InvestGame x Deconstructor of Fun: 8 Predictions for Gaming M&A and Investments in 2025

2024 was a year of recovery and strategic recalibration for the gaming industry. After years of pandemic-related challenges and shifting market dynamics, the sector is gradually finding its footing.

As demand for gaming fell post-COVID, many public companies struggled to demonstrate positive organic revenue growth (i.e. growth excluding revenue from recently acquired companies), often missing analyst expectations. Rising interest rates and broader macroeconomic uncertainty further affected valuations for publicly traded gaming firms, making company stock less attractive currency for new acquisitions. This led sellers of acquisition targets to prefer cash over buyers’ illiquid, risky, and typically depreciating stocks.

Meanwhile, debt raised during the pandemic to finance acquisitions has become more expensive to service. Coupled with weaker organic performance, these factors tightened debt covenants and led numerous public strategic players to announce strategic reviews, lay off staff, cancel projects, reshuffle leadership teams, and even consider divestments.

2024 M&A recap: pursuing long-term strategic goals vs. short-term arbitrage gains

Last year, unlike the financial deal frenzy of the pandemic era—mainly driven by financial arbitrage (buying at lower transaction multiple vs. trading multiple)—witnessed a shift toward more targeted acquisitions aligned with long-term objectives. Key industry players recalibrated their portfolios accordingly:

Companies like Embracer Group and Aristocrat streamlined operations by divesting non-core assets and doubling down on key business divisions.

Conversely, publishers like Miniclip and Playtika took an aggressive stance, acquiring studios to strengthen their market positions.

Some players, like Take-Two Interactive and MTG, successfully managed both sides of the equation—offloading non-core studios while simultaneously acquiring promising developers to fuel future growth.

Almost every corner of the video game market saw M&A activity in 2024:

(a) After weathering the challenges of the post-IDFA landscape, the mobile sector saw strong activity in the evolving in-app advertising (IAA) space, with notable deals involving Easybrain, GamoVation, and Zephyr Games. Additionally, in-app purchase (IAP) games catering to broader audiences (e.g., SuperPlay) gained traction. However, mid-core developers relying on whale-driven economies have encountered limited activity, lacking growth, and often traded at lower multiples (e.g., Plarium sold for 4.5x EV/EBITDA).

(b) The PC & console segment stood out with reputable developers undergoing sales processes (e.g., Jagex, Gearbox, Saber Interactive) and others participating in minority deals (e.g., Facepunch, Remedy);

(c) A standout year for gaming services, led by the $2.8B takeover of Keywords Studios. Numerous smaller deals (e.g., Certain Affinity, Third Kind Games) closed by Keywords and Virtuos also highlighted the growing demand for outsourcing.

(d) The gaming platform and tech side weren’t left behind, with notable transactions such as SensorTower acquiring data.ai, Magic Leap ($590m), and Chartboost divested by Zynga.

As we step into 2025, the gaming industry’s M&A landscape promises another dynamic year, building on the solid momentum of 2024.

Prediction #1: M&A activity normalizes

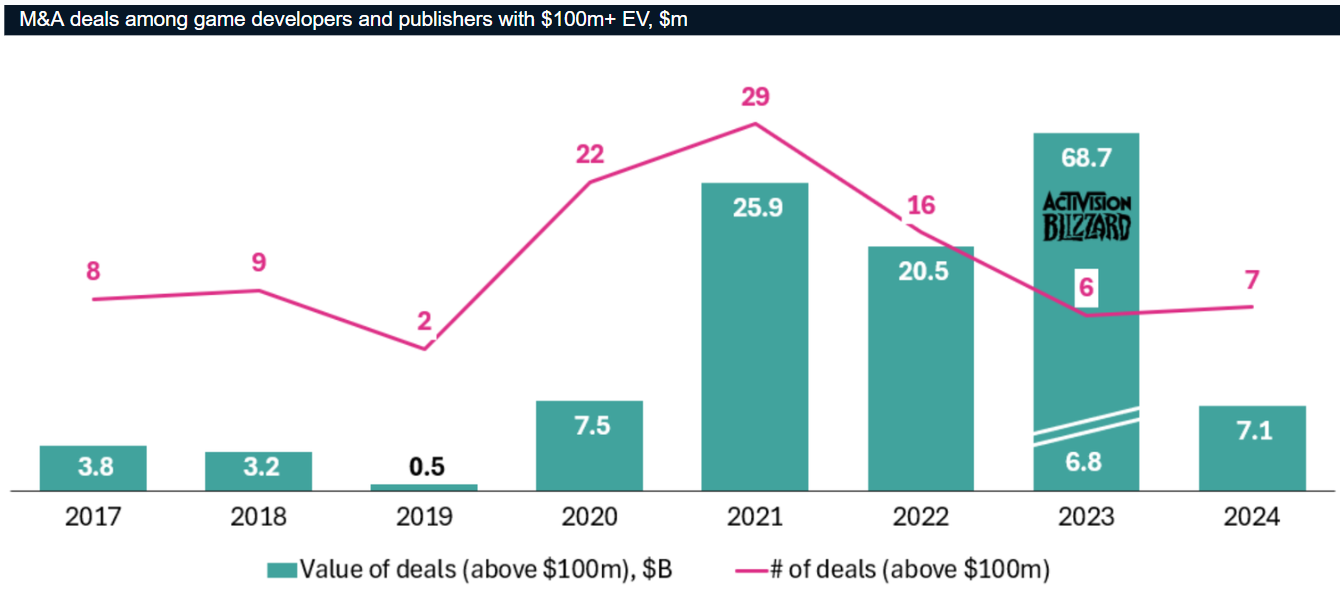

The pace of deals remained strong in 2024, with seven gaming transactions exceeding $100 million in upfront enterprise value (EV)—not only surpassing the pre-pandemic average number of deals (2017–2019) but also significantly outpacing them in value. With the S&P 500 closing up 25% for the year and signs of broader economic stability, M&A momentum is expected to continue into 2025, potentially matching or slightly exceeding 2024’s activity levels.

Other factors contributing to the steady state of M&A activity in the coming year include:

- Public gaming companies will be more active: With approximately $10.5 billion in cash reserves1 and relatively low leverage, major publishers are well-equipped to sustain dealmaking activity. As the stock market recovers, trading valuations improve, and interest rates ease, these companies will support dealmaking activity.

- High-profile studios remain in demand: Studios with strong IP and healthy financials—whether driven by rapid revenue growth or solid profitability—will continue to command high valuations and attract significant interest in the M&A market.

- Work-for-hire services on the rise: Following ~15,000 layoffs in 2024, publishers are increasingly relying on work-for-hire services. Companies like Keywords Studios (now privately held) and Virtuos are well-positioned to benefit, competing for talent and solidifying their roles as key players in the 2025 M&A landscape.

- Gaming converges with social and entertainment: A growing trend blends gaming with broader consumer experiences. Voodoo’s acquisition of BeReal, Telegram’s launch of Mini Apps for gaming, and Crazy Maple Studio’s expansion of its ReelShort micro drama app all highlight fresh opportunities for creative, boundary-pushing deals in 2025.5.

Note: (1) combined total cash & cash equivalents of select public gaming comps incl. Take-Two, Electronic Arts, Playtika, Ubisoft, MTG, Stillfront, Paradox, Embracer, CD Projekt, Team17, NetEase, Krafton, Kakao Games, ShiftUp.

You can find the rest of this article using the link below.

| Read the full article |