Weekly News Digest #7

# of announced deals

30

announced deals’ size

$172m

# of closed deals

30

Haveli Investments Acquires Budge Studios from General Atlantic

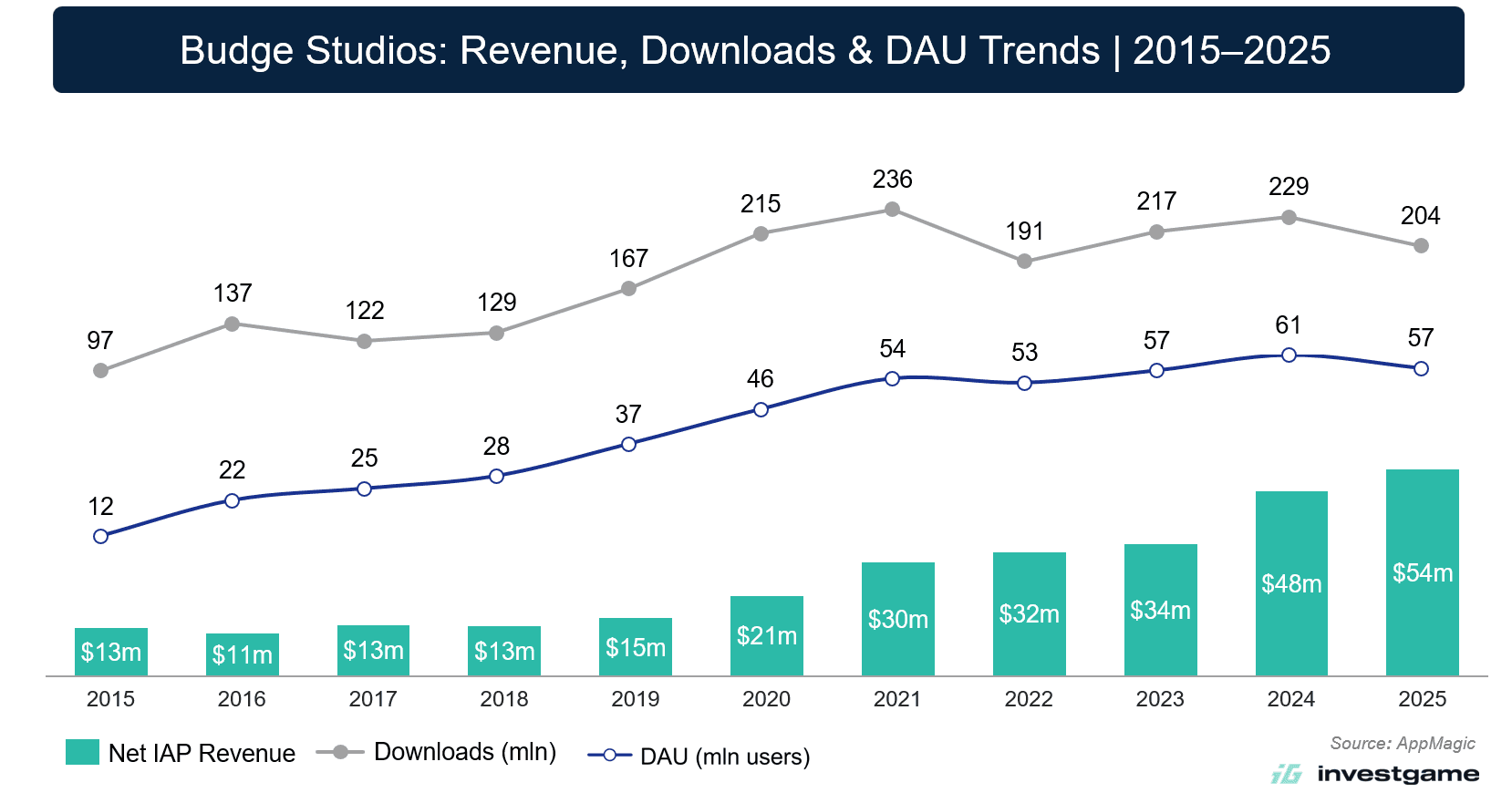

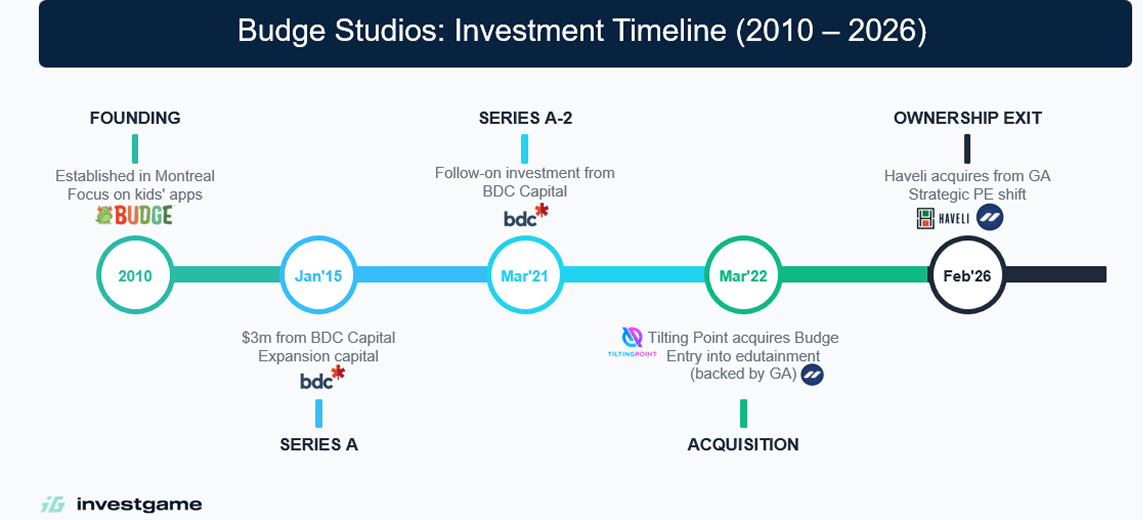

Haveli Investments has entered into an agreement to acquire Canada-based children’s mobile app developer Budge Studios from General Atlantic, the majority backer of Tilting Point, Budge’s previous owner, for an undisclosed sum. Founded in 2010 in Montreal by Michael Elman, David Lipes, and Noemie Dupuy, Budge Studios was among the first companies to bring recognized children’s brands to mobile platforms. The company has since reached over 2 billion cumulative downloads across its portfolio, with an annual install base consistently exceeding 200 million. Recent growth is primarily attributable to Barbie Dreamhouse Adventures and Bluey: Let’s Play! titles.

Key licensed brands include Bluey, PAW Patrol, Barbie, Disney’s Frozen, Hot Wheels, and Hello Kitty.

Budge Studios raised $3m in Series A funding from BDC Capital in Jan’15, followed by a follow-on investment in Mar’21 through BDC’s Growth Equity Fund for an undisclosed amount. At the time of the Mar’21 investment, BDC Capital became the largest shareholder ahead of the founders. In Mar’22, Budge Studios was acquired by US-based mobile games publisher Tilting Point, which was at that stage backed by General Atlantic following a $235m investment in Jul’21. At acquisition, Budge had over 1.25 billion downloads, tens of millions of MAU, and over 300k recurring subscribers.

The transaction represents a strategic shift in PE ownership, with Haveli officially taking the studio private. Haveli, founded in 2021 by Vista Equity Partners co-founder Brian Sheth, partnered with Apollo in Oct’22 with a $500m commitment to support Haveli’s investment strategy. Haveli has since scaled its capital base, closing its debut software buyout fund at $4.5B in Mar’25, alongside a dedicated $833.8m gaming venture fund. The firm has made several gaming investments, including a $100m round for Candivore in Aug’23, the developer of the PvP mobile puzzle game Match Masters. Haveli also holds stakes in PC, console, and mobile games developer Behaviour Interactive (Dead by Daylight) as well as PC & Console games developer Omeda Studios (Predecessor). This acquisition adds Budge’s family-friendly IP to Haveli’s expanding gaming portfolio, which also includes a co-investment in Jagex (RuneScape) alongside CVC Capital Partners.

Savvy Games Group in Talks to Acquire Moonton from ByteDance

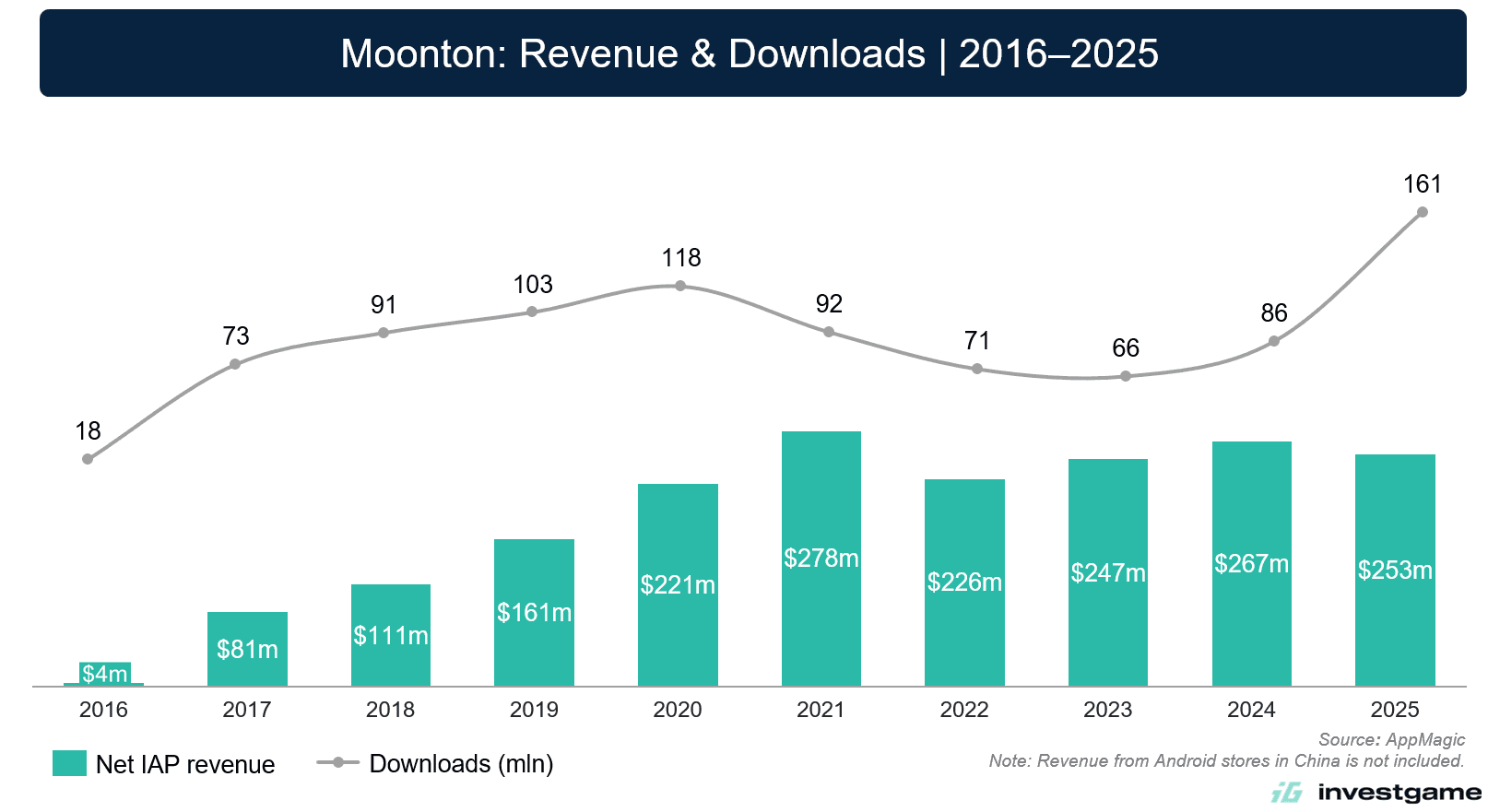

China-based internet technology company ByteDance is in advanced talks to sell Shanghai-based mobile game developer Moonton Technology to Saudi Arabia-based Savvy Games Group for $6B–7B, according to Reuters. A deal could be signed by the end of Q1’26, with broad commercial terms already in place.

ByteDance acquired Moonton in 2021 for approximately $4B via its gaming subsidiary Nuverse, outbidding Tencent (SEHK: 700). At the lower end of the reported valuation range, the transaction would represent an approximately $2B return on ByteDance’s original investment. For a high-growth tech conglomerate, a $1.5–1.7B net return over a five-year holding period would translate into a relatively modest IRR, suggesting that ByteDance may not have scaled Moonton’s monetization sufficiently to justify its position within the portfolio.

Founded in 2014, Moonton is best known for Mobile Legends: Bang Bang, one of the world’s most popular mobile MOBAs. The title has surpassed 1.5 billion installs and maintains over 110 million MAUs, ranking among the top 10 most-played games in 80+ countries. The M7 World Championship in Jan’26 recorded a peak viewership of 5.6 million.

The transaction would mark ByteDance’s major retreat from online gaming, following a 2023 internal review that led to the restructuring of its gaming operations. The deal had already been circulating as a rumor since Nov’25, and we covered it at that time in one of our previous digests.

Savvy Games Group, wholly owned by Saudi Arabia’s Public Investment Fund (PIF), continues its global gaming acquisition push. The company acquired US-based mobile publisher Scopely for $4.9B in Jul’23, and Scopely subsequently acquired Niantic‘s games division, including Pokémon GO, for $3.5B in May’25. Separately, a PIF-led consortium including Silver Lake and Affinity Partners agreed to take Electronic Arts (NASDAQ: EA) private for $55B in Sep’25, with the transaction pending regulatory approval and an expected close in Q2’26. At $6B+, the Moonton deal would rank among the top 10 largest gaming acquisitions in history.

Mellow is how 200+ gamedev companies work with talent worldwide. Contracts, IP transfer, compliance, payments — across 50+ jurisdictions, handled in one platform. No patchwork of local providers, manual invoicing, or unresolved compliance gaps. Gaijin Entertainment, Scorewarrior, and Domini Games already run on Mellow.

Neon helps game publishers take control of their commerce. Our DTC platform handles everything from webshops and checkout to global payments, tax, and compliance, with full transparency and flat-rate pricing. No black boxes, no restrictions, no surprises. Built by payments, fintech, and gaming veterans, we work hands-on with publishers to optimize revenue and simplify operations. If you’re serious about DTC, we’re serious about helping you win.

| NOTABLE TRANSACTIONS |

MERGERS & ACQUISITIONS

US-based toy company Mattel (NASDAQ: MAT) has acquired NetEase’s (NASDAQ: NTES) 50% stake in mobile game developer Mattel163 for $159m. This buyout gives Mattel full ownership of the mobile game studio and values the company at $318m. Founded in 2018 as a 50/50 joint venture between the two companies, Mattel163 was formed to adapt Mattel’s iconic card/tabletop IP brands for mobile gaming, producing titles such as UNO!, UNO Wonder, Phase 10: World Tour, and Skip-Bo. The company has generated over 550 million downloads and ~20 million MAU. The transaction is expected to close by the end of Q1’26. The acquisition will contribute to Mattel’s earnings upon closing, as more than half of the purchase price will be paid using Mattel’s portion of the cash already held by the joint venture.

Spain-based AI infrastructure provider Submer has acquired Australia-based GPU cloud services provider Radian Arc Operations for an undisclosed sum. Radian Arc deploys high-performance GPU compute directly within telecom carrier networks, enabling low-latency workloads such as cloud gaming and AI at the edge. The deal expands Submer’s cloud offering by combining its InferX platform with Radian Arc’s carrier-integrated edge footprint across multiple global regions.

VENTURE FINANCING

Türkiye-based PC and mobile games developerHOGO Games has received investment from Türkiye-based developer Nokta Games (creator of Supermarket Simulator) at a $10m valuation for an undisclosed stake. Founded in Dec’22 and based in Kocaeli, HOGO has 13 employees and develops simulation titles for PC and mobile. The funds will support team expansion and increased development output across five concurrent PC projects and ongoing mobile production.

Saudi Arabia-based gaming accelerator Exel by Merak has invested $300k each in 19 MENA gaming startups, totaling $5.7m, following the completion of its second cohort Demo Day in Feb’26. Each startup receives $150k in cash and $150k in in-kind services, along with mentorship from global industry leaders and relocation support. Selected from over 300 applicants, Cohort 2 studios span mobile, PC, and console projects and have already generated $1.2m in early revenue with 2m+ cumulative social impressions. Backed by Merak Capital’s $80m gaming fund, applications for Cohort 3 will open in Apr’26.

US-based PC & Console game developer Ironwood Studios has raised $4m in Seed funding led by Lifelike Capital. The funds will support the Seattle-based studio’s next project, following the success of its previous game, Pacific Drive, which sold over 1.5 million units and reached 3 million total players across PlayStation Plus and Xbox Game Pass. Founded in 2019 by CEO Cassandra Dracott, Ironwood is a 20-person indie studio focused on atmospheric games with surreal worlds. The studio also released paid expansion Whispers in the Woods in Oct’25, and filmmaker James Wan acquired TV rights to Pacific Drive.

Japan-based YOAKE entertainment has raised $3.2m led exclusively by Sony Innovation Fund, bringing total funding to $4.45m following a $1.25m Extended Seed round in Apr’25. YOAKE is scaling Record Protocol on Soneium blockchain to track and verify fan engagement across music, gaming, film, and anime IPs. The company develops the IRC APP and partners with Sony Block Solutions Labs.

UK-based PC and mobile games developer TruePlayers has raised £140k (~$190k) in pre-Seed funding from British Business Bank via The FSE Group, bringing total investment from the Cornwall & Isles of Scilly Investment Fund to £365k (~$496k). The studio has sold over 10,000 units of drone simulation game FireHawk FPV since its Aug’25 release. Recent funding supports their expansion into PC and console platforms, multiplayer modes, and B2B drone pilot training. The company’s valuation was last disclosed at approximately £2.9m (~$3.2m) in May’22.

Türkiye-based mobile games developer Ace Games has received investment from state-backed Türkiye Development Fund via its Technology and Innovation Fund for an undisclosed sum. Founded in 2020, Ace Games previously released Serial Burglar, Prison Life!, Mix and Drink, and Fiona’s Farm. The studio has already generated over $100k in revenue and surpassed one million total downloads across its portfolio. The company is currently scaling its puzzle- and board-driven titles, Cluedo Chase and Mystery Trail. Ace Games raised $7m in Seed funding at a $25m valuation in 2021. This was followed in late 2022 by a $25m Series A round led by Playtika, part of a larger $33m funding cycle to scale the studio’s global operations.

South Korea-based games developer Polestar Games has raised Pre-Series A funding from Union Investment Partners for an undisclosed sum. The funds will accelerate development of Project Thanatos, a co-op action RPG title for PC and console. Veteran developers lead the studio from PC MMORPG Dekaron, mobile RPG Lost Kingdom, mobile action RPG Superstring, and PC action RPG Hellgate: London, bringing specialized experience in high-action combat and the technical infrastructure required for large-scale online games.

China-based miHoYo and Monolith Management are investing in an angel round for a new studio founded by Xuan Zi, former producer of NetEase’s Beyond the World. The investment is in the final closing stages. The amount for this round has not yet been publicly disclosed. The startup is developing a 2D female-oriented story-driven game. Xuanzi left NetEase in 2025; Beyond the World launched in 2024 and competed with Love and Deep Space.

EARNINGS REPORTS

| Report Date | Company Name | Earnings Release Presentation | Report Date vs. 16-Feb |

|---|---|---|---|

| 2/9/2026 | KRAFTON | KRAFTON FY2025 Q4 | 8.7% |

| 2/10/2026 | Remedy | Remedy Entertainment FY2025 Q4 | 0.1% |

| 2/11/2026 | Unity Software | Unity Software FY2025 Q4 | (12.8%) |

| 2/12/2026 | Applovin | Applovin Corp FY2025 Q4 | 6.4% |

| 2/12/2026 | Embracer | Embracer Group FY2025 Q3 | (1.3%) |

| 2/12/2026 | Pearl Abyss | Pearl Abyss FY2025 Q4 | (6.7%) |

| 2/12/2026 | Nexon | Nexon FY2025 Q4 | (17.6%) |

| 2/13/2026 | Sega Sammy | Sega Sammy FY2026 Q3 | 10.2% |

| 2/13/2026 | DoubleU Games | DoubleU Games FY2025 Q4 | (2.9%) |

| 2/13/2026 | GungHo Online | GungHo Online Entertainment FY2025 | (3.4%) |

| 2/13/2026 | Ubisoft | Ubisoft Entertainment FY2026 Q3 | (9.0%) |

| 2/13/2026 | NetEase | NetEase FY2025 Q4 | 2.1% |