Electronic Arts (NASDAQ: EA), one of the last major Western independent publishers in gaming, has agreed to be acquired via a $55B all-cash transaction by a consortium of Saudi Arabia’s Public Investment Fund (PIF), Silver Lake, and Affinity Partners, the private equity firm founded by Jared Kushner, which PIF also backs. EA shareholders will receive $210 per share in cash, representing a 25% premium to EA’s unaffected price of $168.32 on September 25, 2025, with PIF rolling over its 9.9% stake. The deal is backed by approximately $36B of equity commitments and $20B in debt financing arranged by J.P. Morgan, and is expected to close in Q1’FY27. EA will remain headquartered in Redwood City, with Andrew Wilson continuing as CEO. This marks the largest all-cash private equity-backed take-private deal in history and the second-largest take-private gaming deal after Microsoft’s $68.7B acquisition of Activision Blizzard.

Founded in 1982, EA has been shaping the industry for decades. From The Sims to Battlefield and Apex Legends, the company built a massive portfolio — but above all, it established dominance in sports through FIFA (now EA SPORTS FC) and Madden NFL. These franchises pioneered recurring monetization long before “live services” became industry standard.

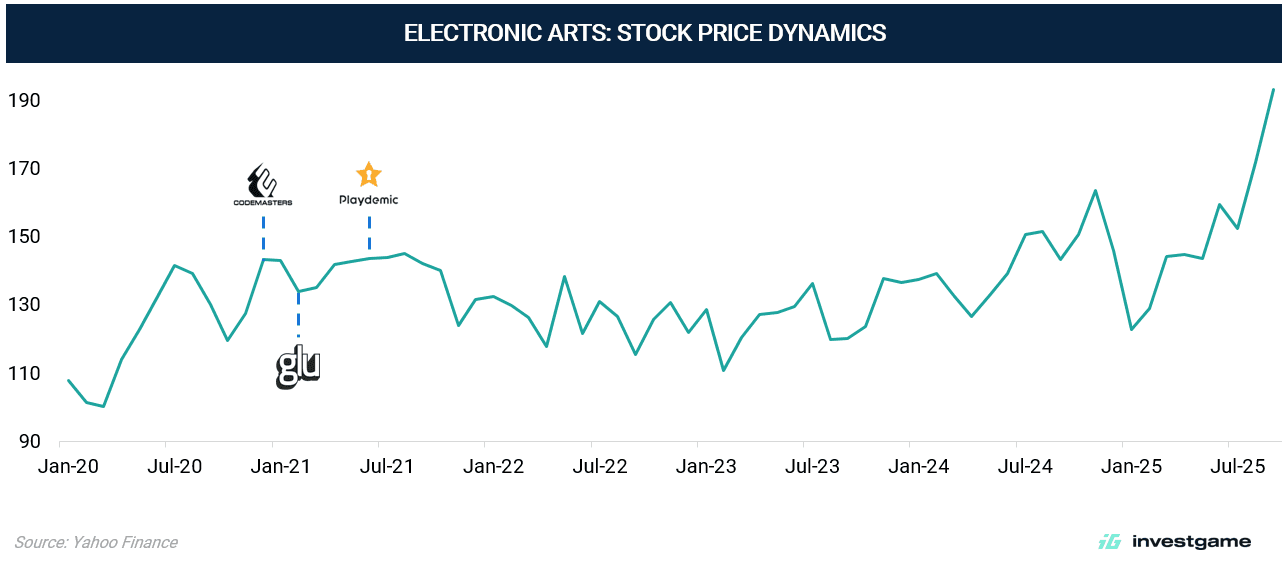

Today, EA finds itself in a different position. While it remains one of the industry’s largest publishers, its growth profile has shifted. Revenues remain flat, sustained primarily by its sports franchises, while other segments deliver uneven results. The company has invested heavily in M&A — $5B since 2020 across Codemasters, Glu Mobile, and Playdemic — but these deals have not become new growth engines for EA. Within public markets, that pattern has recast EA: no longer viewed as a high-growth innovator, but increasingly as a cash-flow utility — valued for predictable margins, yet discounted for its lack of expansion.

Financial Performance: Stable but Capped

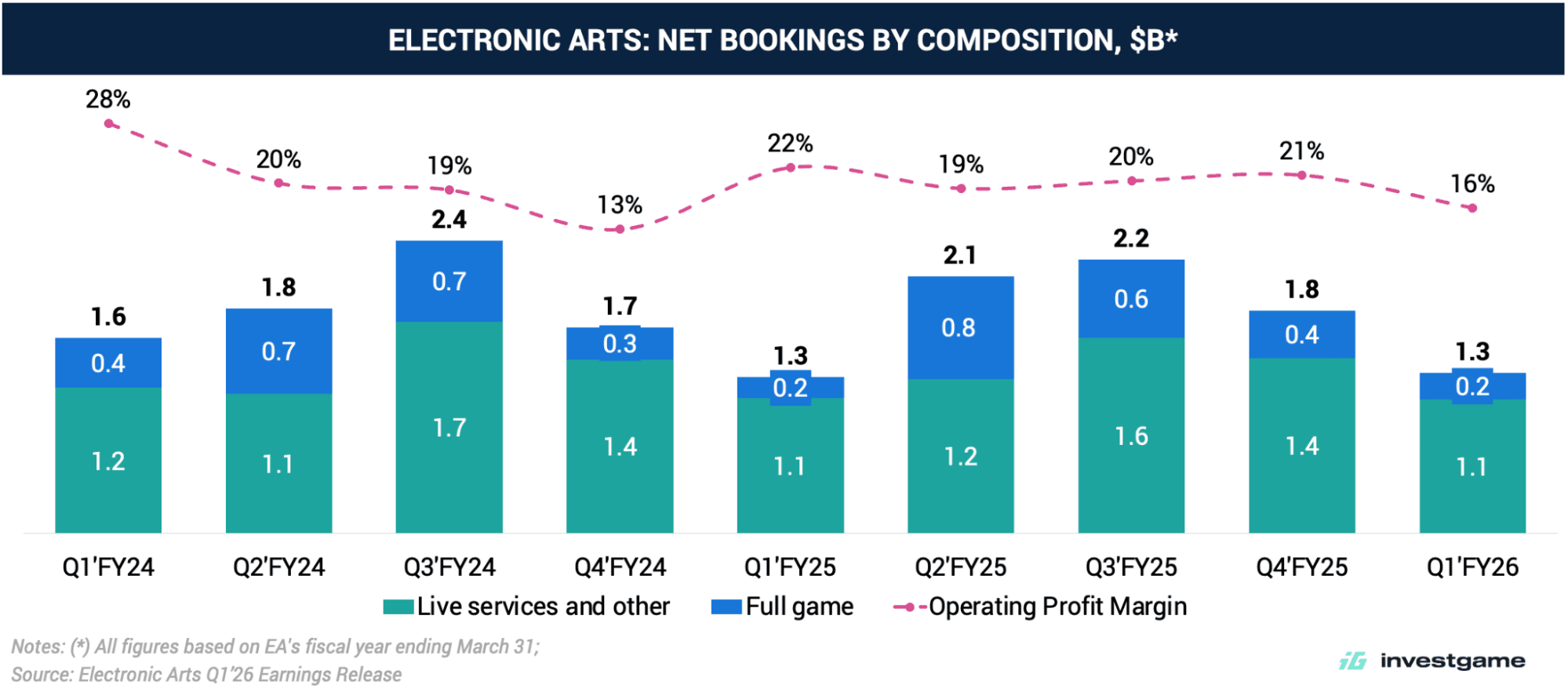

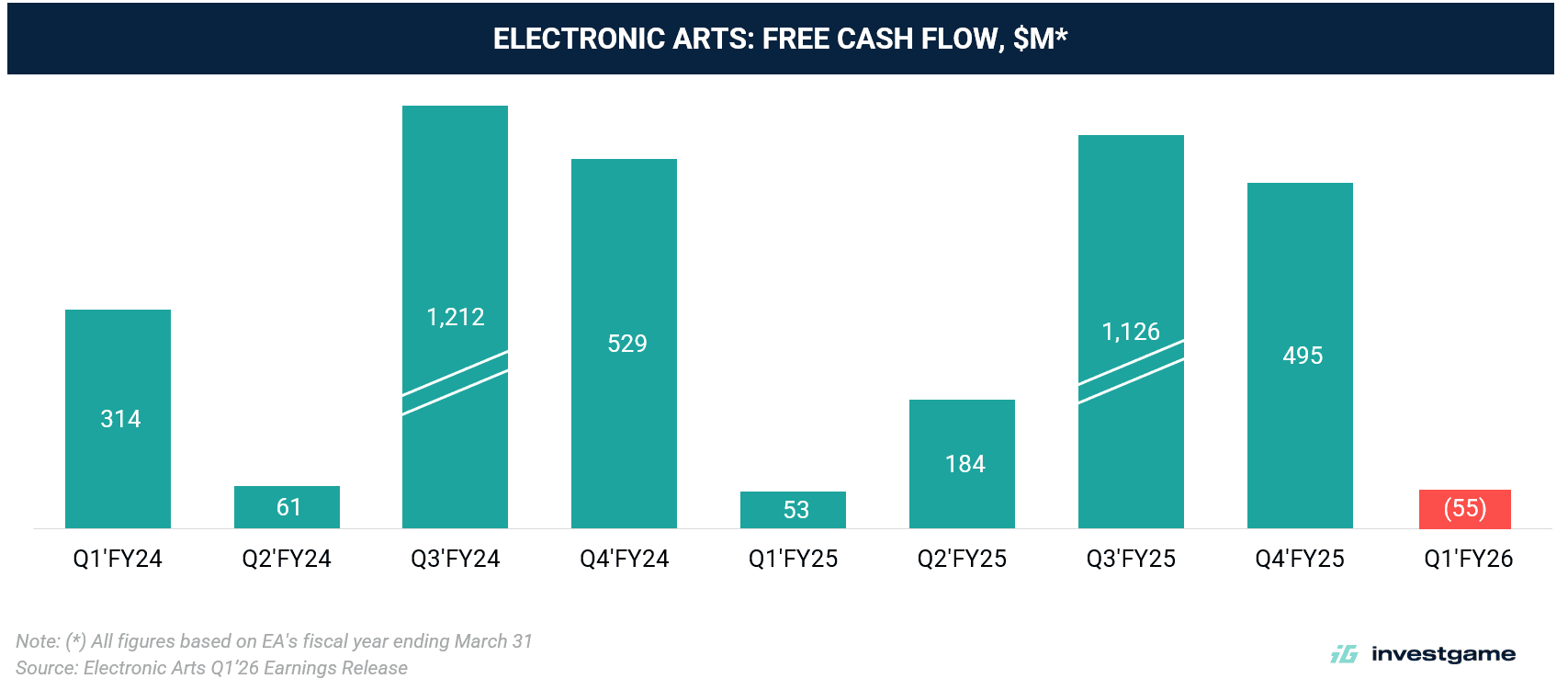

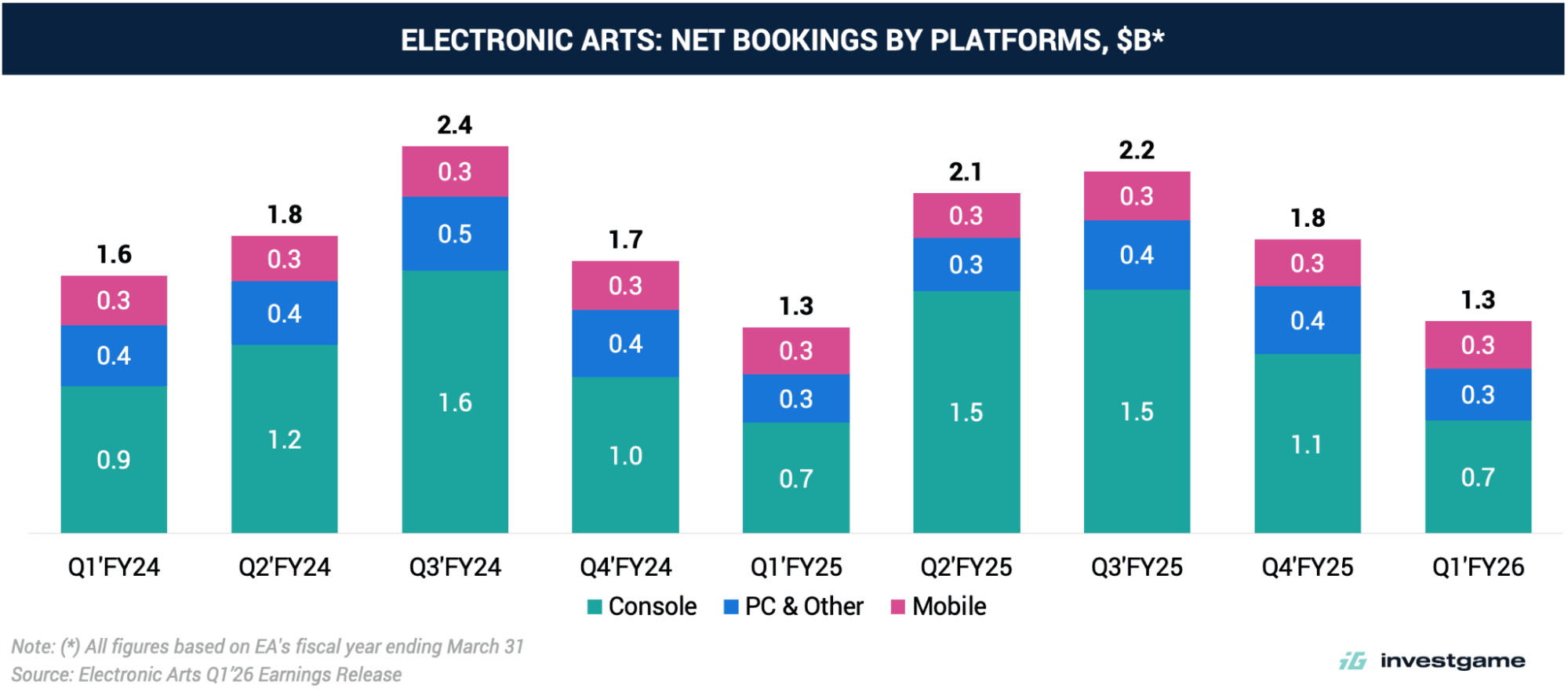

Over the past five years, EA’s quarterly revenues have consistently ranged between $1.5–$2.5B, peaking around annual sports launches and easing in off-quarters. Operating income has fluctuated between $175m and $540m per quarter, reflecting solid profitability but volatility tied to release cycles. Free cash flow has been strong in aggregate but fluctuates seasonally, surging during major sports launches before tightening in quieter periods.

Looking ahead, EA’s FY26 guidance projects net revenue of up to $7.5B, implying growth of just 0.5% YoY at the high end. At the same time, the company expects its GAAP operating margin to decline from 20.4% in FY25 to 18.9% in FY26, underscoring the pressure on profitability despite stable topline performance.

Despite this profitability, the lack of sustained topline growth has constrained investor enthusiasm. EA’s $5B M&A push failed to create scalable new growth engines:

- Codemasters ($1.2B, 2021): The UK racing specialist brought F1 into EA’s catalog, which has since grown alongside the global motorsport boom. But other franchises (Grid, rally games) were canceled, and the studio was later downsized, leaving EA with one strong IP but no broader racing expansion.

- Glu Mobile ($2.1B, 2021): Acquired for its portfolio of lifestyle and celebrity-driven titles such as Design Home and Kim Kardashian: Hollywood. EA expected Glu to anchor a new casual mobile segment, but these games remained niche and failed to scale.

- Playdemic ($1.4B, 2021): Bought from Warner Bros. to secure Golf Clash, a hit mobile sports game. Yet the title had already peaked and has since declined. EA was unable to build it into a lasting franchise.

At the same time, EA attempted to adapt core franchises to mobile. Apex Legends Mobile and Battlefield Mobile were positioned as flagship global titles but were sunset within a year due to poor retention and monetization. The company’s mobile revenues are still dominated by EA SPORTS FC Mobile, first released in 2016 and rebranded in 2023.

Source: AppMagic

By contrast, rivals have been more successful: Activision Blizzard scaled Call of Duty Mobile into a billion-dollar franchise, and Take-Two leveraged Peak Games’ portfolio into substantial growth. EA’s acquisitions secured assets, but they did not create new growth engines.

Franchise Dependence: Sports as the Core

Beyond the financials, EA’s business is best understood through the performance of its franchises. The company’s revenue base is heavily concentrated in a handful of titles, with sports driving the majority of full-game sales and recurring monetization. While this concentration underpins stability, it also limits growth opportunities outside of a few evergreen IPs.

- EA SPORTS FC — The franchise is the cornerstone, with approximately 85% of all net bookings from full-game copies sold in the last twelve months coming from EA SPORTS FC. Despite losing the FIFA license, demand has remained resilient.

- Madden NFL — Sold over 5 million copies across PC and PlayStation in the last twelve months, reinforcing its position as a dependable U.S. sports annuity with both packaged and live-service monetization.

- The Sims — Continues to grow steadily, benefiting from strong community engagement and expansion of the life-sim genre.

- Battlefield — The upcoming Oct’25 release is viewed as a major reset after Battlefield 2042 received mediocre reviews and underperformed commercially. Expectations are high, with hopes that a live-service model will restore the franchise’s relevance.

- Apex Legends — Remains under pressure after a period of declining engagement, with EA signaling the need to stabilize the franchise’s trajectory.

Outside sports, franchises have struggled to maintain momentum. RPGs and shooters such as Dragon Age and Battlefield have been inconsistent, while licensed projects like Star Wars Jedi provide temporary boosts but leave EA with less control. Some of the new IP publishing attempts — Immortals of Aveum and Wild Hearts — struggled to scale. The most recent third-party publishing success, Split Fiction, has delivered stronger initial traction, with more than 4 million units sold since its release in March 2025. Developed by Hazelight Studios, it represents a continuation of the team’s success following the release of It Takes Two (18 million copies sold to date, according to Alinea Analytics). However, it remains too early to assess whether it can evolve into a durable publishing success on the scale of EA’s sports ecosystems.

Mobile reinforces this pattern. According to AppMagic, over the past three years, EA’s top-grossing mobile titles have been legacy games, including EA SPORTS FC Mobile (2016), Galaxy of Heroes (2015), and SimCity BuildIt (2017). No new titles have broken into the top tier, despite $3.5B spent on mobile-focused acquisitions.

The overall picture is clear: EA’s growth is built on extracting more value from entrenched franchises rather than creating new ones. This concentration in a handful of sports and live-service ecosystems provides resilience and predictable cash flows — but also exposes the company to stagnation if a major release underperforms.

Market Dynamics: Valuation and Public Pressure

For the past five years, share price movements have been tied to release cycles, with spikes around sports launches followed by reversions.

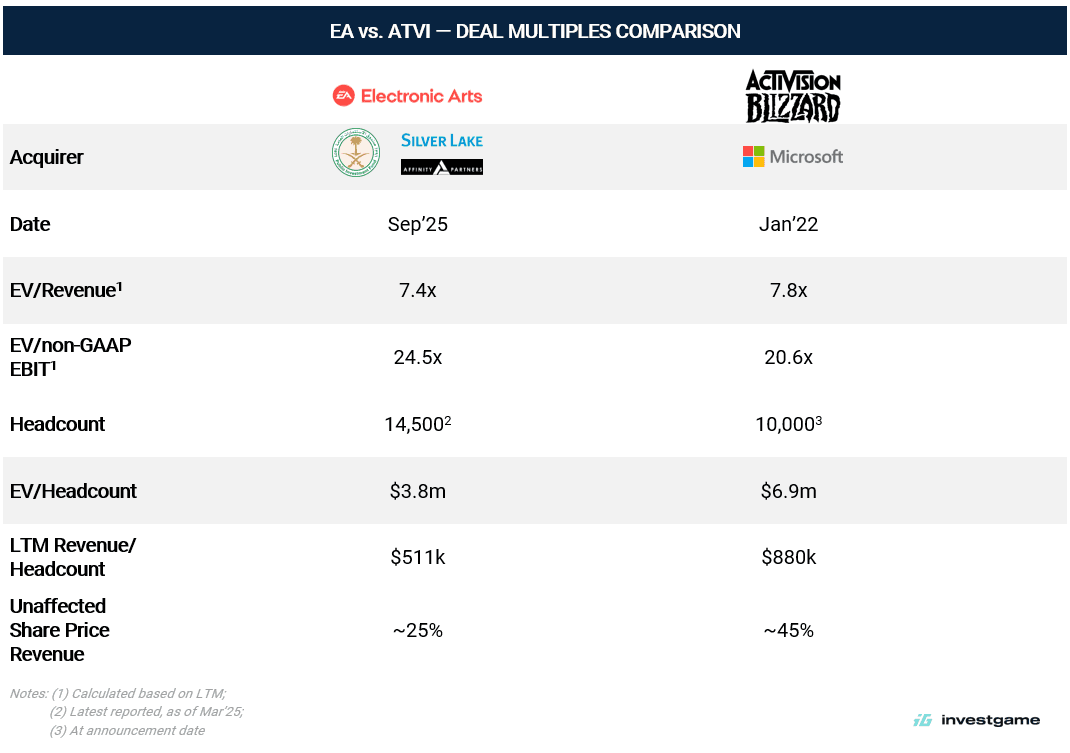

The $210/share offer, representing a 25% premium, re-rates EA to valuation multiples that public markets had not rewarded. Despite the company’s flat growth profile, institutional and sovereign investors bid for strong double-digit valuation multiples (21.2x EV/LTM EBITDA) for stable, cash-generative franchises.

Strategic Rationale: Saudi-Driven, PE-Backed

The structure points to a Saudi-led transaction, with Silver Lake providing private equity expertise. On its own, a PE firm would be unlikely to shoulder a $55B buyout. At the same time, PIF may face regulatory and political hurdles without strong U.S. partners, such as Silver Lake and Affinity Partners, headed by Jared Kushner, a former U.S. presidential adviser.

For PIF, the logic is straightforward. Football is central to Saudi Arabia’s cultural and political agenda, from investment in the Saudi Pro League to hosting the 2034 World Cup. EA SPORTS FC is the global interactive gateway to football, making it a uniquely strategic asset. Combined with Madden and F1, EA gives PIF control over a portfolio of franchises that dominate both U.S. and global audiences. Alongside Scopely in mobile and Niantic in AR, EA positions Saudi Arabia at the center of a cross-platform sports and entertainment ecosystem.

Silver Lake’s football connections deepen the strategic logic. The firm holds a significant minority stake in City Football Group (CFG), the parent company of Manchester City and a global football network comprising more than a dozen clubs. In light of EA’s strength in football IP, the alignment is compelling: EA’s success in EA FC dovetails with Silver Lake’s existing footprint across football clubs, turning this deal into more than a media play — it’s a convergence of content, sport, and ownership.

For EA, leaving public markets removes the constraints of quarterly reporting and enables a long-term focus, rather than a rush for short-term profits. Management will have more flexibility to streamline operations, double down on profitable live-service ecosystems, and fund long-term projects. Crucially, privatization enables EA to take creative risks that public investors have historically discouraged, thereby addressing the creative stagnation in non-sports titles.

Risks remain. A leveraged buyout of this scale (8.4x Debt/LTM EBITDA) inevitably puts pressure on underperforming assets, especially in the mobile sector, and presents challenges in retaining senior talent without offering broad stock-based compensation. Yet, the combination of sovereign capital and institutional discipline suggests a longer-term approach: EA is less likely to face aggressive short-term cuts and more likely to be positioned as the cornerstone of a sovereign-backed sports and entertainment strategy.

Institutional Capital Doubles Down on Gaming

The $55B EA acquisition highlights a broader structural shift: institutional investors now treat gaming as a core long-term asset class (a growing trend across private equity). PIF’s Savvy Gaming Group, CVC Capital Partners, and other institutional allocators, as well as large-scale investors, are consolidating ownership of the industry’s largest IP platforms.

While long-term capital allows publishers to reinvest in live services and new IP without the pressure of short-term market fluctuations, the trade-off is that the industry loses another major public comparable, reducing transparency and liquidity in gaming equities.

EA’s sale underscores two realities. First, sports remain one of the most enduring categories of entertainment, even in gaming, capable of anchoring tens of billions of dollars in enterprise value. Second, the sector’s largest assets are increasingly controlled by sovereign and PE portfolios — signaling both confidence in gaming’s durability and a new governance model defined less by public markets and more by private institutional capital.