Pearl Abyss to Sell CCP Games? EVE Online Maker Reportedly Up for Grabs

Pearl Abyss to Sell CCP Games? EVE Online Maker Reportedly Up for Grabs

South Korea-based multiplatform game developer Pearl Abyss (KQ:263750) is reportedly in the process of divesting its Iceland-based portfolio company CCP Games — the studio behind sci-fi MMORPG EVE Online and other games based on the same IP — according to several sources.

Pearl Abyss originally acquired CCP Games in 2018 in a deal worth up to $425m, including earn-out payments. Reports suggest that the company has already appointed a third-party underwriter to manage the sale process.

Deal Background

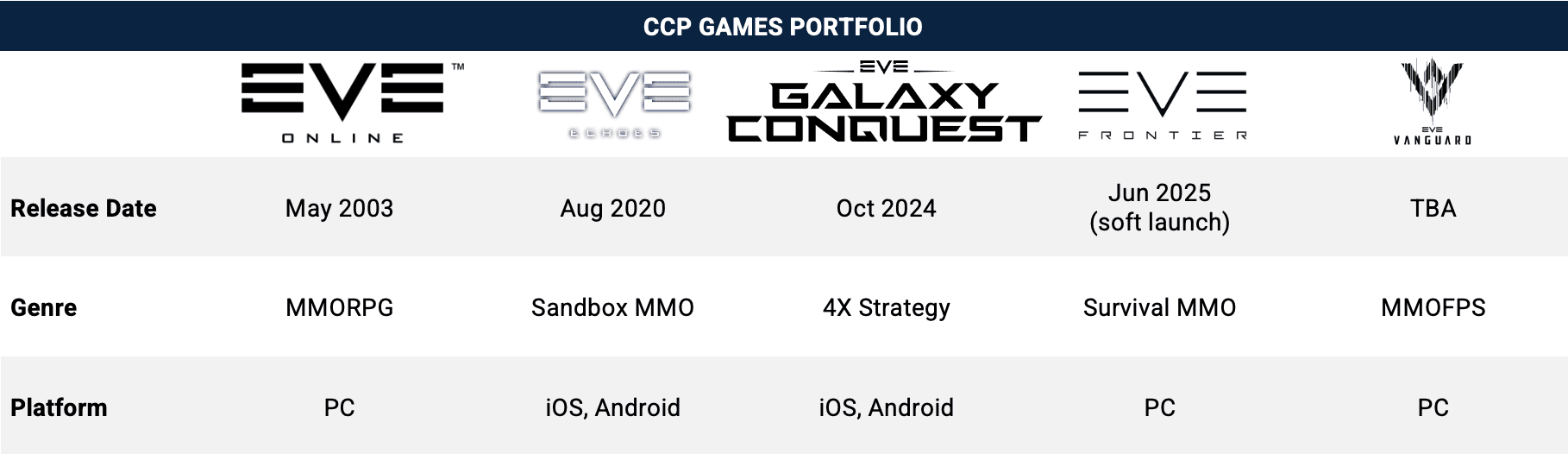

While EVE Online continues to deliver solid revenues — with IP revenue estimated at ~$60m (₩85.2bn) in 2024, supported by updates like Equinox — CCP’s broader R&D pipeline has yet to yield major commercial successes. Over the years, the studio explored multiple genres and platforms, from VR to FPS and experimental technologies, though none have matched the scale or longevity of EVE Online.

Pearl Abyss appears to be shifting its focus back to internal IPs like Crimson Desert and DokeV. Since acquiring CCP, the company has made only one additional acquisition — Factorial Games (~$17.8m / ₩20bn) in 2021, suggesting a cautious M&A approach. With this in mind, the CCP sale may be part of a broader operational streamlining strategy aimed at optimizing resource allocation and reducing fixed costs.

Source: Pearl Abyss Financial Statements

Despite a decline in topline revenue and operating margins in recent years, Pearl Abyss maintains a strong financial position with ~$87m (₩124.8bn) in cash and equivalents and ~$57m (₩81.2bn) in total debt, resulting in a net cash position of $30m (₩43.6bn) based on the latest filings.

Strategic Rationale For The Potential Buyer

EVE Online remains one of the longest-running, community-driven MMOs in the market, with a high-retention, niche audience and a monetization model built around long-term engagement. Beyond the IP itself, CCP’s operational experience in managing live-service MMOs at scale is a key asset.

In that regard, CCP’s role in the market resembles that of other long-lived MMO operators. For instance, Jagex — the UK-based studio behind RuneScape — was acquired in 2024 by CVC Capital Partners and Haveli Investments, reportedly for $1.1B+. While the business models and IPs differ, both companies share core strengths: stable cash flows, loyal player communities, and deep expertise in MMO live operations.

Like Jagex, CCP could offer strategic upside for several types of buyers:

- Private Equity funds. For PE funds targeting stable, cash-generating assets with upside optionality, CCP is a good fit. Its lean operations and predictable monetization model could appeal to long-term hold strategies, especially with potential upside from new product launches.

- Strategic buyers with MMO expertise (e.g., Jagex, NCSoft). For experienced operators in the MMO space, CCP offers both operational depth and potential synergies in infrastructure, tech, or regional audience overlap. The studio’s ability to run persistent, complex virtual worlds is a rarity in today’s market.

What Is The Twist?

If the rumored sale materializes, it would mark Pearl Abyss’ first major portfolio divestment since its IPO. Originally seen as a diversification move beyond Black Desert, the CCP acquisition has arguably lost strategic alignment due to the limited success of new products and shifting internal priorities. Still, for the right buyer, CCP represents more than just a legacy brand — it offers a resilient live-service business, a dedicated community, and a team with decades of experience running high-complexity online ecosystems. In an industry where sustainable MMO operations are increasingly complex to build from scratch, acquiring CCP may offer a strategic shortcut into a space with high barriers to entry.