Feature #13

Capital Concentration Paradox: Why did $6.7B of the ~$9B UGC investments since 2020 flow almost entirely into Roblox and Epic — what makes late-stage investors double down on incumbents while challengers struggle for retention and monetization?

Ecosystem-Native Studios: How are teams building inside Roblox and Fortnite scaling into publisher-level businesses — what content strategies, live-ops, and M&A dynamics prove ecosystem hits can rival standalone launches?

Beyond the Duopoly: With Rec Room layoffs, Zepeto’s social commerce bet, and blockchain-driven experiments, can niche challengers crack network effects and sustainable economics — or will UGC remain dominated by two platforms?

Feature sponsored by $GDEV

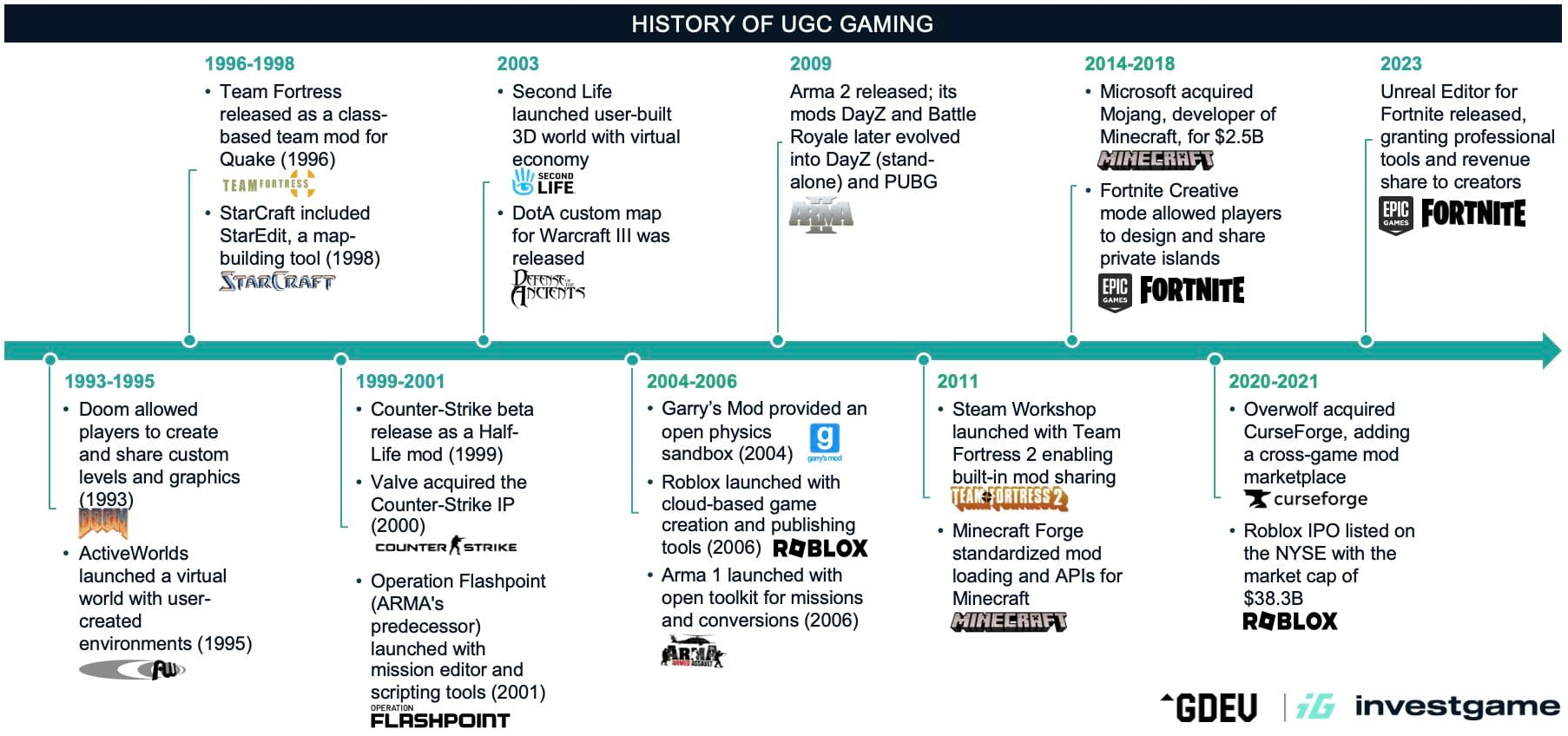

User-generated content (UGC) has been part of gaming for decades. Community-driven mods have repeatedly spawned billion-dollar franchises: Counter-Strike grew from a Half-Life mod, DotA from Warcraft III, and PUBG from Arma‘s modding community. Minecraft‘s creative tools and StarCraft‘s map editors set the template for large-scale user creativity.

However, from an investment capital perspective, UGC has only recently come into sharper focus. For years, modding and community content thrived informally on forums and fan sites — vibrant but fragmented, and largely unmonetized. Only in the past few years have we seen major platforms emerge to capture this value, from Roblox (NYSE: RBLX) and Fortnite Creative to infrastructure players like Overwolf and Mod.io. These platforms have turned UGC into scalable ecosystems with monetization, discovery, and professional pipelines, creating clear entry points for capital.

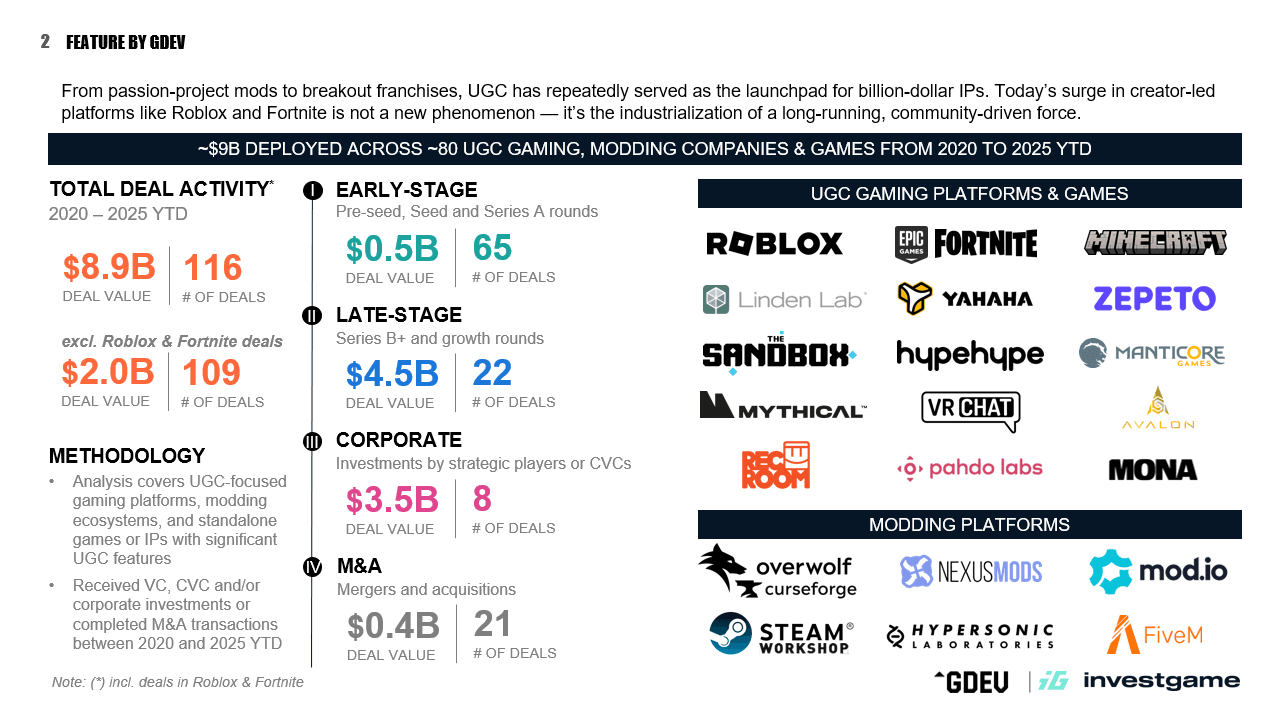

Despite UGC’s track record of spawning billion-dollar franchises, funding remains highly concentrated: just six deals account for 76% of the $9B deployed since 2020. In this report, we map where funding flows, why it concentrates, and which models are breaking through.

For a detailed analysis, check out the accompanying report:

Methodology

We tracked nearly $9B flowing into creator-driven gaming through 95 investments and 21 M&A deals across ~80 studios and IPs worldwide from 2020 to 2025 YTD. The analysis spans three major segments of the UGC ecosystem: creator platforms, modding ecosystems, and UGC-native games.

Scaling Game Mods

Before ‘UGC platforms’ became an investment category, modding operated as gaming’s R&D lab — generating hits and gradually reshaping the industry through mods. Doom opened the door for level creation, Half-Life gave rise to Counter-Strike, Warcraft III birthed DotA, and Arma laid the foundation for DayZ and PUBG. Yet for years, modding thrived in forums and fan sites – prolific but scattered, capturing little investor attention and largely unmonetized.

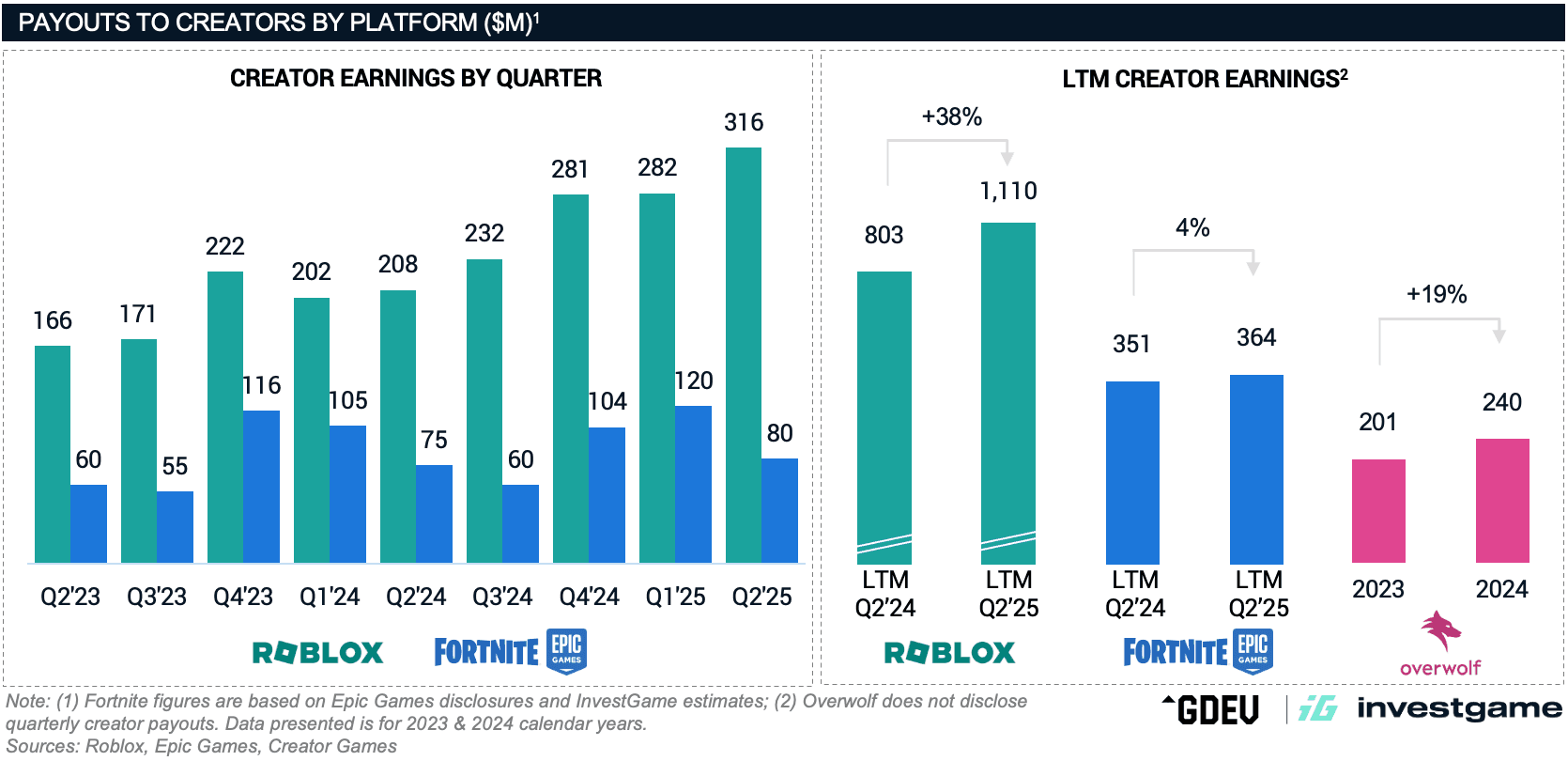

That has changed dramatically in the past decade. Overwolf’s acquisition of CurseForge in 2020 turned it into one of the largest monetized repositories, logging 24 billion downloads in 2024 (+60% YoY) and paying $240m to creators. Nexus Mods hosted 4.4 billion downloads (+65% YoY), with The Elder Scrolls V: Skyrim and Fallout 4 still among the top draws. Mod.io pushes a cross-platform approach, embedding mod rails directly into games: by 2024, it powered mods for 260 games and enabled 590 million downloads (+40% YoY). Steam Workshop, Valve’s integrated mod distribution system, supports 2.7k+ games, making mods easy to discover for PC players.

Engagement is massive, but reliable payouts and attribution appear only where platforms manage the experience end-to-end. Modding remains high-engagement but under-monetized — creating opportunities for infrastructure plays around payments, rights, safety, and cross-platform discovery.

UGC Platform Duopoly

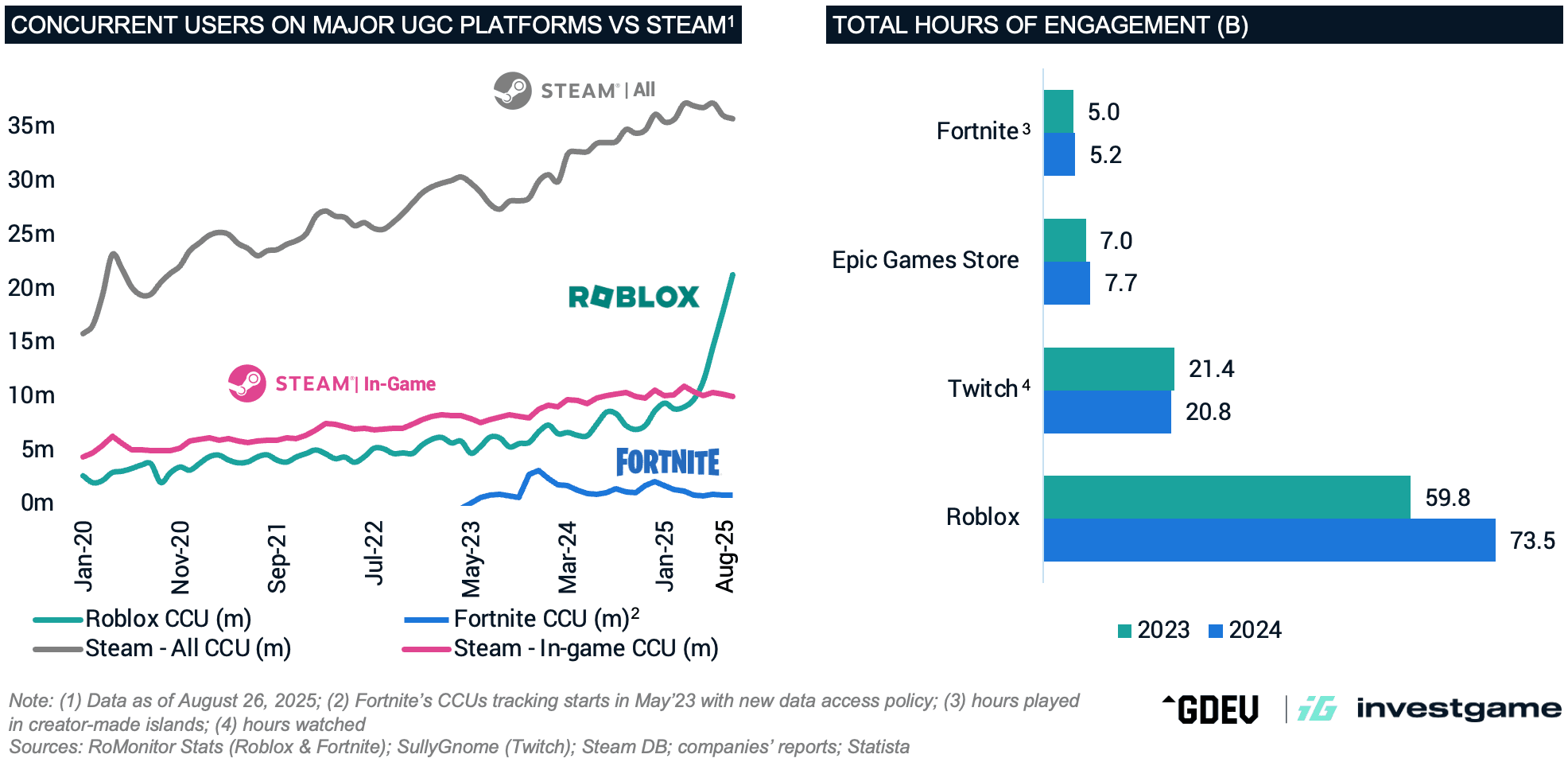

While modding infrastructure evolves, two platforms have already cracked the UGC monetization code: Roblox and Fortnite. Both now compete for prime screen time with gaming’s largest ecosystems — Roblox regularly matches or surpasses Steam’s concurrent users, while Fortnite delivers concentrated spikes around seasonal events.

The numbers highlight clear differences. Over LTM Q2’25, Roblox distributed $1.11B (+38% YoY) to creators versus Fortnite’s $364m (+4% YoY). Roblox’s payout curve is more concentrated than Steam’s: the top 10 creators captured 37% of payouts (vs Steam’s 28%), while the top 100 captured 65% (vs Steam’s 61%). By contrast, Fortnite’s mid-2024 shift to the Engagement Score model, prioritizing new-user acquisition, introduced payout volatility, pushing teams toward short-term, acquisition-optimized experiences over long-session play.

Yet, as with any content-related platforms, we see clear “hit” content being produced. On Roblox, Grow a Garden, a farming simulator acquired by Splitting Point Studios in Apr’25, vaulted from niche sim to 2 million CCUs peaks within a quarter, while Brookhaven, acquired by Voldex in Feb’25, keeps compounding via steady live-ops — proof that “hits” on Roblox are operating systems, not one-off moments. On Fortnite, growth is reflected through M&A. In May’25, JOGO acquired RHQ Creative, a Fortnite map development studio. In Jul’25, Gaijin Entertainment acquired The Pit, one of the popular multiplatform islands with 9.5k CCU in Jul’25. Meanwhile, Epic’s own games dominate discovery through internal tools (Unreal Editor) and promotion, creating an uneven playing field for external developers.

Beyond the Duopoly: UGC Contenders

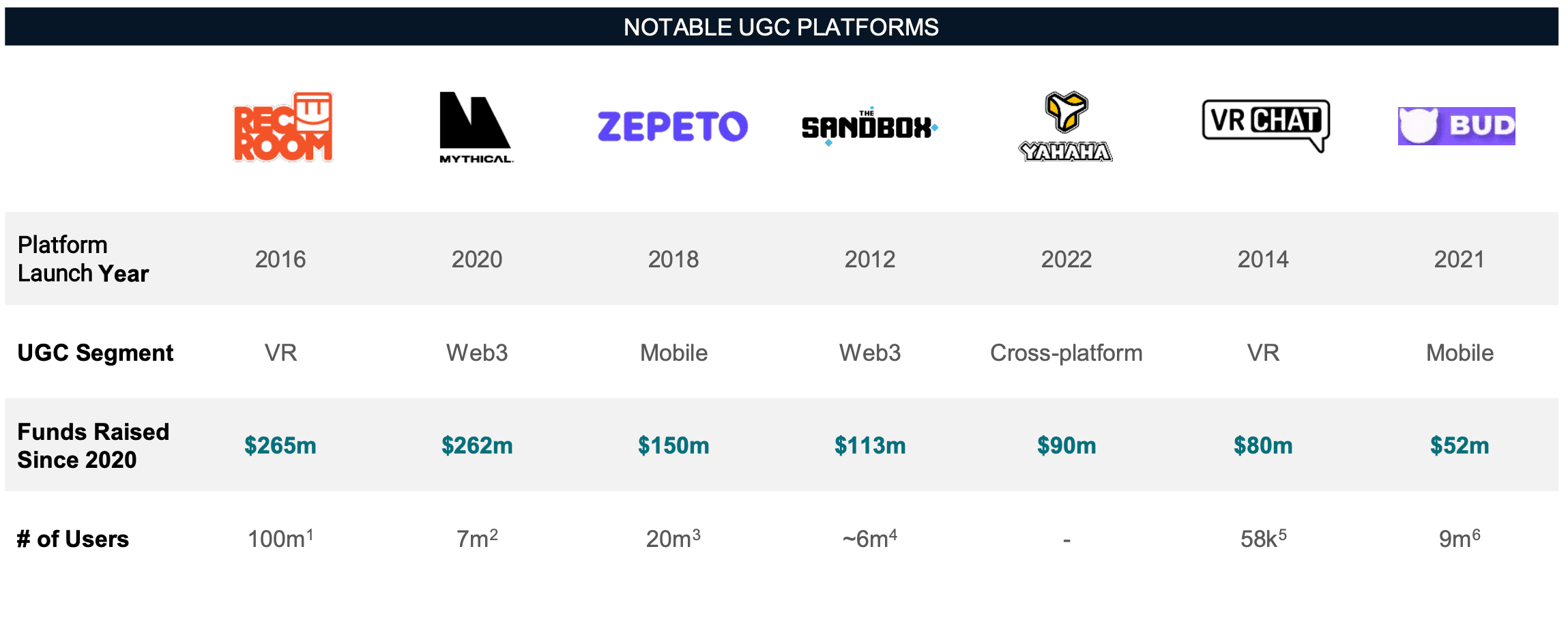

Beyond the duopoly, challengers target specific niches. Rec Room ($265m raised) has positioned itself as a cross-platform social UGC hub across VR, console, and mobile. Zepeto ($150m raised) focuses on avatar-based social commerce with 20 million MAU. Yahaha ($90m raised) offers desktop-to-mobile creation tools.

On the blockchain front, The Sandbox courts brands and IP to structure an economy of themed experiences and virtual land, while Mythical Games experiments with ownership built into UGC-forward titles, less about speculation, more about whether portable items and creator royalties can strengthen monetization.

Despite active experimentation — including low-code tools, mobile-first design, and blockchain integration — these challengers face harsh realities: narrow audience funnels, uneven retention, and monetization per user far below that of Roblox and Fortnite. The core challenge remains proving they can not only attract creators and audiences, but keep them long enough to build network effects and self-sustaining economies. The current situation in Rec Room could probably illustrate this difficulty: after years of investment, the company has struggled to sustain growth in a competitive market, forcing two rounds of layoffs in 2025 — 16% of staff in March and nearly half of its workforce in August.

Concentrated Capital

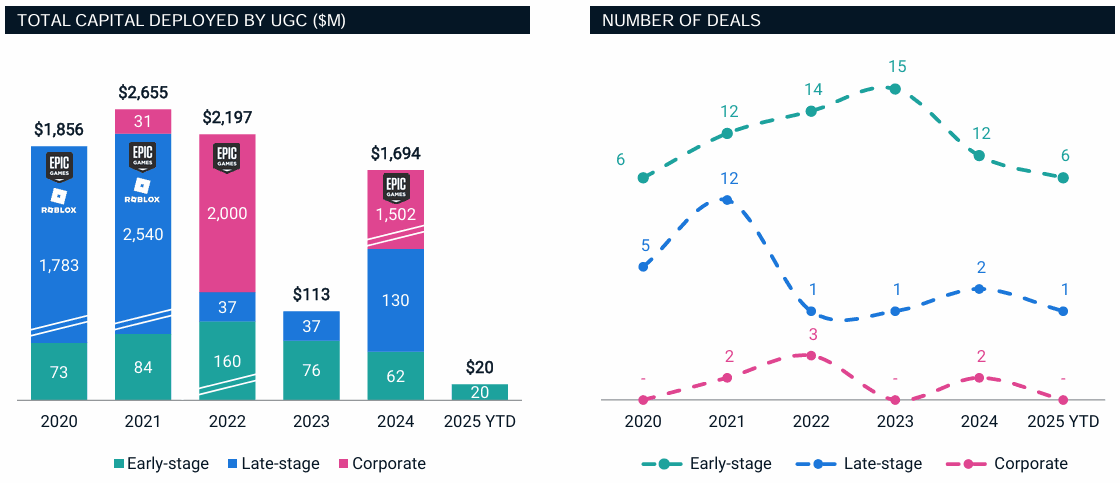

UGC investment has mirrored a COVID hype cycle. The 2020–21 boom, powered by Roblox’s IPO in 2021 and the broader metaverse narrative, produced platform‑scale bets. Since 2022, late-stage capital has concentrated on incumbents: of ~$8B across 30 large deals, $6.7B went into just six checks for Roblox and Epic (primarily Epic: Sony & KIRKBI’s investment in 2022; Disney’s investment in 2024). Strategic investors are validating leaders, not challengers.

Note: For a deeper look at where corporates currently invest — see our previous feature.

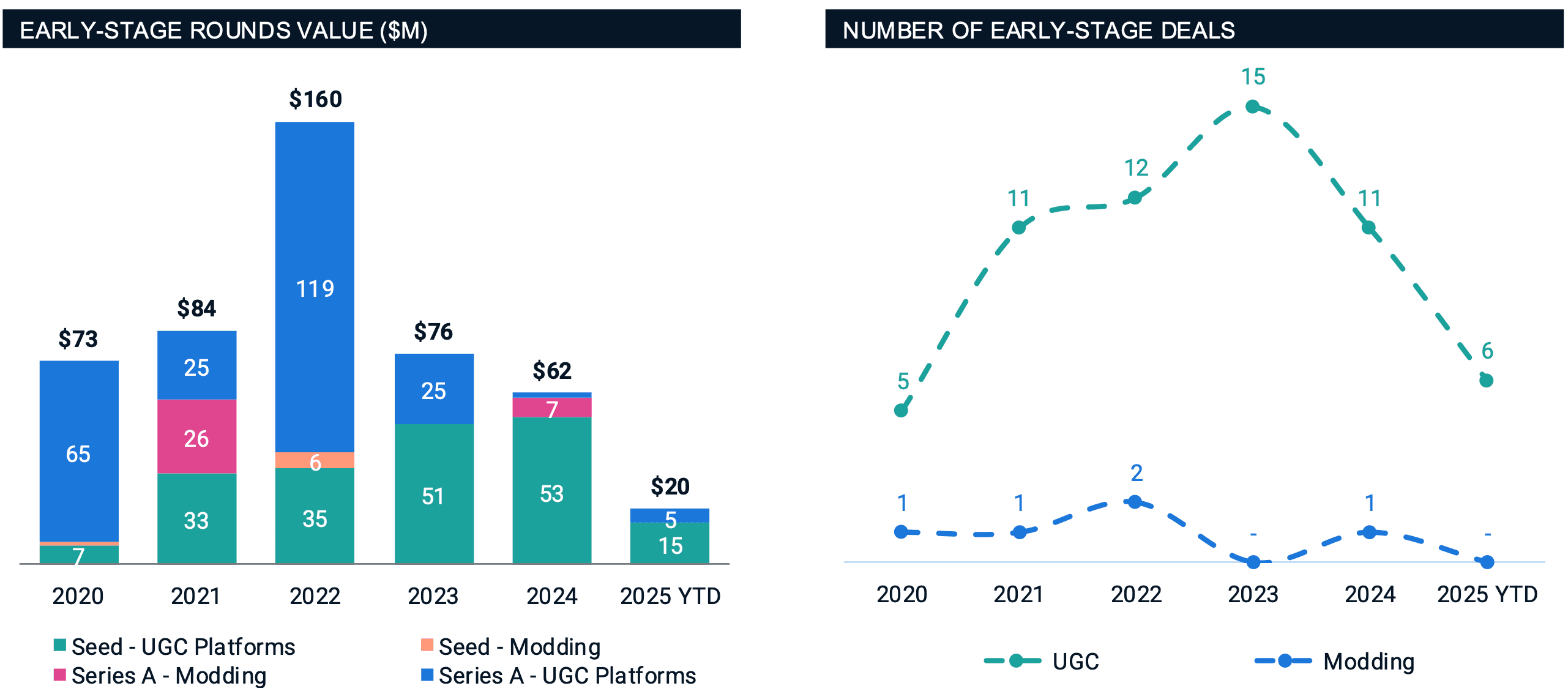

Early‑stage activity has been steadier. From 2021–2025 YTD, we tracked 65 Seed/Series A deals (12–15 per year). The largest share — 38 deals (~$324m) — went to new platforms aiming to be the “next Roblox.” Another 17 deals (~$81m disclosed) funded studios building games inside Roblox and/or Fortnite (e.g., Gamefam, Infinite Canvas, Supersocial, Future Trash, Look North World). Breakout titles such as Grow a Garden, Brookhaven, and The Pit validate this approach: ecosystem‑native studios can scale like standalone publishers while riding platform distribution.

Modding remains under‑monetized relative to engagement. Only a few venture‑backed players tackle hard problems. Exceptions include Overwolf (raised $52.5m Series C and $75m Series D in 2021 to expand CurseForge Premium Mods) and mod.io ($26m Series A in 2021 for cross-platform mod distribution). Beyond these, deal flow has been sparse; progress likely hinges on publishers’ productizing monetization around their native toolchains.

M&A remains limited (21 deals since 2020) but strategically revealing: eight transactions targeted individual UGC-born IPs rather than studios, with five tied to Roblox or Fortnite. Buyers seek proven revenue assets within dominant ecosystems.

Shaping What’s Next

UGC has shifted from a niche R&D lab to one of the central growth engines for the gaming industry, attracting over $9B in capital over the last 5 years, yet paradoxically concentrated in just two platforms. Roblox and Fortnite dominate creator economics, while challengers struggle to achieve sustainable unit economics despite continuous experiments with new formats, monetization models, and creation tools in search of a breakout moment.

The investment playbook is crystallizing: late-stage capital validates incumbents ($6.7B to Epic and Roblox alone), while early-stage bets split between platform hopefuls and ecosystem-native studios. The latter strategy shows good results — within Roblox and Fortnite, content continues to professionalize as studio teams deliver genre-defining hits that rival traditional game launches, eventually achieving venture-scale exits without extra platform risk.

What’s clear is that UGC has evolved from gaming’s side feature into an investment trend reshaping how games are created, monetized, and experienced. The next breakout could emerge from multiple vectors: a challenger that finally cracks retention economics, ecosystem-native studios scaling into standalone franchises, or infrastructure that captures value from modding’s billions of downloads. The concentration may be extreme today, but the underlying shift is permanent.

Special thanks to David Taylor for proofreading this feature, and congratulations to him and the Creator Games team on the recent completion of their pre-seed round backed by Spin Master and FunPlus, to support up-and-coming Roblox developers with ML-driven publishing.