladder raised a $12M Series A round for strength training. With institutional capital deployed, exits validated, and early-stage rounds accelerating, Fitness & Wellness is positioned for continued expansion as more verticals adopt proven gamified mechanics.

Entertainment & Social: Community-Driven Content Loops

Entertainment & Social apps have continuously operated in close proximity to the video game industry. As transmedia became essential to major gaming IPs—such as Riot’s Arcane, Sony’s The Last of Us, and Nintendo’s Super Mario film—the entertainment sector found itself disrupted by interactive mechanics. What began as interactive fiction in gaming evolved into standalone platforms, such as micro-drama apps like Holywater, which secured Fox Entertainment’s equity investment to combine serialized storytelling with gamified engagement.

ShareChat & Moj’s $647m Series F (Lightspeed and Tiger Global, Apr’21) demonstrated the power of gamified content creation, Discord’s $500M growth round (Dragoneer, Sep’21) validated community-as-infrastructure, while Wattpad’s $600M sale to Naver (May’21) proved that reading achievements and creator progression systems can monetize participation without relying on content libraries. Recent deployments include Dashverse’s $13M Series A (Aug’25) and GammaTime’s early-stage funding, maintaining relatively stable deal flow through 2024-2025, despite corrections in EdTech and Fitness & Wellness.

Yet Entertainment & Social follows a different exit trajectory. Despite ranking among the top three segments by capital raised, the segment delivered $2.5B in exits primarily through public market liquidity rather than strategic acquisitions—Reddit’s IPO (Mar’24), NetEase Cloud Music IPO (Dec’21) exemplifies this path, whereas Wattpad’s $600M acquisition remains its lone major M&A exit—a stark contrast to EdTech and Fitness & Wellness multiple billion-dollar M&A deals.

Gamification as Competitive Advantage

The exit environment validates the thesis. Strategics pursued dominant positions: Google acquired Fitbit to anchor the wearables market, Naver bought Wattpad to control creator infrastructure, and Chegg consolidated the EdTech sector with Busuu. Private equity deployed matching conviction—Goldman Sachs Asset Management took Kahoot! private for $1.7B, Silver Lake-funded Noom’s $540M raise, KKR-backed Zwift’s $450M round, targeting established businesses with proven unit economics enhanced by gaming mechanics.

The distinction matters. Duolingo didn’t invent language learning—it made daily streaks unmissable. Strava turned cycling data into social competition. Noom wrapped behavioral psychology in progression loops. These companies built utility first, then applied retention mechanics borrowed from F2P gaming to extend lifetime value. Gamification has become a growth accelerator, not a substitute for business models.

What emerged across $20.7B in transactions isn’t speculative: strategic buyers now view gamified retention as essential infrastructure, and capital continues to flow. Ergatta closed $30M for gamified rowing training, GammaTime secured $14M for interactive storytelling, and Wayground raised $12.5M for gamified quizzes and interactive lessons. Early-stage deployment is accelerating even as late-stage deals mature into exits. The pattern suggests durability: the next billion-dollar live-ops business might not be a game—it might be the app that turns progress itself into play.

As the boundary between gaming and utility dissolves, InvestGame will continue tracking this convergence: where gaming capital flows, which mechanics prove defensible, and which exits validate gamification as a permanent competitive advantage in consumer engagement.