Feature #12

Market Paradox: Why does mobile gaming attract record M&A while VC investment shrinks — what drives buyers to double down as VCs retreat?

Operational Edge: How have studios evolved into predictable, scalable revenue machines — what live ops, monetization, and UA strategies set them apart?

Genre & Geography Shifts: How did the collapse of hypercasual and rise of casual, hybrid models, and regions like Turkey reshape the mobile gaming landscape?

Feature sponsored by $GDEV

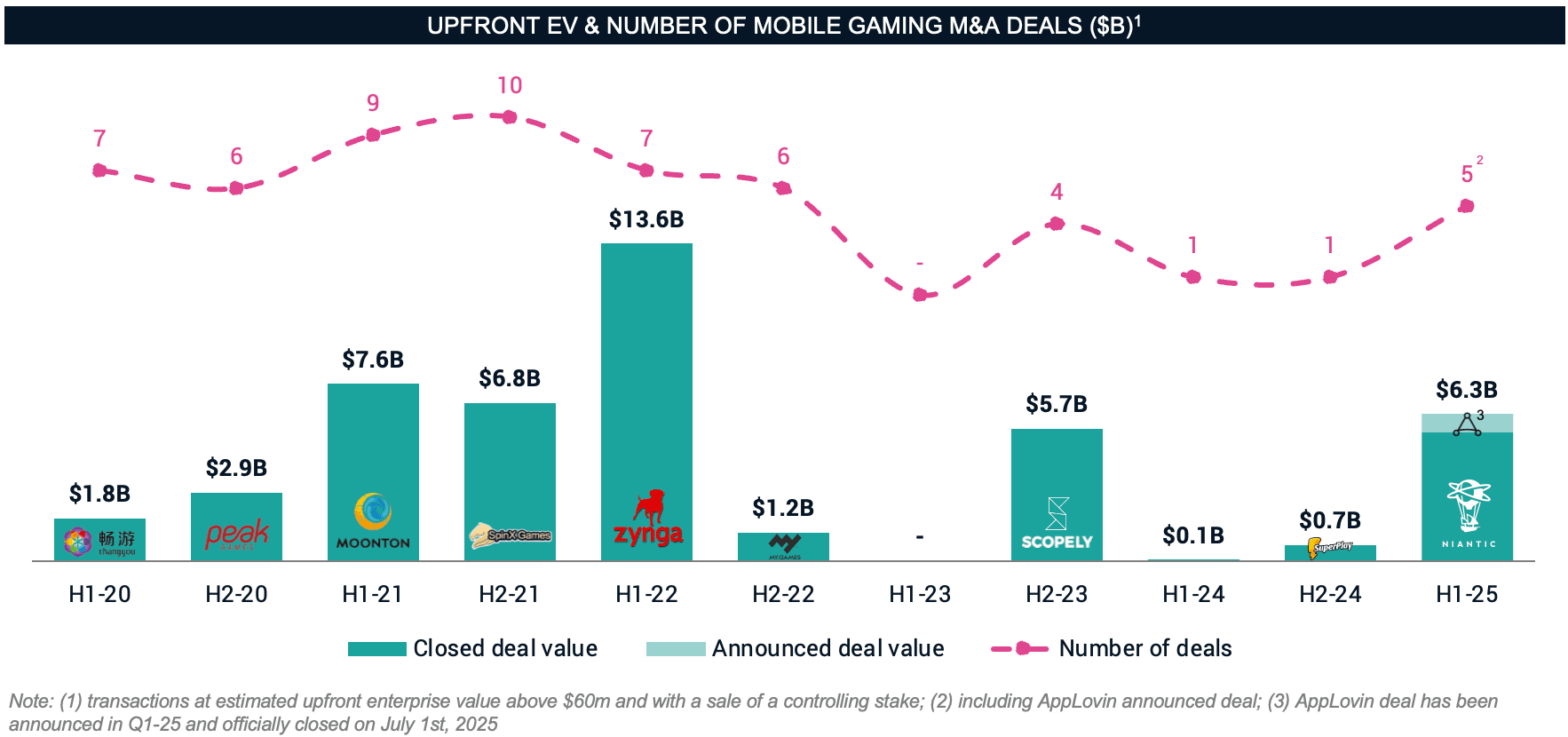

The Mobile Gaming Investment Paradox

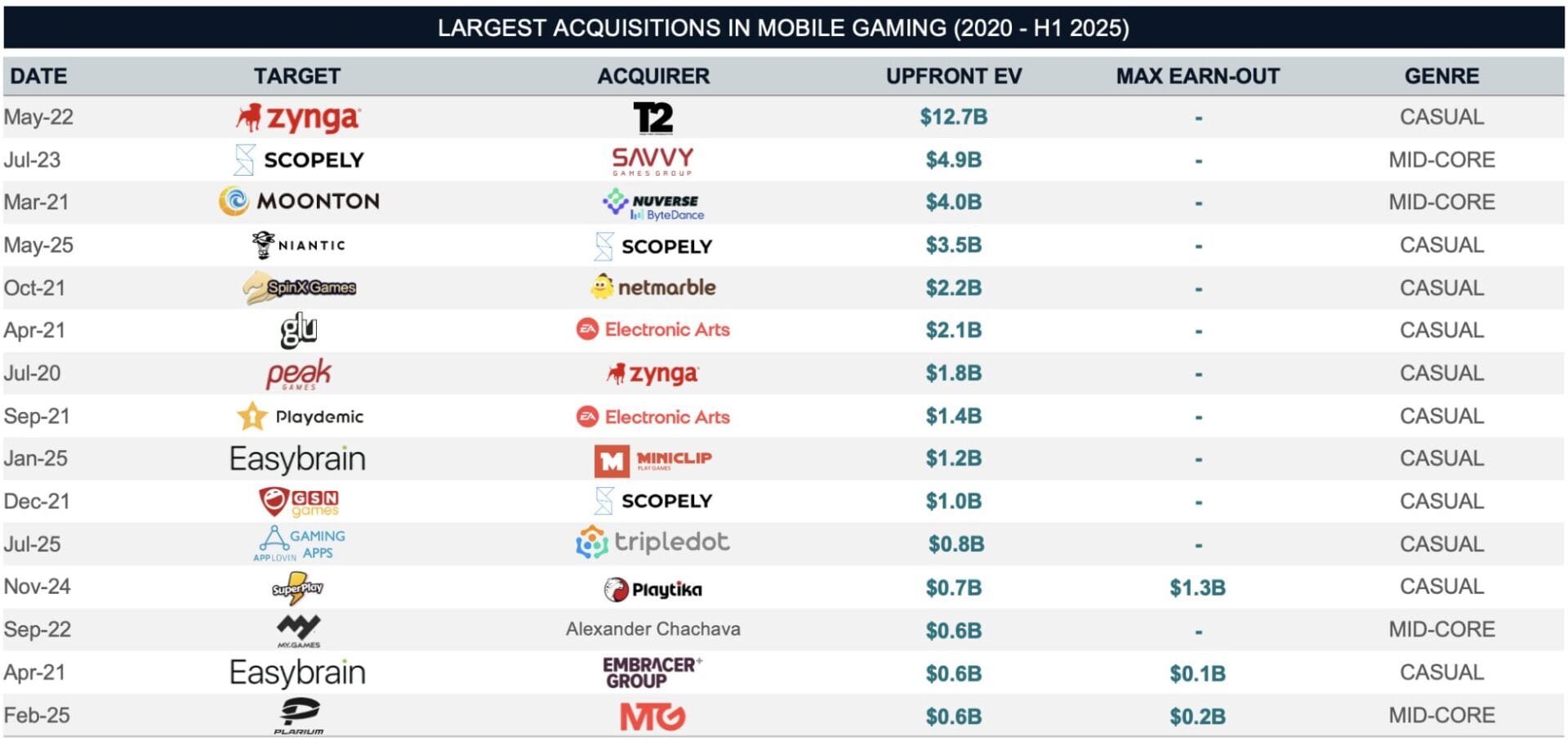

While global attention today often centers on major PC & Console franchises, AI-driven tech companies, and rapidly growing UGC platforms, mobile gaming has remained the dominant force in gaming M&A. Over the first half of this year alone, the mobile segment contributed nearly $6.6B in deal value — an estimated 98% of total gaming M&A value in H1’25 — driven by mega-deals including Niantic’s gaming division sale for $3.5B, Dream Games’ $2.5B round, and Easybrain / Miniclip, AppLovin / Tripledot transactions. This concentration underscores just how central mobile has become to Private Equity and Strategic investors.

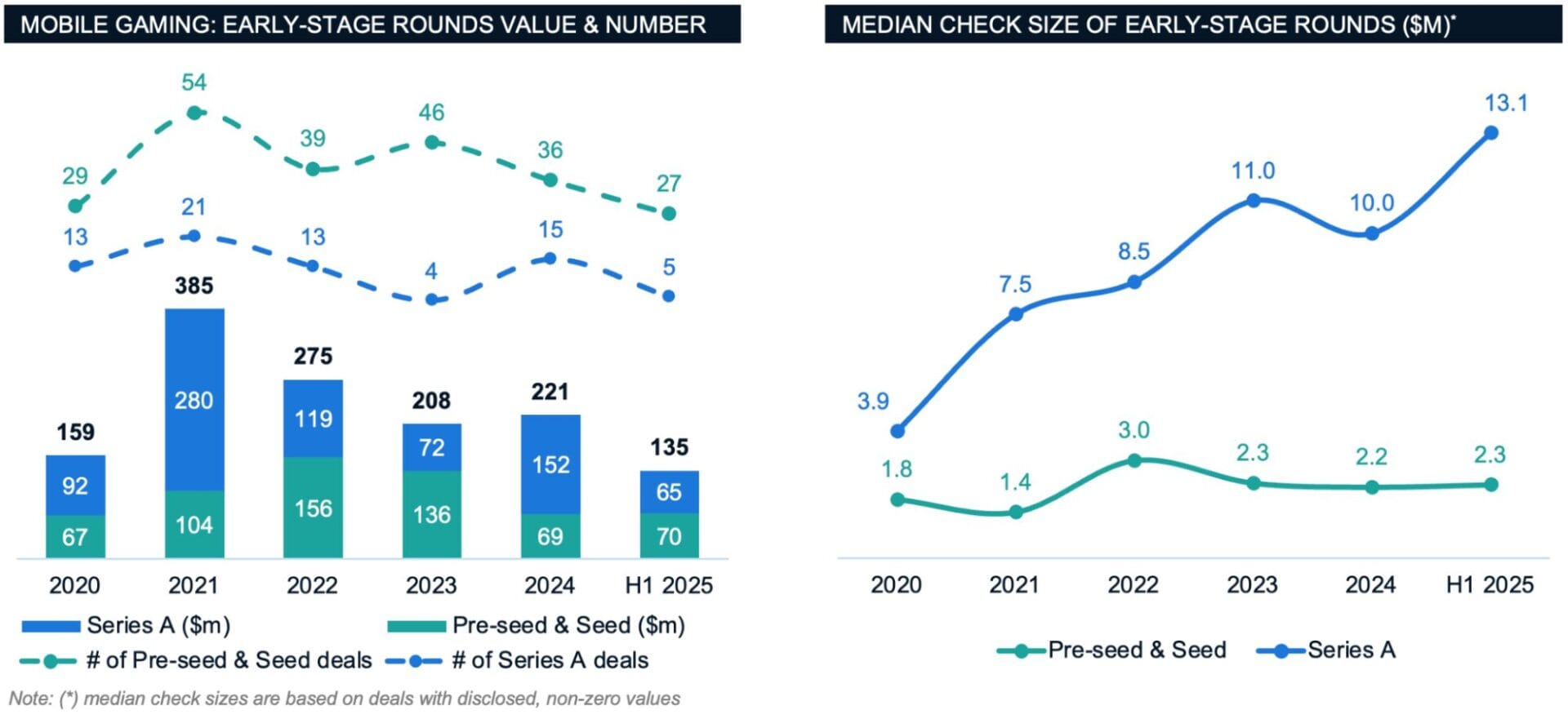

Paradoxically, this surge in M&A activity has coincided with a notable decline in VC investment across the mobile space. The number of VC-backed rounds has dropped sharply from 2021 highs. This contrast raises key questions: why are strategic corporates and private equity firms doubling down on mobile while VCs step back? And what makes mobile studios attractive in this new environment?

By tracing the journey of mobile gaming from peak investment hype to operational maturity, we examine how these market dynamics have created clearer opportunities for disciplined investors and strategic acquirers.

For a detailed analysis, check out the accompanying report:

Methodology

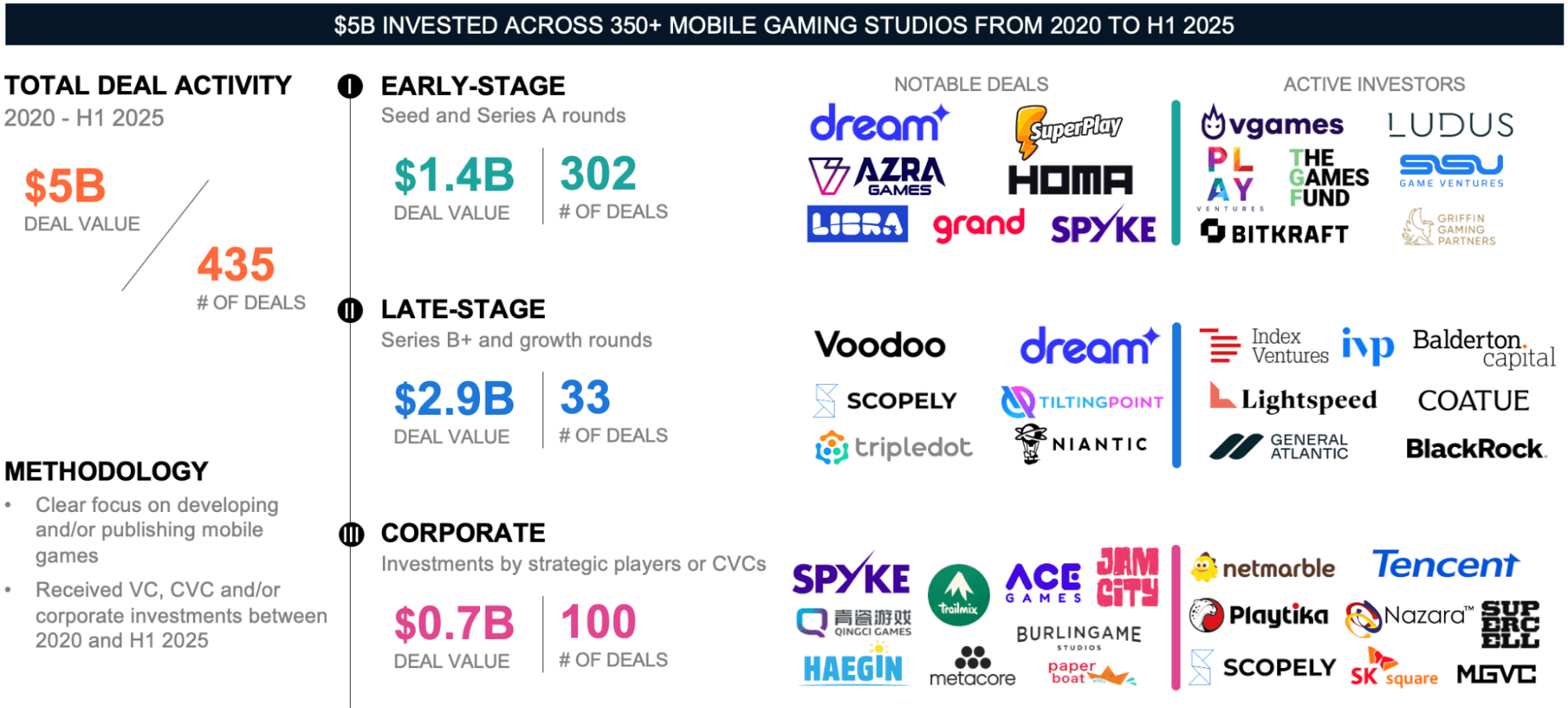

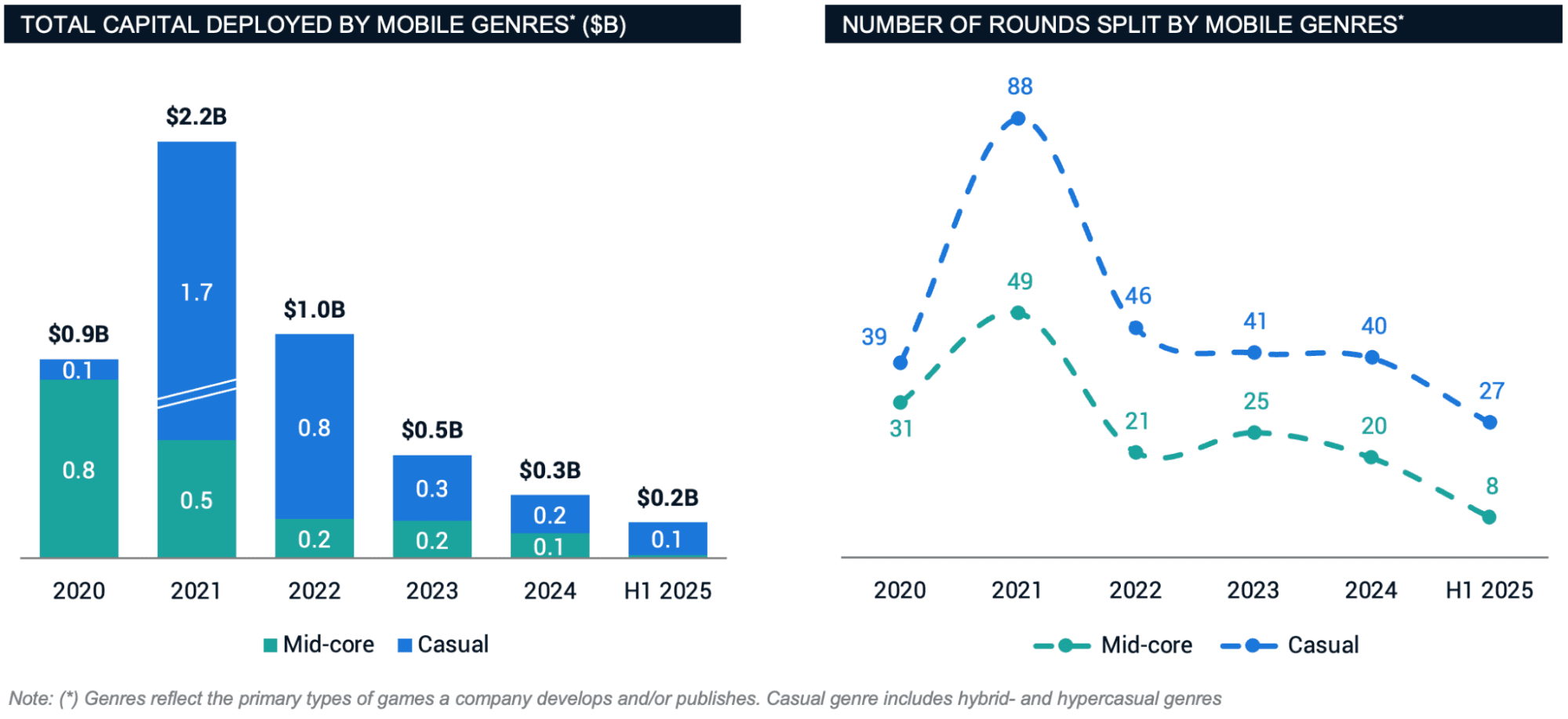

Our analysis tracked nearly $5B flowing into mobile gaming through 435 deals across more than 350 studios worldwide from 2020 to H1’25. One key insight shaped our approach: the traditional hyper-casual category has essentially dissolved. With only 27 pure hyper-casual deals remaining and most studios embracing hybrid models, we combined the casual and hyper-casual into a single category. This reflects today’s reality — developers no longer chase rigid genre formulas but instead focus on what drives revenue. Note: Platform-centric companies, such as Roblox and PortalOne, fall outside the scope of this analysis.

2020–2021: Pandemic-Fueled Boom

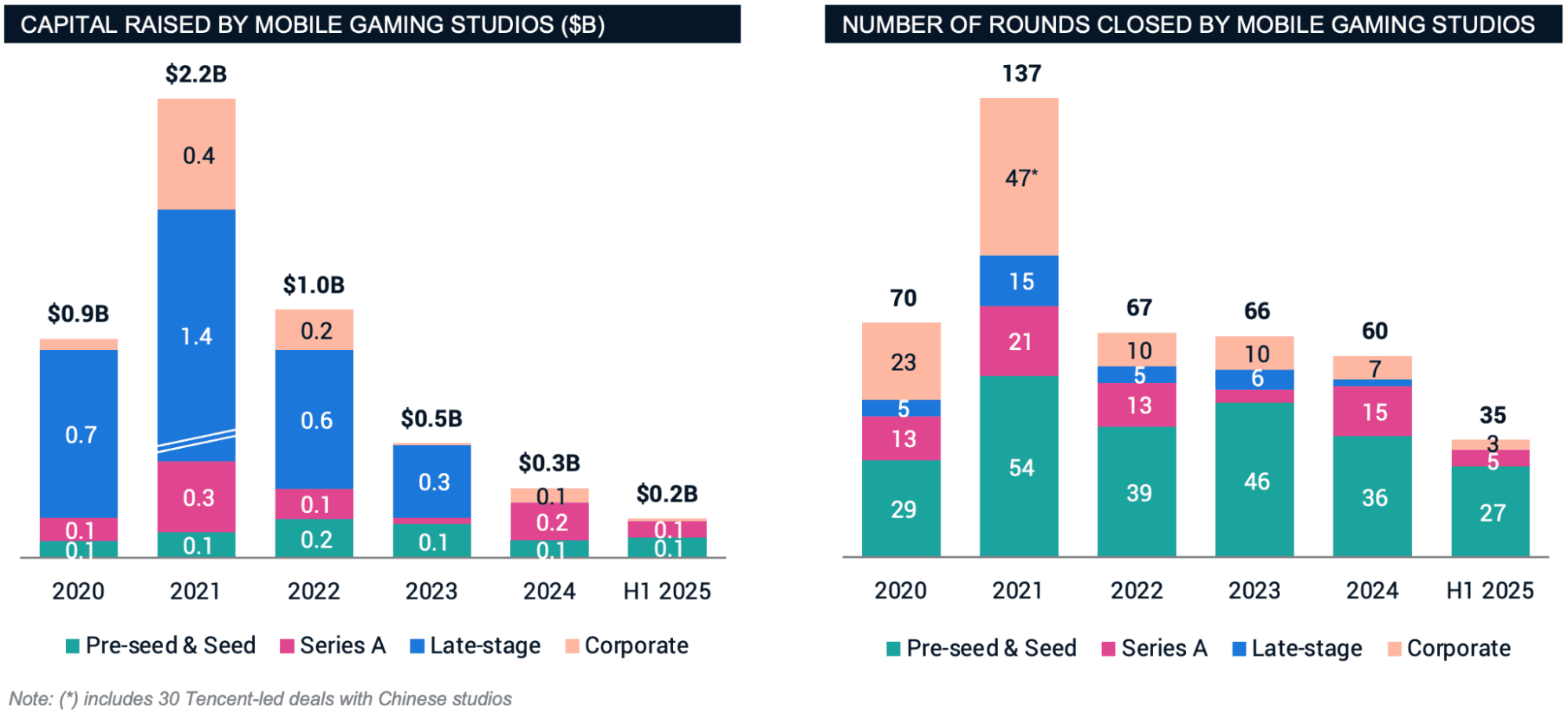

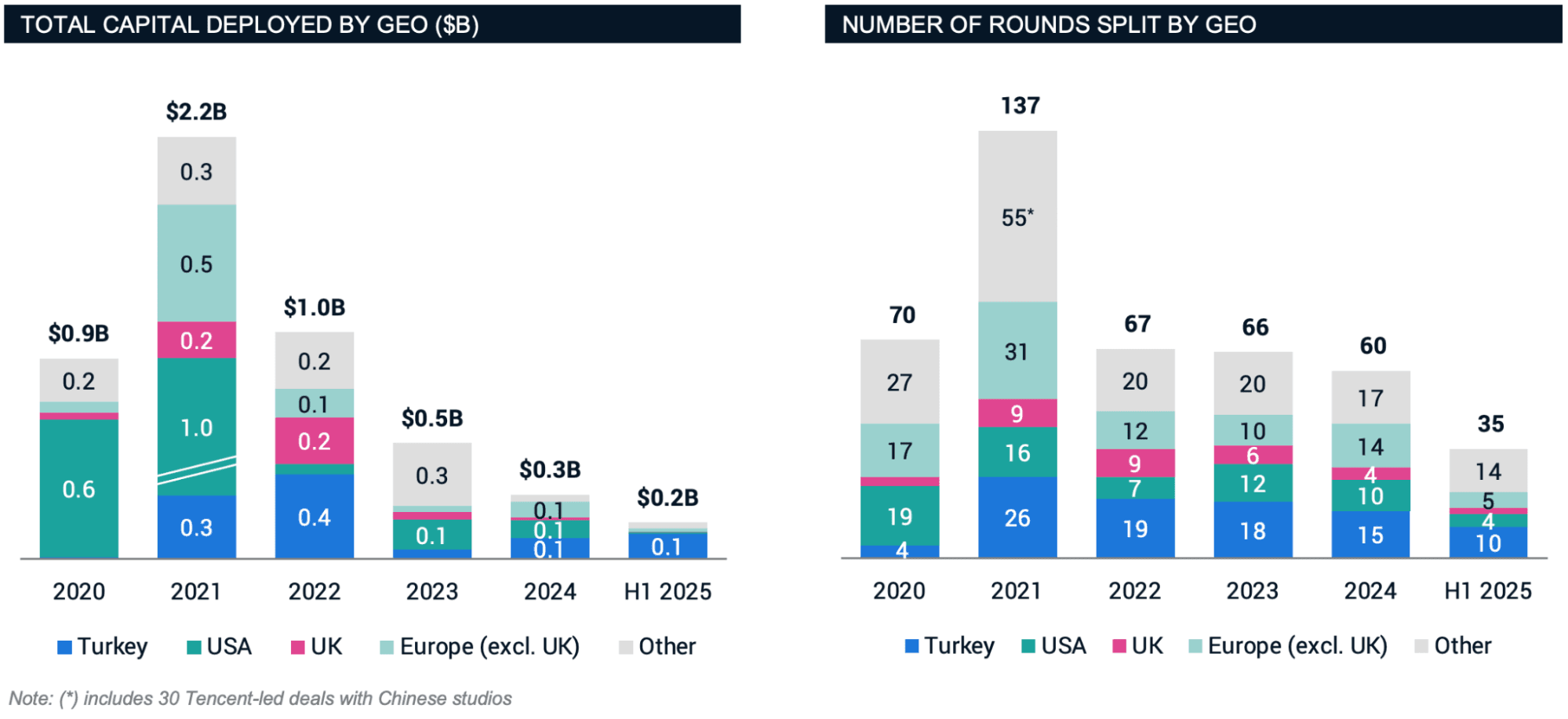

Shifting consumer habits during pandemic lockdowns triggered a surge in mobile game engagement and monetization, sparking unprecedented investor interest. The numbers were staggering: 137 mobile deals in 2021 totaling $2.2B — a historic peak that more than doubled the previous year’s activity.

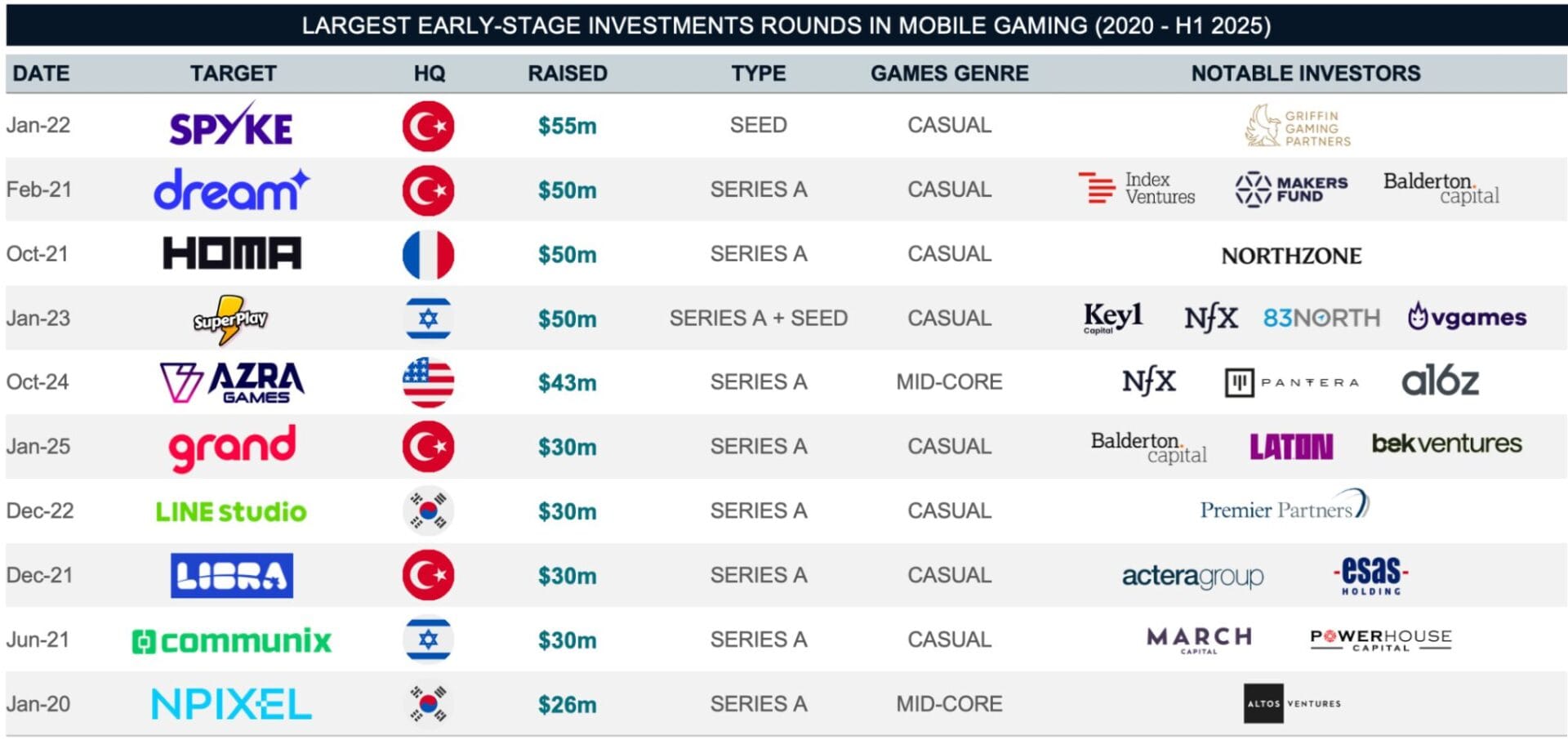

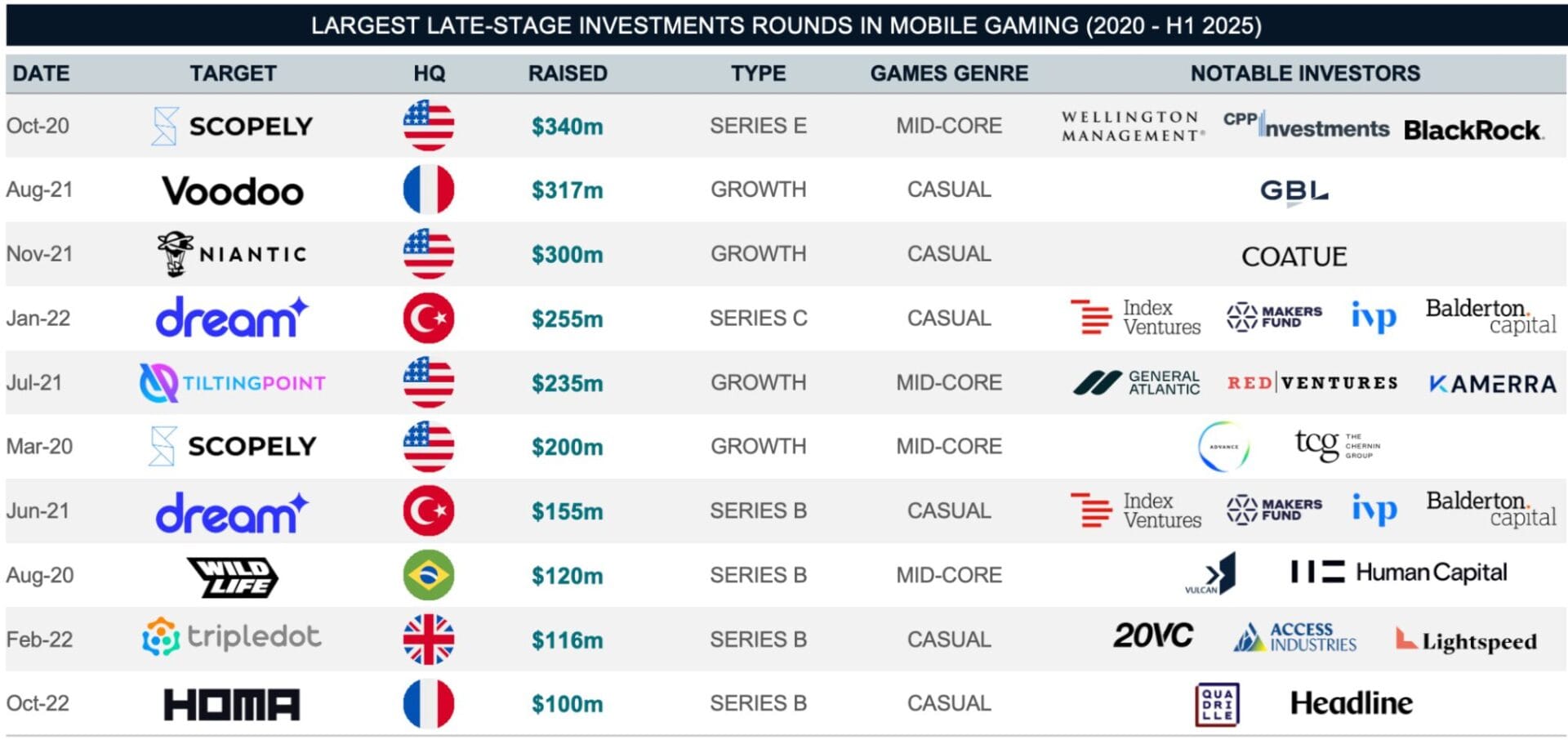

This period also marked the peak of large-scale capital inflows into the mobile gaming industry, with 9 of the top 10 deals closing between 2020 and Feb’22. The boom extended across all funding stages, with 6 of the 10 largest early-stage rounds occurring during this window. Together, these mega-deals contributed ~$2.4B in funding, representing nearly half of all mobile gaming investment tracked over the past five years.

The funding frenzy extended beyond traditional VC rounds. GDEV (formerly Nexters) exemplified the era’s diverse exit opportunities, going public via SPAC at ~$2B valuation in Aug’2021. This alternative path to public markets became increasingly popular during the boom, offering faster liquidity for founders and early investors eager to capitalize on soaring valuations.

Beneath the surface, however, many investors overlooked core business fundamentals. The focus shifted to rapid user growth over sustainable, long-term-oriented strategies, with many betting that scale would eventually resolve future profitability challenges. This speculative environment, where growth metrics took precedence over business fundamentals, laid the groundwork for the market correction.

2022–2023: IDFA Shock and Investor Caution

Apple’s IDFA deprecation in 2021, arriving just as post-pandemic engagement began normalizing, didn’t just disrupt mobile user acquisition — it fundamentally broke the engine that had powered the hypercasual boom. Attribution became a matter of guesswork, targeting lost its precision, and costs per install (CPIs) soared. Studios built entirely on paid performance marketing traffic watched their unit economics collapse.

The funding market reflected this new reality. Series A rounds — the traditional growth accelerator for promising studios — virtually vanished, plummeting from $280m across 21 deals in 2021 to near-extinction by 2023. Even more telling: while Series A check sizes ballooned during the boom (reaching $11m), this growth only made the category’s collapse more dramatic. Studios discovered a harsh truth: without predictable unit economics, even strong early metrics couldn’t justify growth capital.

The Genre Reshuffling and Geographical Rebalancing

The IDFA shock didn’t hit all genres equally. Hypercasual — once the darling of mobile gaming — saw investment virtually disappear. Studios scrambled to pivot toward hybrid casual models, adding retention mechanics and monetization depth to survive in a world where every user had to be accounted for.

Meanwhile, midcore’s decline was also precipitous, from 49 deals in 2021 to just 8 by H1’25. These complex, high-ARPU games faced a perfect storm: not only were they expensive to develop, but their reliance on finding and converting specific player types made them especially vulnerable to targeting degradation. With acquisition costs soaring and competition from established titans intensifying, new midcore ventures became hardly investable.

The pandemic period’s gold rush had a clear favorite: casual developers. Their faster iteration cycles, mass-market appeal, shorter development cycles, diverse monetization strategies, and attractive unit economics offered the flexibility needed to adapt to the post-IDFA world, making them irresistible to investors. Casual studios captured 65% of all deals, with VCs particularly drawn to their promise of rapid, repeatable success.

These genre shifts also reshaped the geography of funding, with new regional hubs emerging. Turkey claimed the crown in casual gaming, capturing 27% of all casual deals — 76 investments that defied the global downturn. This was no accident. Turkey’s casual gaming ecosystem had quietly matured through repeat entrepreneurs who had learned from previous exits. Peak Games’ $1.85B sale to Zynga created a generation of experienced operators, while newer success stories such as Dream Games proved the model’s repeatability (read a more detailed analysis on Turkey’s rise as a gaming powerhouse).

Meanwhile, Europe and Asia led the mid-core market, accounting for 66% of mid-core deals, with a strong emphasis on complex genres such as RPGs, shooters, and 4X strategies — titles that require deeper gameplay systems and sophisticated monetization loops.

2024–2025: Fewer Deals, Higher Standards

As if IDFA wasn’t enough, VCs underwent their transformation. The era of growth at all costs ended abruptly, replaced by demands for clear paths to profitability. In this new landscape, profitability and strong unit economics weren’t just preferred — they became table stakes for any funding conversation.

The pain wasn’t limited to independent studios. Major public mobile publishers posted negative organic growth while watching their valuations plummet (explored in our previous market analysis), and mobile stocks were trading at historic lows.

By H1’25, the number of mobile gaming investments had reached just 35 deals, a slight increase from H2’24, which had the lowest half-year figure at 25 deals. While Seed-stage activity remained relatively stable, Series A all but vanished, and Series B nearly disappeared. Yet, even in this capital desert, studios founded by experienced teams with solid track records continue to raise new funds. This environment has filtered the landscape, surfacing a smaller group of high-performing studios. These are typically teams with hybrid monetization models (IAP + IAA), solid UA metrics with potential to scale, and already grossing portfolios targeting mass-market audiences. Their proven execution has pushed median check sizes upward for Series A rounds (e.g., $30m Grand Games, $25m for Bigger Games) and Seed rounds (e.g., $23m for Good Job Games, $7m for TaleMonster Games).

Why Do Buyers Remain Bullish on Mobile?

While VCs retreated, strategic buyers doubled down. The numbers tell a remarkable story:~ $7B in mobile M&A across 6 transactions, including the announced AppLovin deal in Feb’25 and closed on Jul 1, 2025, in just the past 12 months. Despite all the industry headwinds, mobile gaming has captured 61% of the total gaming M&A value since 2020 (excluding the Activision Blizzard acquisition by Microsoft) — a dominance that demands explanation.

The answer lies in what mobile studios have become. Today’s successful mobile operators don’t just make games — they run predictable revenue machines. Where PC & Console studios chase the next blockbuster hit (yet struggling to sustain performance over longer horizons), mobile studios have built something fundamentally different: businesses with recurring revenue streams, real-time optimization powers, and profit margins that improve over time.

Strategic buyers aren’t acquiring games — they’re acquiring capabilities:

- Live operations expertise that keeps players engaged for years, not months. The best mobile studios run their games like ongoing services, with dedicated teams optimizing every aspect of the player experience in real-time.

- Battle-tested monetization systems that generate predictable revenue. These aren’t guessing games—they’re data-driven machines that know exactly how much each cohort will spend over its lifetime.

Post-IDFA marketing playbooks that work. While others struggled with Apple’s privacy changes, the survivors developed new user acquisition strategies that deliver profitable growth.

This operational sophistication explains why everyone from public companies like Playtika and MTG to private operators like Miniclip and Tripledot, alongside sponsor-backed Savvy and PE giants like CVC, are competing for mobile assets. Consider the contrast: a typical PC & Console game requires years of development, massive upfront investment, and still generates most of its revenue in its first few months (with a few notable exceptions; examples include Jagex and CCP Games). A successful mobile game, meanwhile, often grows revenue over multiple years, continuously optimizing and expanding its player base.

The irony is striking. The same market pressures that drove out higher-risk investors have crystallized the true value proposition of mobile gaming. In an industry often characterized by creative risk and hit-driven economics, mobile studios offer something invaluable: predictability, scalability, and proven profitability. For acquirers seeking stable returns in uncertain times, that combination has proven irresistible.

Looking Forward: From Hype to Maturity, Mobile’s Moment of Clarity

Mobile gaming’s transformation from speculative boom to disciplined market has created unexpected clarity. The shakeout that began with IDFA and accelerated through rising capital costs didn’t destroy value — it revealed it. Today’s active acquirers aren’t chasing growth stories but repeatable revenue operators: studios with sustainable unit economics, sophisticated live operations capabilities, and monetization systems that improve over time. For strategic buyers seeking predictable returns, these battle-tested businesses offer exactly what traditional gaming often can’t: recurring revenue streams and operational excellence.

As traditional VC funding remains selective, new models are taking shape. Cohort-based financing — where capital is deployed in stages based on a game’s actual performance — is gaining traction as a more disciplined, performance-driven alternative. At the same time, ecosystems like Turkey are proving more resilient, with experienced founders leveraging lessons from past exits to build capital-efficient studios with strong fundamentals. Together, these trends reflect a shift away from speculative funding toward models that prioritize execution, retention, and monetization from day one.

As mobile gaming enters its next chapter, the winners are clear: studios that survived the correction by building sustainable businesses, not just promising products. Their proven ability to generate profits in a capital-constrained environment makes them attractive to both strategic and financial buyers. The paradox of rising M&A amid falling VC investment ultimately signals a market that has grown up, and for those who understand this evolution, the opportunities remain compelling.