AppLovin to Divest Its Gaming Division for $900m to Strengthen Its Ad Tech Focus

US-based mobile gaming and ad tech company AppLovin (NASDAQ: APP) has signed a term sheet to sell its entire mobile gaming division for $900m to an undisclosed private company, according to an SEC filing.

The consideration will be $900m, paid in $500m in cash and $400m in common shares of the acquirer. To finance the cash portion, the acquirer will borrow up to $250m, and if it fails to secure such funding, AppLovin will provide financing through promissory notes.

The mobile gaming division comprises 10 studios, including Machine Zone, PeopleFun, Magic Tavern, Lion Studios, Belka, Athena, Clipwire, Leyi, ZenLife, and Zero Gravity.

Deal multiples (based on 2024 Apps Segment Financials) are shown in the table below, calculated using adjusted EBITDA, which excludes stock-based compensation and restructuring costs and may exclude some central group costs.

| Apps Business | FY2024 | Q4’24 Recurring Revenue |

|---|---|---|

| EV / Revenue | 0.6x | 0.6x |

| EV / adj. EBITDA | 3.2x | 3.2x |

Source: AppLovin

FINANCIALS

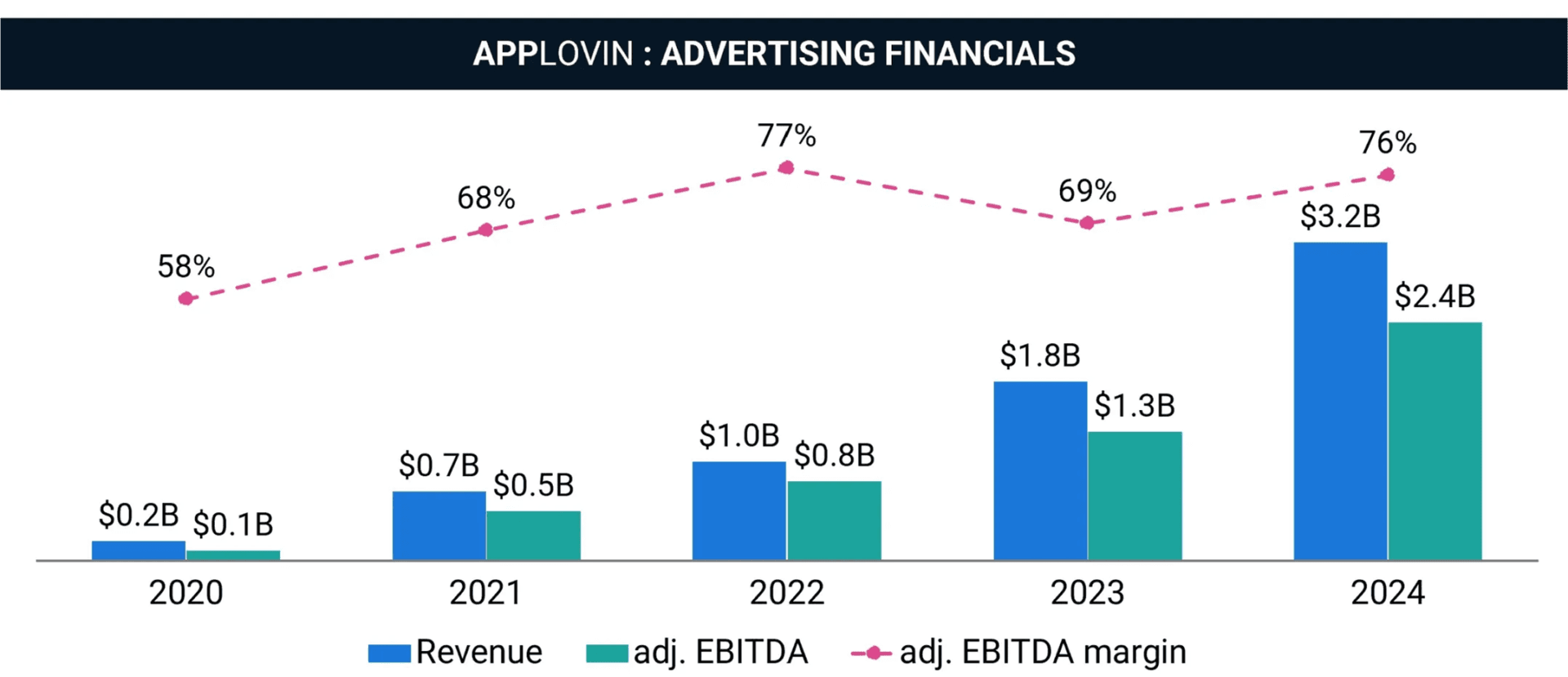

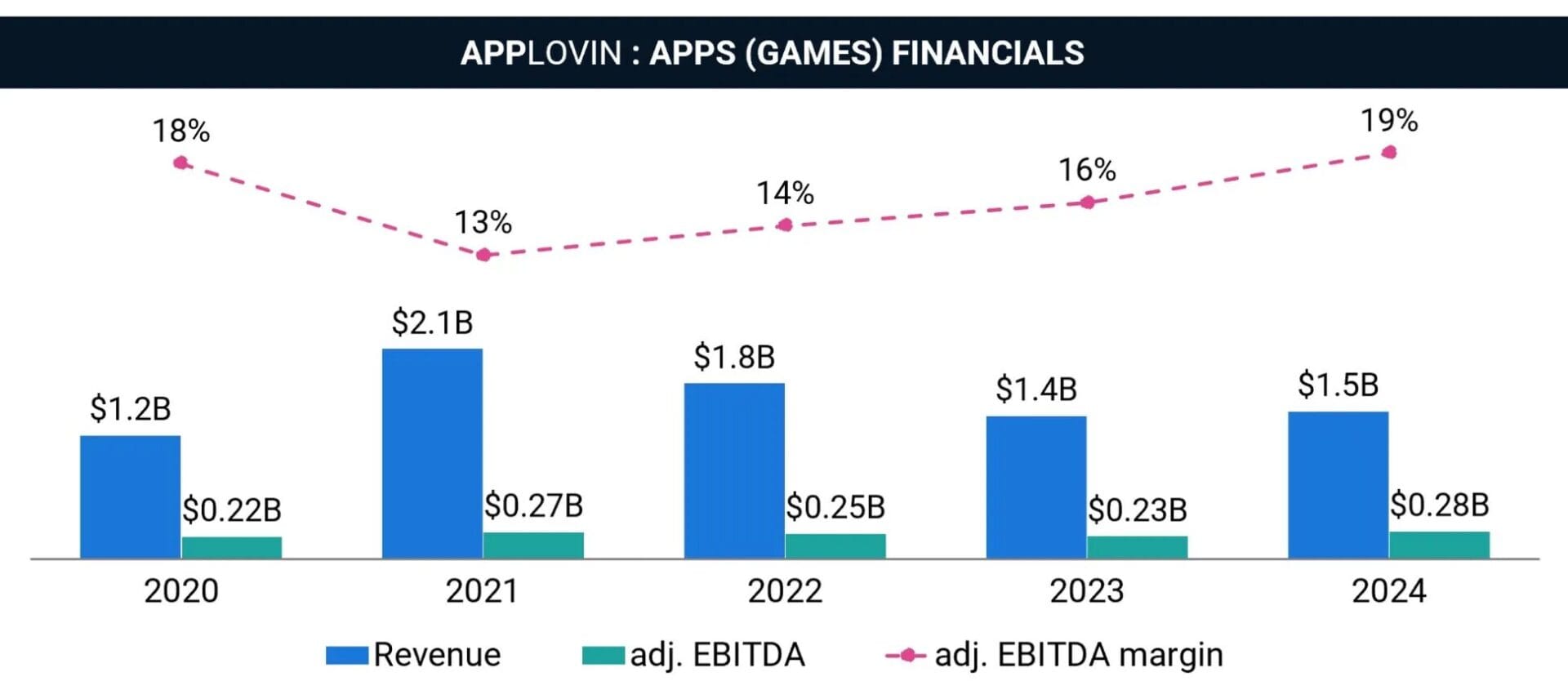

For the past five years, AppLovin has shifted from a mobile gaming-driven business to an ad tech-first company, significantly changing its revenue structure:

- In 2020, apps contributed 86% of revenue ($1.2B) and 65% of EBITDA ($224m).

- In 2024, advertising accounted for 68% of revenue ($3.2B) and nearly 90% of EBITDA ($2.4B), with a 76% EBITDA margin.

| Apps Business | FY2024 | Q4’24 Recurring Revenue |

|---|---|---|

| Revenue | $1,485m | $1,493m |

| YoY growth % | 3.0% | (1.0%) |

| adj. EBITDA | $277m | $285m |

| margin % | 19% | 19% |

Source: AppLovin

Source: AppLovin

Source: AppLovin

As part of its ad tech expansion strategy, AppLovin pursued organic growth and acquisitions to strengthen its position in mobile advertising. The company acquired Max in Sep’18 and MoPub Jan’22 to increase its control over mobile ad mediation. In 2022, AppLovin made a $17.5B bid to acquire Unity, aiming to establish itself as a dominant force in ad tech. However, the bid was ultimately rejected, with Unity opting to merge with ironSource instead.

Meanwhile, AppLovin’s gaming segment remained essentially unchanged. Unlike its major gaming competitors, which continued investing in content development and acquisitions, AppLovin did not pursue further gaming M&A, with Machine Zone (May’20) being its last major gaming acquisition.

The gaming division also faced mounting challenges, including rising competition, post-IDFA user acquisition difficulties, and a volatile revenue performance. Its EBITDA margin also struggled to be optimized and exceeded 20%, peaking at 19% in 2024, primarily due to cost-cutting in user acquisition. Additionally, there is evidence of potential studio closures, as AppLovin had 20 gaming studios in its Q1’22 report but currently lists only 10 studios on its website.

Source: Google Finance

STRATEGIC RATIONALE

The decision to divest its gaming division aligns with AppLovin’s long-term strategic focus on ad tech, a business that has consistently delivered higher growth and stable margins than gaming.

In its Q1’22 report, AppLovin stated that it would treat its gaming business as a separate financial unit rather than an integrated asset. While this did not indicate an immediate decision to sell, it revealed that top management was already evaluating the gaming division’s long-term role within the company. This separation allowed AppLovin to better assess its gaming operations’ financial impact while ensuring that ad tech remained its primary growth driver.

Over time, it became increasingly evident that ad tech provided a more sustainable revenue model, with higher margins and fewer operational risks than mobile gaming, which faced rising competition and growing user acquisition costs in a post-IDFA environment.

CONCLUSION

Divesting its gaming assets is a logical next step for AppLovin. This will allow the company to concentrate fully on its high-margin ad tech business, which continues to show solid growth and fewer forecasted challenges.

With this transaction, AppLovin is completing its transformation into a fully ad tech-focused company, offloading its gaming operations while maintaining a stake in the acquirer, ensuring it retains some exposure to the gaming industry’s future performance.