Weekly News Digest #31

# of announced deals

7

announced deals’ size

$85m

# of closed deals

6

Atari Acquires 82% Stake in Thunderful for $5.2m

France-based gaming holding Atari (EURONEXT: ALATA) has agreed to acquire an 82% stake in Sweden-based indie games publisher and developer Thunderful Group (STO: THUNDR) for $5.2m (SEK 50m) through a directed share issue of 333 million new shares at SEK 0.15 per share. The transaction is expected to close by the end of Aug’25 and comes amid Thunderful’s ongoing restructuring and marks Atari’s push to expand its European presence. Additionally, Thunderful has extended its existing $12.1m (€10.5m) revolving credit facility, which was initially secured in 2024, originally set to mature at the end of Dec’25, with revised terms subject to a directed share issue.

The acquisition follows a challenging period for Thunderful, which previously pursued an aggressive M&A strategy across 2020–2021 — acquiring studios and publishers such as Coatsink, Headup Games, Station Interactive, and others. During this period, the group has made 9 acquisitions with a total disclosed value of ~$150m. You can find the full list of Thunderful’s acquisitions since 2020 by subscribing to our Patreon.

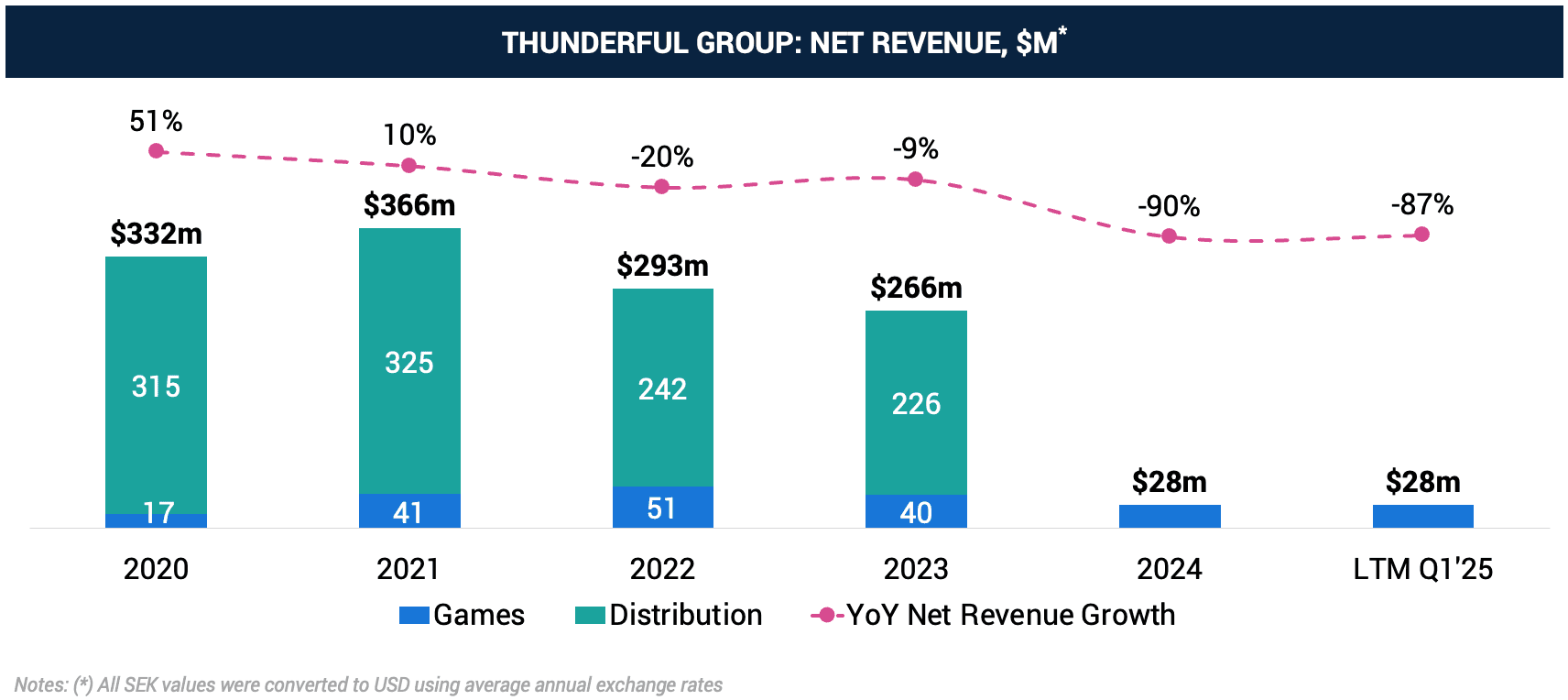

While the roll-up strategy significantly increased Thunderful’s production capabilities, it also increased operational expenses and financial strain. Since 2021, revenue has started to decrease YoY, pushed by a fall in both segments, but dramatically in the distribution. The group decided to exit the distribution segment and focus purely on gaming.

By the middle of 2024, Thunderful has completed a full exit:

- In Apr’24, the company sold its German-based publishing subsidiary, Headup GmbH, to Microcuts Holding, led by Headup’s founder, for a net consideration of $580k (€500k), acquired for $13m in 2021.

- Thunderful also divested its operations in Nordic Game Supply, a Denmark-based distributor of gaming peripherals, for ~$6.98m (SEK 76m) in Apr’24. The buyer, Handelsselskabet af 15 Marts 2024 A/S, is the company owned by Henrik Mathiasen, CEO of Bergsala AB and Nordic Game Supply.

- In Jun’24, Thunderful sold the remaining part of its distribution and toy businesses — including AMO Toys AB, Bergsala Aktiebolag, Thunderful 1 AB, and Thunderful Solutions AB — to Bergsala NDP AB, a holding company controlled by Thunderful’s largest shareholder, Owe Bergsten, and led by Henrik Mathiasen as CEO. The sale closed at ~$59m (SEK 634m) with SEK 595m paid upfront and SEK 39m deferred until mid-2025. The funding was used to settle an existing revolving credit facility from Danske Bank for $63.8m (€55m) and to obtain a new one for $12.1m (€10.5m).

The divestments marked the end of Thunderful’s multi-segment structure and provided a crucial liquidity boost. However, a purely gaming focus has not performed as expected.

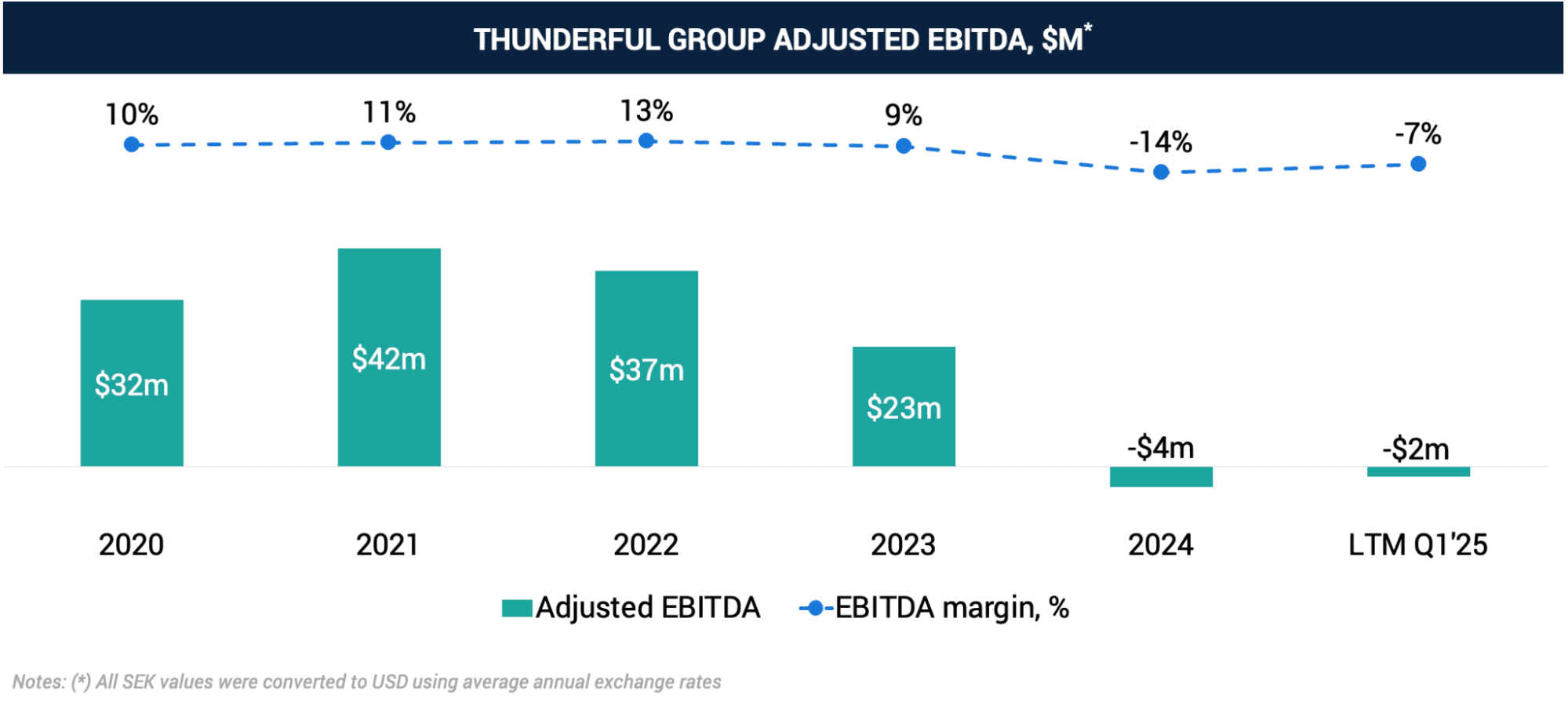

By FY’24, Thunderful reported ~$28m (SEK 293m) in revenue but generated -$4m (SEK -41.3m) in adjusted EBITDA, while the EBITDA margin has significantly fallen. The latest release — Lost in Random: The Eternal Die — has had weaker sales than expected.

In response, the company initiated a major restructuring program aimed at achieving ~$4-4.6m (SEK 40–45m) in annual savings by FY’26, including staff reductions and divestitures of non-core assets. CEO Martin Walfisz is expected to step down by year-end.

For Thunderful, the deal provides a much-needed capital injection to stabilize operations and avoid bankruptcy. For Atari, it’s a continuation of its IP-driven expansion strategy — following previous acquisitions including Digital Eclipse and Nightdive Studios — as it continues to scale its publishing and development footprint. With the acquisition, Atari adds Thunderful’s broad portfolio (SteamWorld, Lost in Random, ISLANDERS, Vampire’s Fall) and operational teams across Sweden, Spain, and the UK — expanding its European reach and development capacity.

Following the announcement, Thunderful’s (STO: THUNDR) share price dropped by 61%, closing at SEK 0.24 on Jul’29, while Atari’s (EURONEXT: ALATA) stock remained unchanged.

Good Job Games Raises $60m Series A to Fuel Mobile Growth

Istanbul-based mobile studio Good Job Games has secured $60m in Series A funding, co-led by Menlo Ventures and Anthos Capital, with additional participation from Bessemer Venture Partners. The new funds will support the continued growth of the studio’s core Match-3 title, Match Villain. The round brings the company’s total funding to $83m, following a $23m Seed round closed in Mar’25.

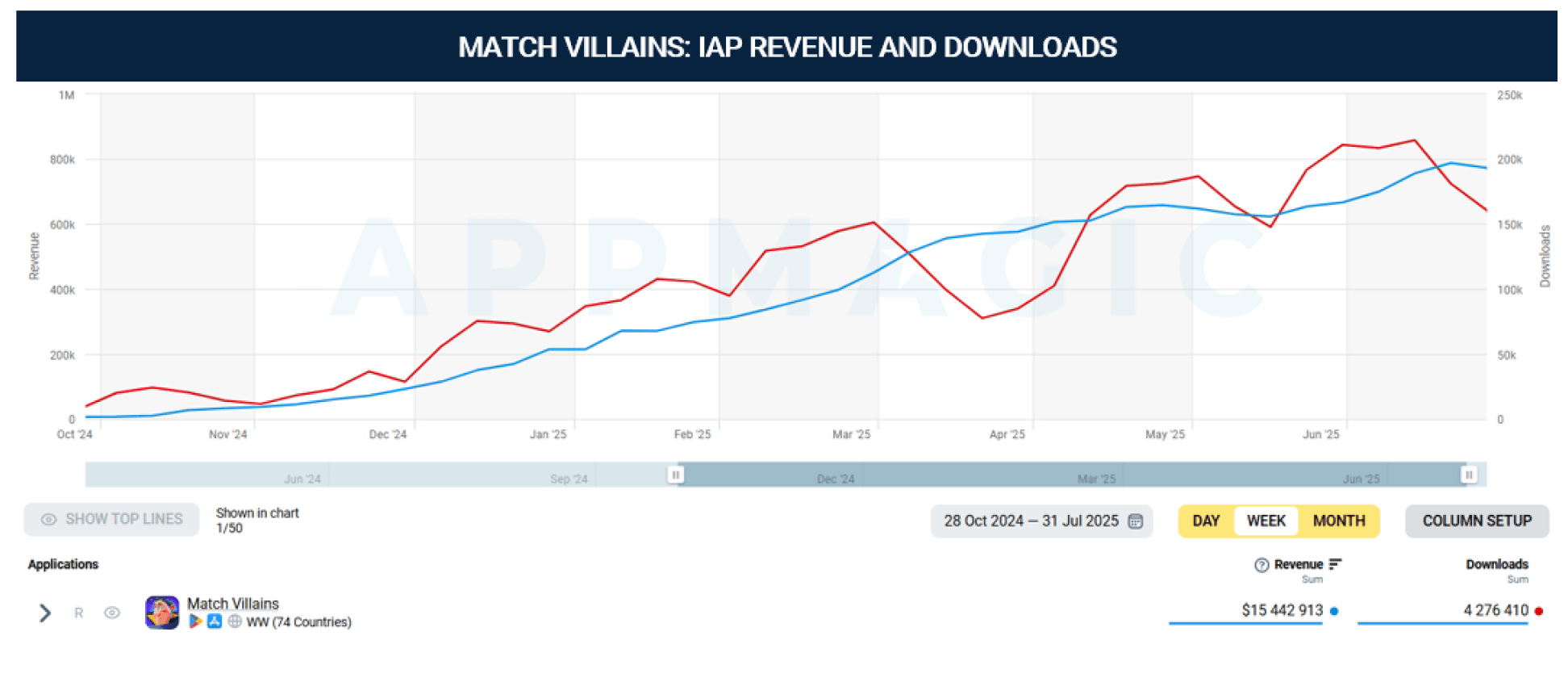

Good Job Games has quickly gained traction in the casual mobile space — with the Match Villains generating $15.6m in IAP revenue and reaching 4.3 million downloads since the global launch of the game in Nov’24, according to AppMagic. Notably, $12.7m in revenue and 3.2 million of those installs came after the Seed round, reflecting a strong post-funding growth trajectory.

Source: AppMagic

As part of a broader strategic shift, Good Job Games has sold its hypercasual portfolio in 2023 to UAE-based AI Games FZ, signaling a move away from high-volume, ad-driven titles. The pivot highlights a larger trend among Turkish developers — evolving toward long-term IAP-driven franchises with deeper retention systems.

With its focus on casual puzzle mechanics and scalable monetization, Match Villains continues to benefit from the Match-3 genre’s proven metrics — including high ARPU potential, efficient payback periods, and predictable performance curves. The deal also reflects broader market dynamics highlighted in our recent feature, The Great Mobile Reversal — where M&A activity continues to concentrate around mobile studios demonstrating operational maturity and reliable monetization models.

For investors, the round reflects a growing appetite for mobile studios demonstrating strong monetization fundamentals with room for marketing efficiency gains. Good Job Games showed clear post-Seed momentum — increasing revenue while lowering CPI — a profile that continues to attract strategic and financial backers looking for scalable, performance-driven models in mobile gaming.

The deal also continues the momentum for Turkey’s mobile gaming ecosystem, which has become one of the most active globally. With multiple breakout studios such as Dream Games, Peak Games, and Spyke, the region remains a key investment hub for mobile gaming. For more on Turkey’s evolution as a gaming powerhouse, check our feature: Five Years of the Rising Gaming Empire: Türkiye.

PvX Partners: The Leading Growth Platform for Scaling Mobile Games

PvX Partners empowers gaming and consumer app developers with capital and intelligence to scale their user acquisition effectively.

The PvX Lambda platform drives this by delivering advanced cohort analytics, real-time ROAS benchmarking, and financial projections, enabling teams to optimize performance and make informed decisions.

These insights power PvX Capital, which provides non-dilutive funding to grow UA spend without impacting your cash balance. Teams can confidently scale campaigns, maintain their cash position, and increase long-term ROI — all without giving up equity.

With seamless data integration and ongoing funding eligibility checks, PvX offers the infrastructure for sustainable, profitable growth.

👉 Visit PvX Partners to Learn More

| NOTABLE TRANSACTIONS |

MERGERS & ACQUISITIONS

Ireland-based mobile games developer Playrix has acquired a 2.11% stake in China-based gaming company iDreamSky for $5m (HKD 39m) through its subsidiary PLR Worldwide Sales. The deal involved the purchase of approximately 38.08 million shares at $0.13 (HKD 1.024) per share. The strategic investment is intended to reinforce Playrix’s position in the Chinese market. iDreamSky is the publisher of Gardenscapes and Homescapes in the Chinese market for Playrix.

VENTURE FINANCING

India-based web3 esports and social gaming platform STAN has raised $8.5m in a funding round backed by Bandai Namco (T:7832), Square Enix (T:9684), Reazon Holdings, AI Futures Fund, Aptos Labs, General Catalyst, and GFR Fund. The company plans to use the proceeds to expand across India and other mobile-first markets, while enhancing its AI personalization capabilities, creator toolkits, and publisher integrations to support gaming communities. STAN is a voice-led social platform focused on Gen Z users, enabling creators to build and monetize gaming communities through features such as Clubs, live game integrations, and creator infrastructure. In Sep’24, Indian gaming company Nazara Technologies (NSE: NAZARA) acquired a 15.86% stake in STAN for $2.2m.

Web3 games developer Inutan Studio has raised $5m in a Seed funding round led by Folius Ventures, The Spartan Group, and Beam FDN, with additional participation from Animoca Brands. The proceeds will be used to expand the core systems of the company’s flagship title, Aria, and to develop the infrastructure for a tokenized in-game economy. Inutan Studio is currently working on a mobile open-world RPG.

UK-based game development tool provider JECO has raised $1.3m in a pre-Seed funding round. The investment was led by the British Business Bank’s Regional Angels Programme, with participation from The Games Angels, Innovate UK, and Creative UK’s Creative Enterprise programme. The proceeds will be used to support team expansion, product development, and partnership initiatives. JECO is developing an automated toolset designed to streamline game development by minimizing repetitive tasks. The solution aims to enhance production efficiency, enabling developers to deliver higher-quality and more sustainable games within shorter timeframes.

South Korea-based mobile games developer iDaNote has secured an undisclosed investment from Boğaziçi Ventures. The funding will support the company’s growth initiatives. Founded in 2022 by a veteran of Netmarble and Nexon, the studio has developed two mobile casual titles — Coingrid and Bubble Monster.

| Report Date | Company Name | Earnings Release Presentation | Share Price Dynamics (Report Date vs. 03-Aug) |

|---|---|---|---|

| 2025-07-29 | Krafton | Krafton Q2’FY25 | (7%) |

| 2025-07-29 | Electronic Arts | EA Q1’FY26 | 6% |

| 2025-07-30 | Capcom | Capcom Q1’FY26 | (7%) |

| 2025-07-30 | Microsoft | Microsoft Q4’FY25 | 2% |

| 2025-07-31 | Roblox | Roblox Q2’FY25 | (9%) |

| 2025-08-01 | Nintendo | Nintendo Q1’FY26 | 1% |