Weekly News Digest #5

# of announced deals

8

announced deals’ size

$21.2m

# of closed deals

8

Dream Games Aims for $2.5B—Possibly The Biggest Gaming Fundraising Round Ever

Turkey-based mobile games developer Dream Games is preparing to raise $2.5B through debt and equity financing. The company aims to secure $1.25B in debt from private credit lenders and an additional $1.25B in equity. The funds will be used to buy out existing investors.

If completed, the deal will almost double Dream Games’ valuation from $2.75B to $5B. The company’s founders plan to retain a 70% ownership stake after the transaction.

This marks Dream Games’ fifth fundraising round since its founding in 2019:

— In Nov’19, Dream Games secured a $7.5m Seed funding round led by Makers Fund;

— In Mar’21, Dream Games raised a $50m Series A funding round led by Index Ventures;

— In Jun’21, Dream Games secured a $155m Series B in a funding round, co-led by Index Ventures and Makers Fund, valuing the company at $1B;

— In Jan’22, Dream Games raised a $255m Series C round, bringing its valuation to $2.75B.

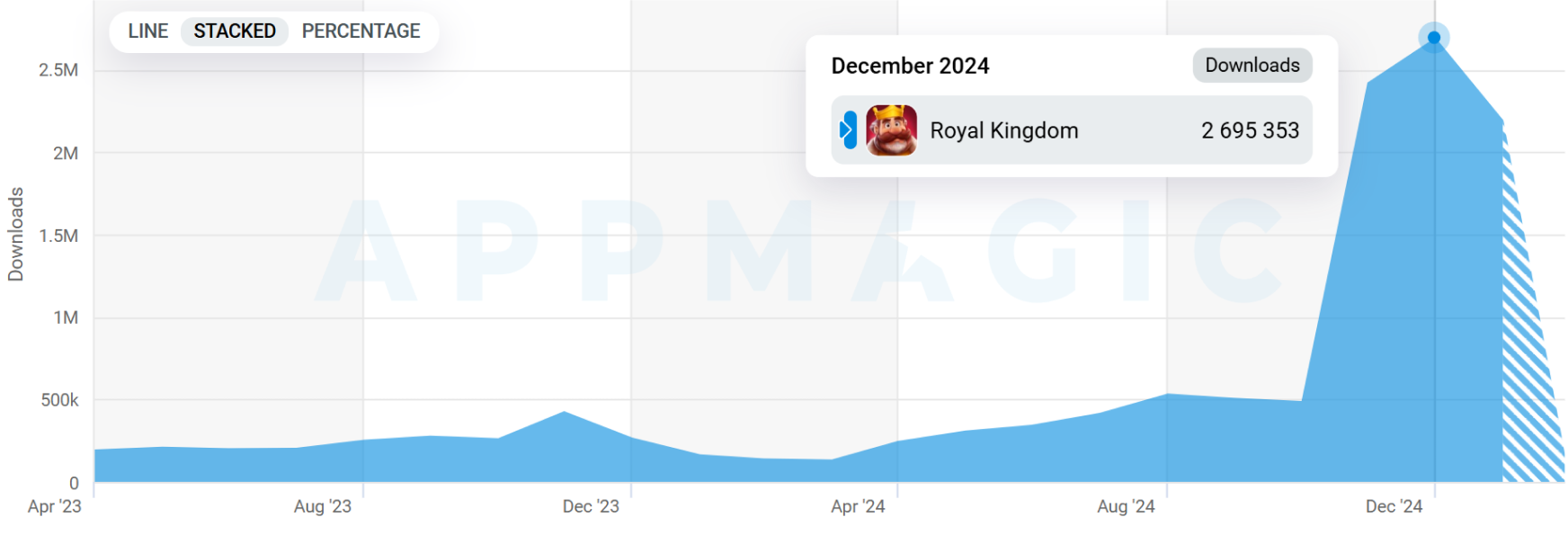

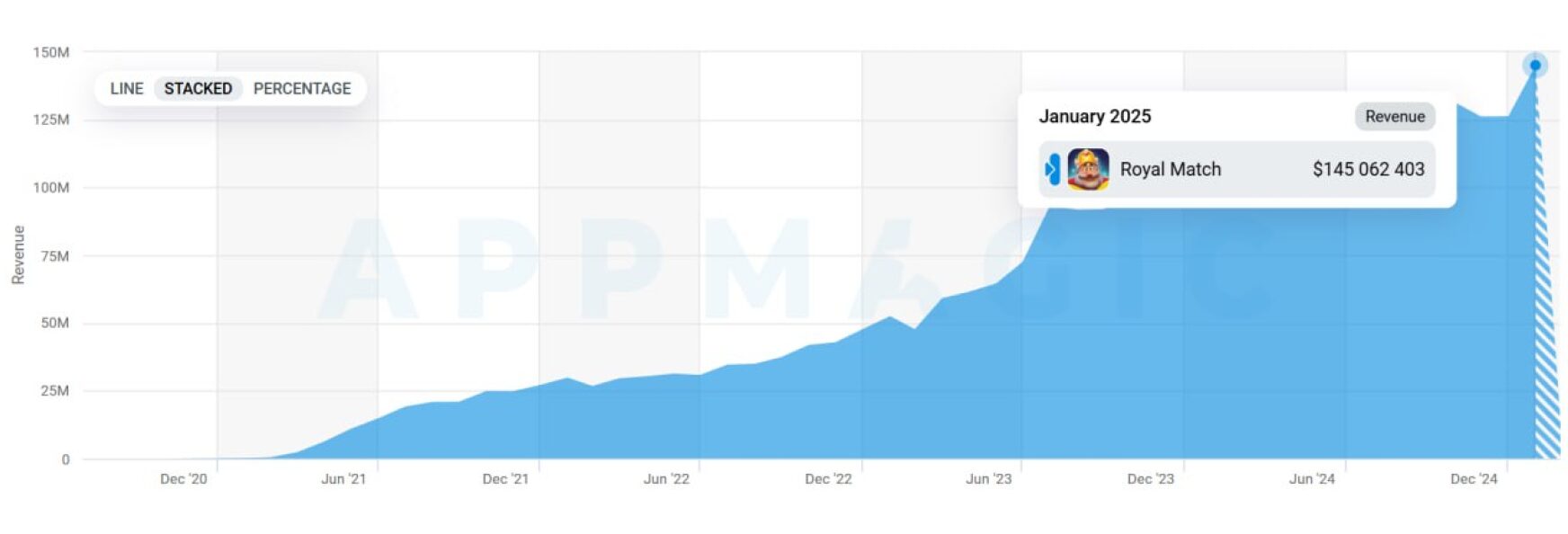

Dream Games has developed two Match-3 titles: Royal Match and its latest release, Royal Kingdom, launched in Nov’24.

Royal Match is one of the most influential casual games out there. The title has dominated the Match-3 genre since 2023, reaching a total of 327 million downloads and $3.1B in revenue since its launch. In 2024, the game outperformed the second-highest-grossing title in the genre, King’s Candy Crush Saga, by 35% in Net IAP Revenue.

This deal could become Turkey’s largest transaction since Zynga’s acquisition of Peak Games in Jul’20 and the most significant global mobile gaming fundraising round between 2020 and 2024, surpassing Jam City’s $350m funding round in Sep’21.

We thank MY.GAMES for supporting this digest.

| NOTABLE TRANSACTIONS |

MERGERS & ACQUISITIONS

India-based esports firm Nodwin Gaming, a subsidiary of mobile game publisher Nazara Technologies (NSE: NAZARA), has acquired Ukraine-based esports company StarLadder for $5.5m. The deal includes $2m in cash and the remaining $3.5m through a swap of equity shares in Nodwin Singapore with additional earnouts tied to performance. The acquisition is expected to support StarLadder’s growth in new markets while advancing Nodwin’s global expansion strategy. StarLadder will continue to operate under its current brand and management. This transaction follows Nodwin’s recent acquisition of AFK Gaming for $890k in Dec’24, further strengthening Nazara’s expansion through its subsidiaries.

US-based mobile casual games developer Pocket Worlds has acquired US-based user-generated content (UGC) platform Infinite Canvas for an undisclosed sum. Infinite Canvas, which develops AI-powered UGC content for platforms like Roblox and has reached 19 million monthly active users (MAU), will contribute to developing Pocket Worlds’ flagship title, Highrise. This includes game improvements, world-building, and tool innovation. Highrise has achieved $250m in revenue and amassed 40 million players from 2019 as of Jun’24. Infinite Canvas raised $6m in a funding round in Jul’23.

US-based mixed reality game technology company VRAL Games has acquired a 30% stake in US-based VR game studio PolarityOne for an undisclosed sum. The acquisition is part of VRAL Games’ strategy to strengthen its presence in immersive gaming. PolarityOne, the developer of the cooperative VR shooter Exoshock, which is currently in development and set for release in Q2’25, will continue to operate independently. VRAL Games will support the studio with publishing activities.

Finland-based games developer Social First has acquired the Pixel Worlds and Tiny Troopers IPs from Finland-based mobile games developer Kukouri Mobile for an undisclosed sum. The acquisition follows Kukouri Mobile’s decision to cease game development operations due to Pixel Worlds’ lack of commercial success. Social First is currently developing Nexus Station, a successor to Pixel Worlds.

VENTURE FINANCING

UK-based web3 game developer Pixion Games has raised $12.4m in a funding round led by Delphi Ventures, with participation from Animoca Brands, Arete Capital, L1D, Sky Mavis, The Spartan Group, and Yield Guild Games. The funds will support the development of Fableborn, an action RPG with building elements for mobile platforms, and the expansion of Pixion’s web3 Power Protocol ecosystem. The company also plans to launch its native token. This funding follows Pixion Games’ previous $5.5m round in Jun’23.

US-based AI social games developer Little Umbrella has raised $2m in a Seed funding round with participation from a16z Speedrun, Breakpoint Ventures, Disrupt.com, GFR Fund, Ubiquoss Investment, Virtual Reality Fund, Workplay Ventures, and other investors. The funds will support the launch of three new titles. Little Umbrella specializes in AI-driven social games and has developed Death by AI, which is available via Discord and has attracted 20 million players in three months.

India-based gaming startup MetaShot has raised $1.3m in a mixed equity and debt funding round led by Sauce VC, with participation from Sharrp Ventures and Panthera Peak Capital. The funds will support the company’s expansion and R&D efforts. MetaShot, developing cricket hardware launched in Aug’23, previously secured $0.4m in a pre-seed funding round in the same month.

UK-based PC games developer Blue Dot Games has secured an undisclosed sum in a funding round from angel investors. Part of the funding was raised through a Discord channel and will support the development of ’83, a Cold War-based first-person shooter (FPS). ’83 was developed initially by Antimatter Games, a studio that shut down in 2023 following its acquisition by Enad Global 7 in Sep’19.