Weekly News Digest #30

# of announced deals

6

announced deals’ size

$565.6m

# of closed deals

6

Sony Acquires 2.5% Stake in Bandai Namco for $464m

Japan-based Sony Group Corporation (TYO: 6758; NYSE: SONY) has agreed to acquire a 2.5% stake in Bandai Namco (TYO: 7832) for $464m (¥68B), purchasing approximately 16 million shares. The deal is positioned as a strategic partnership aimed at deepening collaboration across gaming, anime, and content distribution, with a particular emphasis on anime and manga IP.

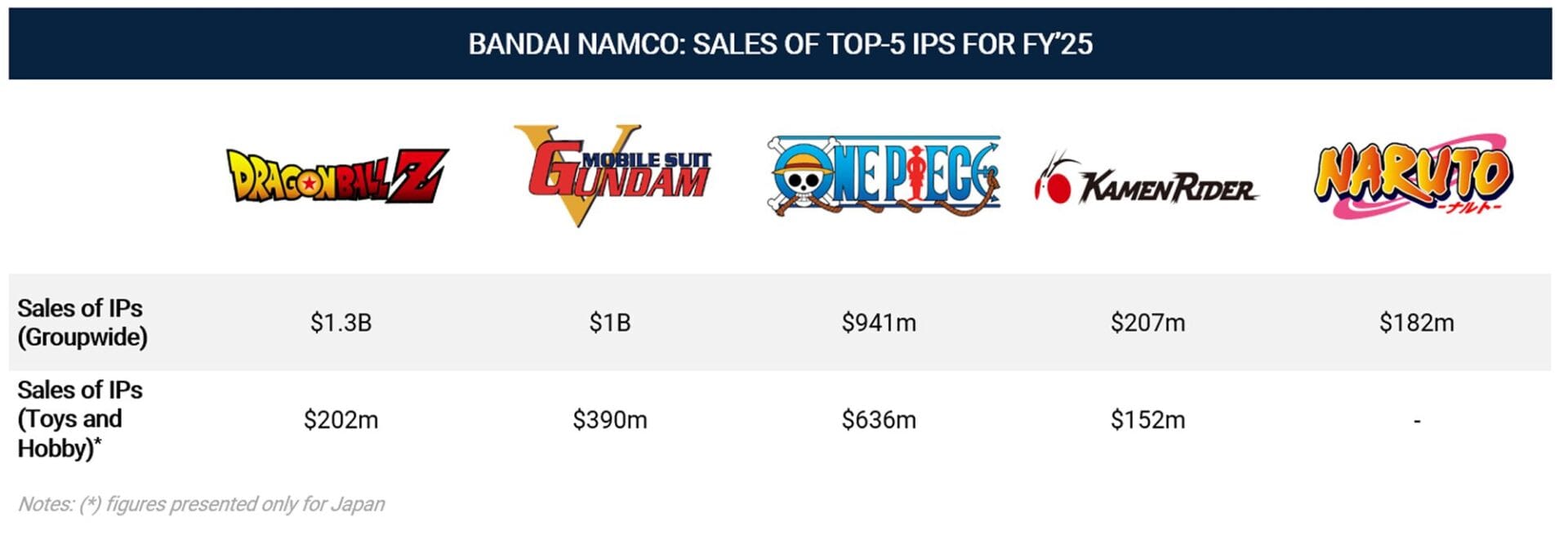

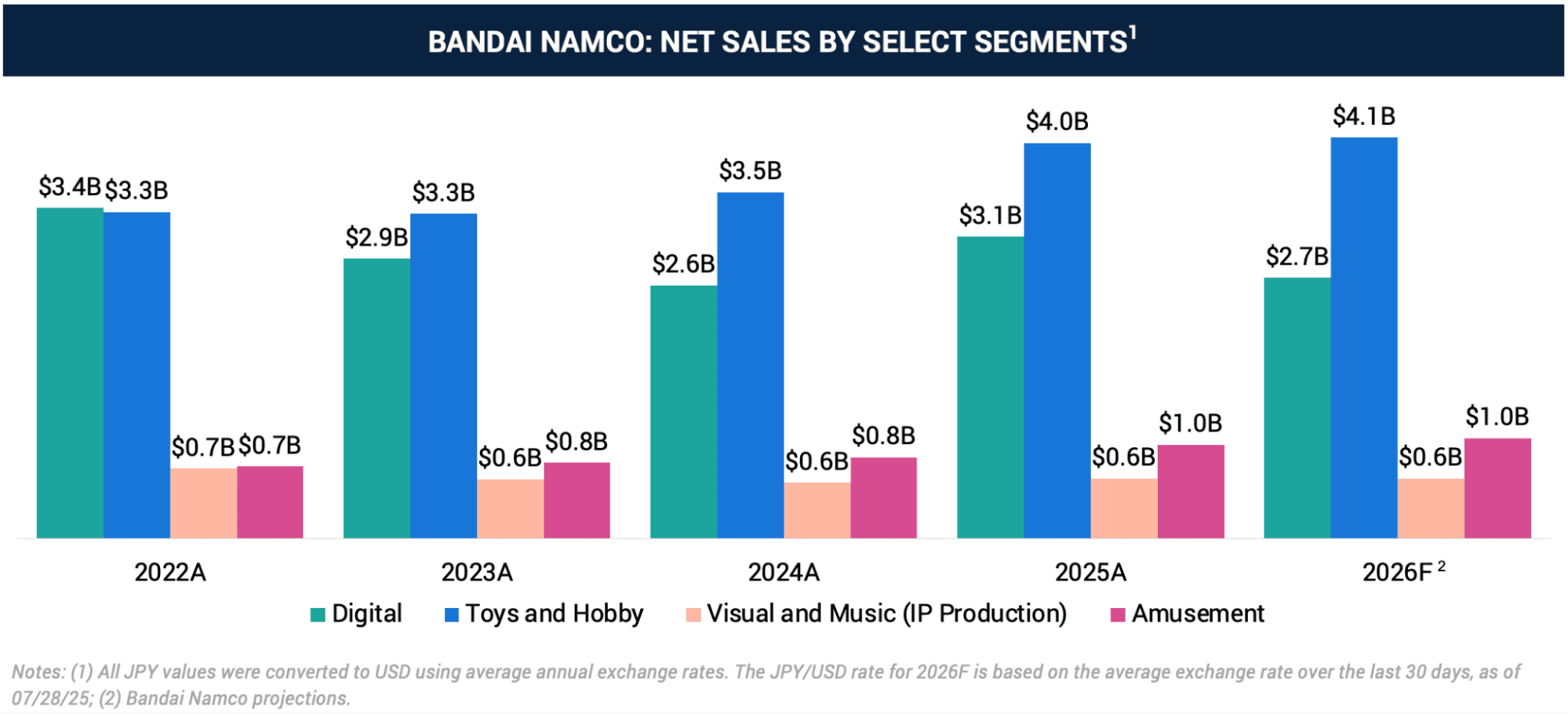

While the move doesn’t grant Sony control, it reinforces its long-standing ties with one of Japan’s most valuable content conglomerates. Bandai Namco operates across multiple segments, including Digital Business (games publishing and development), Toys and Hobby, IP Production (anime, music, and films), and Amusement (IP licensing and merchandising). Its portfolio spans iconic franchises such as Dragon Ball, Mobile Suit Gundam, Tekken, and One Piece.

Source: Bandai Namco

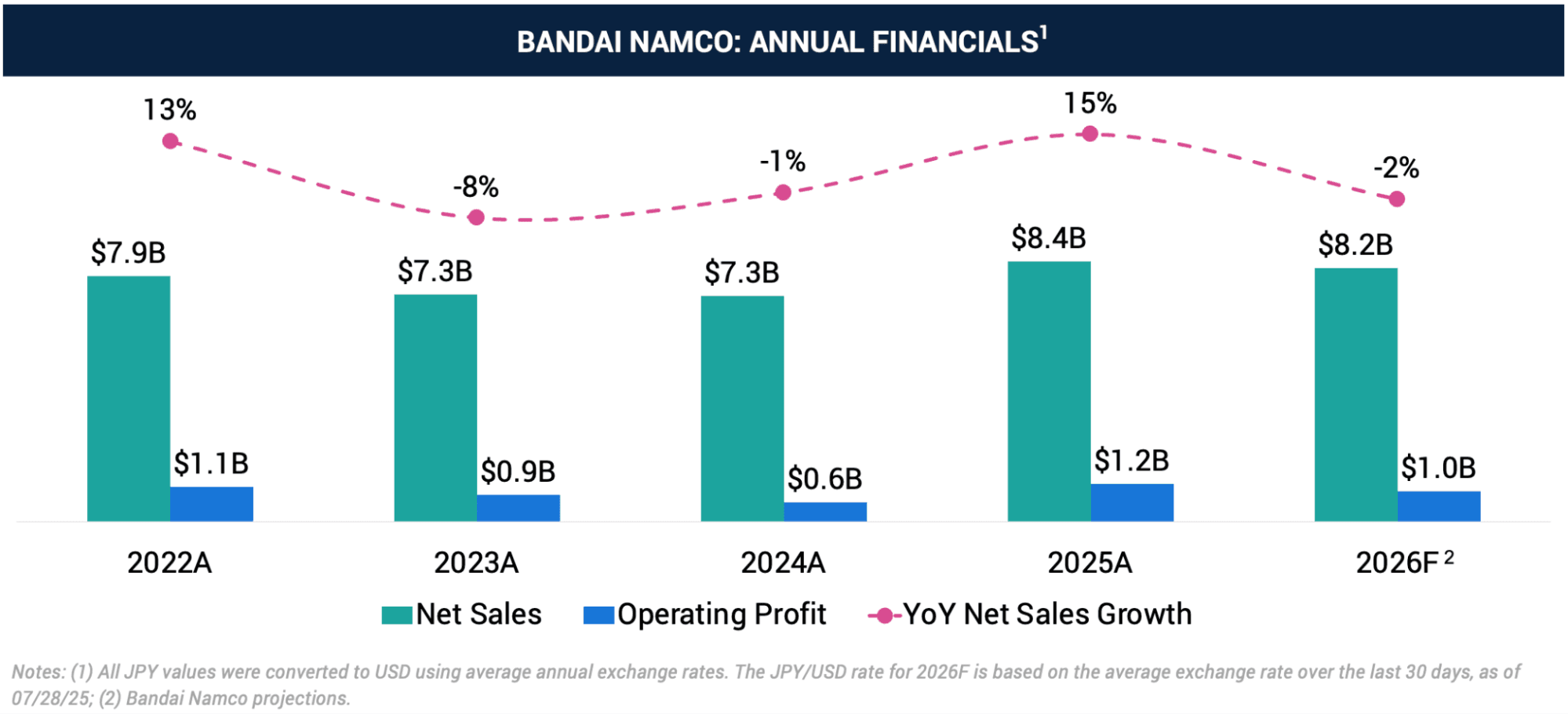

For Bandai Namco, the deal will maximize its IP value, as Sony will support both content creation and global rollout, while providing access to its platform technology stack and infrastructure. According to its FY’25 report, Bandai Namco generated ~$8.4B (¥1.24T) in revenue — a 15% YoY increase — with operating profit nearly doubling to ~$1.2B (¥180B).

Source: Bandai Namco

Source: Bandai Namco

Despite a strong FY’25, Bandai Namco lowered its forecast for FY’26, suggesting that the Sony partnership may serve as a strategic lever for long-term stability and global reach.

At a time when cross-media IP strategies are central to global platform expansion — and anime continues to scale as a worldwide monetization engine (e.g., Demon Slayer, Jujutsu Kaisen) — Sony is tightening its grip on the anime-industrial complex. With full ownership of Aniplex and Crunchyroll, this deal is less about equity returns and more about securing a long-term position in Japan’s transmedia value chain.

The move also aligns with Sony’s broader strategy of minority investments in premium IP holders, following previous deals with Kadokawa (parent of FromSoftware) and Epic Games — allowing it to secure upstream content without resorting to full-scale M&A.

Following the partnership announcement on July 24, Bandai Namco (TYO: 7832) shares rose slightly by 0.1% on July 25 and then slipped 0.4% by July 28. Sony’s (TYO: 6758) shares, meanwhile, fell roughly 2.1% on July 25 and another 1.8% on July 28, reflecting cautious sentiment around the deal despite its strategic narrative reinforcement.

Krafton Acquires Eleventh Hour Games for $96M

South Korea-based gaming holding Krafton (KRX: 259960) has acquired 100% of US-based PC & Console game developer Eleventh Hour Games for approximately $96m (KRW 132.4B). The studio, known for its ARPG Last Epoch, will continue to operate independently following the acquisition.

Last Epoch has emerged as one of 2024’s most notable premium PC launches, with 79% positive reviews on Steam, praised for its streamlined ARPG mechanics, active community feedback loops, and agile content updates. Released in Feb’24, the game has sold approximately 2.5 million copies on Steam as of Jul’25, according to VG Insights. During its launch weekend (Feb’24), the game hit ~264,700 peak concurrent players — the third-highest Steam peak of the year, behind only Helldivers 2 and Palworld.

For Krafton, the deal signals a clear push to diversify its current portfolio. Over the past several years, Krafton has acquired several studios, including:

— Tango Gameworks is a Japan-based PC & Console game developer, creators of The Evil Within and Hi-Fi Rush;

— Unknown Worlds is a US-based PC & Console games developer, creators of Subnautica. Recently, three former executives have sued Krafton, stating the publisher rushed Subnautica 2’s early access release specially to avoid paying a promised $250m earnout bonus.

📊 You can find the full timeline of Krafton’s acquisitions on our Patreon]

The Eleventh Hour’s acquisition complements the 27 corporate investments made by Krafton during 2020-2024, as well as a pipeline of PC and mobile titles, including inZOI, PUBG, Subnautica, Defense Derby, and others.

Eleventh Hour joins a growing list of Western premium studios acquired by Asian strategics, as companies like Krafton and Tencent target IP with long-tail monetization and strong fundamentals. With Last Epoch gaining momentum in both sales and live-service readiness, Krafton secures a scalable franchise — and a team already equipped to build its next one.

Following the news announcement, Krafton’s (KRX: 259960) shares declined by 0.9%, slipping from KRW 338,500 on July 25 to KRW 335,500 on July 28. The slight dip likely reflects cautious sentiment around valuation impact and market skepticism over the near-term financial upside of premium PC content.

| NOTABLE TRANSACTIONS |

MERGERS & ACQUISITIONS

Hungary-based multiplatform games developer Gaijin Entertainment has acquired the UGC multiplatform island The Pit within Fortnite from its original developer, Geerzy, for an undisclosed sum. The acquisition supports Gaijin’s strategic expansion into the UGC market as part of a broader effort to diversify its business model. In Nov’24, The Pit registered 140,000 concurrent players. The deal follows Gaijin’s initial investment in the map in Apr’25.

VENTURE FINANCING

South Korea-based web3 games developer Delabs Games has raised $5.2m in a Series A funding round led by Hashed, TON Ventures, and Kilo Fund, with additional participation from IVC, Taisu Ventures, Arche Fund, Yield Guild Games, Everyrealm, and Jets Capital. The funding will support team expansion, as well as the development and launch of new games through the company’s Verse8 AI-powered game creation platform. To date, Delabs Games has raised a total of $17.2m across two funding rounds — $4.7m Seed round in Jul’23 and $7.3m funding round in Mar’24.

US-based GenAI games developer Glass Bead Games has raised an undisclosed sum in a funding round led by Supercell Investments. The studio has also established a technological partnership with ElevenLabs. Glass Bead Games is currently developing Project Shanhai, a survival-craft sandbox title that incorporates GenAI elements. The studio was founded by former employees of Google Stadia and Alibaba’s cloud gaming division.

US-based mobile entertainment company m00m world has raised $500k in a pre-Seed funding round led by Boost VC. The investment will fund the m00m world’s full game launch, team growth, and expansion of its virtual-to-physical item ecosystem. The company is developing a cyberpunk-themed mobile MMO game that combines avatar customization and real-world collectible rewards.

| Report Date | Company Name | Earnings Release Presentation | Share Price Dynamics (Report Date vs. 25-Jul) |

|---|---|---|---|

| 2025-07-22 | Ubisoft | Ubisoft Q1’FY26 | 5% |

| 2025-07-22 | Stillfront | Stillfront Q2’FY25 | 1% |