Weekly News Digest #6

# of announced deals

13

announced deals’ size

$53m

# of closed deals

12

Voldex becomes the #1 developer on the Roblox platform

Canada-based PC & console UGC platform developer Voldex has acquired the Brookhaven from UGC content developer Wolfpaq for an undisclosed sum. While the exact valuation remains undisclosed, the estimate is above the $100m mark. Brookhaven is a first-by-popularity game in the roleplay genre and one of the most popular games in Roblox, with 120 million MAU and 60 billion visits since its release in Apr’20. This deal brings Voldex MAU to 145 million. This acquisition continues Voldex’s expansion activity following its acquisition of the Ultimate Football in Apr’24. The deal was supported with the Voldex Series B equity financing that was led by Raine Partners with participation from Makers Fund, QIA, MIT, Tirta Ventures, and Lalotte Ventures. The Raine Group’s Managing Director will join the Voldex Board of Directors. Additionally, Voldex has secured debt financing led by Shamrock Capital.

Voldex previously secured two funding rounds:

— In Feb’22, Voldex secured $3m in a Seed funding round led by Dune Ventures with participation from Makers Fund, POW! Interactive and other investors;

— In Jan’23, the company secured an undisclosed sum in a Series A funding round led by a16z, with participation from Dune Ventures, Makers Fund, and POW! Interactive.

Voldex’s acquisition of the Brookhaven is significant in the UGC gaming sector since it reflects the company’s continued expansion and strengthens its presence within the Roblox ecosystem.

Laton Ventures has closed a $50m fund

Turkiye-based venture capital fund Laton Ventures has closed a $50m gaming fund. This fund continues a $35m fund launched in Apr’24. The fund is backed by 40 tech and gaming founders.

Laton is a significant player in the Turkiye gaming market. For more details on Laton Ventures and the Turkiye gaming venture capital landscape, please read our recent thorough analysis of the Turkiye gaming market.

| Read the full report |

The new fund will invest globally in pre-Seed and Seed-stage gaming startups, focusing on mobile platforms. Before fund closing, Laton has already invested in five companies:

— In Nov’23, Laton participated in a $1.8m Seed funding round of US-based AI game art production tool developer Layer AI;

— In Jan’24, the fund entered a $2.25m pre-Seed funding round of Turkiye-based casual mobile games developer Pine Games;

— In Jun’24, Laton Ventures with Accel have invested $5m in German-based UGC social gaming platform Slay;

— In Jul’24, Laton has participated in a $3m pre-Seed funding round of Turkiye-based mobile games developer Grand Games;

— In Jan’25, the fund participated in a $30m Series A funding round of Grand Games.

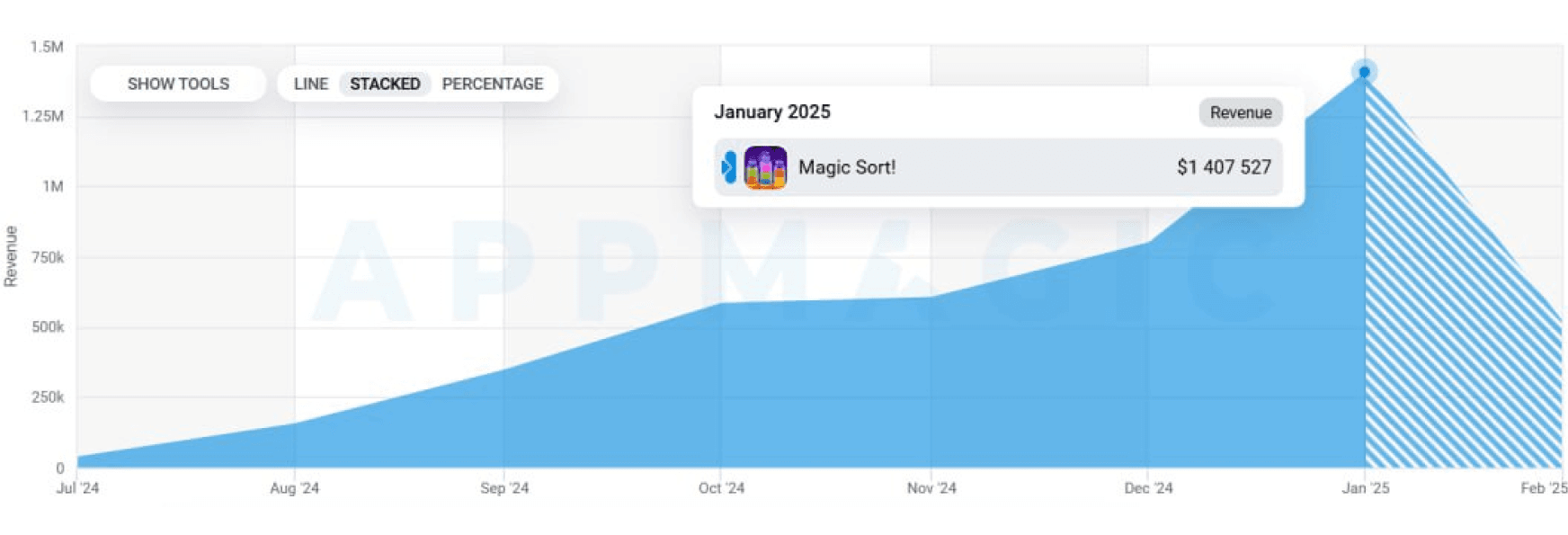

One of the most promising recent investments in the Turkiye gaming market is Grand Games, a casual mobile games developer in which Laton Ventures has invested twice. Although founded only in 2024, the company has released two titles: Magic Sort! and Car Match – Traffic Puzzle. According to AppMagic, its key title, Magic Sort!, ranked in the Top 10 of the Sort Puzzle genre, generating $4m in revenue and reaching 900,000 downloads within a year.

Source: AppMagic

Laton is a significant player in the Turkish gaming market. For more details on Laton Ventures and the Turkish gaming venture capital landscape, please read our recent analysis of the Turkish gaming market.

AdsAdvisor: The All-in-One Platform to Simplify Mobile Marketing

Built by a team with years of hands-on marketing experience, AdsAdvisor simplifies the entire marketing cycle, helping businesses automate processes, gain full visibility into performance metrics, and optimize their creative strategies. Instead of getting lost in manual tasks, teams can focus on growth and making smarter marketing decisions. Guesswork, endless iterations, and manual UA campaigns are out. Here’s what’s IN:

🎯 Get process transparency and team efficiency

📊 Gain full visibility of performance metrics and forecasts

⚡ Automate UA and scale budget with precision

🖌️ Simplify your creative process

Discover the full potential of the AdsAdvisor platform by booking a demo!

| NOTABLE TRANSACTIONS |

MERGERS & ACQUISITIONS

Sweden-based PC & Console games developer Paradox Interactive (STO: PDX) has acquired Bulgaria-based PC & Console games developer Haemimont Games, known for titles such as Tropico series, Jagged Alliance 3, Stranded: Alien Dawn, Victor Vran, and Surviving Mars, for an undisclosed sum, financed fully in cash. The acquisition is part of Paradox’s strategy to expand its presence in the management games genre. Haemimont Games will operate as a wholly owned subsidiary of Paradox Interactive, maintaining its current management team and project pipeline.

US-based multiplatform entertainment company Electronic Arts (NASDAQ: EA) has reached an agreement to acquire Sweden-based sports technology company TRACAB Technologies for an undisclosed sum. The deal is expected to close in Q2’25. The acquisition aims to integrate TRACAB’s sports optical tracking and analysis solutions into EA’s interactive sports platform, the EA SPORTS App, which was soft-launched in the Autumn of 2024, and future EA sports titles.

US-based gaming company Atari (ENXTPA: ATA) has acquired US-based games developer Choice Provisions for an undisclosed sum. As part of the deal, both companies will collaborate on Breakout Beyond, a reimagining of the classic 1976 arcade game Breakout. Initially planned for release on a revived Intellivision platform, Breakout Beyond is now set to launch on PC & Consoles at the end of 2025. This acquisition aligns with Atari’s ongoing strategy of acquiring classic game IPs following its purchase of the Transport Tycoon IP in Nov’24.

US-based outsourcing games developer Blind Squirrel Games has acquired Colombia-based outsourcing company Distributed Development for an undisclosed sum. The studio will be rebranded as Blind Squirrel Games Colombia, while its existing management team will remain unchanged. The acquisition is part of Blind Squirrel Games’ global expansion strategy. The studio is developing Cosmorons, a cooperative shooter for PC & Consoles.

VENTURE FINANCING

Israel-based AI gaming ad tech company Bigabid has raised $25m in a Series A funding round led by MobilityWare. Alongside the investment, the two companies have signed a cooperation agreement to support MobilityWare’s expansion into media activities within the gaming sector. The funds will be used to enhance Bigabid’s developer team. The company provides AI-driven user acquisition and retargeting services for major gaming firms, including SciPlay, Playtika, Zynga, and AppLovin. Bigabid previously secured $3m in Seed funding in 2016.

US-based live operations platform Beamable has raised $13.5m in a Series A funding round led by BITKRAFT Ventures, with participation from Arca, Advancit Capital, 2Punks, P2 Ventures, Solana Foundation, Scytale Digital, defy.vc, GrandBanks Capital, and Permit Ventures. The funds will support the development of the Beamable Network, a Decentralized Physical Infrastructure Network designed to help developers efficiently create online games and virtual worlds. Beamable secured $13.5m in a Seed funding round in Nov’21.

UAE-based web3 cloud gaming infrastructure provider The Game Company has raised $10m through equity and token sales in a funding round led by Telcoin, BullPerks, and Singularity DAO, with participation from NodeMarket and HyperCycle. The funds will be used to enhance the platform, which enables cloud gaming across various platforms and leverages blockchain capabilities. Currently in its alpha stage, the platform offers access to over 1,300 titles. The Game Company also plans to launch its native token in 2025. Previously, the company secured $5m in May’23.

Singapore-based web3 gaming company Mighty Bear Games has raised $4m in a funding round with participation from TON Ventures, Karatage, Amber, and Bitscale. The funds will support the launch of the GOAT Gaming platform, which enables players to earn rewards in Telegram-based games through AI agents. Additionally, the investment will enhance the company’s AI infrastructure. Mighty Beaes also plans to introduce its native token for AI-agent interactions within the platform.

India-based mobile gaming commerce company PlaySuper has raised $500k in a Seed funding round led by IAN Angel Fund and 100X.VC, with participation from angel investors. The funds will be used to expand the company’s team and support its entry into the Southeast Asian market, with further plans to expand into MENA and LATAM regions. Founded in Apr’24, PlaySuper is developing mobile in-game store integrations that do not require updates.

Turkiye-based ad tech company Playable Factory has secured an undisclosed strategic investment in a funding round led by Ludus Ventures. The funds will enhance the company’s web tools and mobile advertising solutions and support its global expansion. Additionally, Playable Factory plans to develop non-core, non-gaming applications. Playable Factory provides playable and interactive ad solutions for companies across various sectors, including Dream Games, Netflix, Puma, and Lego.

India-based mobile games developer SuperGaming has secured an undisclosed amount in a funding round from Bandai Namco Games (TSE: 7832) through its subsidiary O21 Fund. The funds will support the development and expansion of SuperGaming’s gaming ecosystem. SuperGaming recently launched its battle royale title Indus and previously secured an undisclosed corporate round from the O21 Fund in Mar’23.

EARNINGS REPORTS

| Report Date | Company Name | Earnings Release Presentation | Report Date vs. 10-Feb |

|---|---|---|---|

| 2025-02-04 | Nintendo Co., Ltd. | Nintendo FY2025 Q3 | 5.1% |

| 2025-02-04 | Electronic Arts Inc. | Electronic Arts FY2025 Q3 | 8.9% |

| 2025-02-05 | Bandai Namco Holdings Inc. | Bandai Namco Group FY2025 Q3 | 7.5% |

| 2025-02-05 | Stillfront Group AB | Stillfront Group FY2024 | (4.3%) |

| 2025-02-06 | Paradox Interactive AB | Paradox Interactive FY2024 | (2.2%) |

| 2025-02-06 | Modern Times Group MTG AB Class | Modern Times Group FY2024 Q4 | 2.0% |

| 2025-02-06 | Kadokawa Corporation | Kadokawa Corp FY2024 Q3 | 5.2% |

| 2025-02-06 | Roblox Corp. Class A | Roblox Corporation Q4 2024 | (3.1%) |

| 2025-02-06 | Take-Two Interactive Software, Inc. | Take-Two Interactive Software FY2025 Q3 | 16.1% |

| 2025-02-07 | DeNA Co., Ltd. | DeNA Co FY2024 Q3 | 23.1% |

| 2025-02-07 | Enad Global 7 AB | Enad Global 7 FY2024 Q4 | (0.5%) |

| 2025-02-07 | Sega Sammy Holdings Inc. | Sega FY2025 Q3 | (5.6%) |