Weekly News Digest #25

# of announced deals

10

announced deals’ size

$82m

# of closed deals

10

Pearl Abyss to Sell CCP Games? EVE Online Maker Reportedly Up for Grabs

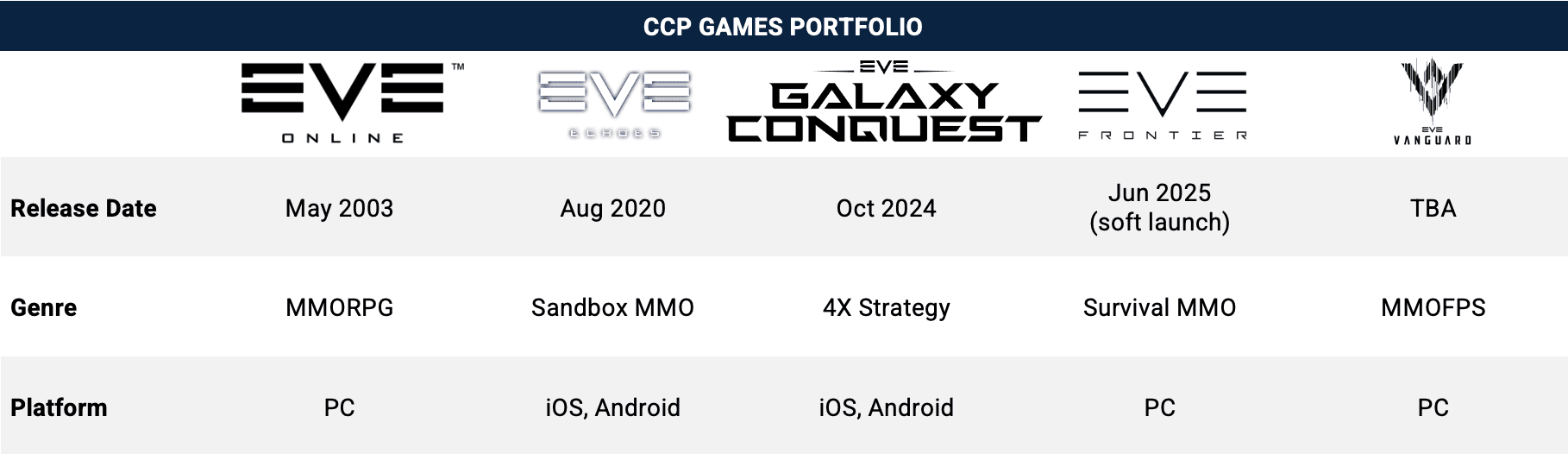

South Korea-based multiplatform game developer Pearl Abyss (KQ:263750) is reportedly in the process of divesting its Iceland-based portfolio company CCP Games — the studio behind sci-fi MMORPG EVE Online and other games based on the same IP — according to several sources.

Pearl Abyss originally acquired CCP Games in 2018 in a deal worth up to $425m, including earn-out payments. Reports suggest that the company has already appointed a third-party underwriter to manage the sale process.

Deal Background

While EVE Online continues to deliver solid revenues — with IP revenue estimated at ~$60m (₩85.2bn) in 2024, supported by updates like Equinox — CCP’s broader R&D pipeline has yet to yield major commercial successes. Over the years, the studio explored multiple genres and platforms, from VR to FPS and experimental technologies, though none have matched the scale or longevity of EVE Online.

Pearl Abyss appears to be shifting its focus back to internal IPs like Crimson Desert and DokeV. Since acquiring CCP, the company has made only one additional acquisition — Factorial Games (~$17.8m / ₩20bn) in 2021, suggesting a cautious M&A approach. With this in mind, the CCP sale may be part of a broader operational streamlining strategy aimed at optimizing resource allocation and reducing fixed costs.

Source: Pearl Abyss Financial Statements

Despite a decline in topline revenue and operating margins in recent years, Pearl Abyss maintains a strong financial position with ~$87m (₩124.8bn) in cash and equivalents and ~$57m (₩81.2bn) in total debt, resulting in a net cash position of $30m (₩43.6bn) based on the latest filings.

Strategic Rationale For The Potential Buyer

EVE Online remains one of the longest-running, community-driven MMOs in the market, with a high-retention, niche audience and a monetization model built around long-term engagement. Beyond the IP itself, CCP’s operational experience in managing live-service MMOs at scale is a key asset.

In that regard, CCP’s role in the market resembles that of other long-lived MMO operators. For instance, Jagex — the UK-based studio behind RuneScape — was acquired in 2024 by CVC Capital Partners and Haveli Investments, reportedly for $1.1B+. While the business models and IPs differ, both companies share core strengths: stable cash flows, loyal player communities, and deep expertise in MMO live operations.

Like Jagex, CCP could offer strategic upside for several types of buyers:

- Private Equity funds. For PE funds targeting stable, cash-generating assets with upside optionality, CCP is a good fit. Its lean operations and predictable monetization model could appeal to long-term hold strategies, especially with potential upside from new product launches.

- Strategic buyers with MMO expertise (e.g., Jagex, NCSoft). For experienced operators in the MMO space, CCP offers both operational depth and potential synergies in infrastructure, tech, or regional audience overlap. The studio’s ability to run persistent, complex virtual worlds is a rarity in today’s market.

What Is The Twist?

If the rumored sale materializes, it would mark Pearl Abyss’ first major portfolio divestment since its IPO. Originally seen as a diversification move beyond Black Desert, the CCP acquisition has arguably lost strategic alignment due to the limited success of new products and shifting internal priorities. Still, for the right buyer, CCP represents more than just a legacy brand — it offers a resilient live-service business, a dedicated community, and a team with decades of experience running high-complexity online ecosystems. In an industry where sustainable MMO operations are increasingly complex to build from scratch, acquiring CCP may offer a strategic shortcut into a space with high barriers to entry.

📄 Phantom Options vs. Stock Options: What Everyone Needs to Know

What if employees could benefit from company growth, without actually owning shares?

Phantom options offer exactly that: a cash reward that mimics equity value, but skips dilution, shareholder rights, and legal overhead. In this new piece, REVERA breaks down how they work and when they might be the smarter choice over traditional stock options.

Key highlights:

🔹 Equity-like rewards, no shares issued — no dilution, no corporate control shifts.

🔹 No shareholder status — employees don’t get voting or dividend rights.

🔹 Taxed as income, not capital gains — simpler in many jurisdictions.

🔹 Fully customizable — vesting, payout formulas, and triggers can be tailored per case.

🔹 Low administrative burden — skip KYC, registration, and governance approvals.

🎯 If you’re structuring an option plan in 2025, phantom stock might be worth a closer look.

| NOTABLE TRANSACTIONS |

MERGERS & ACQUISITIONS

US-based app analytics firm Sensor Tower has acquired Finland-based game analytics platform Playliner for an undisclosed sum. The acquisition aims to enhance Sensor Tower’s analytics capabilities in the mobile gaming industry. Playliner offers developers tools to track and analyze live operations in mobile games. This marks Sensor Tower’s second acquisition in 2025, following its purchase of Video Game Insights in Mar’25.

US-based web3 gaming network B3 has acquired US-based PC hardware company Andromeda Insights for an undisclosed sum. Andromeda Insights will continue to operate under its existing management team. The acquisition marks B3’s strategic entry into the hardware segment, with both companies set to develop a new PC tailored for crypto users, which stands out for its security features designed explicitly for web3 users. The product is scheduled for release in late 2025, with pre-orders opening in Jul’25.

UK-based gaming modifications website Nexus Mods has been sold to an undisclosed buyer for an unknown amount. Nexus Mods is a website for computer game modifications and other UGC related to video game modding.

VENTURE FINANCING

China-based esports organization Wolves Esports Club has secured a $27m (GBP 20m) strategic investment from Lvfa Group. The funding will support the team’s organizational development and the construction of a branded esports venue, which is expected to open by the end of the year with a seating capacity of 2,000.

Turkey-based mobile game developer Bigger Games has raised $25m in a Series A funding round led by Goodwater Capital, with capital infusion from Arcadia Gaming Partners, Index Ventures, and Play Ventures. The funds will support the expansion of the company’s marketing team and the global growth of its Match-3 Kitchen Masters title, released in Mar’24. Founded in 2019, Bigger Games previously raised $6m in a Seed funding round in Dec’20.

US-based social communication platform Root has raised $9m in a Seed funding round led by Headline Ventures and Konvoy Ventures, with participation from Day One Ventures, Untamed Ventures, and several angel investors. The funds will be used to support the development of Root’s communication platform, which is specifically focused on serving gaming communities. The platform features built-in, customizable apps for productivity and collaboration, eliminating the need for external bots. The platform is currently preparing to launch its closed beta.

US-based web3 companies Thousands and The Wildcard Alliance have partnered and jointly secured $9m in a funding round led by Arbitrum Gaming Ventures and Paradigm. The funding will support the creation of a unified ecosystem combining the Thousands protocol and Thousands.tv, enabling creators to drive user growth through interactive content and community engagement.. The round also supports the upcoming launch of Wildcard, an alpha-stage web3 game currently in playtesting. This deal follows The Wildcard Alliance’s $46m Series A funding round in Jun’22.

US-based web3 iGaming company Zoot has raised $6m in a Seed funding round led by CoinFund, with participation from Griffin Gaming Partners. The funds will be used for the company’s international expansion into Southeast Asia, Latin America, and Africa. Zoot is developing an iGaming platform that integrates video game mechanics with blockchain-based payment processing.

US-based web3 gaming platform Uptopia has closed a $4m pre-Seed funding round led by Pantera Capital, with participation from Spartan Capital, Coinbase Ventures, and other investors. The funds will support the development of Uptopia as a web3 game launchpad on the Base blockchain, aiming to enhance game token launches, liquidity, and community engagement. Uptopia utilizes game coins as both entry tokens and player identities, creating a seamless integration between gameplay and community participation.

Turkey-based mobile game developer Mavis Games has secured $2m in a Seed funding round from mobile game publisher Habby, becoming the first announced investment for the company. The funds will be used to support team expansion, as well as game production and marketing activities. As part of the investment, the CEO of Habby will join Mavis Games’ Board of Directors. The two companies have previously collaborated on the release of casual mobile titles, including Easy to Learn and Slide: Block Puzzle.

FUNDRAISING

India-based VC firm ChimeraVC has launched a $10m investment fund focused on early-stage game studios, platforms, game tech, web3, and UGC startups across India and Asia. The fund will provide up to $150k per initial investment, with potential follow-on rounds ranging from $500k to $700k. ChimeraVC has already deployed $1m in a pre-Seed round for Qila Games in Mar’25 as part of this fund.

UK-based web3 company Somnia has launched the $10m Dream Catalyst accelerator in partnership with Uprising Labs. The accelerator focuses on supporting blockchain integration in games, providing funding, technical resources, expert guidance, and go-to-market strategy support. Initial participants in the program include Dark Table CCG, Netherak Demons, Mullet Cop: Mall Sim, QRusader, Variance, Maelstrom, Masks of the Void, and Sparkball.

US-based media and tech giant Meta (NASDAQ: META) has launched the Meta Gaming Accelerator, a three-month initiative designed to support game developers and studios across India. The accelerator is being run in partnership with BITKRAFT Ventures, Elevation Capital, Kalaari Capital, and Lumikai Fund. The program will initially support 20–30 developers, with a specific focus on teams leveraging AI technologies in game development.

The UK government has launched a $40.3m (GBP 30m) Games Growth Package investment program, with an additional $13.5m (GBP 10m) to be allocated annually over the next three years, bringing the total planned investment to $80.6m (GBP 60m). The funding will support UK-based game developers through two dedicated tracks — Accelerator and Scale-Up — offering grants, mentorship, and expert-led training. The program is designed to help studios scale operations and expand into international markets, while strengthening the UK’s position in the global games industry.

EARNINGS REPORTS

| Report Date | Company Name | Earnings Release Presentation | Share Price Dynamics (Report Date vs. 20-Jun) |

|---|---|---|---|

| 2025-06-19 | Embracer Group | Embracer FY24 | (3%) |