Tencent Acquires 15.8% of Helldivers 2 Developer Arrowhead at ~$530m Valuation

China-based tech giant Tencent Holdings (SEHK: 700) has acquired a 15.75% minority stake in Sweden-based PC & Console game developer Arrowhead Game Studios, best known for its breakout hit Helldivers 2. The deal, valued at approximately $80m, implies a valuation of ~$530m.

After the deal, the cap table remains firmly under the control of the founding team and early investors, who collectively retain about 84% ownership. Tencent, with a minority stake, has no board control or operational oversight, consistent with its typical “quiet partner” strategy in game studios.

A Rare Mid-Tier Breakout

Arrowhead’s FY2024E financials reveal why the studio became a compelling target.

| Financial Metrics FY 24 | Valuation Multiples | |

|---|---|---|

| Revenue ($m) | 100 | 5.3x |

| EBIT ($m) | 76 | 7x |

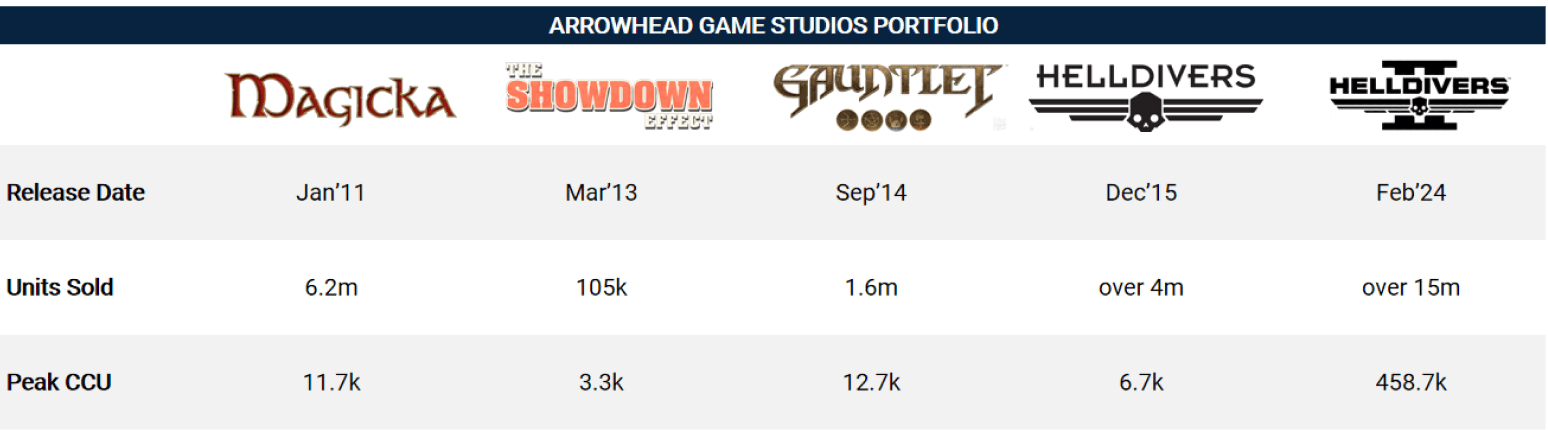

Tencent is acquiring a stake in a highly profitable, fast-growing game studio with deep live-service expertise and significant growth potential. Arrowhead’s success with Helldivers 2 has become one of the most notable releases of the last 5 years in the premium PC & Console space. The studio, originally founded in 2008 in Skellefteå by five graduates of Luleå University of Technology (LTU), now employs around 140 people in its Stockholm headquarters. The current gaming portfolio consists of the following:

Source: VG Insights, SteamDB

All titles remained niche, except for Helldivers 2, published by Sony Interactive Entertainment (TYO: 6758; NYSE: SONY), which was simultaneously released on PS5 and PC for the first time. Within its first three months, the title managed to sell 12 million copies, making it PlayStation’s fastest-selling game of all time.

Source: Alinea Analytics

What Makes Helldivers 2 Tick

Unlike many live-service titles that chase monetization trends, Helldivers 2 succeeded by staying focused on co-op gameplay and player experience. Built over 7–8 years, the game combines third-person squad-based shooting with light strategy and emergent missions.

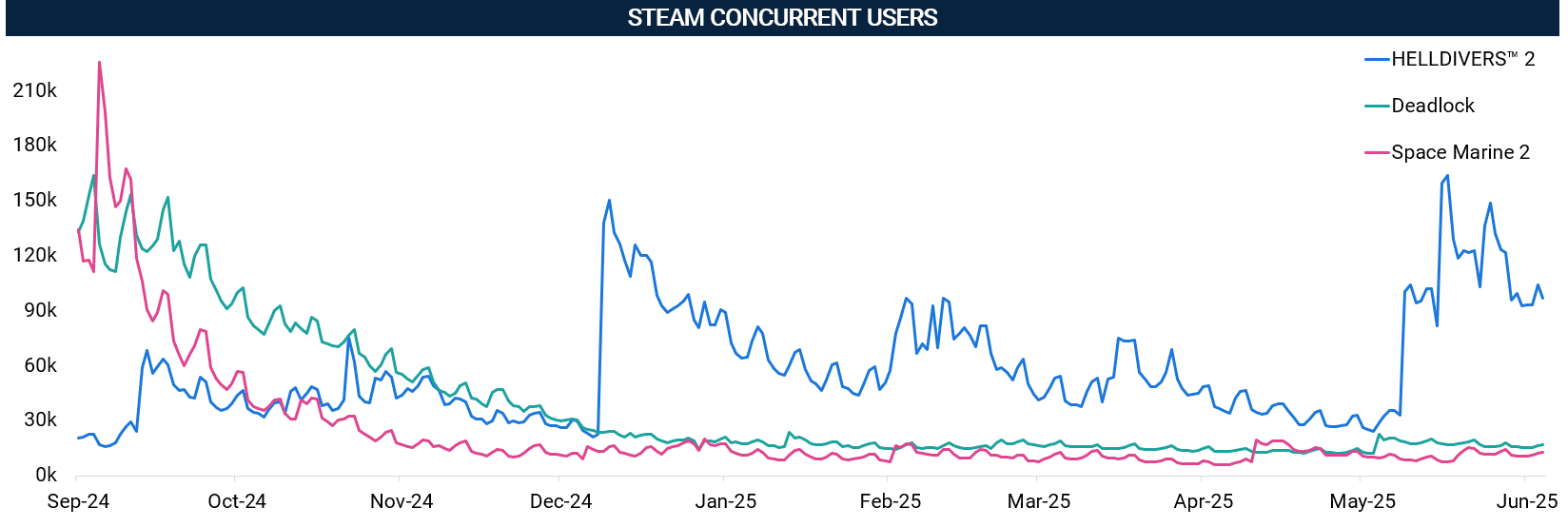

Its monetization is widely seen as player-friendly: a $39.99 premium price, optional battle passes, and cosmetic “Super Credits” — but no pay-to-win systems. This has helped the game sustain momentum. The price was dropped to $32.00 after its “Heart of Democracy” update in May’25, which introduced the Illuminate faction and boosted Steam concurrent users (CCU) by +140% and helped the title to reach Top-5 best-selling games on Steam in May.

- Peak Steam CCU: 458,709 (Feb’24)

- May CCU rebound: ~163,000

(For comparison: Warhammer 40,000: Space Marine 2 peaked at 226K and dropped to <10K; Deadlock peaked at 171K and slid to ~7K.)

Source: SteamDB

Despite impressive figures, Sony, as a publisher, made a misstep by attempting to mandate PSN authorization on PC in May’24. This step triggered a wave of community backlash and mass review-bombing of the game, which Sony quickly reversed. Despite the stumble, Helldivers 2 was cited in Sony’s Q1 FY24 earnings as a key driver of first-party revenue, signaling substantial platform impact even without direct ownership.

Tencent’s Strategy Behind

Tencent’s move reflects a broader strategy it’s pursued for years: minority investments (typically 10–20%) in promising live-service studios. Past investments in Ubisoft (PAR: UBI), Bohemia Interactive, FromSoftware, and others have followed this exact playbook. This deal appears to give Tencent:

- Low-risk exposure to a rising Western IP,

- Optionality for mobile or F2P adaptation in China,

- A high-IRR asset, delivering >$100m in profit at a fraction of a typical AAA budget,

- A share in one of the few independent European gaming companies

Given the current dynamics with the US and China’s regulatory climate, which has slowed Tencent’s pace of major acquisitions, such targeted strategic moves in the European market serve as both a practical risk hedge and a potential launchpad for future collaboration.

Why It Matters

Helldivers 2 proves that premium co-op shooters can break out and evolve into major franchises, especially when supported by smart LiveOps and a hybrid monetization model. It blends premium game design with GaaS elements, offering proper DLC and IAPs that respect player time and spending. Arrowhead now stands as a compelling template for studios and publishers targeting the elusive mid-tier between indie and AAA.

Tencent gains a low-risk stake in a proven Western live-service developer and a foothold in a fast-growing franchise, with optionality for mobile and live adaptations. Arrowhead, in turn, secures capital, credibility, and access to Asian markets — all while maintaining creative control. For Sony, this is strong validation of its push for high-engagement, flexible first-party experiences beyond just PSN expansion.

This is one of 2024’s most strategically sound deals in core gaming — not just for what it achieves immediately, but for what it enables. It aligns the goals of all parties and sets up Helldivers and Arrowhead for significantly larger ambitions ahead.