When you think of recent massive mobile gaming fundraisings, Turkiye is the first country that comes to mind.

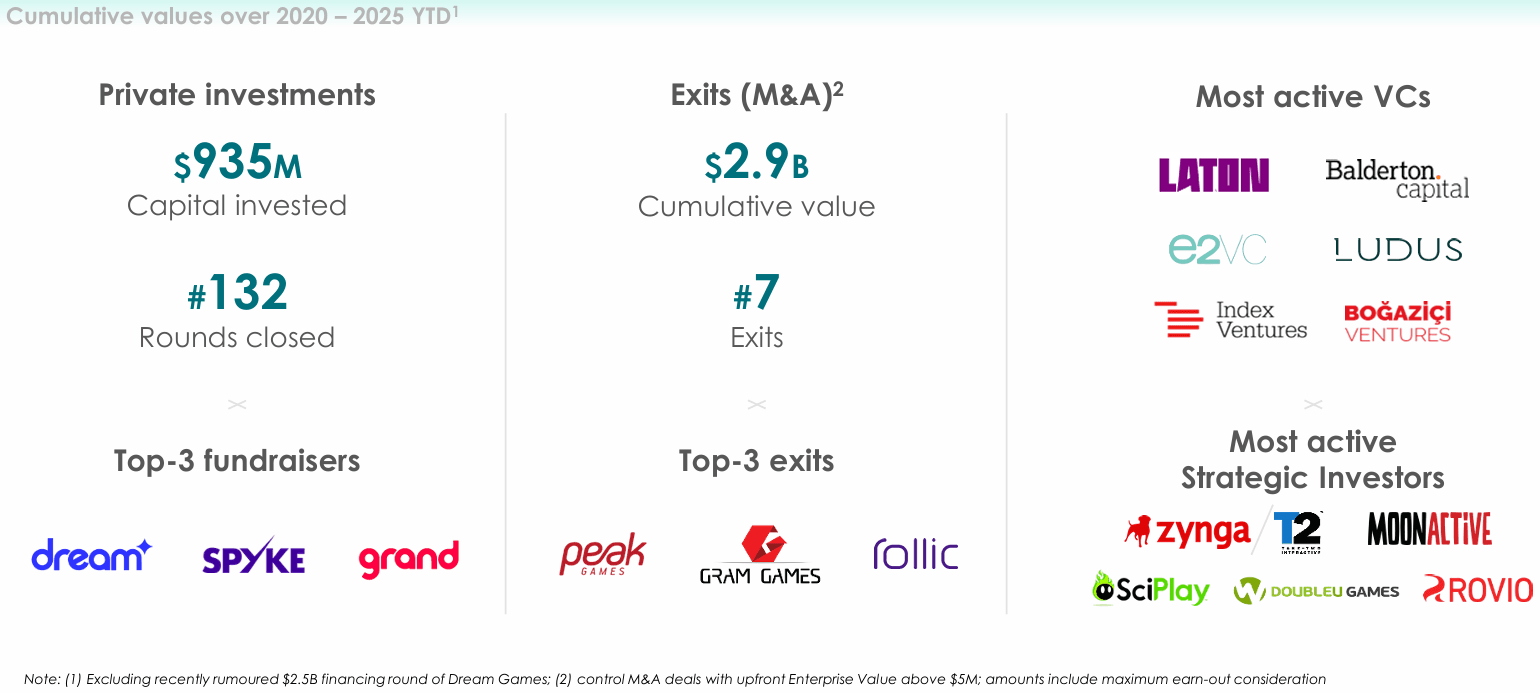

What secret sauce links Peak Games, Gram Games, and Rollic? It’s much more than their Turkiye origin—they’re architects of the casual and hyper-casual gaming boom. Their exits didn’t just validate Turkiye’s market potential; they catalyzed a 4B+ investment surge with over 150 deals in the past five years, positioning Istanbul as a strategic hub for global gaming innovation.

But here’s the kicker: Those figures don’t include the seismic $2.5B fundraising (50/50 split between equity and debt) rumored to be in play for Dream Games. If confirmed, this deal wouldn’t just break a record of being the most prominent gaming fundraising; it would shatter them, surpassing even Europe’s flashiest tech rounds. To put it bluntly, Turkiye isn’t just part of the mobile gaming conversation—it’s writing the script.

That’s precisely why we’re launching our country research analysis here. No other market blends hyper-growth and investor frenzy quite like Turkiye. From billion-dollar exits to massive fundraisings, this market is a masterclass in scaling—one we’ll dissect across VC trends, M&A blueprints, and head-to-head regional comparisons.

For a quick summary, check out the accompanying report.

Five Years of The Rising Gaming Empire—Turkiye

The entire table with all Turkiye deals is available exclusively on our Patreon page. Not only does it make your research even more valuable, but it also supports the InvestGame team, enabling us to share even more insights with you. Support us and gain access through the link!

From Hidden Gem to Global Player:

Before 2020, Turkiye’s gaming market was like a hidden level in a video game—full of potential and waiting to be discovered. The talent was there, but the ecosystem lacked the funding, infrastructure, and global recognition needed to thrive. In 2020, the entire Turkish gaming market saw below 10 funding rounds. So, how did it all start?

The story begins in the early 2000s when Turkish developers quietly built a foundation. A few pioneering startups started developing mobile games for Symbian and Java devices, most focusing on localizing international titles. Among them was Sobee, a PC game developer founded by Mevlüt Dinç. Sobee gained significant recognition and became one of Turkiye’s leading game companies from 2000 to 2010, especially after its acquisition.

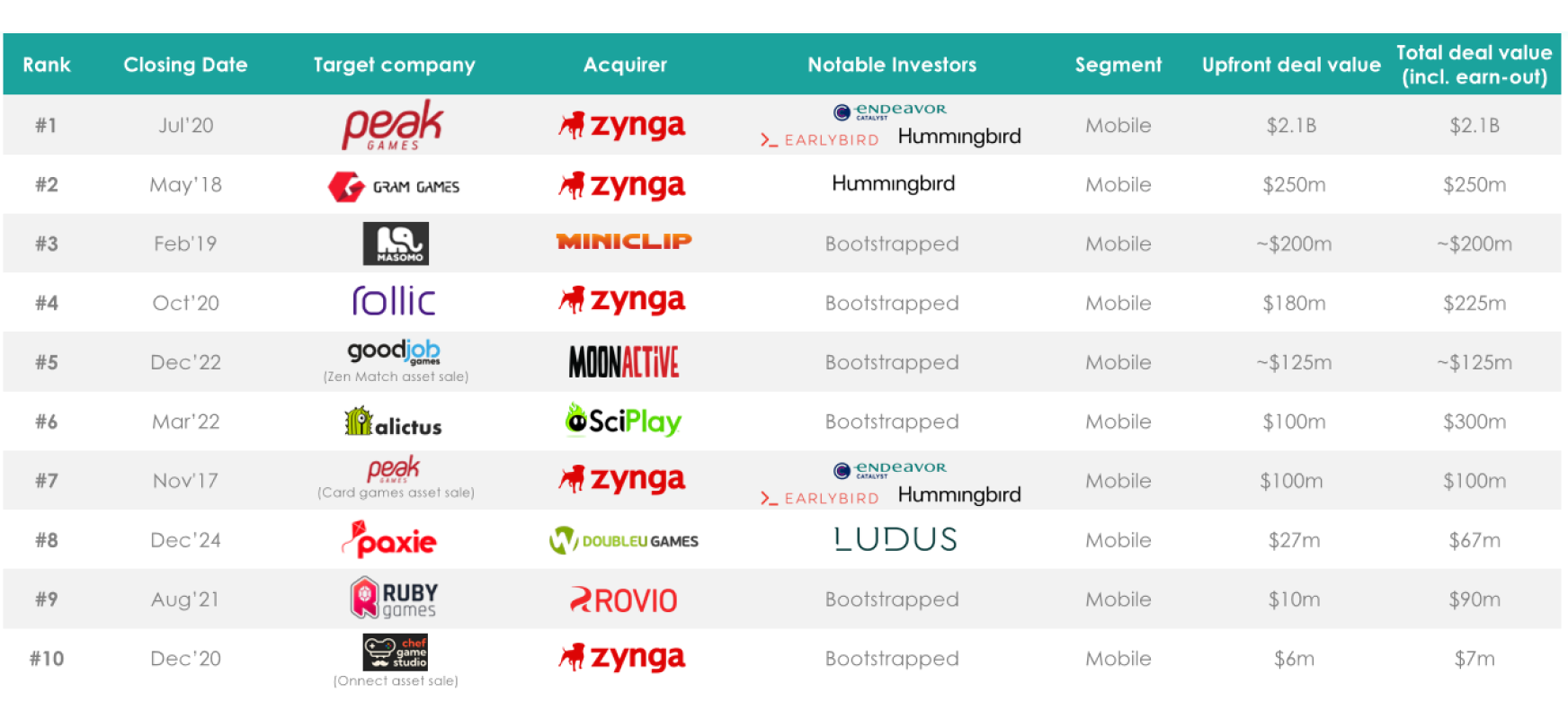

The 2010s marked a pivotal decade for the industry. Sanalika, an early multiplayer online game, reached millions of users and showcased the potential for local industry growth. Its founder went on to establish Gram Games, which achieved one of Turkiye’s most significant gaming exits to date. Around the same time, Peak Games was founded. One of the first notable M&A deals was done by Peak Games when it divested its card gaming business to Zynga in 2017, eventually proving the region’s potential to investors and putting Turkiye on the global gaming industry map. This was shortly followed by the $250m exit of Gram Games to Zynga and the estimated $200m exit of Masomo to Miniclip.

The turning point came in 2020 when Zynga acquired Peak Games for ~$2B at an impressive 3x EV/Revenue multiple. Although investors were already active in the market, this high-profile acquisition by a U.S. publicly traded company significantly boosted confidence in the region, solidifying Turkiye’s position as a hub for gaming talent and innovation. Following Peak’s landmark acquisition, a wave of entrepreneurship emerged, with over 80 new startups founded by or employing former Peak employees. Approximately half of these startups remained in the gaming sector, fostering knowledge transfer and driving the ecosystem’s rapid growth.

Hummingbird Ventures and Earlybird Venture Capital were among the early VCs who were the Columbus of Turkiye’s gaming market, opening the gates to a brave new world of Turkish mobile gaming. By 2020, Turkiye’s gaming market was no longer a hidden level—it was a thriving stage, with developers, investors, and players contributing to its growth. The majority of Turkish gaming studios were established in 2020 or later. Turkiye’s gaming industry has leveled up: this is just the first act of an epic saga. But the further growth won’t be possible without investors.

VC Writing the Check:

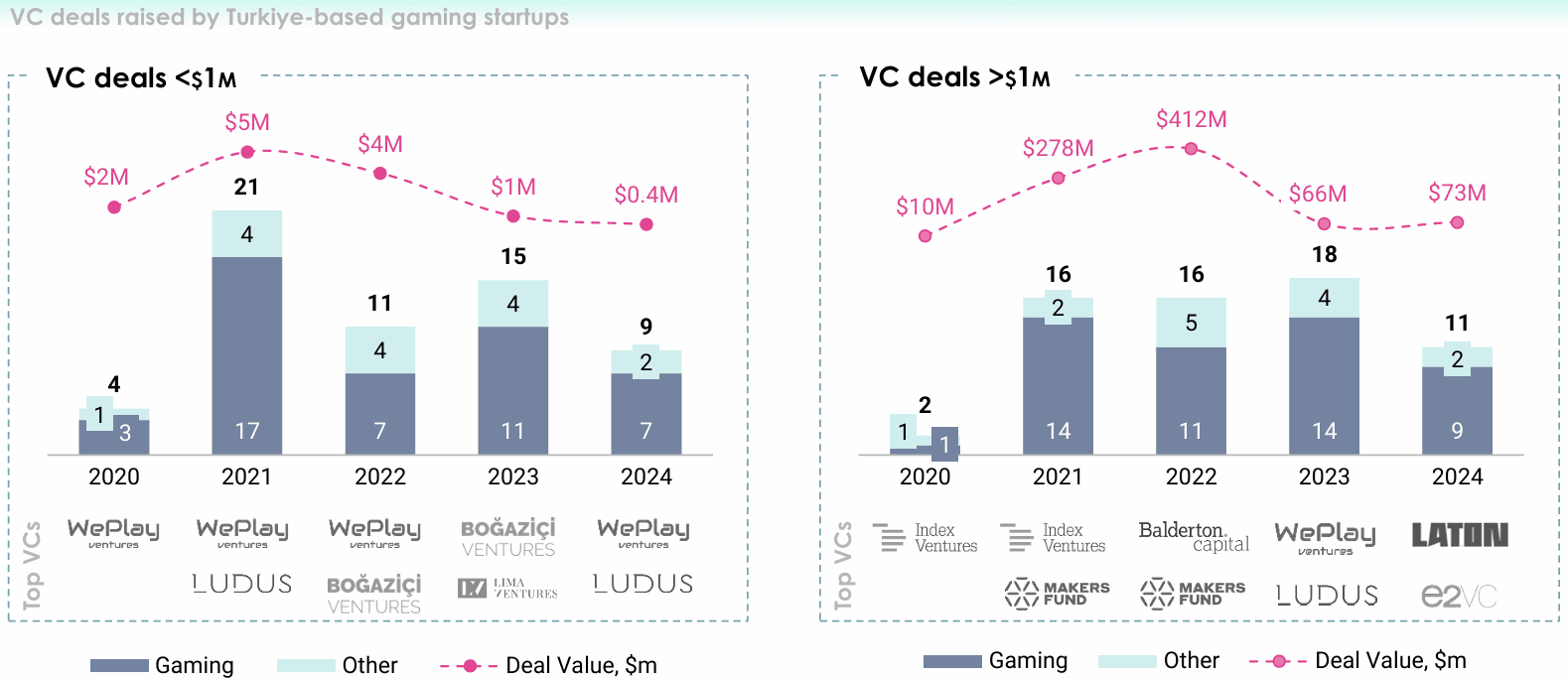

In Turkiye’s gaming scene, the funding game has two distinct tiers. On one side, you have the sub-$1 million squad—a group of local and ambitious funds, accelerators, and angel investors driving early-stage innovation. Key players include Ludus Ventures, WePlay Ventures, and Boğaziçi Ventures, alongside prominent angel investors like Akin Babayigit, a well-respected backer who has invested in nearly every major Turkish gaming studio. These players fuel Turkiye’s early-stage gems, backing underdogs before they hit the radar. They often bet on raw talent and big ideas before the first game even launches.

On the other hand, there are the heavy hitters—global giants like Index Ventures, Balderton Capital, and Makers Fund. These funds became spotlighted with headline deals like Dream Games’ mega-rounds, helping turn Turkiye’s winners into global contenders. Balderton Capital, in particular, cemented itself as one of Turkiye’s most active investors, playing a crucial role in the market’s development.

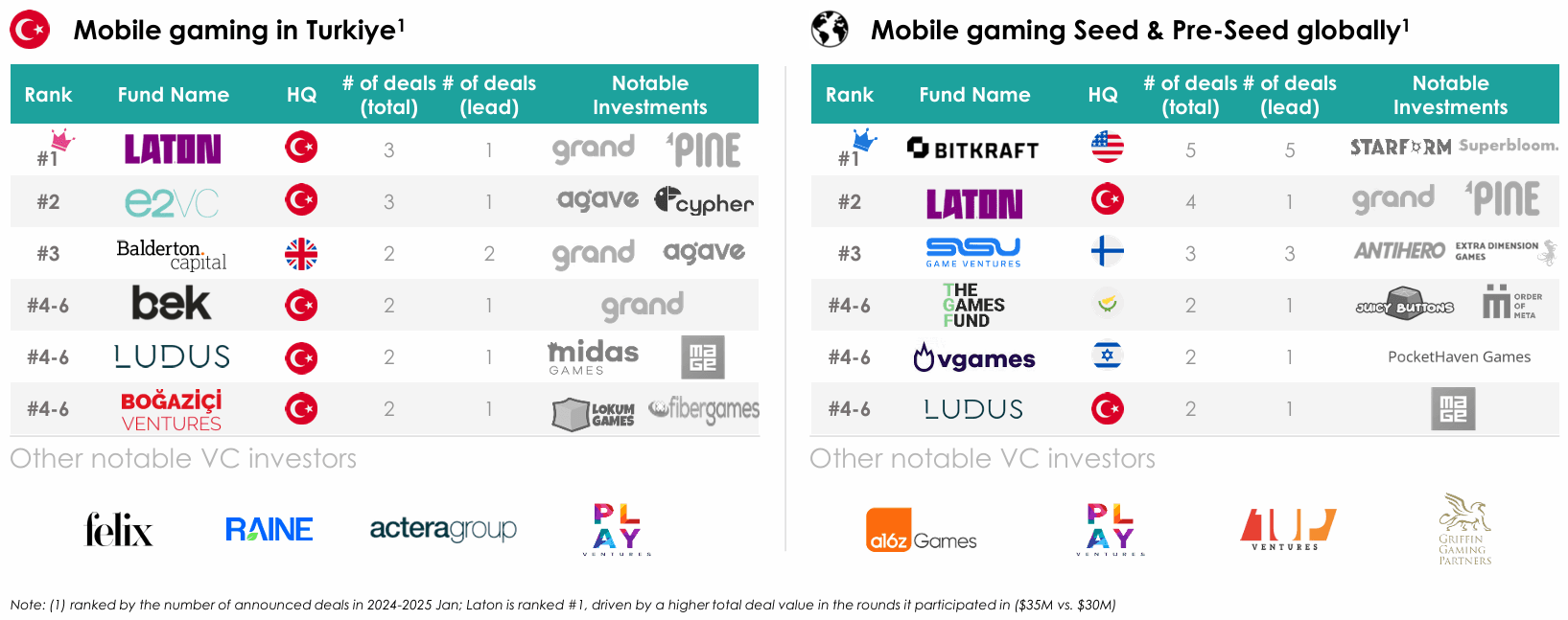

In 2024, we have a new player in the market: Laton Ventures. Despite being a fresh name in the industry, Laton isn’t just making an entrance; it’s making an impact. The firm led the VC rankings in Turkiye for 2024 with three deals, including Grand and Pine Games investments. But its ambitions extend beyond local markets.

Laton also ranked as the #2 most active early-stage mobile gaming fund worldwide for 2024. This places it alongside major international players, a rare achievement for an emerging fund. And they’re not slowing down. With a newly announced $50m fund dedicated to global gaming investments, Laton is poised for even more significant moves. Given their momentum, expect to see their name in more international deals soon.

The Floodgates Opened:

2021 was the year of the boom in gaming investments, with many new international VC names providing fresh capital to Turkiye’s gaming market: $240m raised across 25 deals in just six months. Notably, Dream Games (formed by the ex-Peak Games team) led the charge with a $155m Series B round, signaling the start of a new era. But the show hasn’t stopped there—in 2022, Dream secured a record $255m—the largest mobile gaming investment in the region and one of the biggest rounds globally. This kept Turkiye’s momentum alive, even as other markets began to slow.

Local funding mechanisms sustain early-stage growth, while global players scale the most promising ventures. Unlike the worldwide downturn, Turkiye’s early-stage ecosystem remained well-funded in 2023 thanks to structural advantages: equity-based crowdfunding regulations, the transformation of the BiGG program from an idea-stage grant initiative into a pre-seed investment fund by the end of 2023, and new investment incentives for R&D firms. As a result, 33 early-stage gaming startups secured funding in 2023, averaging $1.9m per round. This surge highlighted the strength of smaller studios and reinforced Turkiye’s reputation as an innovation hub beyond its major players. However, like the global market covered in our Global Gaming Deals Activity for FY23, the post-Series A funding gap persisted. So, who managed to attract attention even during such challenging times?

The Heavyweights and Hidden Gems:

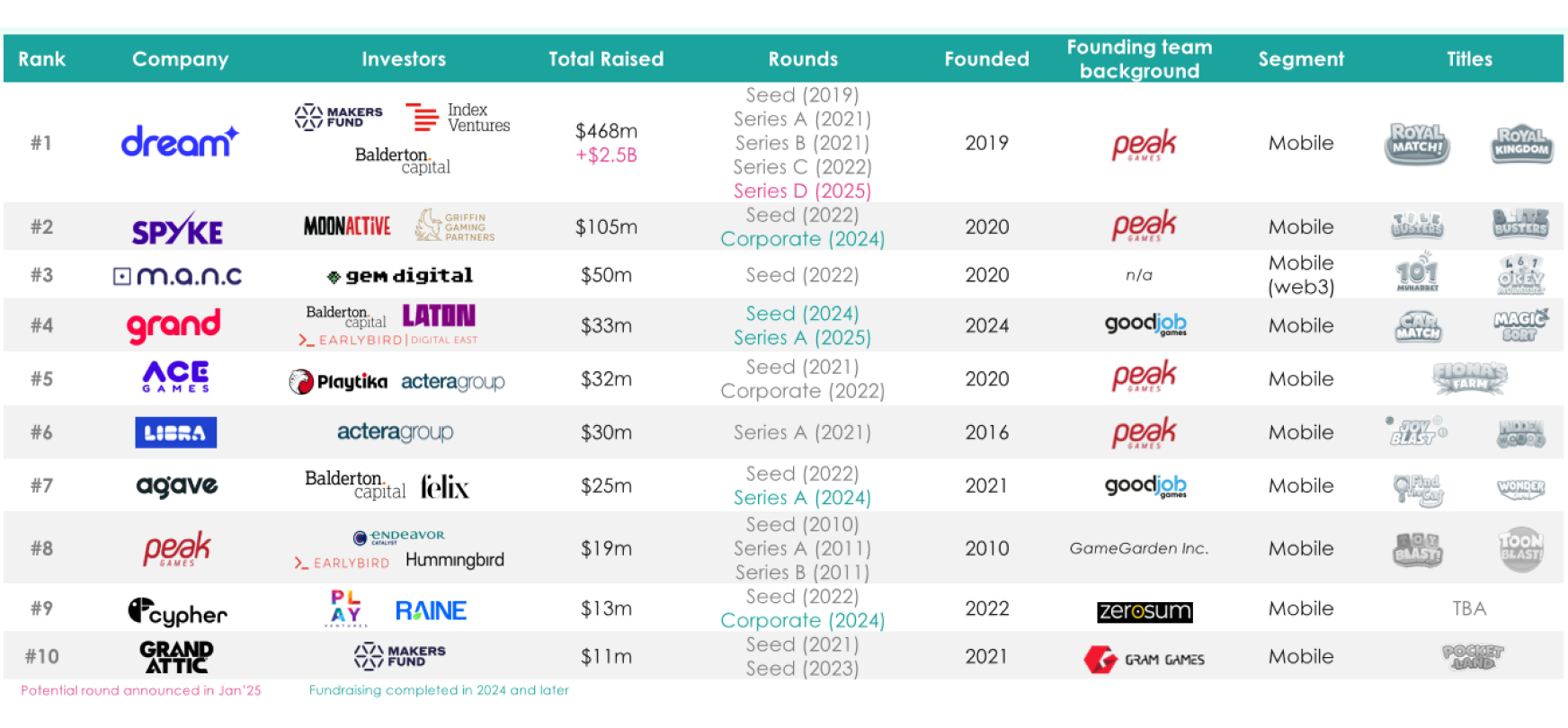

Studios like Dream Games, Spyke Games, and Grand Games emerged as the next generation of Turkish gaming pioneers. Each attracted significant investments and built games that captivated global audiences. Why? Because mobile developers have cracked the code: launch fast, fail fast, and scale faster. Newcomers like Grand Games (2024) and Mega Fortuna (2023) epitomize this, instantly landing Seed funding by betting on rapid iteration. Investors love this agile hustle, and the money keeps flowing.

Corporate giants are circling, too. Ace Games’ 2022 raise and Spyke’s 2024 deal reveal a clear trend: Everyone wants to scale or snap up studios with breakout potential. But here’s the twist: most companies are still in their early growth phase, except for one outlier.

Dream Games is the unicorn in the room. Founded in 2019, it reached a valuation of $2.75B just three years later, thanks to the success of Royal Match. Reports suggest its next funding round could double that valuation, soaring to a staggering $5B. Let that sink in: going from zero to dominating an entire genre in five years.

Do you notice a pattern? Every big-funded dev is all-in on casual titles. Investors aren’t just backing studios—they’re betting on the unstoppable appeal of easy-to-learn, hard-to-put-down gameplay.

Even as global investment cooled in 2023, Turkiye’s gaming sector proved its mettle—defying trends with unshaken momentum. By 2024, the market had entirely shed its “hidden gem” status, emerging as a global heavyweight (e.g., rounds of Cypher Games, Grand Games, Agave).

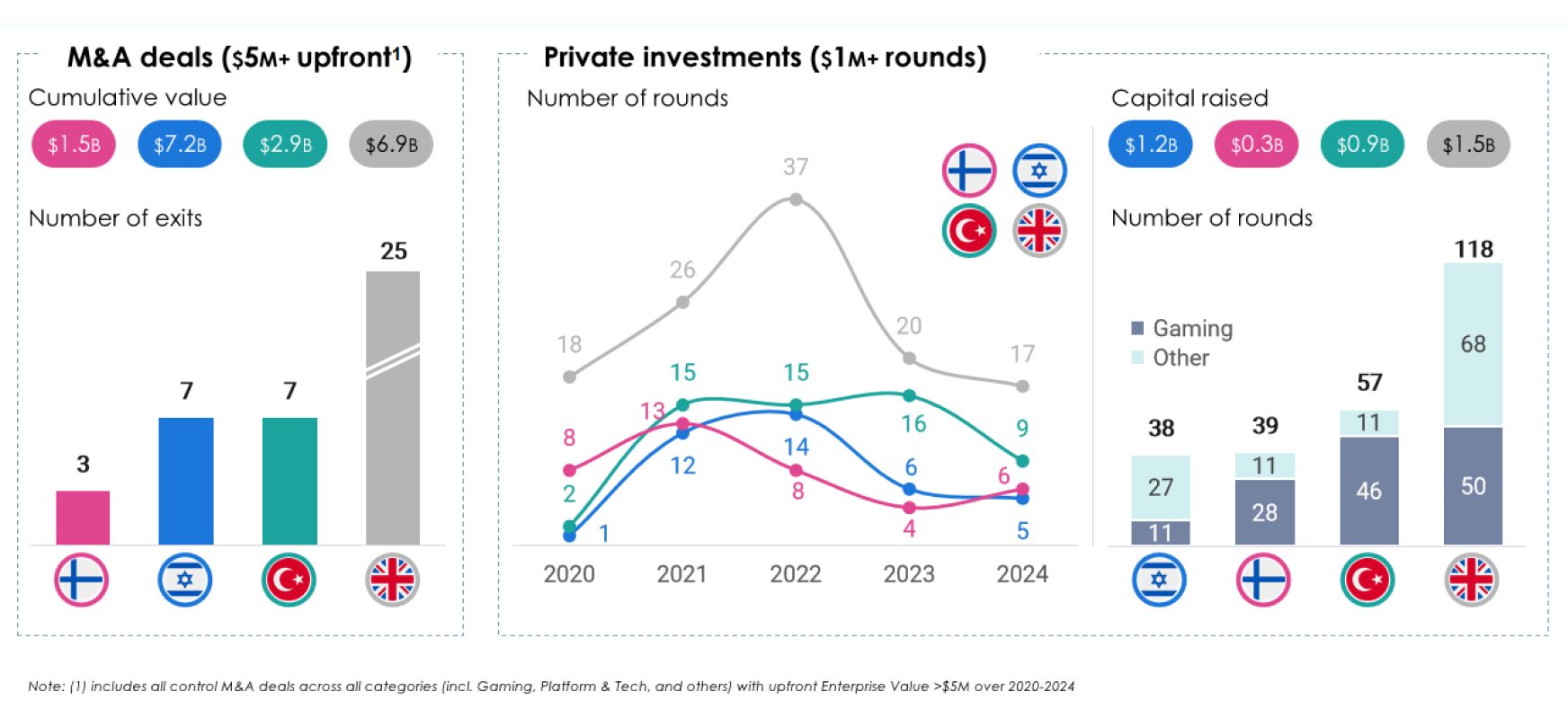

It’s clear that Turkiye isn’t just a flash in the pan; it’s a gaming hub firmly on the rise. Let’s stack it against three other gaming heavyweights, Israel, Finland, and the UK, to understand how far Turkiye has climbed.

Breaking Down the Numbers:

As a financial hub of Europe, the UK attracts the majority of capital, resulting in more funding rounds. However, most of these fundraisings are concentrated in Platform & Tech startups. This aligns with the broader global trend in gaming, where VCs increasingly favor “picks and shovels”—startups developing the infrastructure, tools, and services needed to build, operate, and scale games—over traditional gaming studios (for more, see 8 Predictions for Gaming M&A and Investments in 2025 on Deconstructor of Fun). Similarly, Israel has followed the same path.

While Finland doesn’t match Türkiye or Israel in sheer deal volume, it remains a powerhouse. Its strong legacy in mobile and free-to-play gaming ensures that when Finnish studios make a move, they make it count. Türkiye has outpaced Israel and Finland in raising capital in recent years. Remarkably, it has secured nearly as many funding rounds for gaming studios as the UK—an extraordinary feat for a much smaller, emerging market competing on par with a financial giant.

Unlike other regions where gaming studios have gone public, Türkiye has yet to see a major gaming IPO. This reflects its status as an emerging market and its economic challenges. However, sustained investor interest suggests large-scale exits could be on the horizon.

Conclusion:

Over the past five years, Türkiye’s gaming sector has evolved from a hidden gem into a global contender. With over 150 deals and a cumulative valuation exceeding $4B, the market has demonstrated remarkable resilience despite economic challenges and global downturns. Success stories like Peak Games’ $2B acquisition by Zynga and Dream Games’ record-breaking fundraising have validated Türkiye’s strategic value, sparking innovation and investment.

Türkiye’s success is deeply rooted in mobile gaming’s agility. Low development costs, rapid iteration, and a thriving ecosystem of early-stage studios have made it the ideal testing ground for breakout hits. While blockbuster deals like Peak Games and Dream Games capture headlines, the real growth engine lies in the steady flow of Seed and Series A funding rounds, crucial in fueling new talent and innovation.

The rise of strong local funds like Laton Ventures is pivotal in nurturing early-stage startups, while global investors such as Balderton Capital step in to scale the most promising players.

M&A remains the primary exit route, reflecting Türkiye’s emerging-market status and the absence of major gaming IPOs. However, investor confidence is steadily growing. The challenge is to sustain this momentum, attract late-stage investments, and expand beyond mobile into other segments like PC and console gaming (mainly bootstrapped studios, such as well-known TaleWorlds Entertainment and recent indie hits Curve Animation and Nokta Games).

Turkiye’s gaming ecosystem has everything it needs to compete on the global stage: world-class talent, a culture of innovation, and increasing recognition from investors and acquirers alike. The question isn’t whether Türkiye will produce the next big hit—it’s when and how many.