Weekly News Digest #49

The $108B Fight for Warner Bros.: A Turning Point for Streaming, IP, and Games

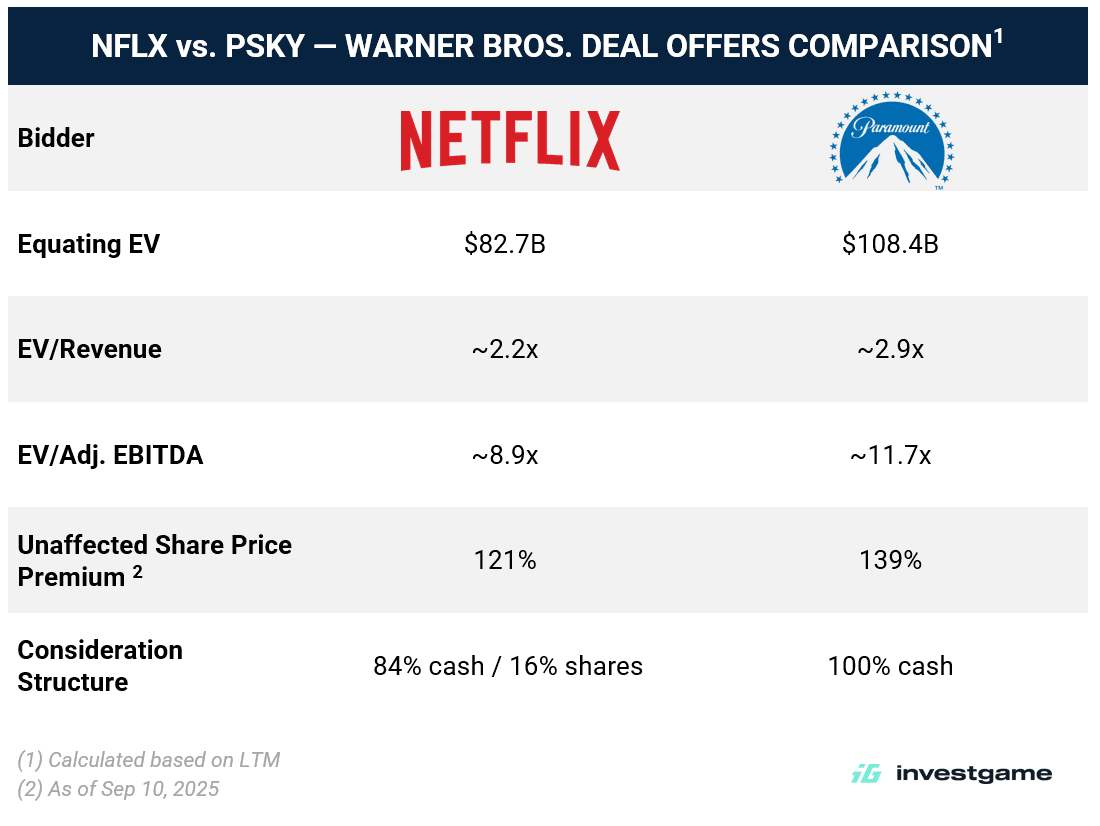

US-based streaming entertainment platform Netflix (NASDAQ: NFLX) has entered into a definitive agreement to acquire US-based media giant Warner Bros. (NASDAQ: WBD) for $27.75 per share, implying a total enterprise value of $82.7B.

Within days of the announcement, the deal was thrown into uncertainty by Paramount (NASDAQ: PSKY), which submitted a hostile all-cash tender offer at $30.0 per share, implying an EV of $108.4B — a 139% premium to the undisturbed share price of $12.54 as of September 10, 2025, before any buyout rumors surfaced. Paramount also claims it had already submitted six proposals over 12 weeks without meaningful engagement from WBD.

Under the Netflix terms of the agreement, each WBD shareholder would receive $23.25 in cash plus $4.50 in Netflix stock, creating a mixed cash-and-equity structure tied partly to Netflix’s future valuation. The structure excludes Warner’s linear TV networks — CNN, Discovery, Eurosport, TNT Sports — which will be carved out into a new publicly listed entity, Discovery Global, prior to closing.

Meanwhile, Paramount is positioning its bid as the simpler, faster-to-close alternative to Netflix’s, proposing to acquire all of Warner Bros. Discovery.

While headlines focus on film, TV, and streaming scale, any of these two proposed transactions would also include one of the largest gaming transactions. Warner Bros. Games — home to Hogwarts Legacy, Mortal Kombat, Game of Thrones: Conquest, and multiple DC and Lego titles — will become a strategic pillar inside whichever streaming ecosystem ultimately wins.

Gaming Angle: Warner Bros. Games

Warner Bros. Games has long behaved like a classic “hit-driven” publisher, with a portfolio anchored by powerful IP but highly uneven quarterly performance. For a buyer like Netflix or Paramount, the core challenge is turning that volatility into a more predictable, subscription-driven, and cross-media monetization engine.

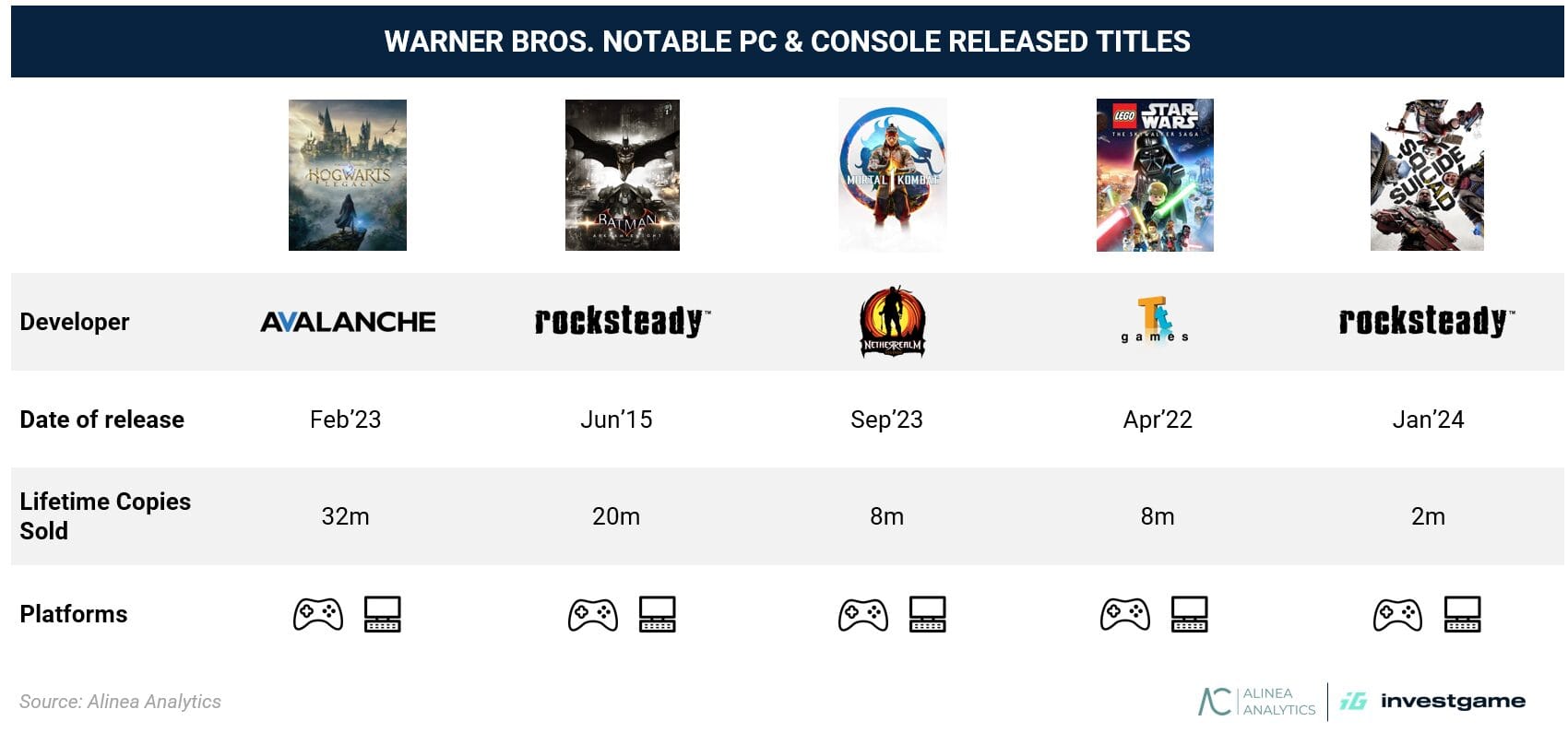

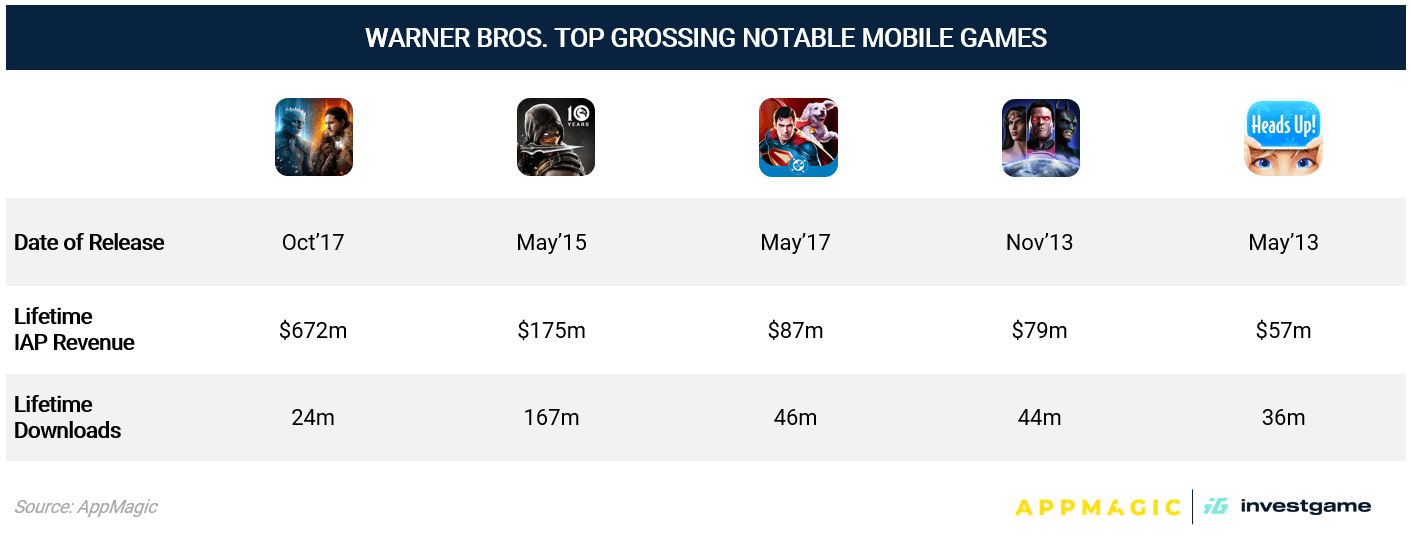

On the upside, WB Games has proven it can deliver global blockbusters across both premium and mobile:

- Hogwarts Legacy: One of 2023’s best-selling PC & console titles, leveraging the Harry Potter IP to surpass 32m units sold and generate over $1B in lifetime revenue. A clear proof point that WB can still execute at the AAA scale with strong transmedia pull.

- Mortal Kombat: One of the most durable fighting game franchises, with more than 80m units sold across the series and strong merchandising and media spillover.

- Game of Thrones: Conquest, operating since 2017 and generating $672m IAP Revenue and reaching 24 million downloads, continues to generate more than $2m IAP monthly revenue and remains a reference case for tying mobile performance to TV release cycles and spin‑offs.

At the same time, the division has stumbled with several live-service bets. Suicide Squad: Kill the Justice League resulted in an impairment of nearly $200m, dragging down late-2024 segment results and highlighting how costly it can be when AAA development strategy drifts from core strengths. In the same year, Multiversus also incurred impairment charges of $100m as engagement fell below expectations.

Negative trendline continued into 2025: for the nine months ended September 30, 2025, WB Games reported a decline in segment revenue, driven primarily by lower carryover from prior-year releases and a lighter launch slate in 2025.

Netflix: Buying a Franchise Engine — and a Ready‑Made Games Business

For Netflix, WBD is primarily about IP depth and studio scale, but gaming is an important secondary motive. The company has been building its own games division with limited commercial impact so far. By acquiring Warner Bros., Netflix gains not only HBO and a century‑deep film and TV library, but also a fully formed games business with proven capabilities in AAA PC & Console, mobile, and IP‑driven development.

The strategic logic is straightforward: leverage Netflix’s 300m+ subscriber base to distribute and promote new shows and films built on Warner IP, while WB Games develops interactive extensions around those same franchises.

On the financial side, Netflix argues the deal will drive higher engagement, incremental revenue, and $2–3B in annual cost synergies by year three, with GAAP EPS accretion by year two.

The company has secured $59B in senior unsecured bridge commitments from Wells Fargo, BNP Paribas, and HSBC to fund the cash portion.

Paramount: Clean Structure, Cash Certainty — and a Games Upside

Paramount presents itself as the “simpler” alternative. Rather than carve around linear TV, it proposes to buy 100% of WBD, including networks, and integrate them into an enlarged Hollywood studio and direct-to-consumer group.

Strategically, Paramount sees a chance to combine its own IP (film, TV, sports) with Warner’s slate and HBO Max to strengthen its direct-to-consumer group position versus Netflix, Disney, and Amazon. The company also stresses its commitment to theatrical releases and its existing sports portfolio as differentiators.

Gaming fits into that picture as a leveraged growth driver rather than a side business. Bringing Paramount IPs together with Warner Bros. Games’ development expertise would give the combined group a credible pipeline for licensed titles across console, PC, and mobile, while keeping WB Games multi‑platform. In practice, that means using the games business to support a more indebted balance sheet, but with potentially broader IP to work with.

The bid is fully backed by equity from the Ellison family and RedBird Capital, and $54B in committed debt financing from Bank of America, Citi, and Apollo. As with Netflix, the offer is not subject to a financing condition.

Industry Perspective

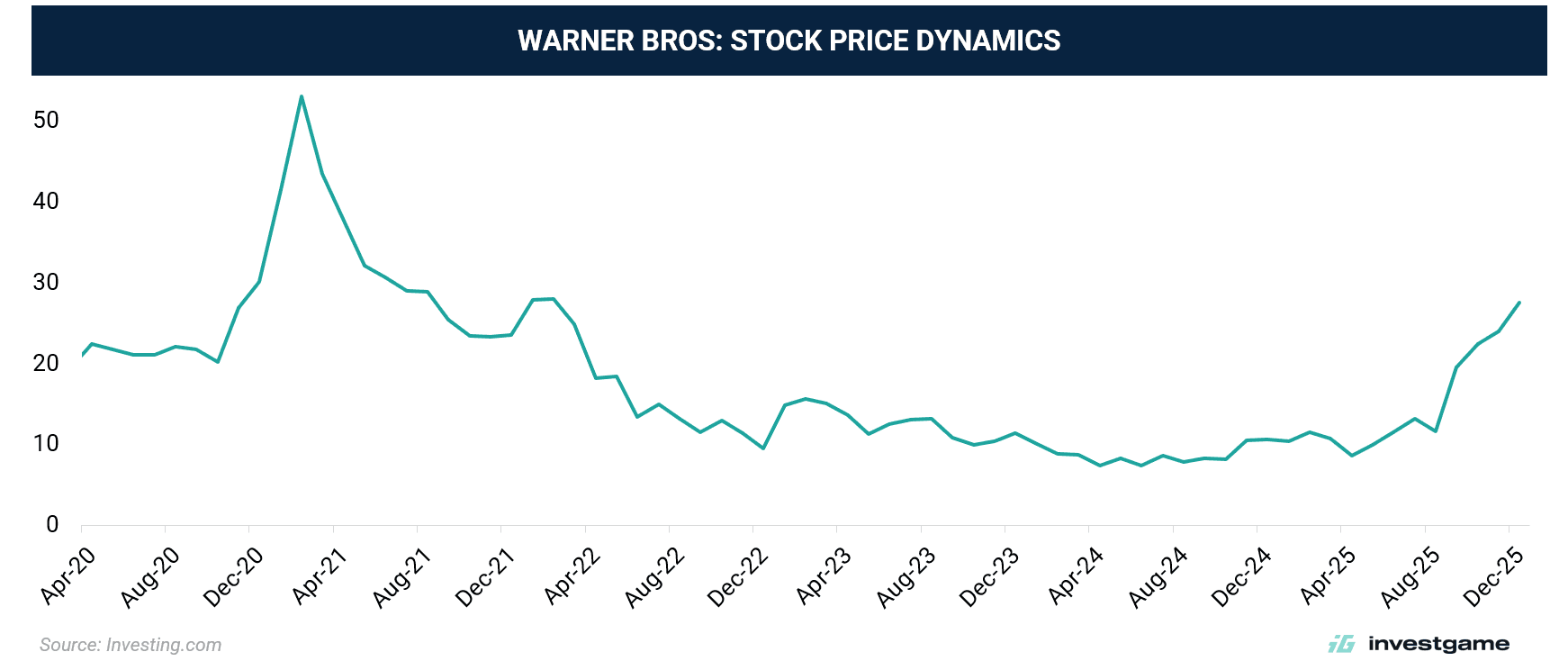

Both bids imply a significant re-rating of Warner Bros. versus its recent trading levels, driven largely by the depth of its IP stack (DC, Harry Potter, Looney Tunes, Game of Thrones). The market reaction reflects this: following the announcements, WBD shares moved sharply higher and are now trading close to the $30.0 level.

At the same time, this takeover battle is one of the clearest signs yet that the streaming wars are shifting into a true consolidation phase. The Netflix–Paramount contest for Warner Bros. isn’t just about adding subscribers — it’s about securing full-stack ownership of film, TV, and games under one roof. In both scenarios, interactive content moves closer to the center of the strategy, not as a standalone vertical but as a core layer in how major media groups build, defend, and monetize their IP portfolios.

We thank NEON for supporting this digest.

| NOTABLE TRANSACTIONS |

MERGERS & ACQUISITIONS

Singapore-based PC & Console publisher 4Divinity, a subsidiary of GCL Global Holdings (NASDAQ: GCL), has secured a $3m strategic investment from ADATA Technology in exchange for approximately 1.2% equity in the company. The funds will support the launch of upcoming titles, including Showa American Story and The Defiant. 4Divinity has published more than 18 titles, including S.T.A.L.K.E.R. 2: Heart of Chornobyl, Black Myth: Wukong, and Huntdown.

US-based streaming entertainment platform Netflix (NASDAQ: NFLX) is divesting its US-based indie game developer, Spry Fox, to the studio’s founders. The deal is part of the corporation’s shift in gaming strategy. Spry Fox has developed eight titles, including its latest release, Cozy Grove: Camp Spirit, which launched exclusively on Netflix. The studio is currently developing an MMO titled Spirit Crossing. Netflix originally acquired Spry Fox in Oct’22 for an undisclosed sum.

VENTURE FINANCING

According to the SEC filings, Türkiye-based casual mobile game developer TaleMonster Games — founded by former Peak Games veterans — has raised $30m from undisclosed investors. The studio is the developer of the Match-3 title Match Valley. This transaction follows the company’s $7m funding round in May’25.

UK-based coaching gaming app Track Titan has secured $5m in a Seed funding round led by Partech Partners and Game Changers Ventures, with participation from Sequel, APX, and angel investors. The funds will support the company’s operational expansion and further development of its platform. Track Titan is an online coaching platform for sim racing and supports titles such as F1, iRacing, and Assetto Corsa. The platform has attracted 200k users since its launch in 2021. Track Titan is a consumer-facing brand of Titan Academy, which raised a $1m Seed funding round in Jan’23.

According to the SEC, US-based games developer Psychedelic Games has secured $3.3m from undisclosed investors. The studio is developing Golden Tides, a pirate-themed PvP adventure MOBA.

Singapore-based user acquisition financing platform PvX Partners has raised $4.7m in a Seed extension round led by Z Venture Capital, with participation from Drive by DraftKings, General Catalyst, Play Ventures, and StoryHouse Ventures. The funds will support the development of the company’s cohort intelligence and underwriting data platform, PvX Lambda. PvX Partners provides non-dilutive UA financing for apps and games, supported by proprietary data technologies. The company has surpassed $250m in committed UA financing across its first 20 gaming and consumer app partners. In Mar’25, PvX Partners secured a $3.8m Seed round. For additional context and deep research on UA, you can check our report at the link.

Israel-based mobile tech company Tapp has secured undisclosed funding in a round led by TIRTA Ventures and Remagine Ventures. Tapp provides mobile engagement solutions, including screen widgets, Live Activities, messenger-based engagement tools, and push notifications.

UK-based games developer Eteo has secured an undisclosed investment from Outersloth. The funds will support the development of the studio’s debut title, planned for release in 2027. Eteo was founded by Gregorios Kythreotis, former creative director of Sable and co-founder of Shedworks.