Ubisoft Shares Plummet 34% following Radical Restructuring and Mass Layoffs

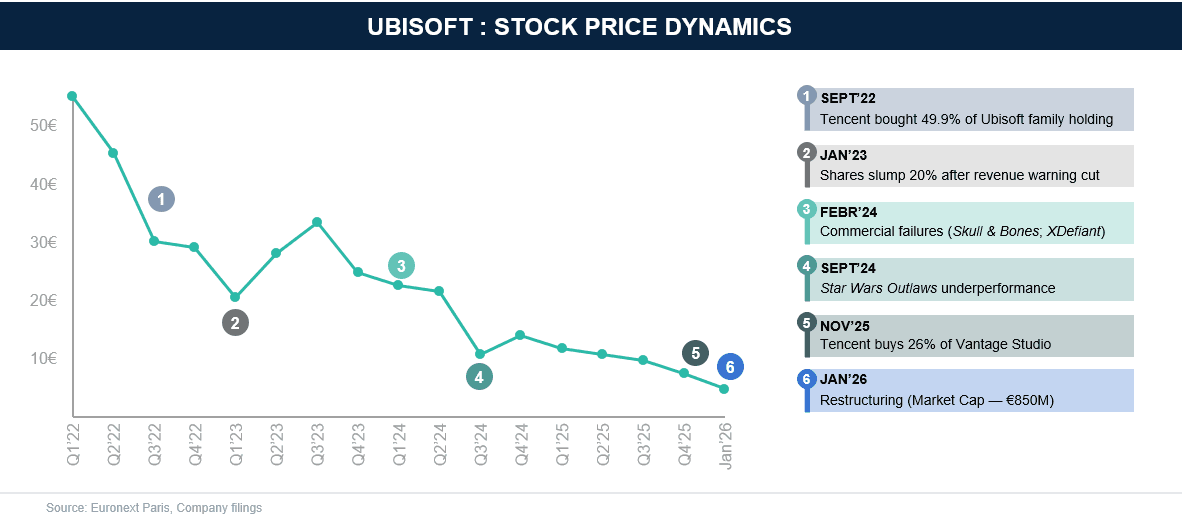

France-based games company Ubisoft Entertainment (PAR: UBI) saw its share price plunge 34% on January 22, 2026, following an announcement of sweeping restructuring measures. The single-day decline, the largest in the company’s 30-year public history, reduced market capitalization to approximately €850m ($995m), down from over €12B at its all-time high peak in mid-2018 — a staggering 93% decline in shareholder value over 7 years. The slide continued into January 26, 2026, with market value hitting a new low of approximately €600m ($712m).

In 2024, Ubisoft faced a series of commercial underperformances with titles like Skull & Bones and XDefiant. Following Star Wars Outlaws‘ underperformance in September 2024, Ubisoft shifted from its Ubisoft Connect exclusivity model to a Day-1 Steam release strategy for all future titles. Fearing a repeat of the soft commercial reception, the company delayed its flagship title, Assassin’s Creed Shadows, from Nov’24 to Feb’25, then subsequently to Mar’25, citing the need for extra time to polish the game and incorporate player feedback.

In Nov’25, the Chinese conglomerate Tencent (SEHK: 700) completed a strategic investment of €1.16B for a 26% stake in Vantage Studios, a new Ubisoft subsidiary holding Assassin’s Creed, Far Cry, and Rainbow Six franchises. The subsidiary was valued at €3.8B on a pre-money enterprise value basis. The funds were used to reduce debt, shifting Ubisoft’s core franchises into a structure partially owned by Tencent. We covered the strategic rationale in a previous review on our website.

On January 21, 2026, Yves Guillemot announced a major organizational restructuring with five key pillars:

- Financial Impact: Expected operating loss of ~€1B ($1.17B) in FY2026, including €650m one-time writedown. Cost-cutting targets €500m in savings.

- Organizational Changes: Company divided into five Creative Houses operating as autonomous business units.

- Game Portfolio Adjustments: Six titles cancelled (including Prince of Persia: The Sands of Time remake, announced 2020); seven additional titles delayed.

- Studio Closures: Halifax and Stockholm locations closed entirely; restructuring at Abu Dhabi, Helsinki, Malmö, RedLynx, and Massive Entertainment.

- Return-to-Office: A five-day in-office mandate was implemented across all teams, prompting union-called walkouts.

The announcement triggered a massive sell-off, with the stock crashing 34% in a single trading session. Ubisoft initiated the application of its cost-cutting measures on January 26, 2026, officially opening a voluntary redundancy program at its head office in Paris. This move targets the elimination of up to 200 roles, approximately 18% of HQ staff. The company withdrew FY2026/27 guidance, expecting content releases in FY2027/28 to drive a return to profitability. A chain of commercial failures, underperformance of new releases, and structural and operational restructuring led one of the top gaming giants in the EU to experience consistent decline over several years. We will continue to watch how the Creative Houses model impacts future releases.