11th and 12 Weekly Digests have brought us new investments from South Korea and Portugal, as well as M&A deals from Canada.

Let’s look at some of the biggest products from the perspective of core & meta gameplay, and monetization mechanics.

NCSOFT (Cross-platform gaming holding)

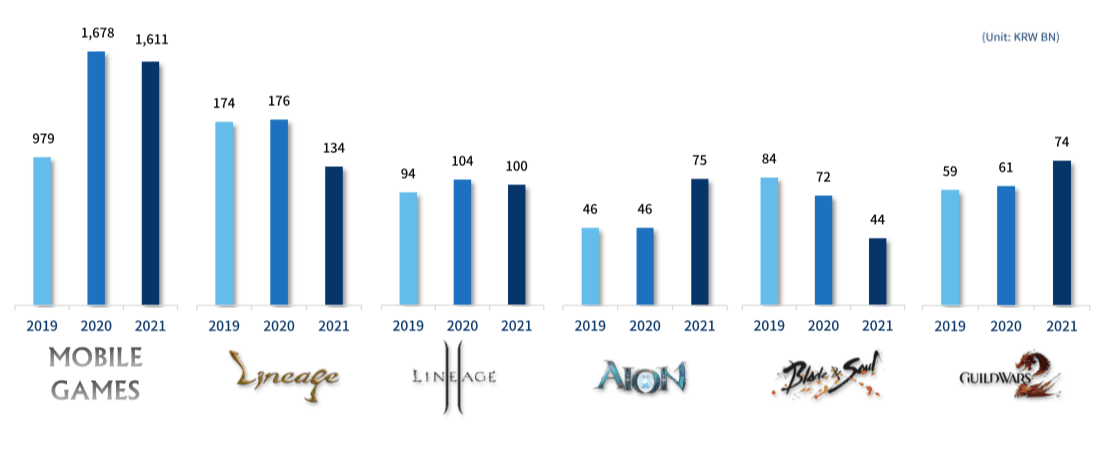

South Korean gaming holding NCSOFT (>$1.9B total sales in 2021) has been known mainly for a popular Lineage franchise. This franchise includes a series of core MMORPG games with most of the paying audience coming from South Korea, Japan and Taiwan.

The main revenue drivers in 2021 were three games:

- Lineage (PC & mobile distribution platforms) with more than $88M total sales in Q4 2021.

- Lineage 2 (PC & mobile distribution platforms) with more than $123M total sales in Q4 2021.

- Lineage W (mobile distribution platforms) with more than $293M total sales in Q4 2021.

All these games has the same gameplay and monetization model:

— Core gameplay is a third-person action RPG in an open game world where players complete quests and fight different monsters. It allows players to increase their character’s level, and buy new equipment.

— Meta gameplay is the mass PvP battles between groups of players (clans).

— Monetization is based on in-app currency which players need to buy/upgrade rare weapons and armor. Also, this currency is used to buy a pet.

The main difference of a new game Lineage W is that it connects different countries (=servers) to bring more players into the open world. Of course, the quality of art and technology are also much higher in the new game version.

FRVR (Web games)

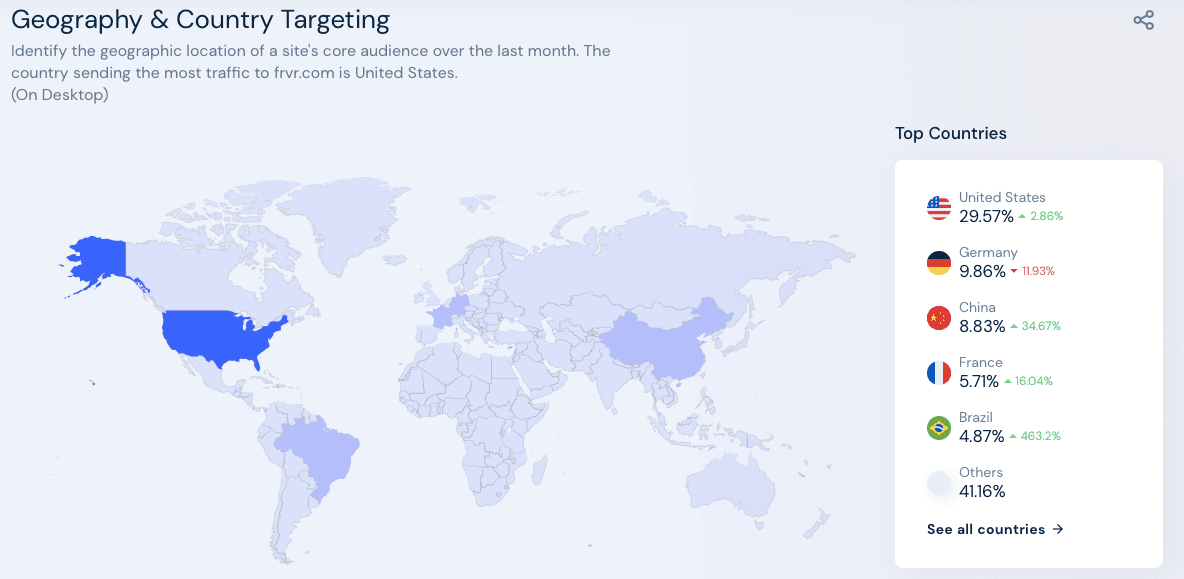

Portugal-based FRVR (1.5B visitors since 2014) is a HTML5 instant gaming platform with 44% of the audience coming from the US, Germany, and France.

https://www.similarweb.com/website/frvr.com/

~9M players per month launch games instantly from their PC/Mobile devices using the internet browser. Inside, they can choose from thousands of casual puzzles/board games, as well as arcades and sports games.

All games in FRVR have the same monetization model – in-game currency and in-game ads.

Players can buy currency to get more moves, or new skins. Also, players can get in-game boosters by watching video ads.

Budge Studios (Mobile games)

Canada-based Budge Studios ($>122M total revenue and >1.2B downloads since 2014) – mobile kids game developer with more than 50% of the audience coming from Brazil, India, Mexico and other emerging markets.

Their main monetization model is In-App Ads like in most kids games.

At the same time, their main In-App Purchases monetization steam is Subscriptions from the US players.

In most cases players will get character skins, dress and house customizations like in the game Barbie Dreamhouse Adventures (>28M total revenue since July 2018) – casual barbie simulator with tamagotchi mechanics.

The two other biggest games are PAW Patrol Rescue World (28M downloads, >$2.5M total revenue since August 2021), and Hello Kitty Salon (>176M downloads since February 2015):

- Patrol Rescue World

- Core game play is an arcade car ride on the location. Players also engage with simulator mini-games.

- Monetization is based on ads after levels, and in-app purchases to buy a new dogs with a unique car with them.

- Hello Kitty Salon

- Core game play is a nail coloring simulator with puzzle level mechanics.

- Monetization is based on interstitial video ads after levels, and rewarded video ads to open a new skin for nail design.

Written by Artur Davydenko,

Venture Partner at Flyer One Ventures, CRO at HoneyLab