GameStop Locks In $2.25B to Power Its Post-Retail Transformation

GameStop Locks In $2.25B to Power Its Post-Retail Transformation

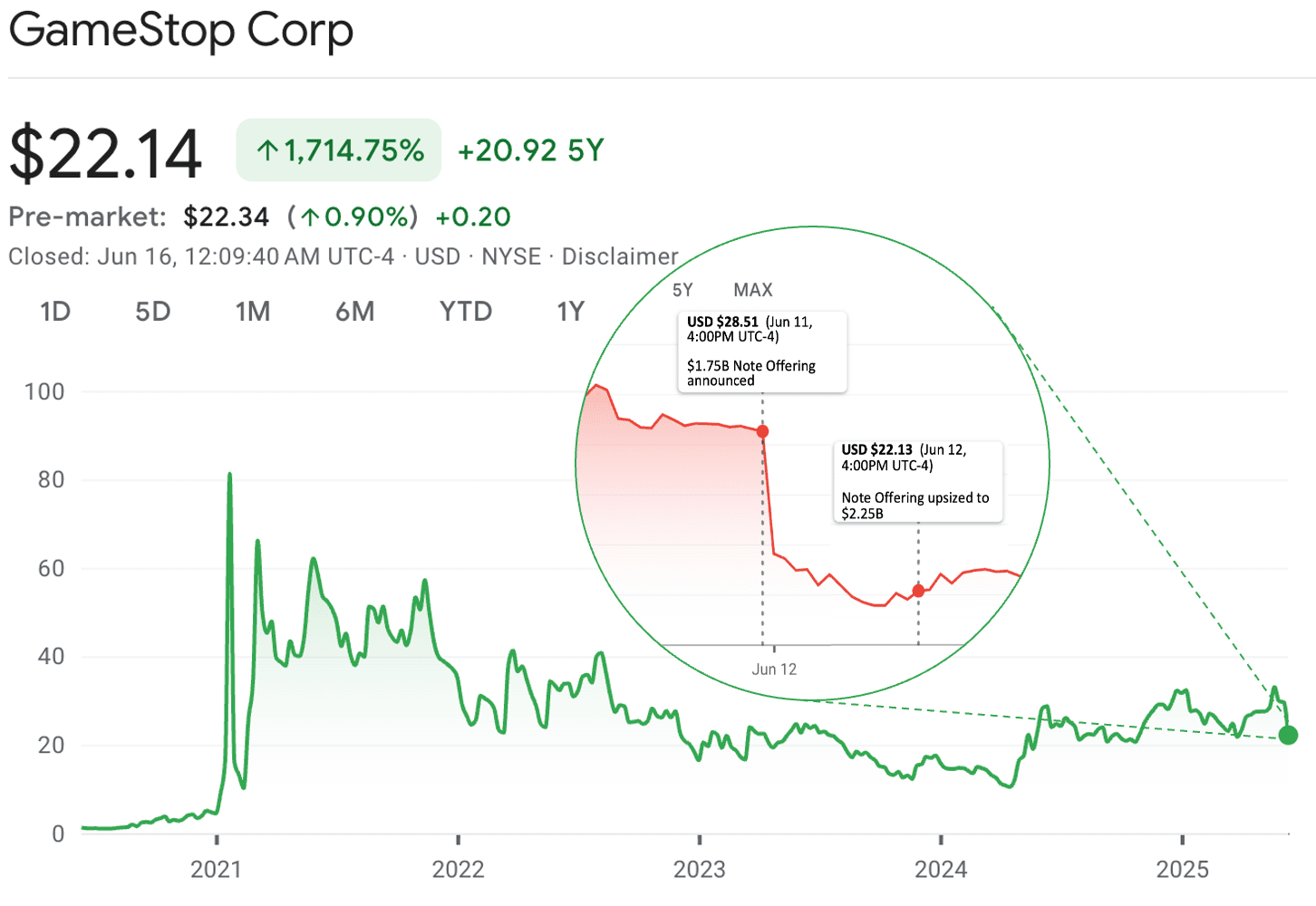

US-based video game retailer GameStop (NYSE: GME) has announced a $2.25B private offering of 0.0% convertible unsecured senior notes due Jun’32. While the notes carry no interest, investors have the right to convert them into shares at $28.91 (a 32.5% premium to the June 12 volume-weighted average price), offering upside potential if the stock appreciates significantly over time. This structure provides no regular income but appeals to investors seeking long-term equity exposure and potential participation in the company’s future growth. The offering also includes an option to purchase an additional $450m in aggregate principal amount of notes. Proceeds are intended for investments across financial instruments and digital assets, including Bitcoin, following the Investment Policy issued in Mar’25.

Once a dominant physical retailer for video games and consoles, GameStop, founded in 1984, struggled as the industry shifted online. In early 2021, the company became the face of a retail investor movement as Reddit’s r/WallStreetBetstriggered a historic short squeeze, turning GameStop into a meme stock and reigniting public attention.

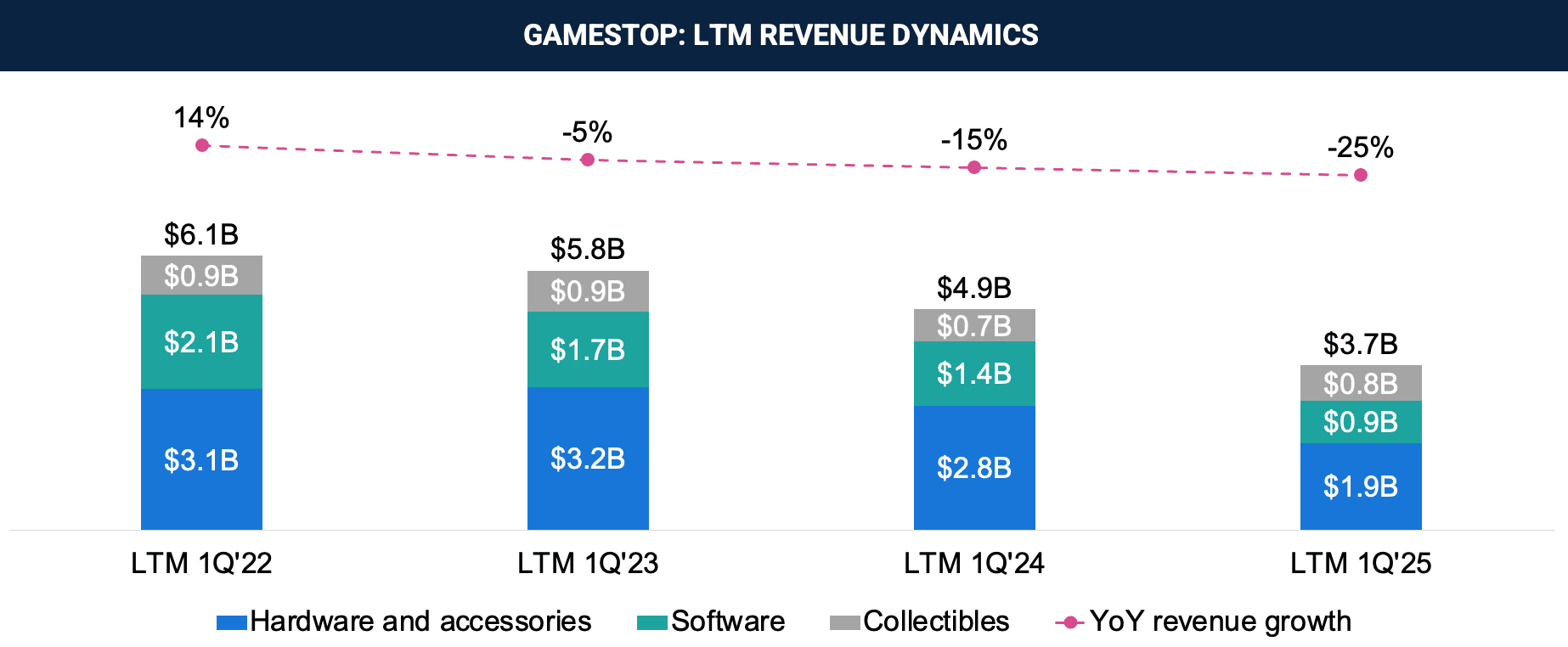

Since then, under Chairman and CEO Ryan Cohen, the company has begun repositioning. It cut costs, exited low-performing initiatives such as NFTs, and shifted its focus to categories showing growth. In LTM Q1’25, while total revenue declined 25% YoY, collectibles revenue increased by 10% YoY (or 55% QoQ), driven by strong performance in the trading cards segment.

Source: GameStop

At the shareholder meeting held on June 12, 2025, Cohen emphasized trading cards as a natural extension of GameStop’s legacy business. Cards now account for 29% of total Q1’25 revenue, surpassing video game software for the first time.

To support its evolving business model, GameStop has actively tapped public and private markets, completing 7 deals with a total value of $6.4B (excl. announced $2.25B notes offering in Jun’25). You can access the complete list of GameStop’s financial transactions since 2020, totaling over $8B in activity, by subscribing to our Patreon.

In May’25, the company purchased 4,710 Bitcoin, valued at over $500m, positioning itself among the top corporate BTC holders globally. The investment followed a formal update to its treasury strategy, which now allows for capital deployment into digital assets.

Cohen stated that future crypto purchases would not be pre-announced, emphasizing that Bitcoin serves as a strategic reserve asset aligned with the company’s longer-term evolution, not a short-term signal.

Despite the narrative shift, investor reaction has been cautious. Following the initial $1.75B convertible notes announcement on June 11, GameStop’s share price fell by 22% on June 12, closing the week at $22.14 on June 13. The sharp decline likely reflects investor concerns around potential dilution, increased risk exposure to volatile assets like Bitcoin, and broader skepticism toward the company’s shift away from its core video game retail business.

The capital raise marks yet another chapter in GameStop’s ongoing reinvention. As the company shifts deeper into digital assets and collectible commerce, it continues to walk a tightrope between transformation and volatility. With investor sentiment wavering and market headwinds in play, GameStop’s next steps will potentially determine whether its changes lead to sustainable value or another speculative cycle.