vgames and General Catalyst launch Growth Financing partnership

Israel-based gaming VC fund vgames has partnered with US-based fund General Catalyst to offer growth capital to mobile gaming studios through a non-dilutive growth financing model. The partnership has already deployed $350m+ into UA and marketing financing, with a target to deploy an additional $500m over the next 12 months.

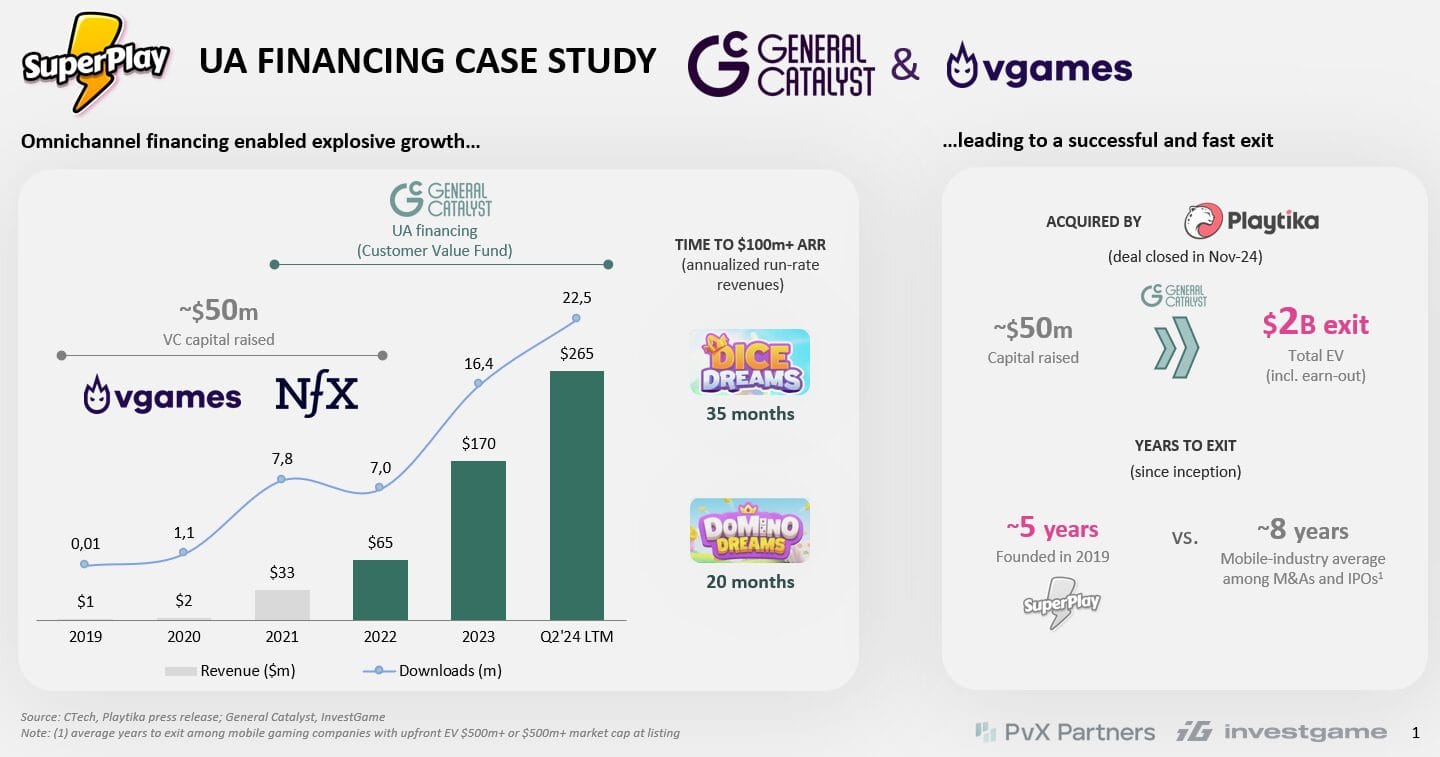

The partnership builds on prior collaboration between the two firms, including UA financing provided to SuperPlay in 2021. The partnership combines vgames’ sector-specific gaming expertise with General Catalyst’s Customer Value Fund, which has deployed over $5B across 60+ companies since its inception in 2019.

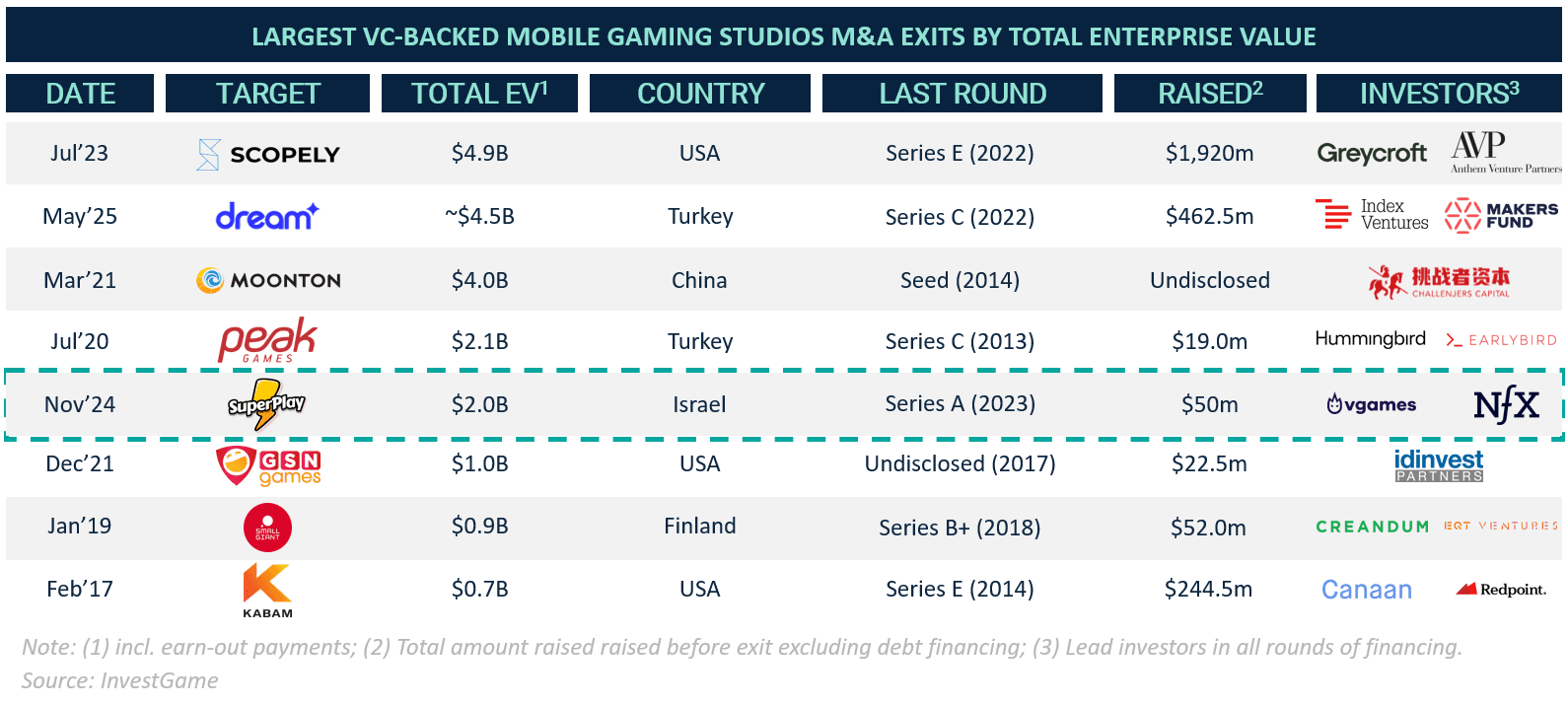

Founded in 2020 by Google Gaming veteran Eitan Reisel, vgames is led by Reisel and Daniel Mironov and has backed over 40 gaming companies, managing ~$400m AUM. The fund has participated in notable rounds, including investments in such companies as Candivore, Innplay Labs, and SuperPlay, which became one of the largest $2B ($700m upfront and $1.3B in earn-out) exits in the mobile gaming industry.

The New Reality of Funding

Growth financing is emerging as an alternative growth capital model for mobile game developers. With user acquisition and marketing-related expenses often accounting for 35-50% of gross revenue, studios have traditionally relied on either dilutive equity financing or debt with fixed repayment schedules. Under the new model, vgames and General Catalyst pre-fund UA and marketing campaigns, with repayments tied directly to revenues generated by the financed player cohorts. Repayment is performance-based rather than fixed, reducing upfront risk and aligning capital costs with actual returns.

The model has already been validated through SuperPlay (read more in the InvestGame UA Financing report). In 2021, General Catalyst provided growth financing to the studio via its Customer Value Fund, supporting growth without equity dilution. SuperPlay’s revenue has seen tremendous growth, achieving $100m+ ARR in less than 3 years.

Source: InvestGame

Mobile gaming studios face an increasingly challenging financing environment (read Aream & Co.’s latest Q3’25 Gaming report). Traditional VC funding has contracted, debt markets remain restrictive, and rising UA costs continue to squeeze margins — leaving many proven studios without viable paths to scale. Against this backdrop, performance-based UA financing offers a compelling alternative: capital that aligns with revenue generation, preserving equity while enabling growth.

The vgames–General Catalyst partnership reflects a broader maturation of the mobile gaming ecosystem. With gaming funds like vgames making strong exits and new financing models gaining traction, the infrastructure supporting mobile game developers is evolving rapidly. This collaboration leverages vgames’ sector expertise and portfolio network to identify studios where performance-based financing can unlock growth while preserving founder ownership — a signal that the industry’s capital stack is becoming more sophisticated and founder-friendly.