Weekly News Digest #50

Coffee Stain Goes Public as Embracer Completes Its Spin-Off Cycle

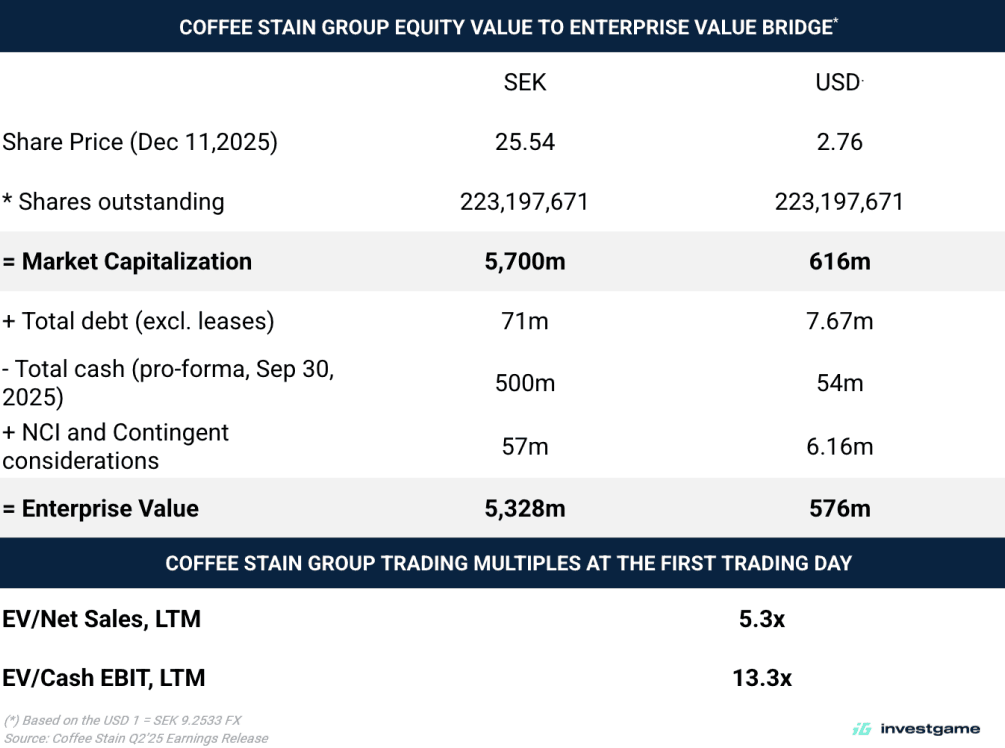

Sweden-based games developer Coffee Stain Group has listed on Nasdaq First North Premier Growth Market with a $616m (SEK 5.7B) market cap under the ticker COFFEE B. The company issued a total of 223,197,671 shares (9,000,000 class A, 214,197,671 class B).

At the moment of listing, Coffee Stain’s top 5 shareholders were Lars Wingefors with 20.10% of capital and 41.37% of votes, Savvy Games Group with 7.46%, DNB Asset Management with 7.09%, Matthew Karch, co-founder of Saber Interactive, with 5.57%, and Alecta Tjanstepension with 3.02%.

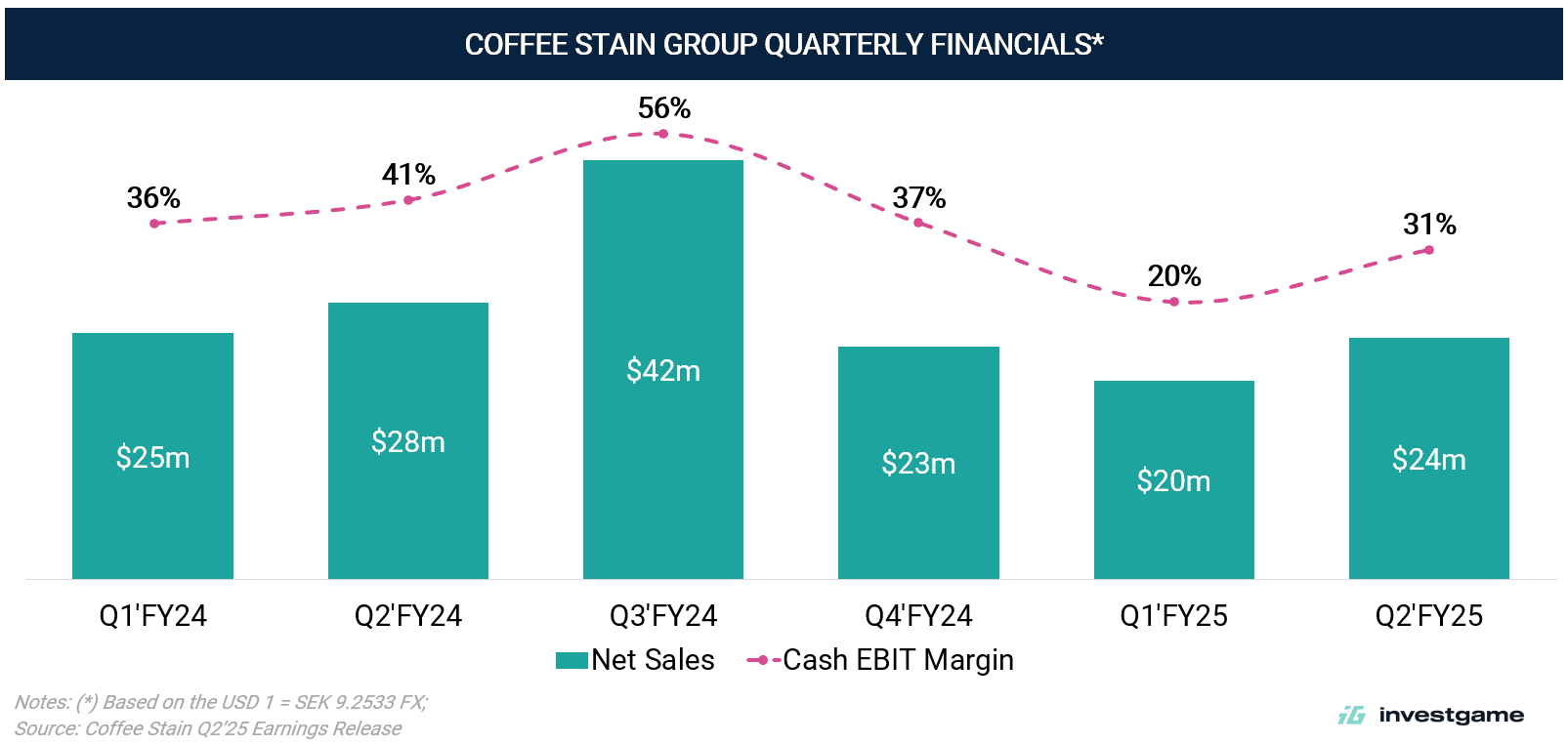

The company reported net sales of $104m (SEK 1.1B) and adjusted EBIT of $52m (SEK 544m) for FY 2024/25, representing a 50% margin and reflecting an organic revenue decline of 7% YoY in H1’25.

The new entity consists of approximately 250 employees across 13 studios: Coffee Stain Studios, Coffee Stain North, Coffee Stain Göteborg, Coffee Stain Malmö, Box Dragon, Lavapotion, Easy Trigger, Invisible Walls, Ghost Ship Games, Tuxedo Labs, ACE (A Creative Endeavor), Kavalri Games, and Frame Break.

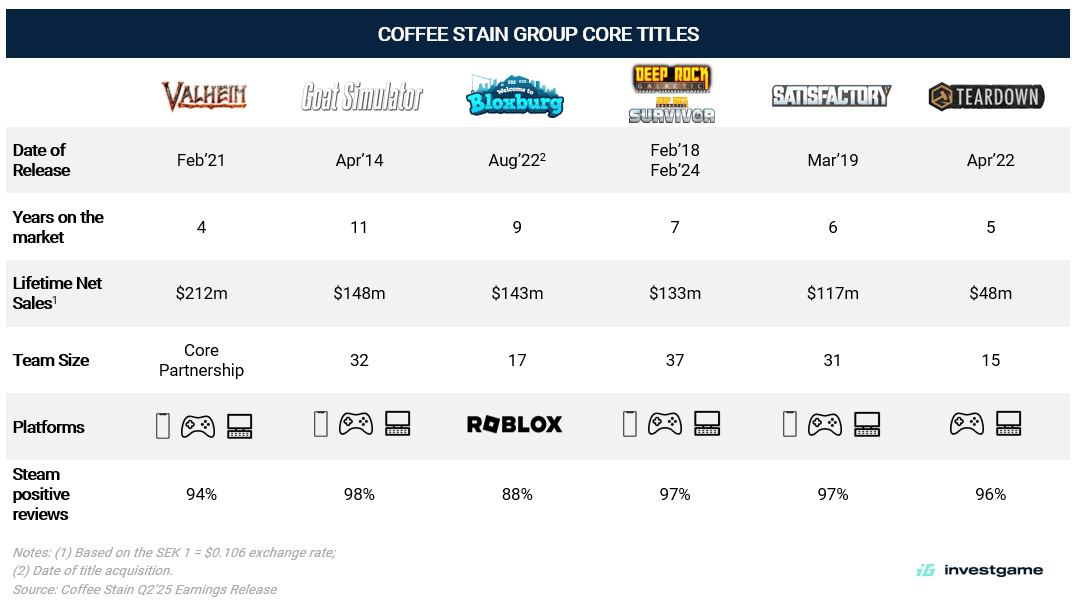

Coffee Stain was divested as part of Embracer Group’s restructuring program, which aimed to streamline the group and allow each division to focus on its respective strategy. The direct listing of Coffee Stain follows the Asmodee listing in Apr’25. Coffee Stain Group will focus on developing and expanding PC & Console indie and AA projects, prioritizing their six core IPs while selectively investing in new titles. The company’s 90% of revenue has been driven by 6 major franchises: Goat Simulator, Satisfactory, Deep Rock Galactic, Valheim, Teardown, and Welcome to Bloxburg.

Strategic Rationale

The Coffee Stain listing marks the final phase of Embracer Group’s restructuring, completing the separation into three independent entities. The separation enables Coffee Stain to operate with an independent capital structure and pursue strategic opportunities aligned with its indie/AA focus, while offering investors direct exposure to PC/Console indie publishing and development business. This is a shareholder value-creation approach validated by Embracer’s successful completion of the Asmodee spin-off earlier in 2025.

We thank NEON for supporting this digest.

| NOTABLE TRANSACTIONS |

MERGERS & ACQUISITIONS

Türkiye-based software company Link Bilgisayar has invested $2m in Türkiye-based metaverse developer Abrakadabra Games, acquiring a 20% stake through a capital injection. The transaction aims to strengthen Link Bilgisayar’s position in in-game and digital entertainment solutions. The investment will support Abrakadabra Games’ development initiatives and data capabilities, including player-behavior modeling and cloud-based gaming infrastructure. In Nov’25, Abrakadabra Games sold a 5% minority stake to MİA Teknoloji for $500k.

China-based tech giant Tencent Holdings (SEHK: 700) has completed the divestment of UK-based PC & Console games developer Bulkhead Interactive to a newly formed UK-based consortium, Super Media Group, backed by everplay group and HIRO Capital. As part of the transaction, everplay has acquired a 20% minority stake in Super Media Group for $2.7m (£2m) with an implied valuation equal to $13.5m. Bulkhead, best known for Battalion 1944, is currently developing a new IP, Wardogs, to be published by Team17, a division of everplay. Splash Damage acquired Bulkhead in Dec’22; Bulkhead was subsequently separated from Splash Damage’s operating perimeter in 2025, ahead of Splash Damage’s own divestment from Tencent in Sep’25.

VENTURE FINANCING

According to SEC filings, US-based PC & Console games developer Fictions (formerly Private Division) has secured $16.7m from undisclosed investors. The studio is the developer of LEGO® Party! and is currently working on Armatus and Beast of Reincarnation, both scheduled for release in 2026. The studio was reportedly divested from Take-Two Interactive Software to Haveli Investments in Nov’24.

UK-based graphical technology company Gracia AI has raised $1.7m from EWOR. The funds will be used to expand operations, scale the engineering team, and further develop the company’s technology and production processes. Gracia AI is developing AI-powered 4D Gaussian Splatting volumetric video infrastructure, including cloud-based processing, editing tools, and production-grade plugins for Unity and Unreal Engine. The technology targets use cases across XR, VFX, gaming, advertising, and next-generation creative tools. Gracia AI previously raised $1.2m in 2024.

UAE-based mobile games developer Hypemasters has secured $1m in a funding round led by Impact46, with additional participation from GEM Capital. The funds will support the development of the company’s new strategy titles and its expansion across the MENA region, including the opening of new offices in Saudi Arabia. Hypemasters focuses on strategy games for mobile platforms. Its portfolio includes World War Armies, released in 2022, which has reached $5.2m in lifetime IAP revenue and 6 million downloads. The company has completed four funding rounds to date, including a $3.25m Seed round in Jun’22.

Saudi Arabia-based game tech company Qwacks has secured $480k in a pre-Seed funding round led by Merak Capital. The funds will support the development of the company’s full game development cycle technology layer. This layer consists of three components: Flock, a backend services suite; Protokite, an AI-powered playtesting platform; and DataDuck, a product focused on market insights.

Poland-based real money gaming company EasyWin has secured undisclosed Seed funding at a $15.5m valuation from Velo Partners, Vladimir Nikolsky, and a group of angel investors. The funds will support the company’s global expansion. Founded by former UAE-based casual mobile games developer Mamboo Entertainment executive Ivan Leshkevich, EasyWin is developing a tournament platform for casual puzzle games, offering real money prizes. The platform currently has 35 thousand daily active users. As of Oct’25, it reached a $30m annualized GMV run rate, with a reported 55.0% Day-30 payer retention rate, and is active across the US, Germany, the UK, Canada, and Australia.

FUNDRAISING

UK-based venture capital firm HIRO Capital has launched HIRO III, a European scaleup VC fund. The fund will target UK and European companies operating in Spatial AI & Cloud, Autonomy & Robotics, Space & Defence, Augmentation & Longevity, and games and interactive technologies. HIRO III will provide between $5.85m and $58.5m per company (€5m–€50m), with initial investments expected in 2026. The fund will be managed by HIRO Capital’s founding partners — Luke Alvarez, Cherry Freeman, and Sir Ian Livingstone CBE — and is now joined by former President, Global Affairs at META, and former UK deputy Prime Minister, Sir Nick Clegg. HIRO Capital’s previous fund, HIRO Capital II, was raised in Feb’22 at $326m, with its most recent disclosed investment being a $629k pre-Seed round in Meeple Corp.

PUBLIC OFFERINGS

Japan-based mobile games developer KLab (TSE: 3656) intends to raise $32.9m (¥5.1B) through a third-party allocation to United Capital Investments Group, Sun Asterisk, Six Cents, and JT Financial Limited Partnership. The transaction is expected to close on Dec’23, 2025. KLab will issue 11.75m shares — 9.75m to UCI, and 1m each to Sun Asterisk and JT Financial — at about $1.38 (¥207) per share, plus 2m shares to Six Cents at about $1.48 (¥222). The deal also includes 107,500 fixed-price warrants (10.75m shares) for UCI and JT Financial at $1.38 (¥207). If all components of the transaction are completed and all warrants are exercised, UCI would own approximately 23.2% of KLab and become its largest shareholder. KLab is known for the development of anime mobile game adaptations Bleach: Brave Souls, Captain Tsubasa: Dream Team, and Love Live! School Idol Festival.

| Report Date | Company Name | Earnings Release Presentation | Share Price Dynamics (Report Date vs. 14-Dec) |

|---|---|---|---|

| 2025-12-08 | Coffee Stain Group | Coffee Stain Q2’FY25 | (18%) |