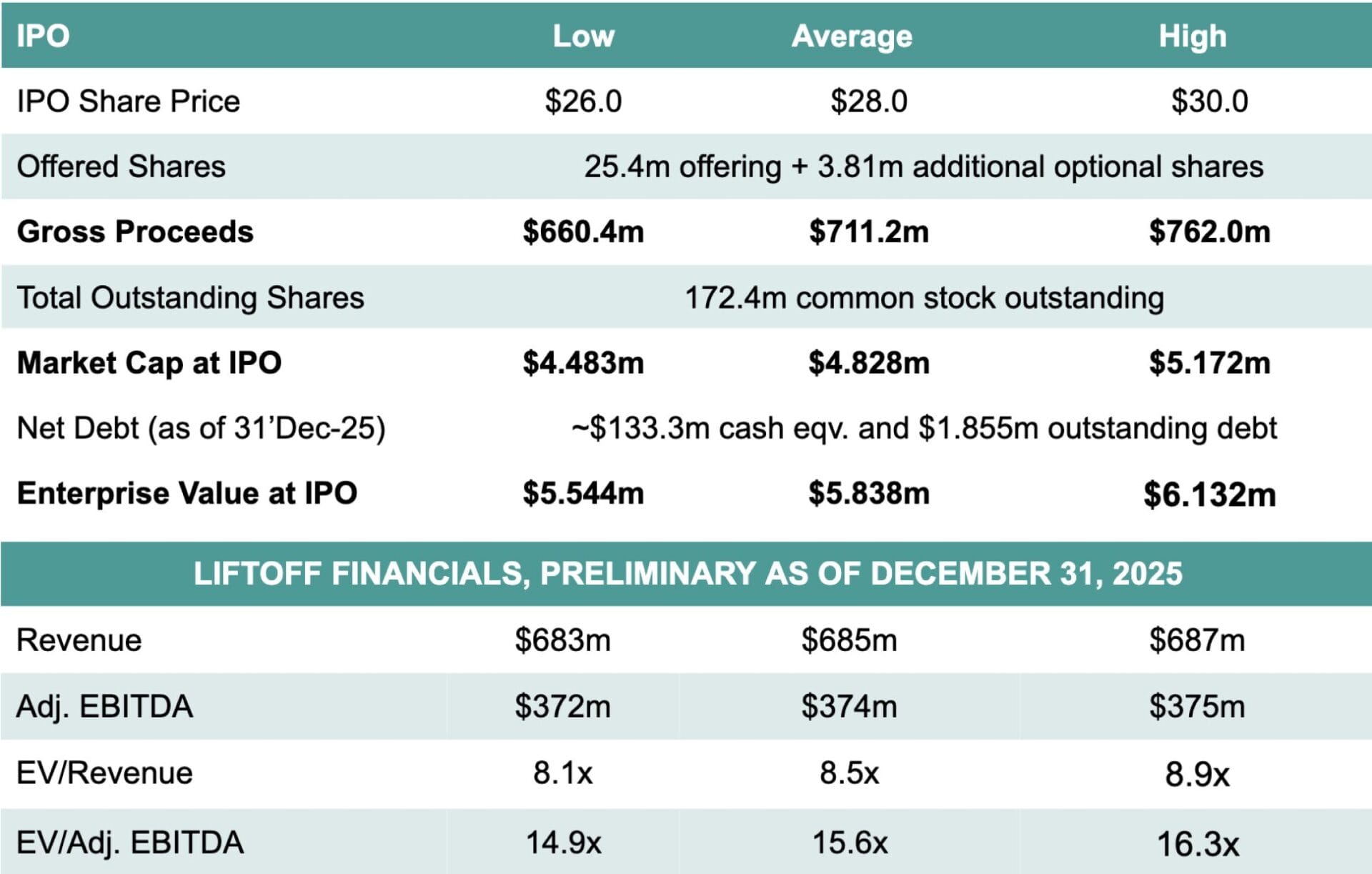

US-based Liftoff Mobile has postponed plans for an IPO on the Nasdaq due to the software sector’s selloff, including declines in shares of peers AppLovin Corp. (NASDAQ: APP) and Unity Software Inc. (NYSE: U). Initially targeting $26–$30 per share, the company planned to use up to $762m in proceeds for its mobile app marketing platform. The firm confirmed in a statement that, “Given current market conditions, we have made a business decision to take additional time before listing,” adding that it plans to pursue public markets “when timing and conditions best support our long-term vision.”

Since late January, more than $800B has been wiped off the market cap of the S&P 500 software and services index, contributing to investor risk aversion in technology IPOs.

IPO Terms Overview

In earlier digests, we mentioned that Blackstone (NYSE: BX) has been positioning Liftoff for a potential public listing following the Vungle acquisition and the subsequent merger of the two businesses. While the company has now postponed its Nasdaq IPO due to weak market conditions, the S-1 filing confirms Blackstone is expected to retain majority control, with Goldman Sachs, Jefferies, and Morgan Stanley leading the offering when the process resumes.