France-based gaming holding Atari (EURONEXT: ALATA) has agreed to acquire an 82% stake in Sweden-based indie games publisher and developer Thunderful Group (STO: THUNDR) for $5.2m (SEK 50m) through a directed share issue of 333 million new shares at SEK 0.15 per share. The transaction is expected to close by the end of Aug’25 and comes amid Thunderful’s ongoing restructuring and marks Atari’s push to expand its European presence. Additionally, Thunderful has extended its existing $12.1m (€10.5m) revolving credit facility, which was initially secured in 2024, originally set to mature at the end of Dec’25, with revised terms subject to a directed share issue.

The acquisition follows a challenging period for Thunderful, which previously pursued an aggressive M&A strategy across 2020–2021 — acquiring studios and publishers such as Coatsink, Headup Games, Station Interactive, and others. During this period, the group has made 9 acquisitions with a total disclosed value of ~$150m. You can find the full list of Thunderful’s acquisitions since 2020 by subscribing to our Patreon.

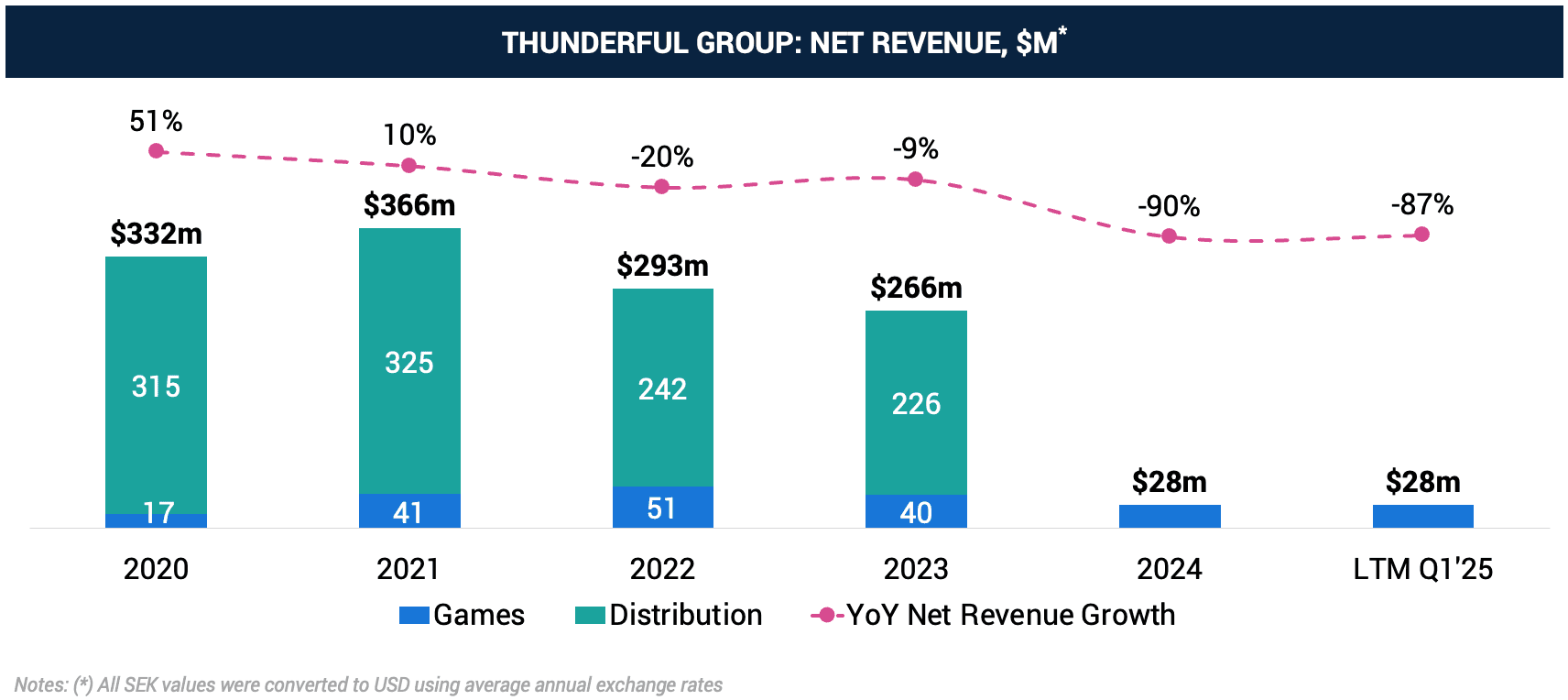

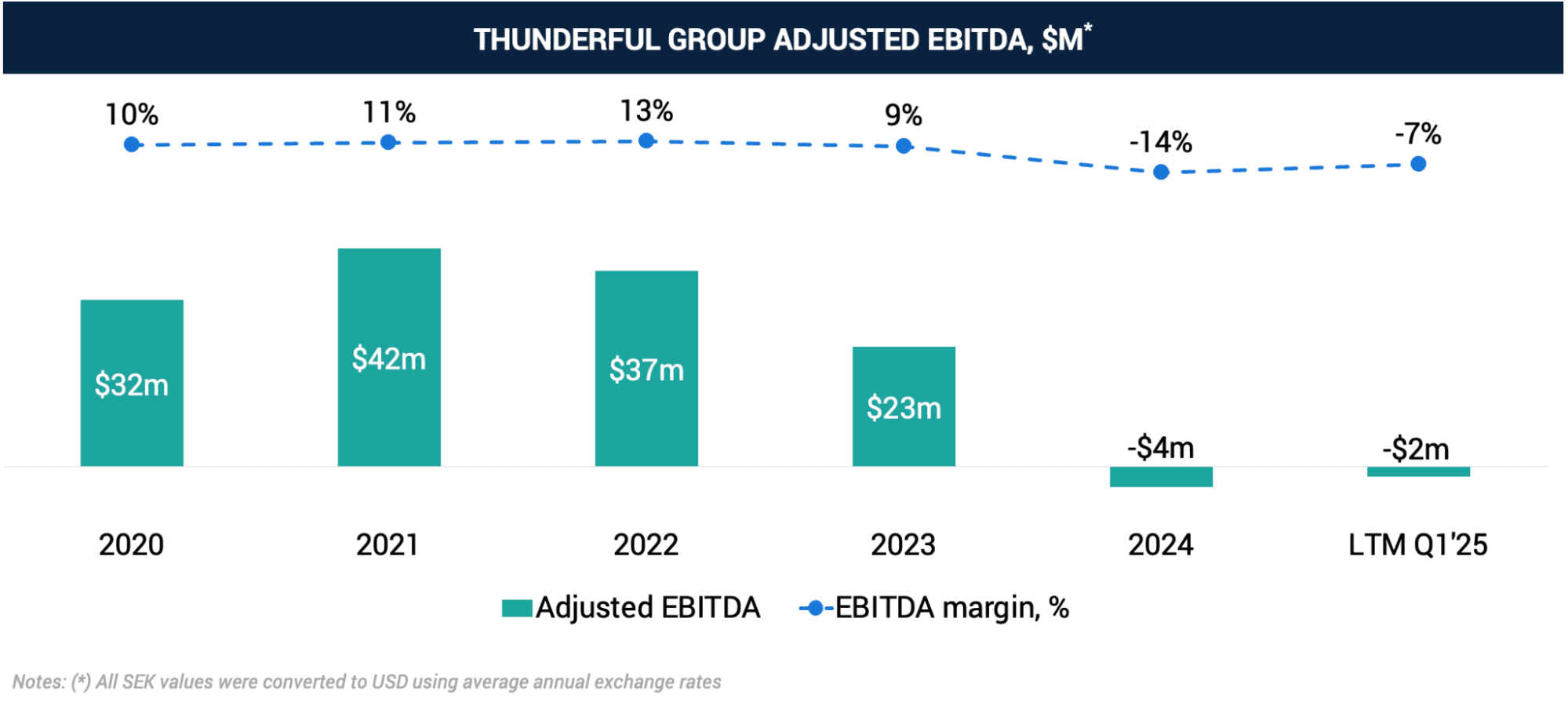

While the roll-up strategy significantly increased Thunderful’s production capabilities, it also increased operational expenses and financial strain. Since 2021, revenue has started to decrease YoY, pushed by a fall in both segments, but dramatically in the distribution. The group decided to exit the distribution segment and focus purely on gaming.

By the middle of 2024, Thunderful has completed a full exit:

- In Apr’24, the company sold its German-based publishing subsidiary, Headup GmbH, to Microcuts Holding, led by Headup’s founder, for a net consideration of $580k (€500k), acquired for $13m in 2021.

- Thunderful also divested its operations in Nordic Game Supply, a Denmark-based distributor of gaming peripherals, for ~$6.98m (SEK 76m) in Apr’24. The buyer, Handelsselskabet af 15 Marts 2024 A/S, is the company owned by Henrik Mathiasen, CEO of Bergsala AB and Nordic Game Supply.

- In Jun’24, Thunderful sold the remaining part of its distribution and toy businesses — including AMO Toys AB, Bergsala Aktiebolag, Thunderful 1 AB, and Thunderful Solutions AB — to Bergsala NDP AB, a holding company controlled by Thunderful’s largest shareholder, Owe Bergsten, and led by Henrik Mathiasen as CEO. The sale closed at ~$59m (SEK 634m) with SEK 595m paid upfront and SEK 39m deferred until mid-2025. The funding was used to settle an existing revolving credit facility from Danske Bank for $63.8m (€55m) and to obtain a new one for $12.1m (€10.5m).

The divestments marked the end of Thunderful’s multi-segment structure and provided a crucial liquidity boost. However, a purely gaming focus has not performed as expected.

By FY’24, Thunderful reported ~$28m (SEK 293m) in revenue but generated -$4m (SEK -41.3m) in adjusted EBITDA, while the EBITDA margin has significantly fallen. The latest release — Lost in Random: The Eternal Die — has had weaker sales than expected.

In response, the company initiated a major restructuring program aimed at achieving ~$4-4.6m (SEK 40–45m) in annual savings by FY’26, including staff reductions and divestitures of non-core assets. CEO Martin Walfisz is expected to step down by year-end.

For Thunderful, the deal provides a much-needed capital injection to stabilize operations and avoid bankruptcy. For Atari, it’s a continuation of its IP-driven expansion strategy — following previous acquisitions including Digital Eclipse and Nightdive Studios — as it continues to scale its publishing and development footprint. With the acquisition, Atari adds Thunderful’s broad portfolio (SteamWorld, Lost in Random, ISLANDERS, Vampire’s Fall) and operational teams across Sweden, Spain, and the UK — expanding its European reach and development capacity.

Following the announcement, Thunderful’s (STO: THUNDR) share price dropped by 61%, closing at SEK 0.24 on Jul’29, while Atari’s (EURONEXT: ALATA) stock remained unchanged.