Weekly News Digest #23

# of announced deals

15

announced deals’ size

$106.5m

# of closed deals

6

Tencent Acquires 15.8% of Helldivers 2 Developer Arrowhead at ~$530m Valuation

China-based tech giant Tencent Holdings (SEHK: 700) has acquired a 15.75% minority stake in Sweden-based PC & Console game developer Arrowhead Game Studios, best known for its breakout hit Helldivers 2. The deal, valued at approximately $80m, implies a valuation of ~$530m.

After the deal, the cap table remains firmly under the control of the founding team and early investors, who collectively retain about 84% ownership. Tencent, with a minority stake, has no board control or operational oversight, consistent with its typical “quiet partner” strategy in game studios.

A Rare Mid-Tier Breakout

Arrowhead’s FY2024E financials reveal why the studio became a compelling target.

| Financial Metrics FY 24 | Valuation Multiples | |

|---|---|---|

| Revenue ($m) | 100 | 5.3x |

| EBIT ($m) | 76 | 7x |

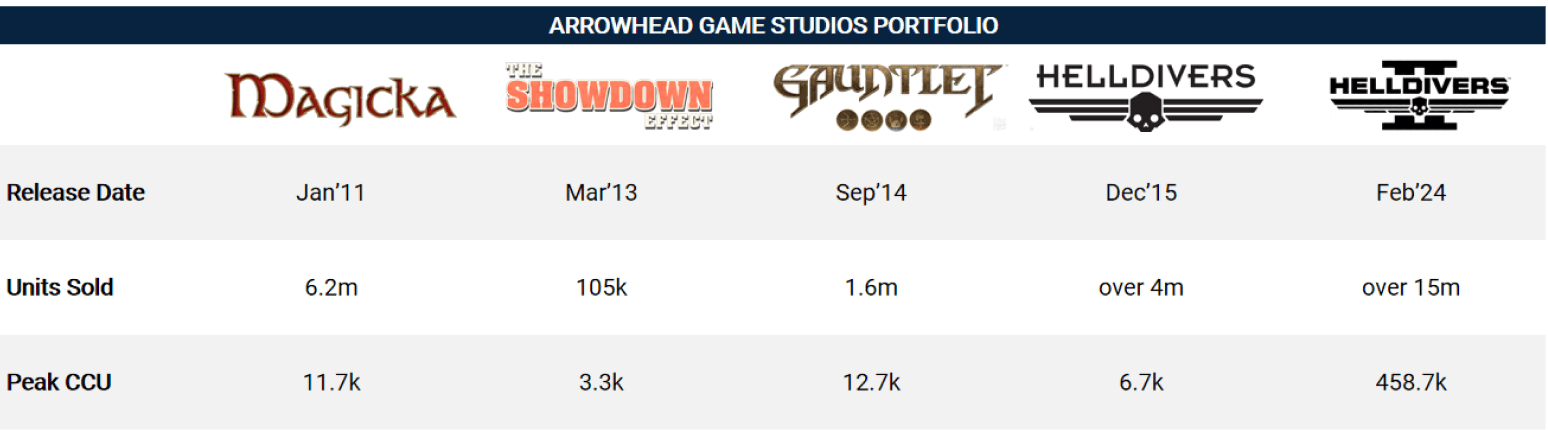

Tencent is acquiring a stake in a highly profitable, fast-growing game studio with deep live-service expertise and significant growth potential. Arrowhead’s success with Helldivers 2 has become one of the most notable releases of the last 5 years in the premium PC & Console space. The studio, originally founded in 2008 in Skellefteå by five graduates of Luleå University of Technology (LTU), now employs around 140 people in its Stockholm headquarters. The current gaming portfolio consists of the following:

Source: VG Insights, SteamDB

All titles remained niche, except for Helldivers 2, published by Sony Interactive Entertainment (TYO: 6758; NYSE: SONY), which was simultaneously released on PS5 and PC for the first time. Within its first three months, the title managed to sell 12 million copies, making it PlayStation’s fastest-selling game of all time.

Source: Alinea Analytics

What Makes Helldivers 2 Tick

Unlike many live-service titles that chase monetization trends, Helldivers 2 succeeded by staying focused on co-op gameplay and player experience. Built over 7–8 years, the game combines third-person squad-based shooting with light strategy and emergent missions.

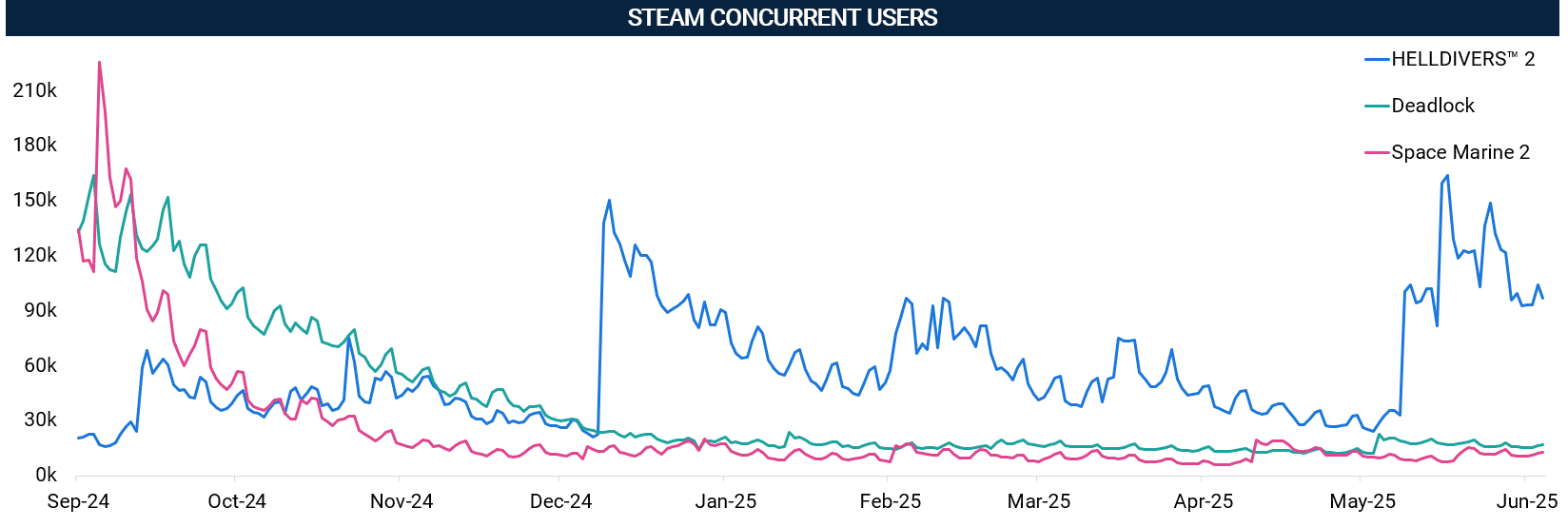

Its monetization is widely seen as player-friendly: a $39.99 premium price, optional battle passes, and cosmetic “Super Credits” — but no pay-to-win systems. This has helped the game sustain momentum. The price was dropped to $32.00 after its “Heart of Democracy” update in May’25, which introduced the Illuminate faction and boosted Steam concurrent users (CCU) by +140% and helped the title to reach Top-5 best-selling games on Steam in May.

- Peak Steam CCU: 458,709 (Feb’24)

- May CCU rebound: ~163,000

(For comparison: Warhammer 40,000: Space Marine 2 peaked at 226K and dropped to <10K; Deadlock peaked at 171K and slid to ~7K.)

Source: SteamDB

Despite impressive figures, Sony, as a publisher, made a misstep by attempting to mandate PSN authorization on PC in May’24. This step triggered a wave of community backlash and mass review-bombing of the game, which Sony quickly reversed. Despite the stumble, Helldivers 2 was cited in Sony’s Q1 FY24 earnings as a key driver of first-party revenue, signaling substantial platform impact even without direct ownership.

Tencent’s Strategy Behind

Tencent’s move reflects a broader strategy it’s pursued for years: minority investments (typically 10–20%) in promising live-service studios. Past investments in Ubisoft (PAR: UBI), Bohemia Interactive, FromSoftware, and others have followed this exact playbook. This deal appears to give Tencent:

- Low-risk exposure to a rising Western IP,

- Optionality for mobile or F2P adaptation in China,

- A high-IRR asset, delivering >$100m in profit at a fraction of a typical AAA budget,

- A share in one of the few independent European gaming companies

Given the current dynamics with the US and China’s regulatory climate, which has slowed Tencent’s pace of major acquisitions, such targeted strategic moves in the European market serve as both a practical risk hedge and a potential launchpad for future collaboration.

Why It Matters

Helldivers 2 proves that premium co-op shooters can break out and evolve into major franchises, especially when supported by smart LiveOps and a hybrid monetization model. It blends premium game design with GaaS elements, offering proper DLC and IAPs that respect player time and spending. Arrowhead now stands as a compelling template for studios and publishers targeting the elusive mid-tier between indie and AAA.

Tencent gains a low-risk stake in a proven Western live-service developer and a foothold in a fast-growing franchise, with optionality for mobile and live adaptations. Arrowhead, in turn, secures capital, credibility, and access to Asian markets — all while maintaining creative control. For Sony, this is strong validation of its push for high-engagement, flexible first-party experiences beyond just PSN expansion.

This is one of 2024’s most strategically sound deals in core gaming — not just for what it achieves immediately, but for what it enables. It aligns the goals of all parties and sets up Helldivers and Arrowhead for significantly larger ambitions ahead.

🎙Game Theory: How Play Is Changing Everything

Top industry voices — from Roblox, Xbox, Take-Two, Scopely, Unity, and Niantic — join Game Theory, a new video podcast by Lightspeed and Goldman Sachs, in partnership with McKinsey.

Hosted by Moritz Baier-Lentz (Lightspeed) and Hemal Thaker (Goldman Sachs), the show features honest conversations on building long-term value in games, product strategy at scale, and how innovation drives growth.

🆕 New episodes drop weekly — tune in to hear how leaders shape the future of gaming.

| NOTABLE TRANSACTIONS |

MERGERS & ACQUISITIONS

New Zealand-based custom Roblox game developer Splitting Point Studios has acquired a stake in Grow a Garden Roblox from solo developer The Garden Game for an undisclosed sum. The company has taken over management of the game. As of the end of May’25, the game reached a concurrent user peak of 7.8 million. The acquisition continues the trend of Roblox UGC-related M&A activity, following the acquisition of Supersocial earlier in May’25.

VENTURE FINANCING

US-based PC & Console game developer Emptyvessel has closed its Series A funding round, raising total capital to $11m, including its investment in the Seed round in Mar’24. Following the initial strategic investment from NCSoft (KRX: 036570) in May’25, the Series A round was co-led by 1AM Gaming, with participation from Black Phoenix Games, Sisu Game Ventures, Raptor Group, and Compute Ventures. The funds will support studio expansion, infrastructure enhancement, and the development of Emptyvessel’s debut title, Defect — a cyberpunk, squad-based immersive shooter for consoles. The investment will also support single-player gameplay improvements.

UK-based AI game technology company Latent Technology has raised $8m in a Seed funding round led by AlbionVC and Spark Capital, with participation from Root Ventures and Alumni Ventures. The funding will support the continued development of Latent’s proprietary technology, with a primary focus on its Latent Behaviour Engine. The company is building physics-based animation solutions through its generative physics animation model, Phoenix, which enables developers to implement autonomous, environment-responsive animations without relying on manually crafted or pre-rendered assets.

Japan-based VR game developer MyDearest has raised $2.2m (JPY 330m) in a funding round with participation from FFG Venture, Awa Bank, and Asahi Shimbun. The funds will be used to develop new original IP targeting the North American market, expand the team, and support the company’s growing focus on VR/MR solutions for corporate clients. In addition to its success in consumer VR gaming — with titles such as Tokyo Chronos, ALTDEUS: Beyond Chronos, and DYSCHRONIA: Chronos Alternate — MyDearest is now expanding into enterprise-grade VR/MR applications through joint initiatives with strategic partners.

US-based content creator Yarnhub Animation Studios has closed a $2.1m community investment round, initially announced in Mar’25. The round attracted 3,600 individual investors to support the development of a F2P World War II first-person shooter, Brass Rain, built on Unreal Engine 5 and scheduled for release in 2026.

Philippines-based web3 infrastructure provider Shards Protocol has raised $2m across several funding rounds from Animoca Brands, Kyber Ventures, Yield Guild Games, based.VC, Zaiken Capital, and Firex Capital. The funds will support the development of the company’s Aura reputation system, which rewards users for on-chain activity by assigning reputation scores and incentives. Shards Protocol was initially launched as an SDK solution for game studios, aiming to improve player retention and in-game spending, and it has since onboarded over 1 million users.

UK-based initiative The Games Scale Up Fund for Wales, established in collaboration with Creative Wales and the UK Games Fund, has awarded $1.2m (£850k) to six UK-based game studios: Cloth Cat, COPA Gaming, Goldborough Studios, Rocket Science, Sugar Creative, and Wales Interactive. The program was initially designed to support studios based in Wales in scaling their operations and expanding into international markets.

UK-based monetization software developer Kohort has secured an undisclosed sum in a funding round led by The Raine Group, with participation from Eurazeo, AlbionVC, Triple Point Ventures, Velocity Capital, and Portfolio Ventures. Kohort is developing machine learning-based forecasting software designed to support decision-making for mobile game developers. The newly raised funds will be used to expand the platform’s applications beyond the mobile gaming sector. In addition, Kohort has entered into a strategic partnership with The Raine Group, which will utilize Kohort’s software for advisory purposes across its client and portfolio base.

Switzerland-based web3 gaming protocol Quranium has secured an undisclosed investment from Animoca Brands. The funds will support Quranium’s scaling efforts across metaverse integration, AI applications, and game development. In addition to financial backing, Animoca Brands will offer strategic support through its network of institutional partners. Quranium is developing a web3 infrastructure protocol with a primary focus on mobile gaming.