Weekly News Digest #3

# of announced deals

16

announced deals’ size

$90.1m

# of closed deals

16

Liftoff Files for NASDAQ IPO

US-based mobile app marketing company Liftoff has filed a preliminary S-1 registration statement for a proposed IPO of its common stock on the NASDAQ exchange under the ticker LFTO. The filing does not yet include key details such as offering size, price range, or timing. The company previously explored an IPO in late 2021 before shelving the plans.

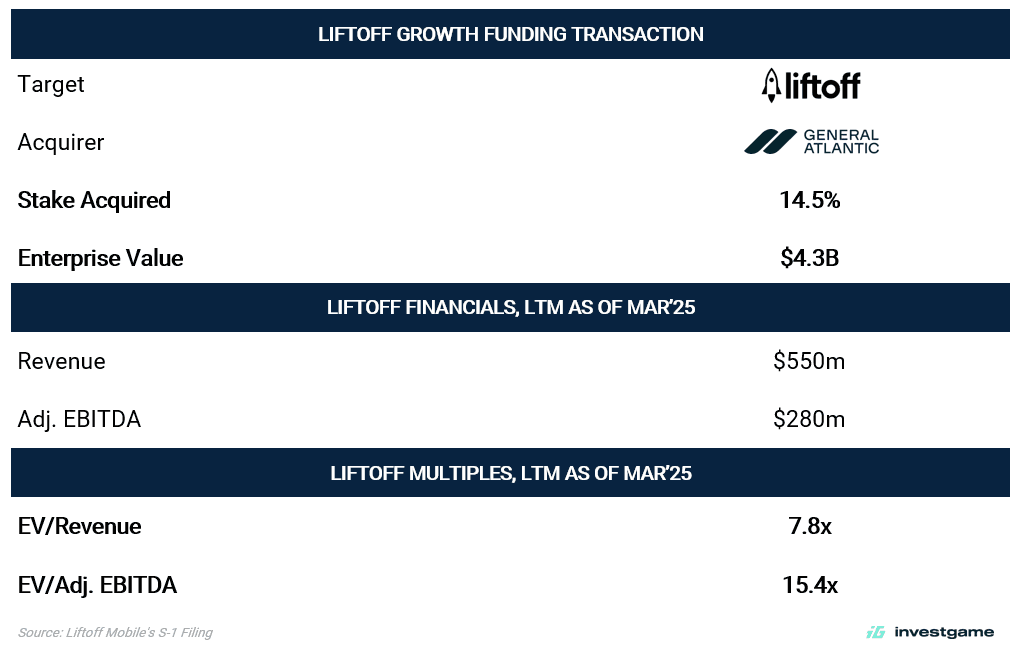

The IPO follows General Atlantic’s acquisition of a 14.5% stake at a $4.3B enterprise value in Jul’25, providing a recent private-market valuation benchmark ahead of the public offering. Based on LTM financials as of Mar’25, this implied multiples of 7.8x EV/Revenue and 15.4x EV/Adj. EBITDA.

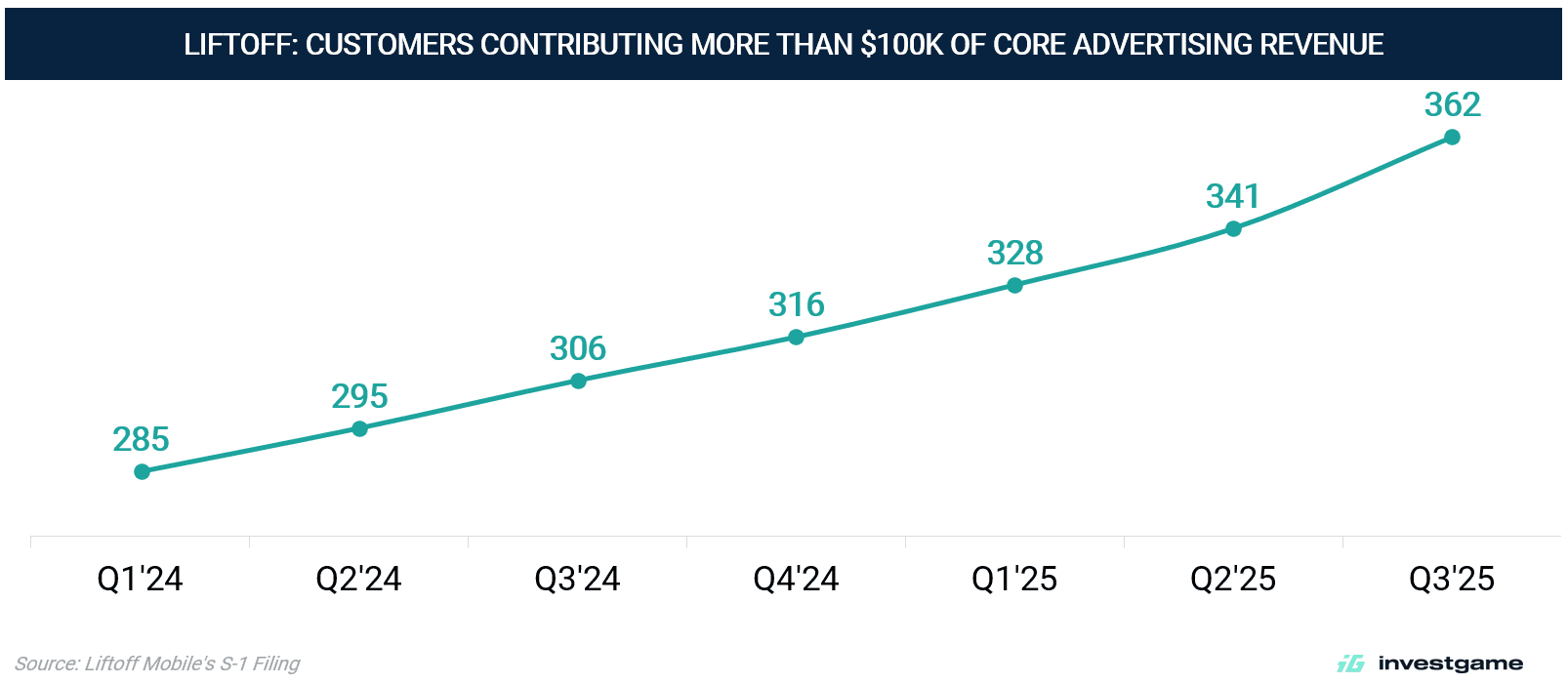

Recent performance indicates accelerating operating momentum. For the nine months ended Sep’25, core advertising revenue increased 43% YoY to $488.5m, while Adjusted EBITDA reached $263.3m (54% margin). In Q3’25, revenue totaled $179.5m with Adjusted EBITDA of $100.3m (56% margin).

The company attributes the improvement to Cortex, its internally developed AI prediction model, which it rolled out beginning in Q4’23 and continuing through early 2025, now processing 21x more data than legacy models. The business has also diversified beyond its gaming roots—slightly more than half of its advertisement revenue now comes from verticals outside gaming, with 33% of supply outside gaming.

STRATEGIC RATIONALE

The company carries $1.86B in total debt and lists debt repayment as the primary use of IPO proceeds. The S-1 confirms that selling stockholders will offer shares alongside the company’s new issuance, though the filing does not disclose the number of shares being sold by existing investors or their identities.

The S-1 also references Liftoff’s track record of identifying and integrating acquisitions, and a public listing may provide additional flexibility over time, including the potential use of equity as consideration for strategic transactions.

Blackstone acquired Vungle in 2019 and made a majority investment in Liftoff in 2020, becoming the controlling shareholder, before merging the two businesses in 2021. The filing indicates Blackstone is expected to retain majority control post-IPO, while the size of any shareholder sell-down should become clearer closer to pricing. General Atlantic invested in Jul’25 at a reported $4.3B valuation, with the filing not providing detailed disclosure on whether it will participate in the secondary sale.

Goldman Sachs, Jefferies, and Morgan Stanley are acting as joint bookrunners, supported by a syndicate of 12 additional bookrunners and 3 co-managers, including Blackstone Capital Markets.

Stay tuned for a full analysis after the filing becomes effective and the final prospectus is issued.

Neon helps game publishers take control of their commerce. Our DTC platform handles everything from webshops and checkout to global payments, tax, and compliance, with full transparency and flat-rate pricing. No black boxes, no restrictions, no surprises. Built by payments, fintech, and gaming veterans, we work hands-on with publishers to optimize revenue and simplify operations. If you’re serious about DTC, we’re serious about helping you win.

| NOTABLE TRANSACTIONS |

MERGERS & ACQUISITIONS

US-based web3 gaming infrastructure company Cartridge Gaming has acquired UK-based web3 gaming studio Playmint for an undisclosed sum. The transaction is intended to strengthen Cartridge’s on-chain game development infrastructure. As part of the deal, Cartridge will integrate Playmint’s Playerchain technology into its Dojo engine. Cartridge develops on-chain gaming infrastructure, including its Controller wallet and Slot rollup service, while Playmint is known for building fully on-chain blockchain games such as Downstream and The Crypt. Cartridge Gaming previously raised a $7.5m Series A round in Aug’24, and Playmint secured $4m in Apr’22.

Germany-based gaming assets marketplace Skinport has acquired the assets of Denmark-based in-game items marketplace SkinBid for an undisclosed sum. The transaction follows SkinBid’s bankruptcy in Nov’25. SkinBid operated as a Counter-Strike 2 skin marketplace. Skinport plans to relaunch the SkinBid platform under its ownership.

France-based esports company Prodigy Agency has merged with Australia-based sports organization Sports Entertainment Group (SEG). The transaction is intended to expand SEG’s operations in esports and gaming. Prodigy Agency founders Jérôme Coupez and Manon Lagarrigue will continue to lead Prodigy Agency as CEO and COO, respectively. As part of the merger, SEG Division Director Rowan Stroo will join the management team.

VENTURE FINANCING

UK-based betting and iGaming company Midnite has secured $35m in a Series C funding round led by The Raine Group, with participation from Play Ventures, Discerning Capital, Makers Fund, and Big Bets. The capital will be used to scale operations, accelerate product development, and support global expansion. Midnite operates a sports betting and casino platform. The round follows the company’s $100m UA financing facility completed in Oct’25.

Türkiye-based casual mobile games developer TaleMonster Games has closed a $30m Series A funding round, which we mentioned back in Dec’25 digest. The round was led by Arcadia Gaming Partners and a16z, with participation from Point72 Ventures and General Catalyst. The funds will support the development of the company’s debut title, Match Valley, a casual puzzle game featuring tower defense elements. The studio secured $7m Seed funding in May’25.

India-based gaming services company Liquidnitro Games has secured a $19.1m Series A funding round led by Northpoint Capital, with participation from Nexus Venture Partners. The new capital will be used to accelerate the development of the company’s AI-driven game production and services platforms, expand partnerships, scale the workforce, and support global growth. Liquidnitro Games is a game production firm specializing in AI-enabled platforms for building, operating, and scaling games for global publishers. The company previously raised $5.25m in a Seed funding round in Mar’24.

Ireland-based play-to-earn platform MoneyTime has secured $3m in a Seed funding round led by Arcadia Gaming Partners. The capital will be used to enhance the platform’s user experience and feature set, advance the product roadmap, and support expansion into new markets. MoneyTime operates a platform that allows users to earn cash rewards by playing games.

France-based crowdinvesting platform Gamevestor has raised $1.16m (€1m) in a funding round led by ForsVC, which contributed $289k (€250k). The round also included participation from LeanSquare with $174k (€150k) and LizardCube CEO Ben Fiquet, who invested $174k (€150k), alongside additional angel investors and public grants from Bpifrance and Initiative Grand Annecy. The funds will support the launch and rollout of a regulated crowd investment platform for video games across Europe, as well as marketing and communication initiatives ahead of the public launch. Founded by EA veteran Ivan Marchand and Ubisoft veteran Arthur Van Clap, Gamevestor is developing a crowdinvestment platform that enables individuals and companies to directly invest in video game projects and participate in their financial upside. The platform is scheduled for public launch in early 2026.

According to SEC filings, US-based web3 games publisher WAGMI has secured $1m from undisclosed investors. WAGMI is the publisher of Panzerdogs, an on-chain PvP tank brawler for mobile and PC platforms. Panzerdogs was developed by Netherlands-based Lucky Kat, with WAGMI serving as the publisher.

UAE-based PC & Console games developer Khosouf Studio has secured $600k in a Seed funding round from Merak Capital. The investment will support the studio’s growth and its planned relocation to Saudi Arabia. Khosouf Studio operates across two business segments: the development and publishing of narrative-driven games for PC & Console and VR, and the provision of non-gaming VR services, including interactive experiences, simulations, and educational solutions.

South Korea-based gaming holding NCSoft (KRX:036570) has made strategic investments in two South Korea-based game developers, Dynamis One and Dexar Studio. The transactions were structured as strategic partnerships focused on long-term collaboration around live service titles. As part of the agreements, NCSoft has secured IP rights and will act as the global publisher for both companies’ upcoming projects: Project AT, an RPG developed by Dynamis One, and Project R, an MMORPG by Dexar Studio. The deals follow NCSoft’s recent acquisition of a 67% stake in mobile games publisher Indygo Group.

France-based mobile games developer One Rule Games has raised a Seed funding round led by Griffin Gaming Partners. The investment will accelerate the development of the studio’s hybrid-casual titles. One Rule Games plans to launch its debut title later this year. The studio was founded by developers who previously worked on Paper.io, Crowd City, and All in Hole, and more than 20 mobile titles.

UK-based investment group EverExcel has made an undisclosed investment in UK-based social gaming platform Couch Heroes. The platform enables players to customize virtual worlds, connect with other gamers, and earn rewards through social gameplay mechanics.

FUNDRAISING

Netherlands-based VC fund e2vc has closed its Fund III at $117m (€100m). The closed fund has committed capital to 10 companies to date. Since its launch in 2016, e2vc has backed more than 50 companies. Recent investments include Loom Games’ Seed round and Cypher Games’ $30m Series A funding round in Oct’25.

PUBLIC OFFERINGS

Canada-based web3 gaming company Boba Mint (CSE: TNJ) has closed a $250k non-brokered private placement, issuing 2.5 million common shares at $0.10 per share. The offering was fully subscribed by Andrew Shore. The proceeds will be used for general working capital purposes and to support game development and platform growth at WERD Studios. The company may complete additional tranches of the offering for aggregate gross proceeds of up to $750k. Boba Mint develops blockchain-based gaming solutions featuring player-owned assets and tokenized gameplay.

OTHER

Saudi Arabia’s Public Investment Fund (PIF) plans to transfer its $12B gaming portfolio to its subsidiary Savvy Games Group. The transfer includes stakes of roughly 10% in Koei Tecmo (TYO:3635), NCSoft (KRX:036570), Nexon (TYO:3659), and Square Enix (TYO:9684), expected once transfers are completed. PIF’s holdings in Nintendo (TYO:7974) and Bandai Namco (TYO:7832) are also part of the transfer. The move consolidates PIF’s gaming assets under Savvy’s governance structure. Savvy stated the transfer does not signal a change in investment strategy and represents a reorganization of holding structures. Savvy is not involved in PIF’s stake related to the proposed $55B Electronic Arts acquisition.

Sweden-based mobile games developer Turborilla has secured $5m in non-dilutive UA financing from Metica. The funding will enable Turborilla to scale user acquisition through performance-based financing, supported by UA and monetization expertise. Turborilla is known for developing mobile racing titles, including Mad Skills Motocross 3, Mad Skills BMX 2, and Mad Skills Rallycross.